Footnotes & Flashbacks: Asset Returns 8-25-24

Powell’s Jackson Hole speech gives the market the assurance on easing it wanted with the next PCE and jobs number to shift the odds to -25 or -50 bps.

Powell feeds the market what it wants and brings joy…

The rally week was part follow-through from the prior week, boosted by FOMC minutes and clinched by Powell at Jackson Hole as the UST curve shifted.

The FOMC easing parameters will get influenced by the next round of GDP revisions this week and the PCE release, but the payroll numbers after Labor Day may edge out PCE for once in priority given the renewed focus on potential labor weakness.

We consider how the handicapping of election year policy risk might start to weigh on market confidence in the fall as the Harris team starts to roll out such critical plans as those in housing and see what their strategy is in locking Trump into a position on his long-MIA healthcare plan.

Taxes always loom large in GOP vs. Dems faceoffs, and that is an area where the progressive vs. centrist yin could get yanged around with the GOP waiting to pounce.

Tariff and mass deportations are also material economic risks well beyond the culture war front, and the related inflation risks and trade escalation scenarios will get a lot more airtime with the weeks ticking off.

The above chart updates our high-level benchmarks that we watch in debt and equity markets, and the week shored up the equity number towards positive with 2 positive (S&P 500, Dow) after last week was all 4 negative over the trailing 1-month.

Bond benchmarks stayed all positive again for the 1-month period with all 4 moving higher vs. last week (see Footnotes & Flashbacks: Asset Returns 8-17-24) as the curve rallied and spreads tightened. All 7 bond ETFs weighed in positive for the week as we cover further below in the ETF and benchmark section covering 32 asset subsectors, index benchmarks, and industry ETFs

The month of August started out volatile and stayed hectic as earnings season wrapped. The month was packed with politics, but Powell generated his own excitement at Jackson Hole with a much-anticipated affirmation of easing. The amount of the first cut will be heavily influenced by a few key metrics dead ahead.

The key metrics include the second round of GDP estimates for 2Q24 this coming week and of course the critical PCE inflation data in the Personal Income and Outlays release. Given the focus on labor weakness that is driving the FOMC support for potentially sustained easing, the August payroll numbers might matter more than PCE for once.

The major downward revision in the BLS updated data this past week armed the Fed with -25 bps on the balance of factors for a series of 25 bps cuts al la 2019 and 1998 (see Payroll: A Little Context Music 8-22-24) but they could come up with an excuse for -50 bps with some positive PCE and/or negative payroll surprises.

Geopolitics is always a wildcard as well if we see Iran go martial in the Gulf and test theories once again on transitory oil factors. On the weekend, we saw Israel and Hezbollah have a go at it again with a bigger exchange of fire. Iran can work through its proxy without screwing up the Strait of Hormuz, but these are unusual times.

