Mini Market Lookback: Tariff Excess N+1

We saw a grim week with a 50% tariff threat against the EU (#1 trade partner) and 25% against Apple

Fresh tariff spike and trade war? Remember, selling country pays…or is that a lie?

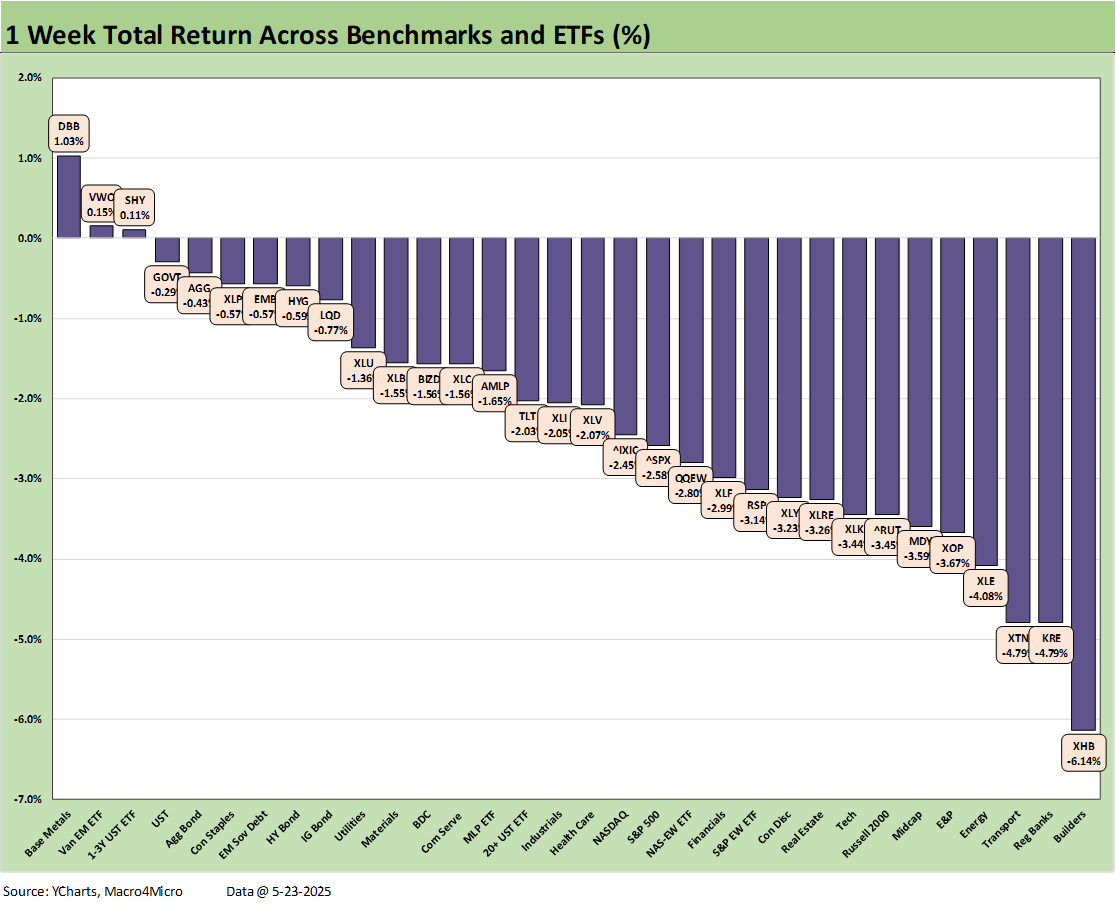

The 1-week return numbers posted a 3-29 score with equities losing, duration losing, and one asset class ETF (base metals) barely crossing 1% for the week. The UST curve was also in disarray with the budget battles and deficit noise sending the 30Y north of 5.0% and the Senate only getting to the House version this coming week.

The 50% tariff planned for the EU as of June 1 risks a trade war with the #1 trade partner as the EU bureaucracy has been preparing for months (see US-EU Trade: The Final Import/Export Mix 2024 2-11-25). The EU has been tinkering around with a very aggressive anti-coercion instrument, so this next round could go down a dangerous path for both economies (see Reciprocal Tariff Math: Hocus Pocus 4-3-25).

Given Trump’s behavior with Greenland/Denmark, Ukraine, interfering in EU elections, and his clear targeting of the #3 economy in the world (Germany), the question is “Will this be the time when the EU finally decides to throw down?” If so, will that influence Canada, Japan, South Korea, or Mexico as they struggle with Washington?

