Consumer Sentiment: Still Feeling the Heat

We look at another month of worsening consumer sentiment stemming from continued low scores for “present economic conditions.”

While the CPI optimism is not in these numbers yet, the July preliminary consumer sentiment numbers still show the disconnect between economic data and perceived economic realities on the ground.

This marks a fourth month in a row of declining consumer sentiment from the most recent peak in March as the Economic Conditions indexes further deteriorate.

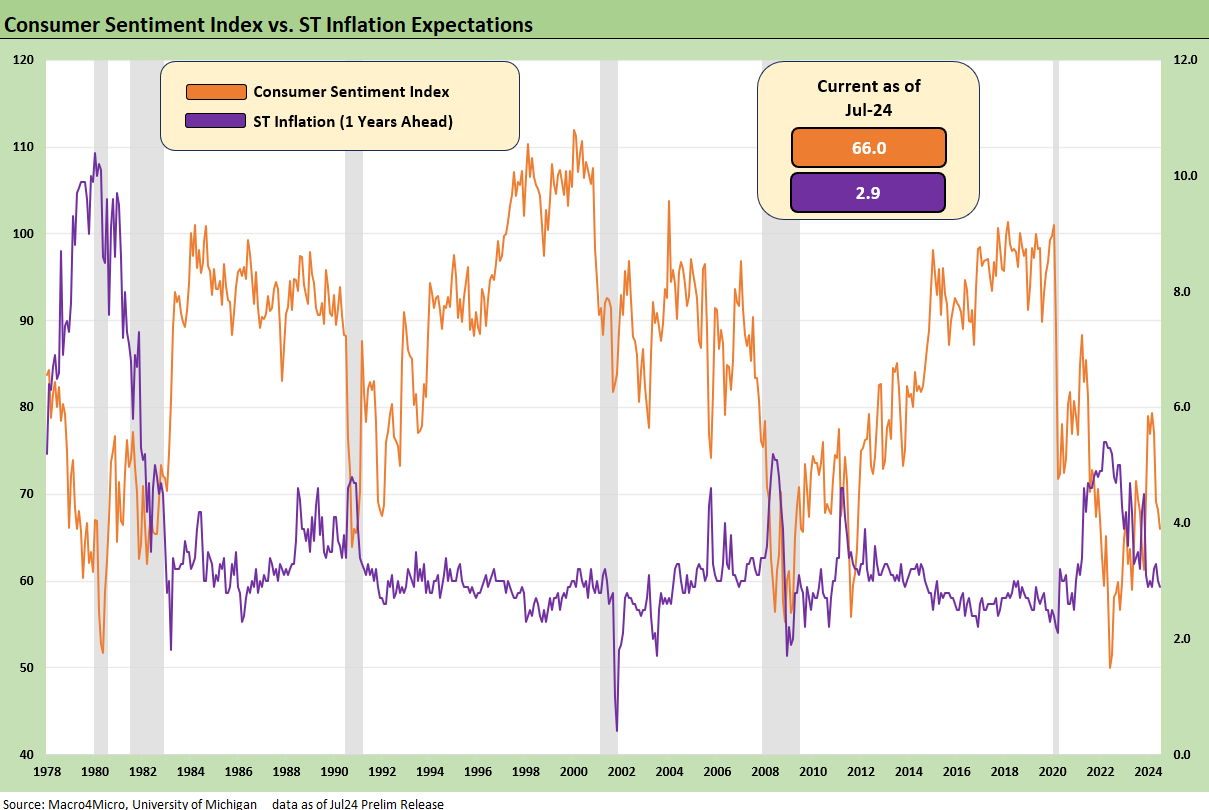

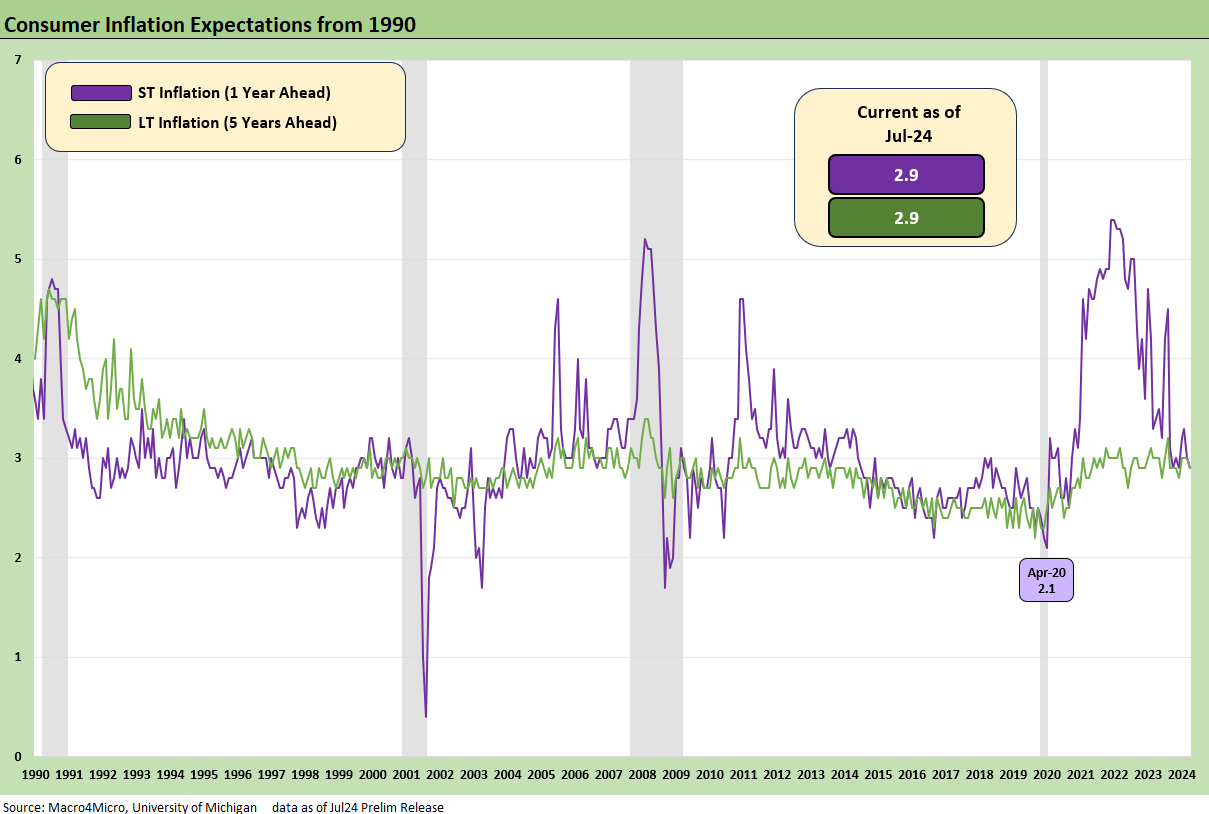

On a positive note, inflation expectations declined to 2.9%, which dovetails with the better CPI data earlier this week that has the market celebrating in interest sensitive sectors and driving new highs on the Dow.

This month’s decline notches another small move down in consumer sentiment similar to the previous month (see Consumer Sentiment: Summer Blues or Election Vibecesson? 6-14-2024). The slide is again tied to declining readings for both the current and expected economic situations where consumers are not experiencing the same economy that the data would suggest.

Though yesterday’s CPI report (see CPI June 2024: Good News is Good News 7-11-24) gave the market even more confidence that rates are coming down, that provides no immediate relief to consumers who are still experiencing sticker shock on every purchase they make, especially around housing affordability and financing costs on their incremental borrowing in mortgages or credit cards. The post-CPI optimism on inflation was anticipated in this release to some extent as short-term inflation expectations came back down to post-COVID lows, offering some support for bolstering sentiment moving forward.

With 2Q bank earnings coming into focus today, we will continue to get some on-the-ground color on the consumer. Both JPM and Citi reported increases in Net charge-offs as well as increasing provisions for credit losses. These metrics have been increasing overall for consumer credit card segments across issuers but have remained in line or below where they started before the wild pandemic roller coaster.

The elephant in the room around these readings remains the wide gap between political party sentiment readings. The cross-party gap of 32 points for overall consumer sentiment (82.5 Dems vs. 50.5 Rep) tells a dark story.