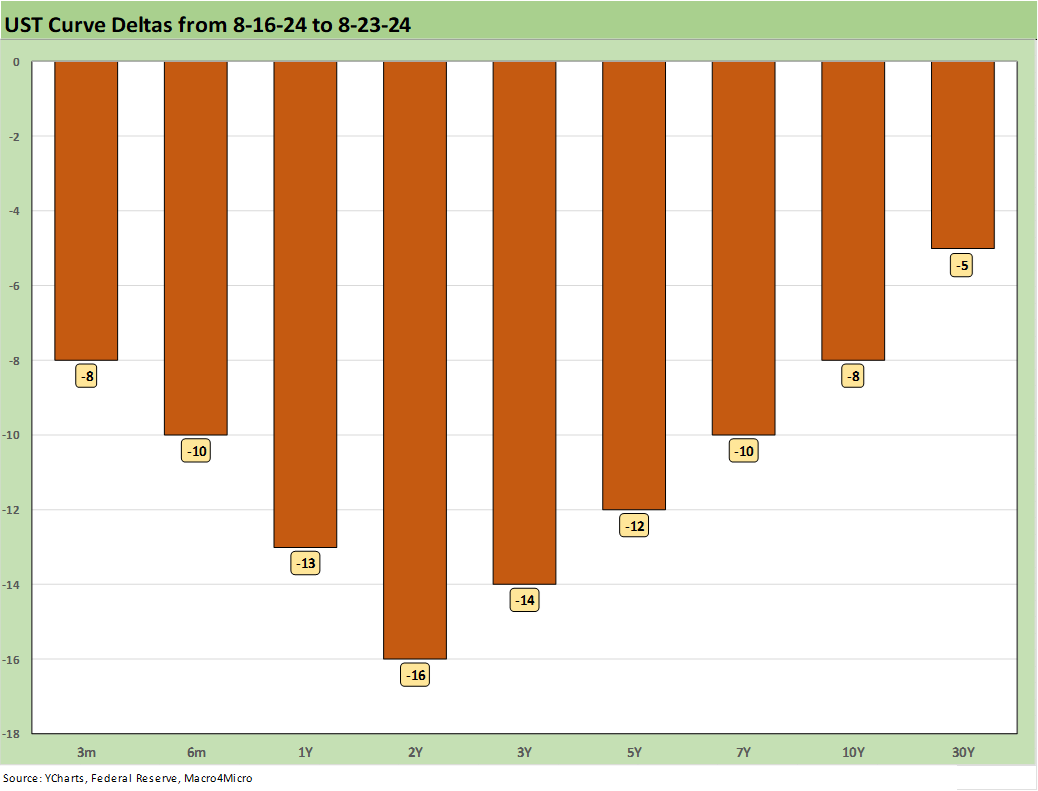

The above chart is one we include each week in our “Footnotes” publication on the State of Yields. We include it also here to underscore the healthy move lower in the form of a 2Y to 30Y bull steepener for the week with double-digit declines from 6M to 7Y.

The above chart updates the 1500 and 3000 series, and the 1-month result is back to 5 positive and 1 negative this week after 4 of 6 were negative in last week’s edition. The Growth index is barely positive for the month after the recent volatility. Only Real Estate pulled well ahead at +5.8% with Financials, Industrials, and Value with 2% handles. The 3 months, 6 months, and YTD numbers are still solid with only the typically volatile energy sector lagging over 3 months and the sole negative for 1-month.

The rolling return visual

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

The above chart offers a quick visual profile of the main time horizons we use. We also added YTD returns recently (not shown above) and we break out the return data in the section further below.

There is clearly a very positive symmetry across the 1-week, 3-month and trailing 1-year with the trailing 1-month also still weighted toward positive at 23-9 despite two days of serious carnage in early August. Considering Trump was yelling “Kamala crash” for a few days, someone may have reminded him that he had two 1,000 point drops in the same week in early Feb 2018 that comprised much higher % declines (see HY Pain: A 2018 Lookback to Ponder 8-3-24). It is hard to see how markets do not see plenty of volatility into the fall with such a wide divergence in policy initiatives.

With quite a few voters in echo chambers and the operative strategy of extremists designed to catalyze hate and toxicity, we always like to retreat to the factual developments first and the interpretation second, plus a little recreational lampooning along the way. GDP growth, inflation, payrolls, real wages, personal income and outlays, trade deficit history, and issues such as “who pays the tariffs” are about the facts. Then the opinions get applied.

Trump and Harris: Bracing for specifics or just needing more?

The risk factors to be introduced into the market are still very murky. Trump’s empty sheet platform in 2020 has given way to a mixed range of theories around what he might do, and Harris will be getting busier soon enough. In the end, a split Washington across Congress and White House might make many topics moot, but the market will want to play with the odds. That of course requires real proposals.

Issues such as what tax policies discourage investment and which foster fiscal prudence may be opinions, but at least they need to be wrapped around specific plans as proposed. Specificity around Trump plans is more limited to social issues and “culture war stuff” but immigration and mass deportations are clear topics on where Trump stands.

Trump’s desire to throw Ukraine to the wolves/Russian bears translates into a second Holodomor with Putin this time rather than Stalin. That will complicate relations with NATO and our largest trading partner, the EU. In the event of tariff clashes, the EU reaction will be important. Trump has been clear on tariffs (even if he still will not admit “buyer pays.”). He has an addiction to hammering nations and their leaders and throwing his weight around. So, tariffs will be delivered with “extreme prejudice.”