In the end, the latest tariff aggression against the EU is another risk variable that threatens growth and inflation and gives the Fed one more variable to hold them back.

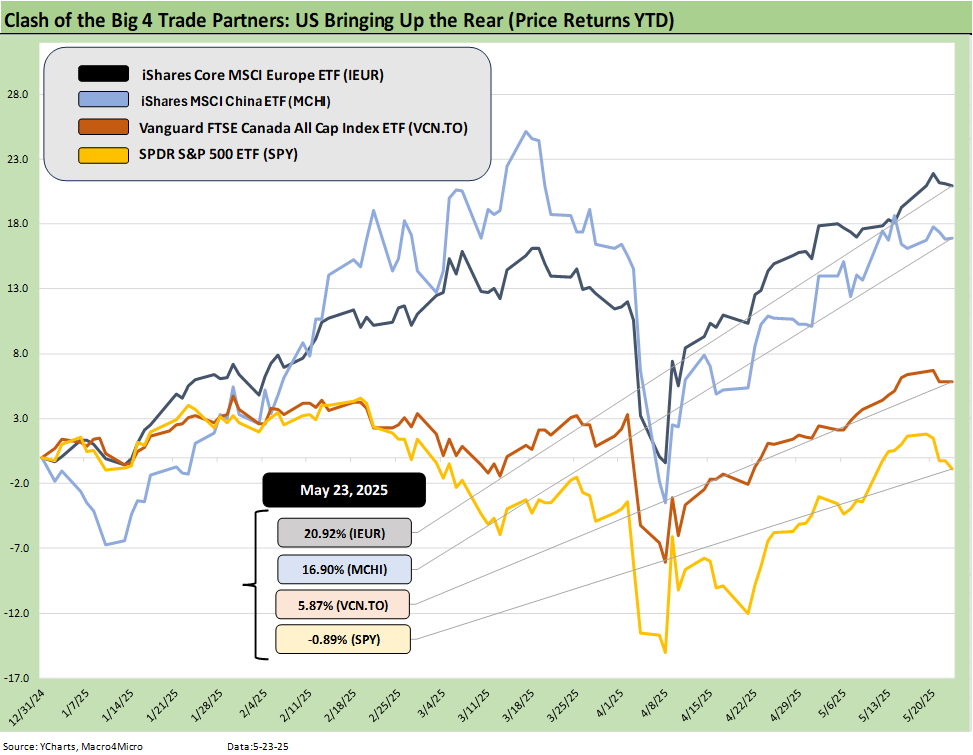

The above chart updates the running YTD return on ETF benchmarks that capture the market view on the battle of the US vs. Europe vs. China vs. Canada. As in recent weeks, the US is pulling up the rear and is back into negative range with Europe and China well ahead. We let the US off easy by using just the S&P 500 index ETF (SPY) since the Midcaps and Small Caps are doing much worse as we cover in the separate Footnotes publication on asset returns. As we head into Memorial Day weekend, the US is running last with a vote of low confidence in the “New Golden Age.”

