Durable Goods: Forced Landing

The worst durable goods headline since April 2020 really is not that bad.

The headline swoon of -6.1% (seasonally adjusted) was all about aircraft and parts but is still positive YoY ex-Transport (not seasonally adjusted) with Transport being around 32% of the weighting in the headline number.

The importance of Boeing production rates and its extended massive supplier base shows up in the numbers for orders and shipments alike, so it will be one to watch closely with all the MAX noise.

Monitoring the commercial aerospace fallout over the MAX programs is joined by the potential for weakness in defense on the combination of House malfunction and Washington dysfunction.

The sharp move in headline numbers offers a reminder of how economic trends can shift in the wrong direction in manufacturing chains and in trade when aircraft and defense get rattled (ponder tariff battles ahead in 2025 for all manufacturing).

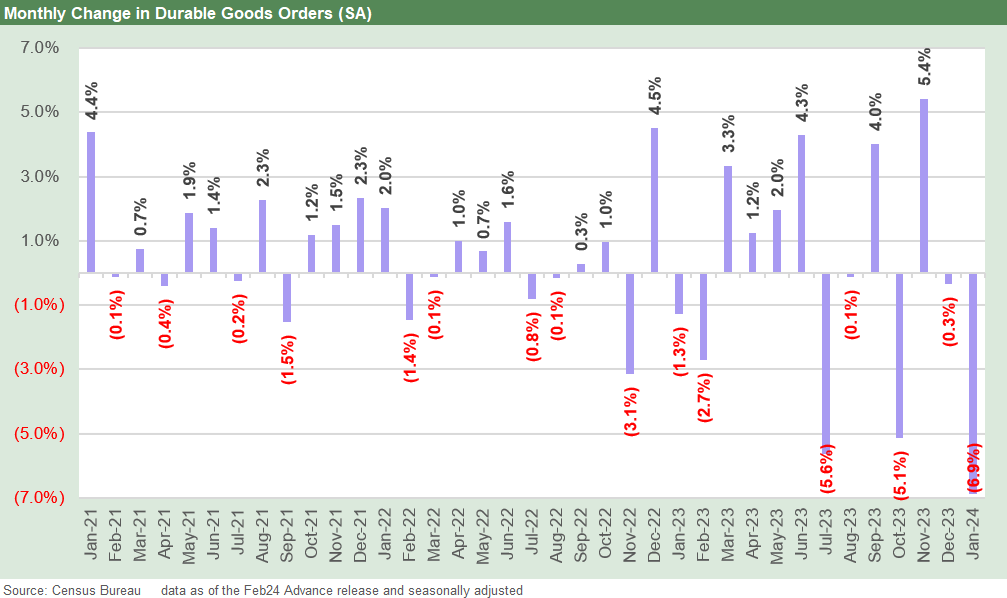

The above chart tracks the headline number for Durable Goods orders, and the Jan 2024 numbers certainly make a statement. The statement is to pay attention to the multiplier effects when a major supplier-to-OEM chain gets rattled. That can also rattle trade flows given the export leadership role of commercial aircraft in high end, big-ticket industrial markets.

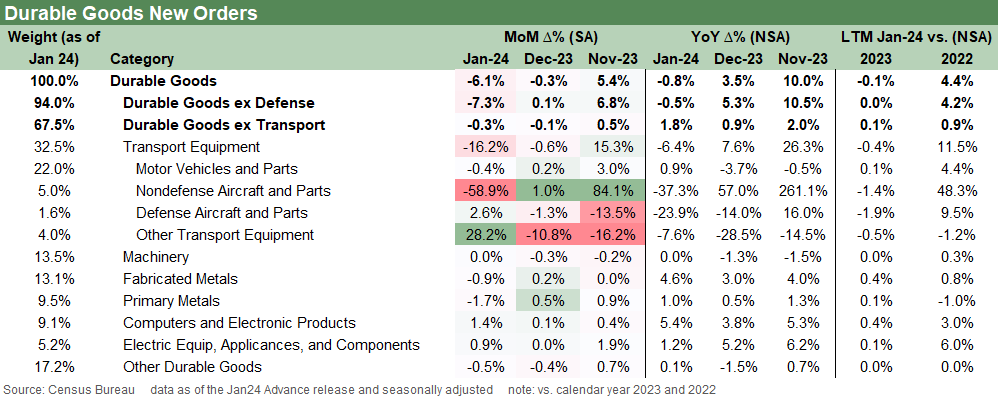

The above chart shows the line items and how nondefense aircraft and parts played in these headline numbers. Transport posted a -16.2% month at its 32.5% weighting with nondefense aircraft and parts at -58.9% and a 5.0% weighting. Motor vehicles was also soft.

Durables ex-transport at -0.3% is still tepid at best, but further into the weeds reveals some constructive positive numbers. Nondefense ex-aircraft is one of those standard lines on Table 1 of the release and that was +0.1% on orders and +0.8% on shipments.

Shipments capture the immediate level of economic activity relative to orders, and durable good ex-transport were positive MoM and +2.1% YoY. That is decent news under the negative banner headline. Machinery shipments were positive MoM and YoY as noted and the same was true for Computers/Electronic Products and Electric Equip/Appliances and Components.

Defense capital goods was +1.5% MoM (+24.2% orders), and that will be a line to watch as Ukraine support and defense procurement unfolds in 2024. Defense aircraft and parts came in at +1.4% for shipments and +2.6% for orders.

Overall, durables goods shows a mixed level of activity with Transport having a set of specific problems for this month’s release on a notoriously volatile line.