Industrial Production April 2024: Another Softer Spot

We look at capacity utilization lines across the industrial subsectors with Manufacturing slightly softer on the month.

Still looking for that soft landing zone…

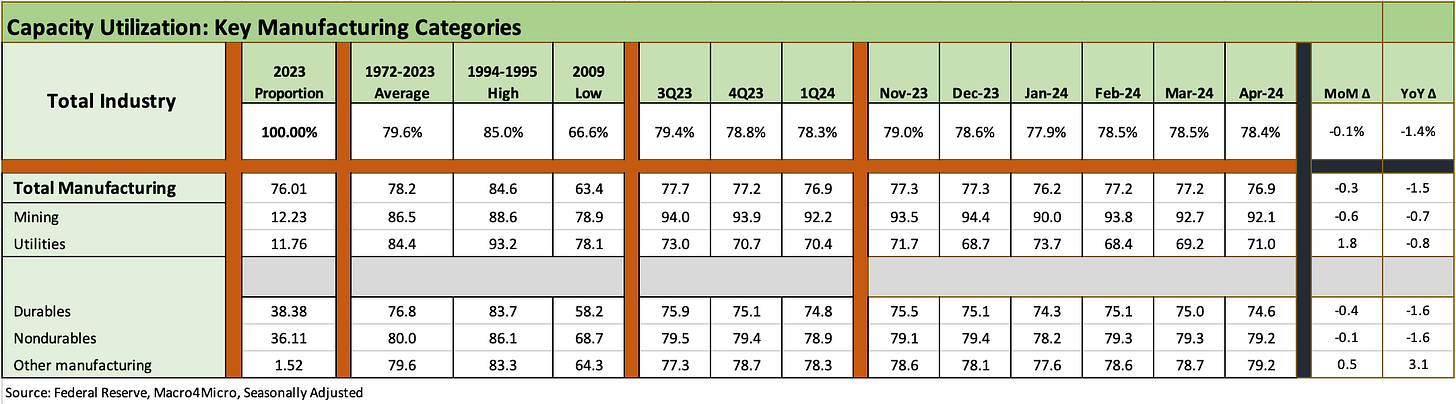

We update our running capacity utilization tracking for the main events in the industrial universe across Durables, Nondurables, Utilities, and Mining with 3 of the 4 posting “cap ute” levels that were slightly lower.

While not signaling hints of recession, the apparent diminished pricing power is evident in Durables as seen in the CPI and PCE monthly reports with Machinery one of the weaker buckets YoY but running only slightly below its post-1972 average.

We include some of our multicycle charts in the mix this month for some long-term perspective on capacity utilization across the cyclical histories.

The above chart takes a journey across the cycles for Manufacturing capacity utilization (excludes Utilities and Mining). Current Manufacturing “cap ute” stands at 76.9%, which is below the long-term median noted in the chart of 78.7%. We break out some other timeline medians in the chart with the post-crisis median of 75.4% being the lowest. Manufacturing is running ahead of the post crisis median but below the post-TMT years and long term median from 1967.

The above chart breaks out some of the major industrial buckets across Total Industrial Production and the 4 main groups: Durables, Nondurables, Mining and Utilities. We detail the MoM and YoY deltas on the right. Durables and Nondurables are both down for MoM and YoY. That clearly says “softer.”

The above chart breaks Durable into 5 of the larger bellwether industry sectors, and we see 3 of 5 down MoM and 3 of 5 lower YoY with one flat at zero. The two largest industry groups in Durables, Chemicals and Food/Beverage/Tobacco are both down YoY but firmer MoM.

The one that stands out in the mix is Machinery, which historically tends to be a late cycle reinvestment story line. With so many supplier chain disruptions and high interest rates penalizing capital investments (at least the subsectors and projects not subsidized by legislation) the underlying drivers are more mixed in this cycle.

The above chart lines up the median capacity utilization levels for expansion and recession periods using NBER dates. With the exception of the current cycle and the month of April 2024 on the left of the chart, we line the medians up in ascending order.

The ability to generate solid profit margins at lower capacity utilization levels is a function of cost structures from fixed to variable. Lowering cost structures was a strategic focus coming out of the credit crisis years and many manufacturing companies were able to print higher profits and margins (and some record profits) by virtue of “leaning” supplier chains and investing in automation. The Auto sector was a case study in lowering break-evens and redesigning their supplier chains.

While there is a lot of to and fro on the politics of efficiency that is in the eyes of the beholder, economics is called the “dismal science” for a reason and can be unforgiving. Higher labor costs, higher services costs, higher materials costs, and tariffs on inputs all push the breakeven volume higher for a given cost structure and product/service mix. That means pricing power will be exercised where it can be. Otherwise, margins shrink. You can’t hide from the numbers if volumes soften and costs rise. Something would have to give in such a scenario, including cost actions (e.g., headcount).

The above chart adds some more granularity to the past capacity utilization metrics across expansions and recessions. The dates go all the way back to 1969 with the Vietnam War raging and Nixon in his first term. The exercise is one of looking back across time to periods that had a very different backdrop for many industries. We looked at some of the event timelines in earlier commentaries (see Inflation: Events ‘R’ Us Timeline 10-6-22).

Many of the industries faced a rapid pace of structural change across the decades tied to various factors including technology (a massive issue in steelmaking), geopolitics (trade tension with Japan to tension with China across the decades), currency dislocations impacting trade flows (Plaza Accord in 1985), energy security (OPEC’s oil embargo war on the US and allies during 1973-1974 and a smaller war front in 1979 with Iran and Libya less than fond of the US).

Political dysfunction was a common theme from Vietnam to Watergate to the stagflation years giving way to Reaganomics. As chaotic as the late 1960s/early 1970s/early 1980s may have been, the current times in Washington DC make the impeachment hearings in the Watergate years look like a Swiss Watch. Wage-price freezes, the end of the gold standard, and the chaotic clashes of Nixon with Congress seem like days of nostalgia vs. the backdrop of 2024.

The 1970’s was a time when economic stress was rising, but at least the gonadotropin count was dramatically higher than what Washington features today. We should also add “spinal fluid” for a more open minded, gender-neutral application.

For examples, Senator Goldwater of Arizona was an anticommunist and anti-union leader who ran against Johnson (he got crushed), but in the end brought the hammer down on Nixon. Senator Sam Ervin (Senator of North Carolina) was conservative enough to lead a fight against Brown vs. the Board of Education and challenge the Civil Rights Act (so not too liberal obviously), but he also managed to slam Joseph McCarthy and helped bring him down in 1954. Ervin also headed the Watergate investigation of Nixon (I remember watching him on TV blister some Nixon aides in hearings). That was before the age of the neutered Senate lapdogs we see today. Oh for a few true leaders who apply principle.