Trump and his pet alien, Miller, have been clear on mass deportation as a means of housing inflation control and freeing up space (Note: that adds a touch of lebensraum and “living space” in that concept that dances too close to a bad history). Trump has also been clear on corporate tax cuts and continuing the substantial personal income tax cuts from his 2017 plan.

The list might get filled in by Trump, but we still see his team who did the writing and editing on Project 2025 as his closet menu of policy actions. His denials on Project 2025 go in the Stormy bucket of credibility along with “losers and suckers.” No impartial person believes him. Tariffs, trade wars, and upheavals of mass deportation are enough to leave the objective very concerned about the threat to inflation and the economy in 2025.

For those who read his rambling, lengthy Time Magazine interview, he ducked some questions on policy on the grounds that there would be policies out in a matter of a few weeks. Months have passed since the Time cover story of late April. Among the lack of plans, the “replace” or “improve” part of the health care plan has been MIA since his promise of 2017 to deliver one (McCain thumbs down in July 2017 was partly on the grounds of “no plan.” Trump has had 7 years to produce one). We will assume the Project 2025 health care plan is his plan. That is for another day, but it is a major household finance threat for individual health care inflation.

Harris and the slow roll on platform detail is underway….

While the Roe v. Wade topic goes without saying, Harris has been getting more specific on housing and health care, two of the most important economic topics in the life of the average household. She is also clear on support for Ukraine.

On the other hand, the price gouging topic is getting beaten up in the media since it is somewhat absurd in the execution of any viable plan. It is more about progressive posturing. The layers of complexity of inflation should be her core view to push back on simplistic views of Trump’s in blaming all inflation on Biden fiscal actions, so there is not much value in picking another simplistic angle that is easily refuted or at worst will fight to a draw without resolution.

I was around in the 1970s and studied Nixon’s wage-price controls that were used.

Some aspects of it were also reused on a voluntary basis by Carter in the later 70s. They don’t work and backfire for a reason. The claim that such policies are Communism/Marxism (blah blah) by the extremist wingnuts on the right is belied by the fact that the ultimate red baiting anti-communist (Nixon), who started out as buddies with Joe McCarthy, was the champion of the earlier version. No one is talking about a replay of the Office of Price Administration in WWII (think Galbraith), but Harris opened a can of worms on this one. Realists recommend she put the can aside and focus on the programs that could actually work.

The reality across time is that food inflation swings around, but it does not deflate back to prior levels in aggregate (see Inflation Timelines: Cyclical Histories, Key CPI Buckets 11-21-23). That history should allow for a lot of rhetoric but a shift of focus to health care and housing would be smarter economics and much better politics for the center. Both shelter and health care are in the Big 5 of CPI (see CPI July 2024: The Fall Campaign Begins 8-14-24).

The tax issues will loom large. Among notable questions beyond letting the old tax bill lines lapse and raising corporate taxes, a big question will be, “Will she eliminate capital gains?” and “Will she make death a realization event for capital gains and crush small business stakeholders?” Those items have been flying under the radar screen except in Silicon Valley. The capital gains tax as Biden proposed did not give effect to the reality that a business tends to get sold all at once. Hitting most of the gain as ordinary income rates in the year sold seemed to be the drift.

We will see what is in the final Harris plan. A decent small business tends to get all the proceeds in the year of sale. It could include decades of commitment and a holding period just as long. Penalizing these hard-won gains as all ordinary income is a radical change of philosophy and a disincentive to hiring and payroll.

As someone who started a business with a range of shareholder employees, I am past that “death as a realization event” now by having sold my stake. If I kicked the bucket, it would have had a very different outcome on what the Democrats have been proposing. What has been proposed in the past to ease the risks is that your estate (children/family) can get 15 years to pay it down. Any small business owner/shareholders can run through the scenarios. So, if you live and sell, they may hit you with all ordinary income? If you die, they crush your estate on an asset that may have minimal liquidity at a substantial haircut.