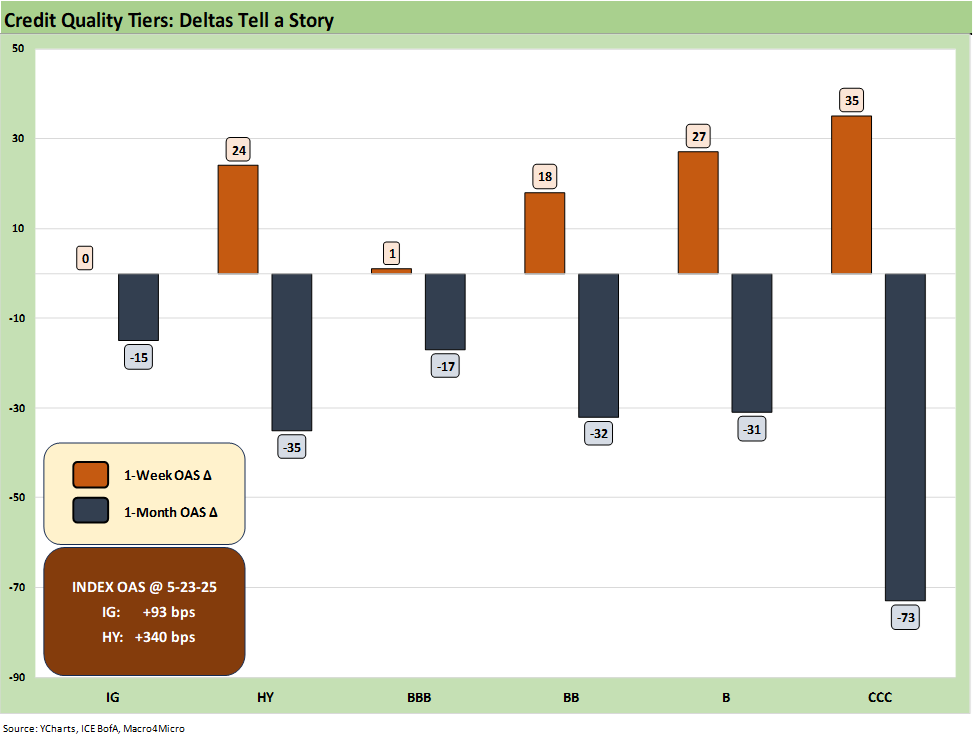

The above chart updates the 1-week and 1-month credit spread deltas for the IG and HY index and the credit tiers from BBB to CCC. The week was another case of quality spread decompression as the BB, B, and CCC tier posted wider spreads that ate into the post-pause, post-China-truce rally.

IG spreads held in well and were still in double digits as we will cover in more detail in our separate Footnotes publication on Credit Markets to be published later this weekend. The HY spread widening comes after a move that sent HY OAS back to the cyclical lows of early Oct 2018 (see Footnotes & Flashbacks: Credit Markets 5-19-25).

The 32 asset line items that we review each week generated a score of 3-29, and that is a clear message from equities and fixed income. EM Equities (VWO) and Short UST 1Y-3Y ETF (SHY) barely registered positive with only the Base Metals ETF (DBB) making it to 1.0%.

We saw homebuilders hit the hardest on yield curve worries with Regional Banks (KRE), Transports (XTN), Energy (XLE) and E&P (XOP) showing the combined worries around trade volumes, the cycle and interest rates.

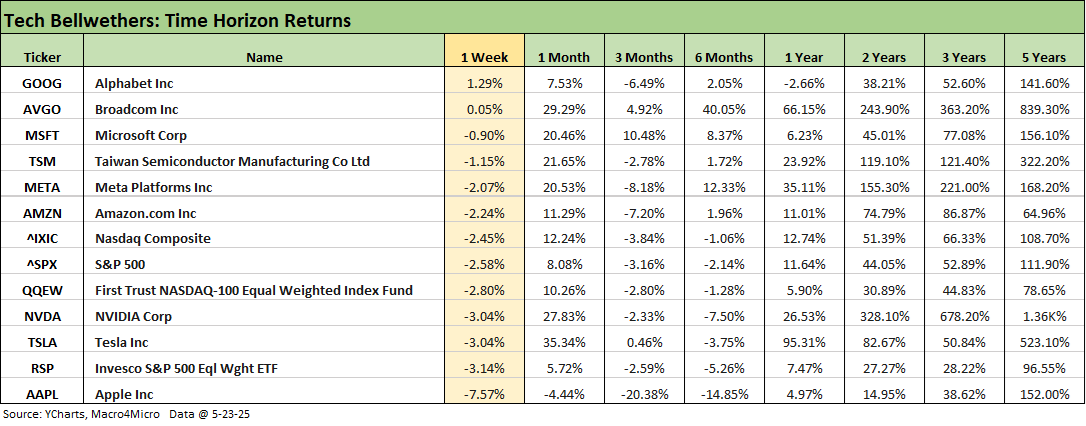

The Tech bellwethers had a return to a negative-heavy bias with only Alphabet and Broadcom in positive range. We see 6 of the Mag 7 in the red and Apple on the bottom with Trump’s 25% tariff threat. The 25% threat specifically stated Apple would have to pay the tariff, but then Trump was back on the airwaves saying he collected “$600 billion of tariffs from other countries” in Trump 1.0. It is not inspiring to see such a poor grasp of basic economics, but such are the times.

A wildcard in the EU battle will be the new EU threat to go after tech services using new retaliatory mechanisms they have put in place (see Reciprocal Tariff Math: Hocus Pocus 4-3-25). Such a strategy would have been a major escalation in most circumstances, but the 50% move by Trump would only make it a partial retaliation. That is how bad 50% is on top of all the other product group tariffs in place and pharma tariffs on the way. Pharma is the #1 import into the US from the EU by far.

