CPI April 2025: 1st Inning for Tariffs and CPI

The China truce was critical, but the slow burn on tariff effects at the transaction level will come at a lag.

Is this the tariff processing line? Everything takes time.

The CPI for this month has some similarities to the waiting game on effective dates and working capital cycles we detailed last month. With the China-US truce (not a “deal” yet), a very critical risk variable has been taken out of the near-term equation. A China-US decoupling would have been an overriding catastrophe for many businesses and consumers (see CPI March 2025: Fodder for Spin 4-10-25). Disaster avoided (for now).

The ability to be reckless may play a role in game theory, but both parties need to have comparable risks and staying power (especially politically in the case of a democracy). China won this latest round, and the US consumer can breathe a sigh of relief for a while. The potential for a more immediate inflation shock on disappearing inventory has gained a reprieve (see Footnotes & Flashbacks: Credit Markets 5-12-25, Mini Market Lookback: Inflated Worry or Slow Train Wreck? 5-3-25).

For those of us who came of working age in the 1970s from Nixon to Carter, the fact that gasoline (-0.1% MoM, -11.8% YoY) and food at home (-0.4% MoM, +2.0% YoY) were both in deflation MoM was cause for memory lane celebration. If it was only that simple, the equity expectations and growth forecasts would be very different. Lower oil is a function of global growth fears as well as OPEC supply (WTI jumped from $57 last week to just under $64 as we go to print), and that has multiplier effects across freight and logistics and food among other lines.

Headline CPI for April declined to 2.3% YoY and Core remained steady at +2.8%. That was good news, but the reality check lurks in terms of the lag effects of tariffs in place and a hefty lineup to come on critical items such as pharma and semis among others. Retaliation can never be taken off the table.

We can just look at the tariff list and across the CPI line items to see what might be at risk. In a month where New Vehicle CPI was +0.3% YoY (0% MoM) and Used Vehicles +1.5% (-0.5% MoM), you know the world is in for some notable shifts in CPI metrics along the auto manufacturing chain or some material changes in corporate earnings.

The above chart updates the running CPI for Headline and Core CPI since the 2020 lows during COVID. Those of us who recall the brief 20% fed funds rates during our careers or who had 23% “prime plus” loans in the last stagflation period see these numbers as minor league in the context of the post-1973 CPI stagflation spike and 1980-1982 double-dip. That said, the stagflation pain of bygone years is exactly why the FOMC does not compromise on its price stability mandate.

The idea of facing a severe supply shock in the China embargo so soon after the freight and logistics meltdown of COVID made the stakes of the China truce that much higher. It was an ill-conceived game of chicken with the wrong opponent. Easing too soon would have been another case of monetary malpractice. Inflation still needs to meet the tariff test.

The CPI Special Aggregates metrics (Table 3 in the CPI release) usually offers comfort with its mix of “CPI ex” stats. “All items less shelter” at 1.4% YoY was lower while “All items less food, shelter, and energy” was flat at +1.8%. Services remaining in a sub-4% YoY level at +3.7% was good news but the MoM number doubled to +0.4%.

Durables remain in deflation mode YoY at -0.4%, but when you consider the materials tariffs in place or in process (steel, aluminum, more coming on lumber, and soon copper) and the tariffs on autos and on finished goods from China, Canada, Mexico, and the EU, then the idea of Durables deflation lasting makes very little sense. The more logical outcomes over time would be a steady increase in Durables CPI as working capital cycles unfold, new orders get booked and contracts roll into new periods. Of course, a recession could change that calculus.

