Durable Goods: Staying the Cyclical Course

We scan the durable goods release columns for MoM trends in new orders, shipments, unfilled orders, and inventories and the trend remains steady.

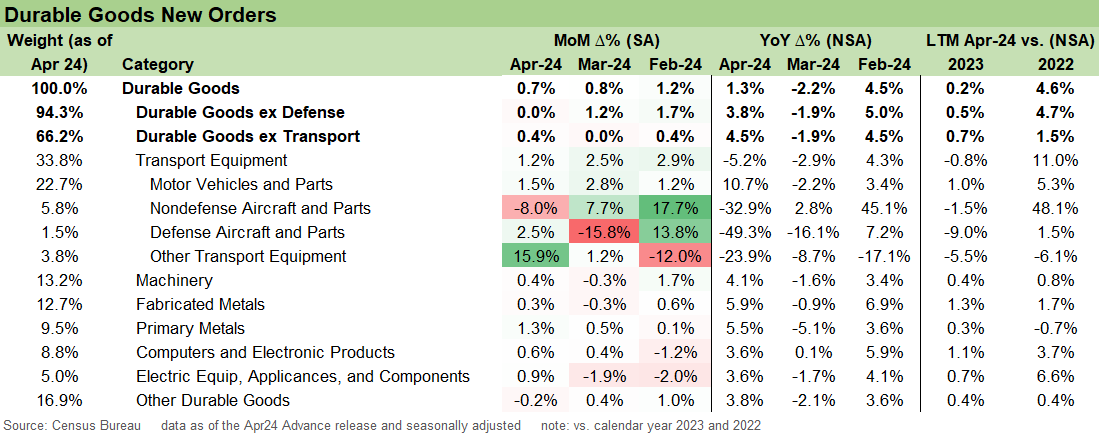

The overall trend for durable goods was similar to last month (see Durable Goods: Back to Business as Usual? 4-24-24) with headline growth in total new orders with few negative numbers to be found except for the sharp decline in non-defense aircraft and parts (-8.0%) and small move in new orders for nondefense capital goods (-1.5%) with the latter positive ex-aircraft.

Overall orders linked to defense carried the month, but we also see strength in larger line items included in Transportation Equipment (led by Motor Vehicles and Parts). We also saw Primary Metals, Fabricated metal products, and Machinery all positive.

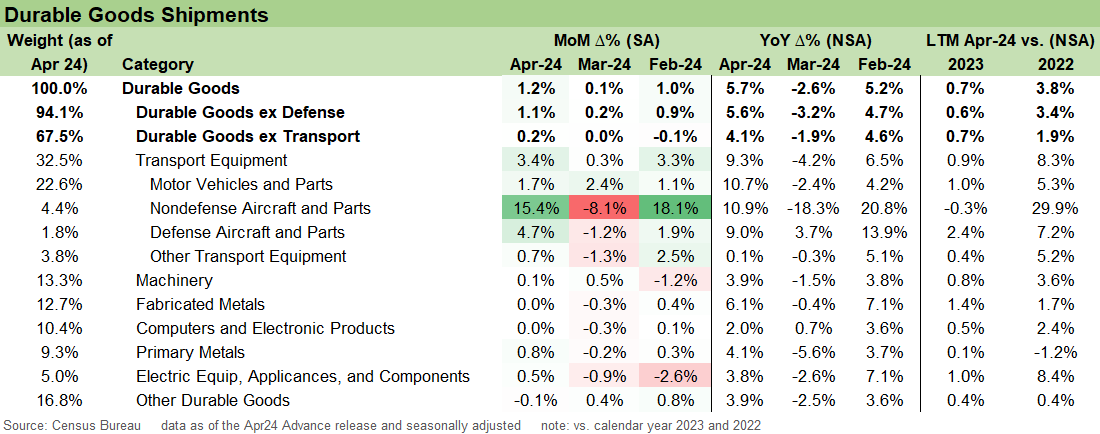

Shipments posted positive or flat MoM trend line across all major categories with 1 minimally negative line in the small category of “Other.”

The total unfilled order and inventory lines were minimal but were positive, so that takes some of the edge off on the idea of a hot manufacturing cycle from here or excess confidence around forward sales in the inventory deltas.