The medicine to ease the pain in “death realization event” thus entails saddling families with a major tax liability on illiquid assets that could erode in value after you’ve already crystalized the taxable gain by dying. Children who might live in a world of normal jobs and normal pay get penalized (e.g., a teacher). For some, that IRS liability could cripple personal credit ratings, and the statutory rights of the IRS as a liability might complicate that further. Tax law is outside my wheelhouse, but it does not sound like it supports small entrepreneurs.

These are the kind of clauses that could cost the Democrats a lot of votes and $$$ in a normal election without such an abnormal, deranged opponent. That is a clear disincentive to many small business operators. If you sell the stock, you pay taxes. Fair enough. If you die, you should not see a family or estate penalized for the success. Those are people on the other side of that. Getting a bill on an illiquid asset on death is crazy bad economics. Just raise the tax rate on wages rather than sneak a small business penalty under the pile of proposals to clear budget rules (for majority vote etc.)

We will see what comes out of the Harris plan that differs from Biden’s. There are often carve-outs and loopholes (e.g., $100 million cut-off, etc.). These tax changes can get very technical, but small businesses will be watching. Penalizing small businesses when sometimes decades of effort have been expended is not the type of policy that leaves a party with staying power. Most people don’t like paying high income taxes, but at least those get paid out of cash flow. Death – rather than sale – should never be a realization event.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

The tech valuation excess and domination of large cap benchmarks has been a recurring story, so we set up this table for a quick reference on the Mag 7 plus Taiwan Semi (a critical chip operator and a geopolitical flashpoint) and Broadcom. We also include the two large cap benchmarks (S&P 500, NASDAQ Composite) and the Equal Weight ETFs for NASDAQ 100 (QQEW) and for the S&P 500 (RSP). We line up the names each week in descending order of total return.

The big news this week is that NVIDIA reports earnings, so that will immediately turbocharge the debate on multiples and growth rates for revenues and earnings for the greater among equals in the Mag 7 story lines.

The overall performance for the week on this list was muted but much better than the recent pounding it took during the volatility of early August (see Footnotes & Flashbacks: Asset Returns 8-11-24). The VIX spike and valuation mini-panic left almost all the lines in the red for the trailing 1-month period. That 65 intra-day tick on the VIX rang the alarm bell on 8-5-24 (see Volatility and the VIX Vapors: A Lookback from 1997 8-6-24). Then the market settled down and risk rallied impressively given the postmortem on what could possibly make recession risk so high in the face of the sea level economic realities (see Payroll July 2024: Ready, Set, Don’t Panic 8-2-24).

We see 5 of the Mag 7 names positive for the past 1-week horizon with AMZN and MSFT slightly negative and Meta and Apple barely positive. We also see 4 of 7 negative for the trailing 1-month (TSLA, GOOG, AMZN, and MSFT).

The 1-week numbers across the 32 line items weighed in at 30-2 with only E&P (XOP) and Energy (XLE) in the red. All 7 bond ETFs were positive with 4 in the bottom quartile and 3 in the third quartile as stock price action ruled the day.

Homebuilders took off on the week after the FOMC expectations kept hopes high, and then Powell gave his speech (see Existing Home Sales July 2024: Making a Move? 8-23-24). Other interest rate sensitive industries joined the party with Regional Banks (KRE) and Real Estate (XLRE). Small caps and Midcaps were in the top quartile. Some cyclical lift gave Base Metals (DBB) support after a rough 3-month stretch and Materials (XLB) got a lift.

The only tech-centric line in the top quartile was Consumer Discretionary (XLY) with Tech ETF (XLK), NASDAQ and Equal Weighted NASDAQ 100 (QQEW) down in the third quartile. The Equal Weight S&P 500 outperformed the S&P 500.

The 1-month time horizon weighs in at 23-9, and that is interesting given the effects of the wild ride in VIX and the equity markets to start off August (see Volatility and the VIX Vapors: A Lookback from 1997 8-6-24). The Utility ETF (XLU) won the month on stability plus interest sensitivity. Bond ETFs saw duration carry the period and include 2 of the 7 in the top quartile with the long duration 20+ year ETF (TLT) at #2 and the IG Corporate ETF (LQD) at #8. We see 3 bond ETFs in the second quartile (EMB, AGG, GOVT) and the last two in the third quartile (HYG, SHY).