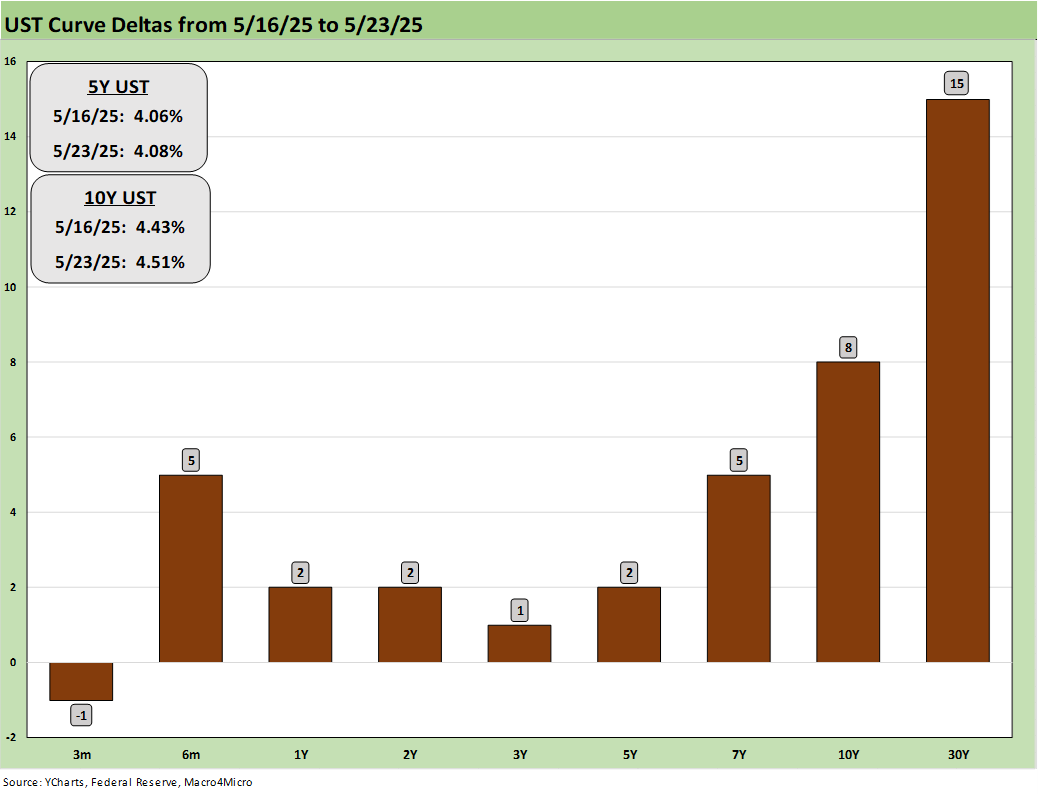

The UST weekly deltas are posted above and the sharp move in the 30Y stands out. The 10Y UST also moved higher and left the 30Y Mortgage rates just over 7% using the Friday close for the Mortgage News Daily survey.