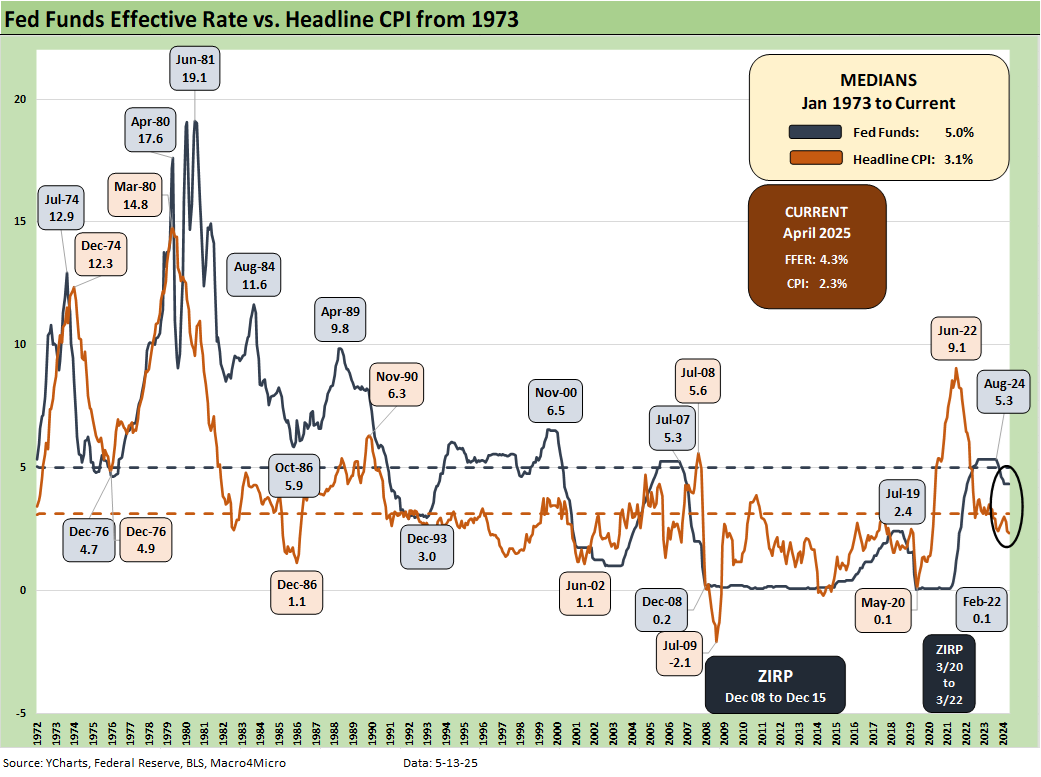

Framing fed funds vs. CPI (or PCE prices given the Fed’s preference) is just another way of framing how restrictive monetary policy is with a proxy for “real fed funds.” That is also a frame of reference for how much room the Fed has to ease. The chart frames effective fed funds vs. headline CPI. The 4.3% for fed funds at the most recent time stamp has 2 points of latitude vs. inflation at 2.3%. There is less room vs. Core CPI at 2.8%. The Fed prefers PCE, but there is not much room to be wrong on inflation and a few more months of market testing on tariffs would be time well spent.

The Big 5 CPI buckets above include our own version of the Automotive sector given the prominent role a vehicle plays in a household budget (see Automotive Inflation: More than Meets the Eye 10-17-22).

Given the tariff lag time, the margin of comfort is not as comfortable as many would like to see given the tariff lineup:

Food: Food at Home at +2.0% YoY included the MoM Food at Home number with -0.4% deflation vs. the +0.5 MoM see in March. That is a crowd favorite for consumer sentiment. In contrast, Food Away from Home at +3.9% YoY (+0.4% MoM) has stayed sticky with all the related costs attached to that line.

Energy: Energy operates like a consumer tax cut when oil prices tank (a tax hike when they rise), so the numbers are helpful at this point even if for the wrong reason. The -3.7% total Energy deflation YoY and Gasoline CPI at -11.8% were favorable. That deflation hope from Trump likely did not include a demand-side panic from recession fears when he was promising drill, drill, drill. OPEC has been helping out in the oil price slide recently, but that X factor is always a wildcard. Trump hostility to Canadian energy that almost called for even higher tariffs was one more threat that did not get as ugly as it might have.

The Energy Services line at +6.2% is the highest since 2023 with Electricity at 3.6%. Energy Services has posted 3 consecutive high MoM numbers with +1.5% in April. Those lines will be worth watching as we roll into the summer and fall. Utility (piped) Gas is another one at +15.7% YoY after back-to-back 3% handle MoM numbers, including a recent high of +3.7% MoM.

