Footnotes & Flashbacks: Asset Returns 5-25-25

A rough week was hit by another over-the-top tariff move setting the stage for a trade war with the EU as the #1 trade partner.

Wilbur, why is he still beating this dead horse with seller pays nonsense?

After a China truce and a UK “not a deal” offered some sentiment support to the market that eased (clearly did not eliminate) the worst of anxiety, Trump made headlines with 50% blanket tariffs on the EU as our #1 trade partner. For good headline measure, he added a 25% threat against Apple. The EU rate of 50% cited June 1 at the very least implies he is not feeling generous on tariffs with numerous other “national security” and emergency product tariffs in the queue (see Trade: Uphill Battle for Facts and Concepts 5-6-25). Since the trade deals with India and China are not yet set, it is unclear how Trump can simply tariff a company and have it hold up in court.

At this point, the US has active trade clashes underway with almost all major trade partner nations including the #1 trade partner in the form of the EU bloc. The reciprocal tariff pause means there are negotiations with some, but most will soon simply be assigned tariffs of Trump’s choosing based on his recent comments (see Reciprocal Tariff Math: Hocus Pocus 4-3-25).

In recent days, Trump has made some admissions indirectly that the “buyer pays” with his demands that Walmart “eat” the tariffs. Then he spoiled it by saying he collected “$600 billion” from selling countries during Trump 1.0. That was in a live interview. That was a very specific number. It happens. Waiting for Bessent to explain that one (see Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25).

This upcoming week brings NVIDIA earnings and perhaps some clarification on what Trump intends on the 50% EU tariffs and June 1 date. We also will see the 2nd estimate on 1Q25 GDP with the Personal Income & Outlays teed up for an update on consumption and PCE inflation. Durable Goods preliminary is also on the calendar.

The above table updates rolling returns for the high-level debt and equity benchmarks we watch. We see the fade in the bond benchmarks for the rolling 1-month and 3-months on duration setbacks on the long end. For equities, the rebound off the China truce and post-Liberation Day pause are still in the 1-month numbers with the rolling 3-months still a case study in ugly.

The 6-month timeline is also showing all 6 equity benchmarks negative given the China trade war followed by a China truce (see Footnotes & Flashbacks: Credit Markets 5-12-25). While the market remembers the volatility, the above timelines remind us that the past 6 months and 3 months have amounted to bad news.

The ebb and flow of tariffs and pauses are excruciating for securities holders. That pain extends to those who need to engage in capital budgeting and decisions on their supplier chain and production capacity.

Planning to reshore or build new capacity is undermined by policy uncertainty…

The upside for Trump is that he thrives on dispute and builds his power base off extreme rhetoric and division. For those in the “money-making, profit-maximizing, investing, and employing” business, the ability to plan around such erratic policy-making undermines the ability to conduct analysis of project economics and assess the timing and scale of such projects.

For capital budgets, corporate planners may assume Trump wants to be President for life a la Xi and Putin, but they need to be aware that someone might run a campaign against him promising to reverse many of his tariff policies. That changes the entire analysis looking out to 2028 when some of these multiyear projects could just be ramping up production or not even completed yet. That timeline includes a 2026 election that further complicates Trump’s planning, but veto risk (and failure to override) and filibuster can prevent that adding up to much.

Trade keeps a risk wildcard in place with Trump holding all the cards…

EU: The US-EU battleground has been much anticipated and will only get worse when pharma protectionist tariffs get released. Pharma is by far the #1 export from Europe as well as the EU more narrowly. Even the UK “not-a-deal” had pharma as an open item (see US-UK Trade: Small Progress, Big Extrapolation 5-8-25). The degree of EU-US tension promises to move higher from here with the broader EU and could even derail the final touches on the UK deal with that country’s trade surplus.

Japan: The trade talks are dragging on with Japan, and the recent heightened headlines around systemic debt risks in Japan come at a time when an aggressive move against them by Trump could further rattle global systemic risk if Trump treats Japan the way he is treating the EU. Japanese automotive players are massive investors and employers in the US and have also brought major multiplier effects across the US (heavily in red states), so this process with Japan is especially worrisome given Trump’s fixation on trade deficit numbers. We have covered those basic Economics 101 issues before and will not revisit here (see Tariffs: Questions to Ponder, Part 1 2-2-25, The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25).

South Korea: Trade terms are also not wrapped up with this top 10 trade partner (post-election on June 3 more likely). The trade headlines come in a week where Trump is talking about removing troops from South Korea. History might get revisited (avid reader of history that Trump may be). Trump apparently did not get the memo on Dean Acheson’s infamous mistake at the Washington Press Club and inadvertently inviting an invasion and war back in 1950. Views vary. The short version is that the presence of troops even on a token basis is a deterrent. Taking troops out increases risk on the Korean peninsula (side note: my father enlisted in the Marines to fight in that war). The US-South Korea relationship will not be getting easier.