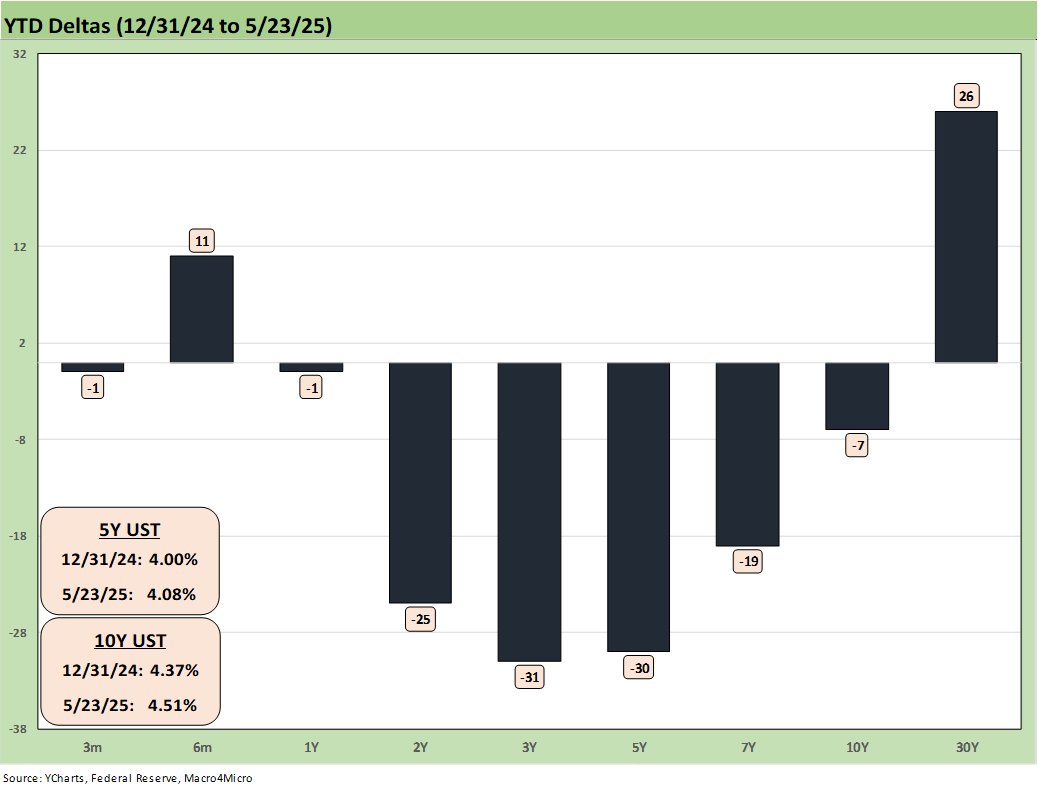

The YTD UST deltas still show a material downshift from 2Y to 7Y, a small move lower by the 10Y UST, but the 30Y UST bringing an ugly move wider on the combination of inflation fears and massive supply needs from the UST. The systemic noise around Japan is not helping as the #1 holder of UST and another trade partner mired in ugly trade demands from Trump.

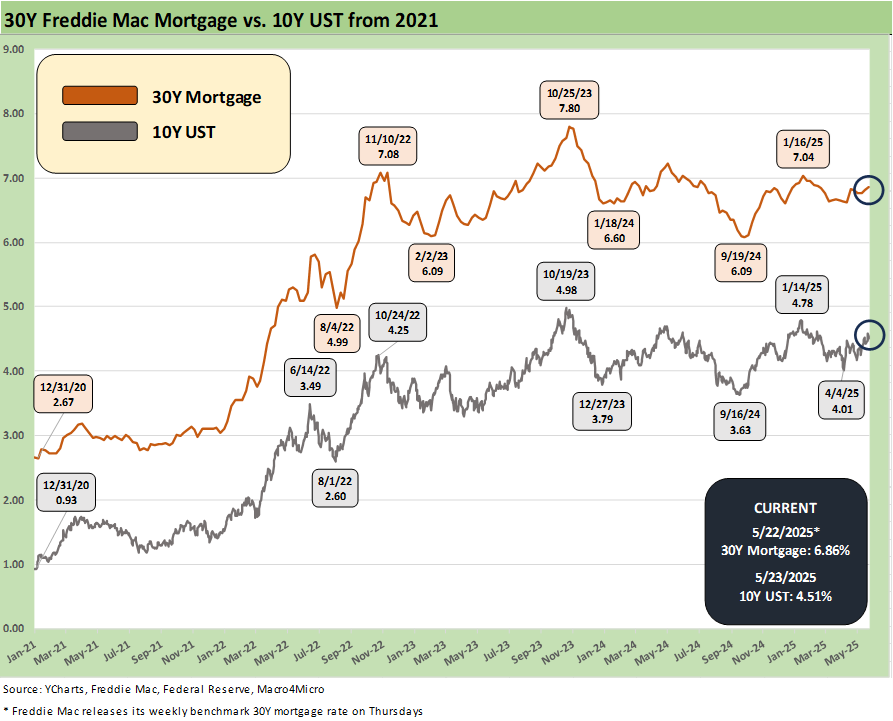

The above time series updates the history of the 10Y UST and Freddie Mac 30Y mortgage benchmarks since the sub-1% 10Y UST of year end 2020. We see the highs of just under 5% at 10-19-23 when mortgages also peaked in the fall of 2023. At that time, surveys distinct from Freddie crossed above 8% while Freddie hit 7.8%. That offers a reminder that we can easily head back in that direction out the curve if these tariffs push inflation higher.