Shelter: The assumption-heavy Shelter CPI offered little relief with headline Shelter CPI at +0.3% MoM, up slightly from +0.2% in March. The YoY Shelter CPI was at +4.0%. Owners’ Equivalent Rent (“OER”) operates in a different world than actual home prices since the early 1980s change in methodology that uses rent-derived Owners Equivalent Rent, but the reality is that home prices (subject to mix and region) keep rising as well out “in the world” (see Existing Home Sales March 2025: Inventory and Prices Higher, Sales Lower 4-24-25, New Home Sales March 2025: A Good News Sighting? 4-23-25).

The rising cost of materials (including lumber) and tighter labor do not bode well for the consumer pocketbook even if the rising costs do not translate well into CPI methodologies. Builders need to recover that cost at a margin. We looked at the change in methodology in the past. Shelter/housing has the attribute of being both a service cost of shelter and an investment that appreciates.

Automotive: For Auto-related, the import car tariffs and rising material costs tied to rising steel and aluminum tariffs will make for higher new and used car prices. Copper is next on the tariff list as well. After a review of 1Q25 results and management commentary in the franchise dealer space and a review of the used car players, the inflation in used cars will be back for a range of reasons. At the top of the list is increased demand for more affordable used cars. April’s used car deflation MoM at -0.5% and YoY and +1.5% YoY will be an old memory soon enough.

Health care: Away from the battles over Medicaid and what will come out of the budget bill, the dominant variable in the home stretch of 2025 will be pharma and how tariffs and recent policy initiatives on price regulation plays out. Medical Care Commodities posted a MoM CPI of +0.4% for April and +1.0% YoY. The Prescription Drug subset was +2.3% YoY.

The handicapping of Medical Care Commodities was getting scary if the China-US trade clash escalated into a supply shock (notably in generics), so that was a near miss on disaster even if a pause and tariff negotiation does not eliminate that risk entirely. The #2 import group from the EU is pharma also, so that does not bode well for trade peace for the #1 trade partners of the US (the EU). The prices of prescription drugs or the broad product group will be vulnerable to inflation pressure.

The remaining cross-section of CPI lines is near and dear to many households and small businesses. The CPI numbers are reassuring overall in the mix above, but the one that jumps out as most vulnerable is “Apparel” given the wave of punishing tariffs assigned to countries with low labor costs and a high mix of textile-based imports into the US (see Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25). The YoY deflation for Apparel is one that seems highly suspect and in fact could see CPI go materially higher with such tariffs as those proposed. Making the country safe from foreign “cut and sew apparel” seems like a stretch of legislative intent for national security tariffs.

Credit Spreads: The Bounce is Back 5-13-25

Footnotes & Flashbacks: Credit Markets 5-12-25

Footnotes & Flashbacks: State of Yields 5-11-25

Footnotes & Flashbacks: Asset Returns 5-11-25

Mini Market Lookback: When in Doubt, Get Forcefully Ambiguous 5-11-25

Credit Snapshot: PulteGroup (PHM) 5-7-25

Credit Snapshot: Toll Brothers 5-5-25

Mini Market Lookback: Inflated Worry or Slow Train Wreck? 5-3-25

Payrolls April 2025: Into the Weeds 5-2-25

Payroll April 2025: Moods and Time Horizons 5-2-25

Construction: Singing the Blues or Tuning Up for Reshoring? 5-1-25\

Employment Cost Index 1Q25: Labor is Not the Main Worry 5-1-25

1Q25 GDP: Into the Investment Weeds 4-30-25

PCE March 2025: Personal Income and Outlays 4-30-25

1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25

Other Inflation Related:

Employment Cost Index 1Q25: Labor is Not the Main Worry 5-1-25

Inflation: The Grocery Price Thing vs. Energy 12-16-24

Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23

Fed Funds – Inflation Differentials: Strange History 7-1-23

Fed Funds, CPI, and the Stairway to Where? 10-20-22