Durable Goods: Back to Business as Usual?

Constructive durable goods report continues the modest recovery theme to close out 1Q24 and eases some transport jitters ahead of 1Q24 GDP.

The headline 2.6% for durable goods orders goes into the positive column for growth trends ahead of tomorrow’s GDP print but leaves 1Q24 down -4.2% vs. 4Q23.

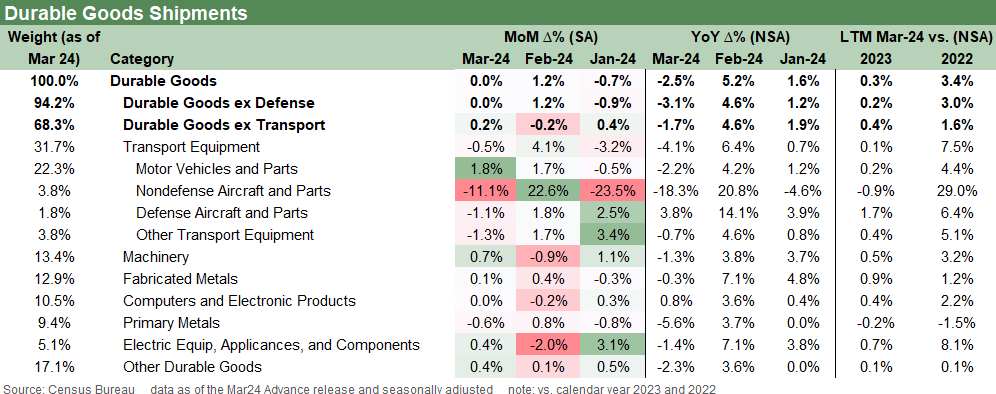

The shipments side of the ledger was flat on a MoM basis and down -0.1% QoQ.

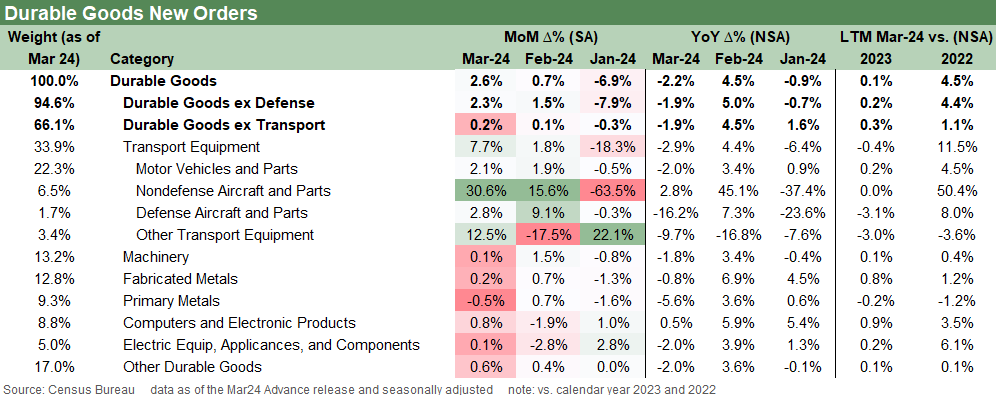

Though the headline Orders strength is driven largely by recovery from the airplane woes in Jan 24, ex-Defense and ex-Transport lines were both positive.

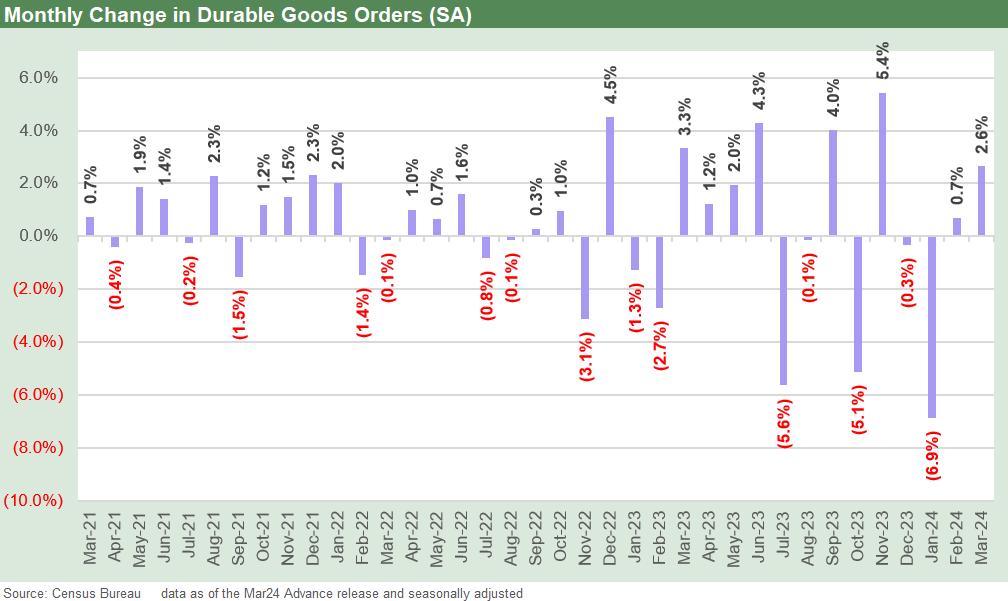

The above chart shows the bumpy ride in Durable Goods orders the past year with 3 prints below the -5% line. Such a small sample does not make a trend, but the recent months are showing volatility in orders.

As we’ve covered previously (See Durable Goods: Forced Landing 2-27-24), the Nondefense Aircraft and Parts line is driving most of the turbulence around the headline number. The most recent order decline is driven by the current Boeing saga and its repercussions as orders pick back up from the Jan 24 plunge. The “ex-Transport” cut tells a different story as we see the last 3 months of prints at +0.2%, +0.1%, and -0.3%.

The above chart provides some granularity with the line items and how much of a transport story 1Q24 has been. Despite the positive headline number, March 2024 is down -2.2% vs. March 2023 (not seasonally adjusted). The numbers speak for themselves but below the Transport lines we see low but broad-based MoM gains outside of Primary Metals down -.5% for the month (in the March 2024 MoM seasonally adjusted column).

With over $60 bn in Ukraine approved this past weekend, we expect that to reflect stronger order numbers in Defense line in the coming months and will be watching the Defense capital goods line more closely.

The above chart frames the shipments side that reflects in current economic activities and flows into GDP, for which we get the first look of 1Q24 numbers tomorrow. We see flat shipments across the major headline groupings. It comes as no surprise that shipments are also weighed down by transport though there is a bright spot given strong motor vehicles and parts shipments. The remaining line items were mostly positive, but we see a more negative picture moving over to Not Seasonally Adjusted.

Overall numbers for March 2024 are mixed but good enough to start a year still in somewhat of quandary over how positive the economic trends can move from here. The transport line continues to dominate the story, but overall the durables story tilts towards the positive side.