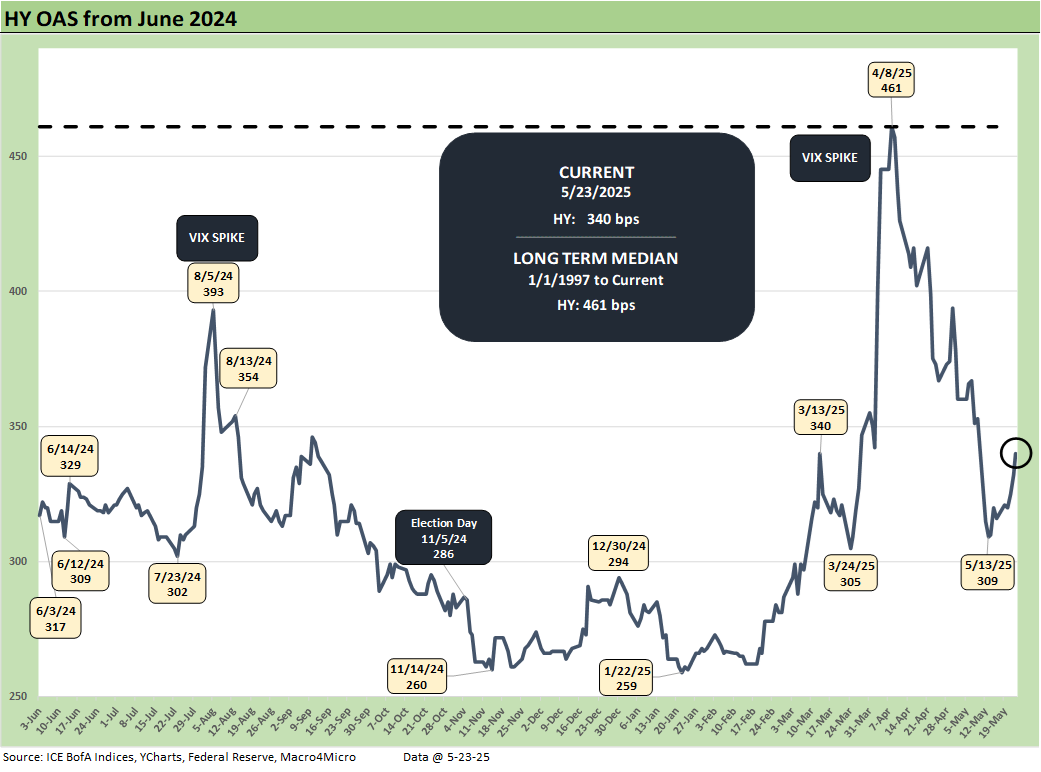

HY OAS widened by +24 bps on the week from +316 to end last week to the current +340 bps. That is a material bounce off the +309 bps lows on 5-13-25 and dramatically inside the +461 bps shortly after Liberation Day.