In the bottom quartile, we see E&P (XOP) on the bottom and the BDC ETFs struggling more of late on floating rate assets and small private companies getting some bad ink on rising bankruptcies. The high cash dividend yields have not been enough to hold off weakness recently in BDCs and the same for Midstream Energy dividends this past month with AMLP closer to the bottom. Small caps and tech also were mired on the low end for the month with NASDAQ (IXIC), Consumer Discretionary (XLY), and the Tech ETF (XLK) in the bottom tier.

The 28-4 score for the 3-month timeline has as its main theme: interest sensitivity wins. We see Regional Banks (KRE) on top followed closely by Real Estate (XLRE) and Homebuilders (XHB) and the long duration UST 20+ Year ETF (TLT) a more distant #4. The Top 3 posted double-digit returns over 3 months. Small Caps (RUT), Consumer Discretionary (XLY), Financials (XLF), and Healthcare (XLV) round out a diverse top quartile.

The bond ETFs are spread across all four quartiles with TLT at the top and short duration UST 1Y-3Y (SHY) on the bottom. The 4 negatives include E&P (XOP), Base Metals (DBB), BDC ETF (BIZD), and the diversified Energy ETF (XLE).

The YTD score comes in at a very impressive 31-1 with the Transports (XTN) lagging in YTD and LTM (next chart). The Homebuilders (XHB) are back at #1 YTD and also for the 1-year as favorable demographics and builder incentive flexibility on mortgage rates carry the day. We spend a lot of time on the macro story in housing and in single names, and the cash flow dynamics of the builders have made a very strong case in both equities and credit.

The top quartile has a range of sectors represented, but the tech flavor shows up in Communications Services (XLC) and Tech ETF (XLK) along with the NASDAQ and Mag 7 influences on the S&P 500, which weighed in at #5 while the Equal Weight S&P 500 (RSP) is in the lower end of the second quartile.

The year has been very mixed in terms of the UST curve story with 5 of 7 bond ETFs in positive range but also in the bottom quartile with only HY (HYG) and EM Sovereign debt (EMB) making it into the third quartile. After a monster rally in Nov-Dec 2023 for the UST from the peak rates of Oct 2023, the curve story has been erratic until this latest round of victories and now Powell cementing some optimism into the fall.

The 1 year scoresheet of 30-2 includes the big rally months for the UST of Nov-Dec with Homebuilders (XHB), Regional Banks (KRE), and Financials (XLF) outpacing the tech-centric leaders that are well represented in the top quartile with Communications Services (XLC) at #4, Tech (XLK) at #5, NASDAQ (IXIC) at #6, and the S&P 500 Mag 7 influence at #7 (Equal Weight S&P 500 at #14).

E&P (XOP) and Transports (XTN) are the only lines in the red while Bond ETFs hold 5 of the 8 spots down in the bottom quartile with HY (HYG) and EM Sovereign (EMB) making it into the bottom half of the third quartile.

See also:

Existing Home Sales July 2024: Making a Move? 8-23-24

Payroll: A Little Context Music 8-22-24

All the President’s Stocks 8-21-24

Footnotes & Flashbacks: Credit Markets 8-19-24

Footnotes & Flashbacks: State of Yields 8-18-24

Footnotes & Flashbacks: Asset Returns 8-17-24

Housing Starts July 2024: The Working Capital “Prevent Defense” 8-16-24

Retail Sales: Third Wind? 8-15-24

Industrial Production: Capacity Utilization Trends 8-15-24

Total Return Quilt: Annual Lookback to 2008 8-14-24

CPI July 2024: The Fall Campaign Begins 8-14-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

HY Industry Mix: Damage Report 8-7-24

Volatility and the VIX Vapors: A Lookback from 1997 8-6-24

HY Pain: A 2018 Lookback to Ponder 8-3-24

Payroll July 2024: Ready, Set, Don’t Panic 8-2-24