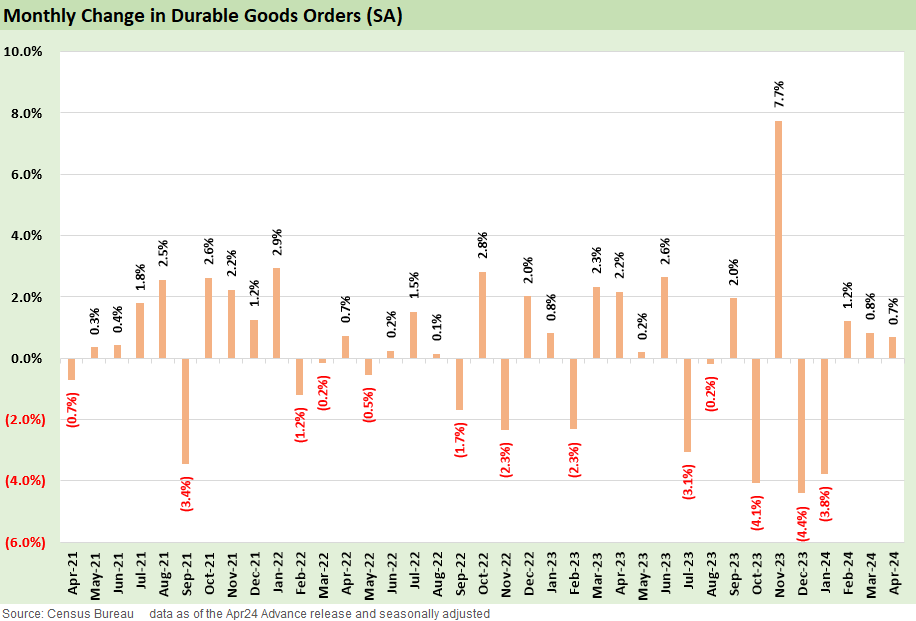

Headline durable goods orders string together another positive month against expectations, rebounding from a volatile stretch at the end of 2023 and into 2024. This month’s release also includes large backwards-looking revisions to the seasonal adjustment factors back to 2012 that includes recent month revisions consisting of Jan24 from -6.9% to -3.8%, Feb24 from .7% to 1.2%, and Mar24 from 2.6% to .8%. The overall theme of volatility remains with 5 of the last 12 months in the red that includes a wild Oct23 to Jan24 period influenced heavily by Boeing’s continuing woes and how that reverberates across the supplier chain.

The above chart breaks out the line items and the major “Durables ex” cuts that are frequently cited. Underneath the headline number we see Durable Goods ex Defense at flat at 0% on the month, implying a significant increase in defense orders.

The $95 bn foreign aid bill passed towards the end of April will be flowing into those defense lines over time (and some potentially already in the numbers), but the timing is uncertain on where such shipments flow into the unfilled orders, inventory, and shipments. Directionally, the aid bill was obviously good news for the defense sector even if not for the pro-Putin characters in Washington.

Durable Goods ex Transport is positive news for manufacturing demand at .4% MoM seasonally adjusted, which is up 4.5% vs. Apr 2023 on a not seasonally adjusted basis. Within that transport grouping, Nondefense Aircraft and Parts is back to a decidedly negative month at -8.0% where much of the Boeing saga continues to play out.

The above chart frames the shipment side of the ledger. We see that shipments are positive across the board and should continue to be next month with the bump in defense orders this month.

April 2024 results are mixed but positive and for many signals a stronger-than-expected manufacturing sector after some softness in the industrial production numbers. This month was largely buoyed by defense spending, but that moved the needle enough to shift focus away from Transport for the one month.

See also:

New Home Sales April 2024: Spring Not Springing Enough 5-23-24

Footnotes & Flashbacks: State of Yields 5-19-24

Footnotes & Flashbacks: Asset Returns 5-19-24

Industrial Production April 2024: Another Softer Spot 5-16-24

Housing Starts April 2024: Recovery Run Rates Roll On 5-16-24

CPI April 2024: Salve Without Salvation 5-15-24

Retail Sales April 2024: Get by with a Little Help 5-15-24

Consumer Sentiment: Flesh Wound? 5-10-24

April Payroll: Occupational Breakdown 5-3-24

Payroll April 2024: Market Dons the Rally Hat 5-3-24

JOLTS March 2024: Slower Lane, Not a Breakdown 5-1-24

Employment Cost Index March 2024: Sticky is as Sticky Does 4-30-24

PCE, Income, and Outlays: The Challenge of Constructive 4-26-24

1Q24 GDP: Too Much Drama 4-25-24

1Q24 GDP: Looking into the Investment Layers 4-25-24

Durable Goods: Back to Business as Usual? 4-24-24

Systemic Corporate and Consumer Debt Metrics: Z.1 Update 4-22-24

Credit Markets Across the Decades 4-8-24

Credit Cycles: Historical Lightning Round 4-8-24