That bottom line as the smoke clears on this past week is the reciprocal tariff pause has brought little good news outside the China truce. In the case of China, the clock is ticking. We saw a toothless “sort of framework” with the UK where the US has a trade surplus. This most recent move on the EU marks a material escalation with the EU 50% alongside an attack on a household name in the Mag 7. Consumers can do the 25% math on iPhones. After being pressed on the idea that Apple could be treated worse than South Korea (Samsung et al), Trump quickly said that Samsung would face the same tariff as Apple. That is not going to make consumers feel any better. It is called inflation.

The rolling return visual

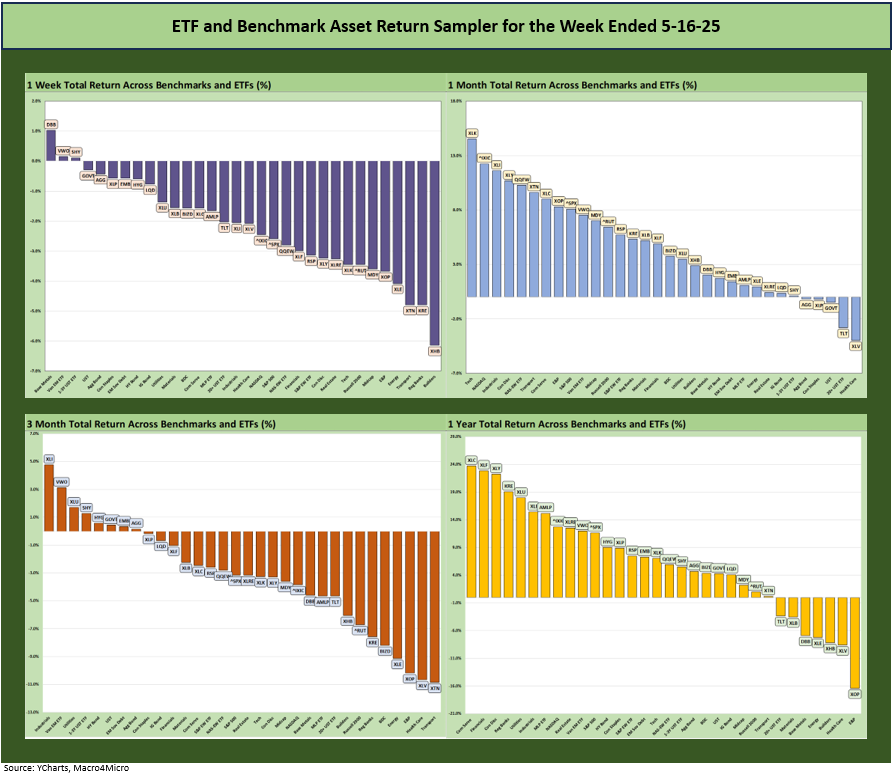

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

There is not a lot of mystery to the performance symmetry over 1-week and 3-months, but the 1-month horizon includes the post-pause and post-China truce rebound. This drama can only play out over time the “new” reciprocal tariffs get assigned, the new national security and product tariffs roll out (pharma, semis, aerospace/parts, lumber, copper, etc.) and the effects flow into new transactions and new inventory cost of sales. Of course, even when tariffs are announced, the market endeavors to handicap “what Trump really means.” In terms of the Fed or those expected to invest, they also have the option of “pausing.”

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We already looked at the tech bellwether performance in Mini Market Lookback: Tariff Excess N+1 (5-24-25). We line the assets up in descending order of total return for the week. The week saw Apple take a hit on the 25% tariff threat. The tariff game gets tiring for markets to the point where the senses get dulled (perhaps that is the strategy), but smart phones facing high tariffs is one more consumer inflation log on the fire. That is also one that will be very unpopular.

The 1-month boom set against a poor 3-month performance and very mixed 6-months is a recurring theme of the volatility and the basic concerns around cyclical resilience in 2025. The 6-month numbers present a very mixed bag. We see 3 of the Mag 7 in the red over 6 months and 5 of 7 negative over 3 months.

We already looked at the 1-week score of 3-29 in Mini Market Lookback: Tariff Excess N+1 (5-24-25). We also saw 11 of 11 S&P sectors in the red (not shown below). The UST steepener is hurting valuations by definition, but the Homebuilder ETF (XHB) was dead last this past week and ranks 2nd to last YTD with only the trade-dependent Transports (XTN) doing worse YTD (covered below).