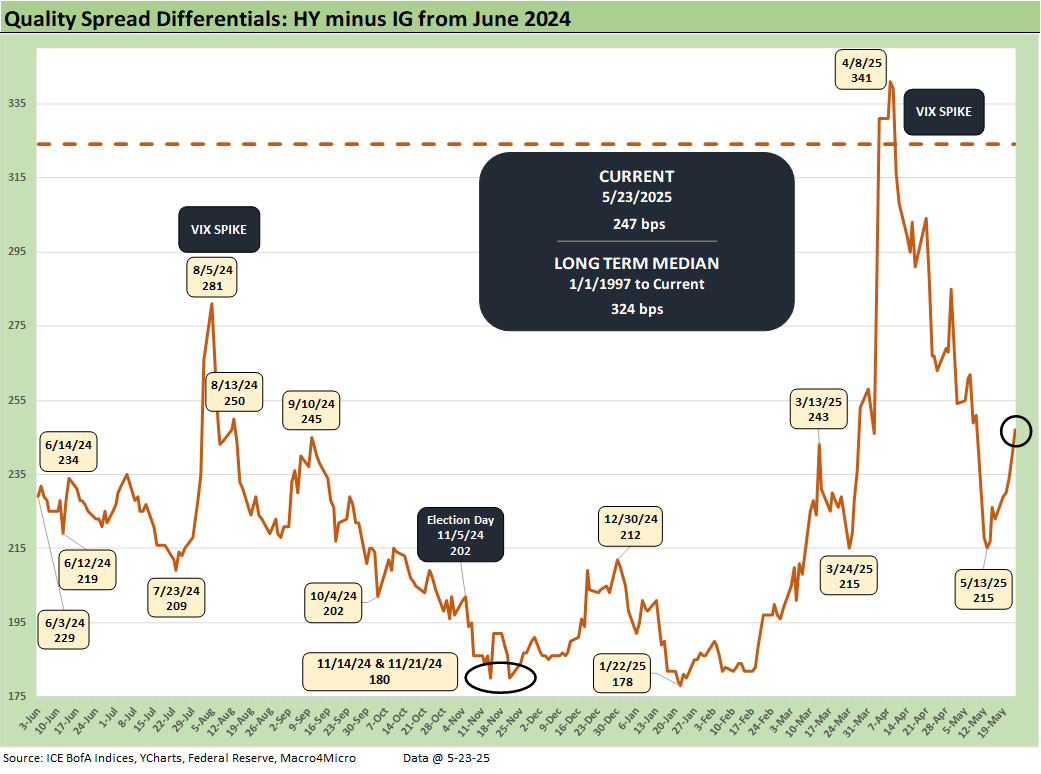

The “HY OAS minus IG OAS” differential saw material quality spread widening on the HY OAS move wider as the week ended at +247 bps or +24 bps wider than last week. It is notable that the IG OAS was flat on the week.

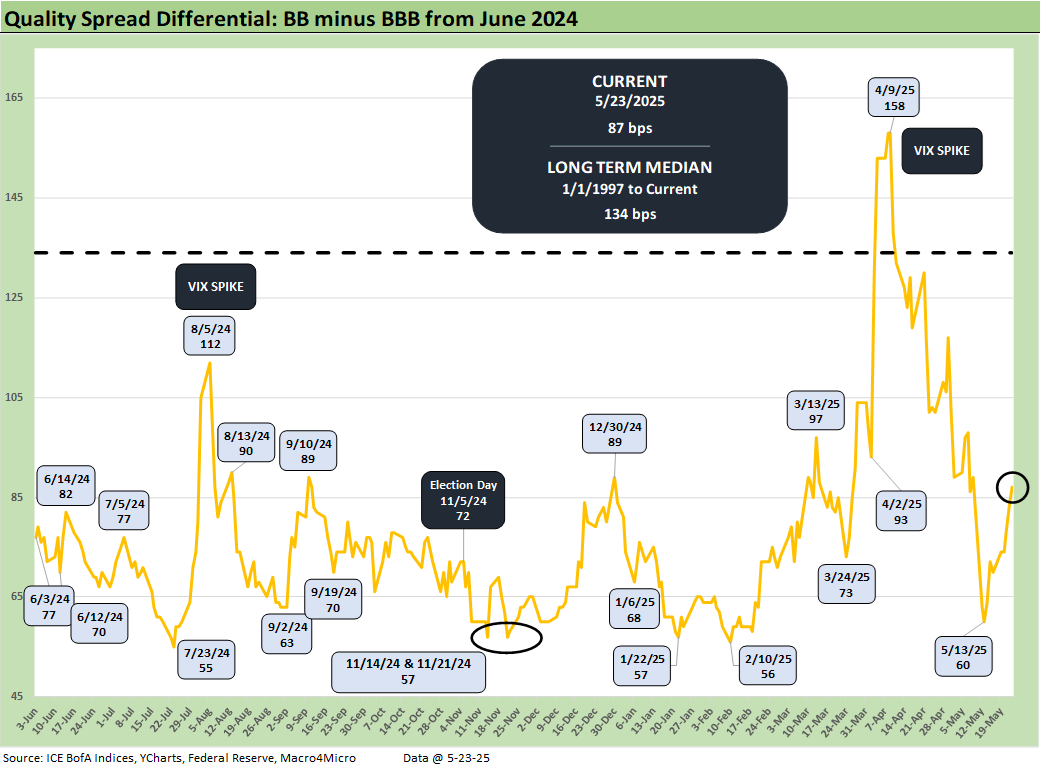

The “BB OAS minus BBB OAS” quality spread differential widened to +87 bps from +70 bps the past week on the BB tier move wider by +18 bps and BBs by +1 bps.

See also:

Footnotes & Flashbacks: Credit Markets 5-19-25

Footnotes & Flashbacks: State of Yields 5-18-25

Footnotes & Flashbacks: Asset Returns 5-18-25

Credit Spreads: The Bounce is Back 5-13-25

Recent Tariff Commentaries:

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25