1Q24 GDP: Too Much Drama

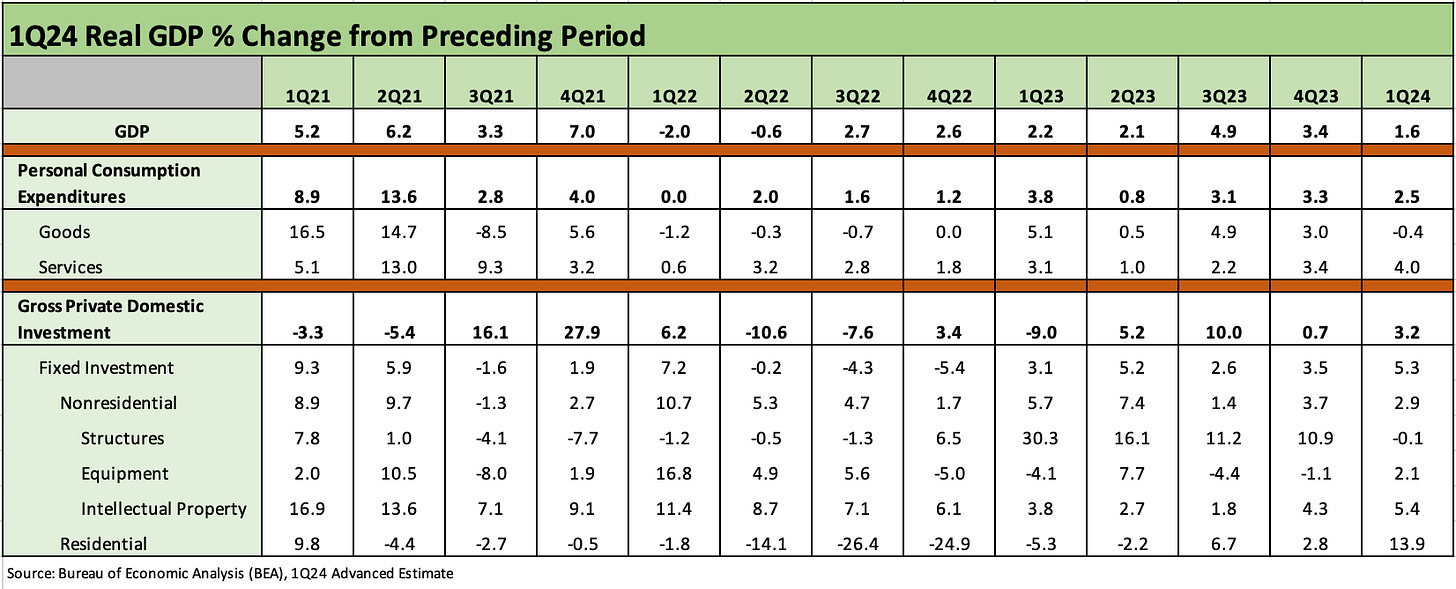

The lowest GDP since 2Q22 included +2.5% PCE, solid fixed investment, lower government, and negative distortions of inventory and trade deficits.

“Leave me out of this!”

At +1.6%, the markets saw the lowest GDP since 2Q22 , but that included some of the “Big Little Things” we like to watch for with the total GDP contribution of inventory + trade deficits driving a haircut of -1.21% to GDP.

The PCE line that details changes from preceding periods (Table 1 of GDP release) was +2.5%, which is lower than the 3% handles in 3 of the 4 2023 quarters (+3.3% 4Q23, +3.1% 3Q23, +3.8% 1Q23) but well above the +0.8% of 2Q23. Those came after an ugly 2022 which posted a high quarterly PCE number of +2.0% in 2Q22.

GPDI was solid at +3.2% with +5.3% on the Fixed Investment line with Residential putting up an eye-popping +13.9% and Nonresidential at +2.9%.

Government investment of +1.2% was the lowest since back-to-back negatives of -1.9% in 2Q22 and -2.9% in 1Q22.

More unnerving for the market on inflation fears was the quarterly price index for gross domestic purchases at +3.1% and core price index at +3.7% alongside yet another strong set of weekly numbers for initial claims and continuing claims. There is not much in terms of contraction signals in employment.

The above chart runs through the line items we like to lock in on each quarter. The headline number of +1.6% is certainly lower than expectations, but the line items had a very constructive mix in the lines that matter most. The price index nerves caused some commentators to use the word stagflation, but we find that more a matter of drama (or axes) and goes in the “does not apply” category at this point. The line items above in PCE and GPDI lack a “Stag.” Reduced chances of FOMC cuts on the last mile inflation challenge would be a more logical takeaway rather than sounding the 1979 alarms.

As mentioned in the bullets, the negative tweaks included a -0.86% GDP delta contribution for trade deficits while changes in private inventories brought a –0.35% negative hit to headline GDP. That is -1.21% of the +1.6% headline GDP number.

For the -0.86 contribution to GDP on trade (see Table 2 of the release), that comes on the heels of 7 straight positive quarters following a -2.59% negative in 1Q22, which for its part was a -2.0% headline GDP quarter. After that setback in 1Q22, the market saw a +2.58% positive from trade in 3Q22 (see 3Q22 GDP: It’s the Big Little Things 10-27-22). Private inventories have been negative in GDP contributions for 6 quarters since 1Q22, positive twice, and 0.0% once (Table 2 of release).

In the slicing and dicing of the PCE lines, we see Goods at -0.4% in a slide in Durables down by -1.2%. Services at +4.0% offers a reminder of demand and why that bucket has stayed sticky in the inflation metrics in the struggle over that last mile.

The nonresidential and residential investment side overall was reassuring with the Fixed Investment line making a contribution to GDP of +0.91% for the highest since 1Q22. We have seen 3 quarters in negatives there since 1Q22. The YoY growth in Residential investment at +13.9% was the highest since 4Q20 when home starts had exploded on the flight to the suburbs (see Housing Starts March 2024: The Slow Roll and Ratchet 4-16-24). Structures was almost flat at -0.1% for the only negative in that mix, but that is framed against a boom on that line with 4 straight double digit quarters of growth as construction has soared.

We will follow up with a separate note on the fixed investment lines and the mix across GPDI nonresidential. From our vantage point, we see the fixed investment lines as a positive even if they slow. Many of the construction programs are multiyear in nature while residential gets more wagged by a mix of mortgage rates and demographics. Residential goes under the heading of long-term demand strength with short term headwinds. The strength of the homebuilder reports this quarter are consistent with this hot residential investment line (see PulteGroup: Strong Volumes, Stable Pricing 4-24-24, D.R. Horton: Ramping Up in 2024 Despite Mortgages 4-19-24).

See also:

4Q23 GDP: Final Cut, Moving Parts 3-28-24

4Q23 GDP: Second Estimate, Moving Parts 2-28-24

GDP and Fixed Investment: Into the Weeds 1-25-24

4Q23 GDP: Strong Run, Next Question is Stamina 1-25-24

3Q23 GDP Final Cut: Swing and a Miss on 5%, Good Contact on PCE Prices 12-21-23

Tale of the Tape in GDP: Trump vs. Biden 12-4-23

Construction Spending: Timing is Everything 12-1-23

Construction: Project Economics Drive Nonresidential 10-2-23