Energy also felt weakness again this past week with the broad Energy ETF (XLE) and E&P (XOP) weaker after some similar tariff and trade-related beatdowns earlier this year. E&P (XOP) is 3rd off the bottom YTD.

The post-pause, post-China-truce rally is evident in the 1-month time horizon as the China truce (still just a pause and not “a deal”) took what was an irrational, policy-driven crisis off the table for now. Freight and logistics were heading toward chaos and are still in disarray at this point, but at least Christmas orders can go on for now (after Trump threatened to bankrupt Mattel in one of his social media tirades).

The 1-month numbers show the tech rebound with the Tech ETF (XLK) at #1 and NASDAQ at #2. The scale of the China stress relief is evident in Industrials at #3 before we bounce back to Consumer Discretionary (XLY) at #4 with its heavy Tesla and Amazon exposure. Overall, the top quartile is part of the worst-shall-be-first rebound after the China battles and reciprocal tariff beatdowns.

The 5 line items in the red include 3 bond ETFs hit by the UST curve steepening. We also see the Health Care ETF (XLV) in last place with more than a few crosscurrents at work there from pharma tariffs and price control threats to the idiosyncratic issues around United Health. The attacks on offshore pharma production by major pharma companies will raise their costs and raise their prices, in turn hurting consumers.

Trump can try to control those pharma prices, but that will wind up in the courts if he tries that without Congressional legislation. That is one more reason hardliners in the house slipped non-budget topics into the past week’s legislation to limit the ability of the courts to challenge executive orders by Trump policies that in theory violate the law. Those maneuvers are only gradually getting some headline time over the weekend. The only thing that scares center right House reps and Senators more than Trump is having to record a very specific vote on a very specific topic that they don’t agree with when they use their “off the record” voices.

The 3-month returns detailed above ring up a score of 8-24 with 5 of the 8 that are positive comprised of bond ETFs. That means a score of 3-22 ex-bond ETFs with the 3 being Industrials ETF (XLI), EM Equities (VWO) and Utilities (XLU). That is a bleak start to the new Golden Age with tariffs and trade conflict weighing heavily on performance.

The bottom of the rankings shows the Transports ETF (XTN) dead last with Health Care (XLY), E&P (XOP), Energy (XLE) and the BDCs (BIZD) rounding out the bottom 5. The credit risk exposure for small and mid-sized businesses that typify BDC asset exposure are perceived as victims of tariffs (even if that is a generalization given the wide variety represented).

For the YTD period, the score of 15-17 has better balance with the top quartile only posting 2 tech-centric names at #7 (Communications Services) and #8 (Equal Weight NASDAQ 100). We see the EM Equities ETF (VWO) at #1 ahead of Utilities (XLU) at #2, Industrials (XLI) at #3, the defensive Consumer Staples ETF (XLP) at #4, and the income-heavy and stable Midstream Energy ETF (AMLP) at #5 followed by broad Financials ETFs (XLF) at #6.

Sitting on the bottom is Transports (XTN) at -12.8% as trade-related companies were the most exposed to tariff policy damage. We see Homebuilders (XHB) feeling the weight of the UST curve and growing consumer uncertainty around the economy as evidenced in the brutal trend line in consumer surveys.

We see the small cap Russell 2000 (RUT) and Midcaps (MDY) in the bottom quartile and the NASDAQ (IXIC) and S&P 500 (SPX) in negative range in the third quartile. Having all 4 major benchmarks from large caps to small caps in negative return range offers little in terms of bragging rights.

The LTM mix at a score of 27-5 is still living off the very strong 2024 returns that ended the year at 30-2 with only E&P (XOP) and the long duration UST ETF (TLT) in the red (see Footnotes & Flashbacks: Asset Returns for 2024 1-2-25). In the negative zone, we see some of the usual suspects of trade and rate-sensitive sectors in the red with base metals going through some tumult with the China X-factor during the LTM period.

See also:

Mini Market Lookback: Tariff Excess N+1 5-24-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Credit Snapshot: Lithia Motors (LAD) 5-20-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Footnotes & Flashbacks: Credit Markets 5-19-25

Footnotes & Flashbacks: State of Yields 5-18-25

Industrial Production April 2025: CapUte Mixed but Time Will Tell 5-15-25

Retail Sales April 25: Shopping Spree Hangover 5-15-25

Credit Spreads: The Bounce is Back 5-13-25

Recent Tariff Commentaries:

CPI April 2025: 1st Inning for Tariffs and CPI 5-13-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25