As we’ve noted before, the deep political divisions have been present in this set of numbers, but the gap has widened even more since 2016. Both parties are seeing similar declines over the past few months, but 50.5 for Republicans is below all the headline readings except for the June 2022 low, when the Republican index read 33.0.

The above chart shows the history of present and expected economic situation components of headline consumer sentiment. The current reading remains low in the context of past recessionary periods as the past few years have defined how far perceived economic realities can differ from the economic data.

The above chart lines up short-term inflation expectations against the headline consumer sentiment. Short-term inflation expectation spikes had always been a signal of declining sentiment across history. The absence of a new spike to inflation expectations makes this most recent decline in consumer sentiment stand out.

The last chart updates the short-term and long-term inflation lines. The longer-term inflation trend is still elevated vs. the past cycle but at least appears to be anchored. That is good news for UST bulls that already have been celebrating this week’s CPI print. We would highlight that it is easier to celebrate the UST short end prospects than get too bullish on the longer end of the curve.

Contributors:

Kevin Chun, CFA kevin@macro4micro.com

Glenn Reynolds, CFA glenn@macro4micro.com

See also:

CPI June 2024: Good News is Good News 7-11-24

Footnotes & Flashbacks: Credit Markets 7-8-24

Footnotes & Flashbacks: State of Yields 7-7-24

Footnotes & Flashbacks: Asset Returns 7-7-24

The B vs. CCC Battle: Tough Neighborhood, Rough Players 7-7-24

Payroll June 2024: The Race Gets Confusing 7-5-24

JOLTS May 2024: The Jobs Oasis Still Has Water 7-2-24

Footnotes & Flashbacks: Credit Markets 7-1-24

State Unemployment: A Sum-of-the-Parts BS Detector 6-30-24

The Debate: The China Deficit and Who Pays the Tariff? 6-29-24

PCE, Income and Outlays: Practicing Safe Growth? 6-28-24

HY Spreads: The BB vs. BBB Spread Compression 6-13-24

HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Miscellaneous histories:

Systemic Corporate and Consumer Debt Metrics: Z.1 Update 4-22-24

Credit Markets Across the Decades 4-8-24

Credit Cycles: Historical Lightning Round 4-8-24

Histories: Asset Return Journey from 2016 to 2023 1-21-24

Credit Performance: Excess Return Differentials in 2023 1-1-24

HY vs. IG Excess and Total Returns Across Cycles: The UST Kicker 12-11-23

Inflation Timelines: Cyclical Histories, Key CPI Buckets 11-20-23

US Debt % GDP: Raiders of the Lost Treasury 5-29-23

Automotive Inflation: More than Meets the Eye10-17-22