2Q24 GDP: Into the Investment Weeds

We dig into the underlying details of the Fixed Investment lines that roll up into the 2Q24 GDP release as we see high water marks for all categories except Structures.

We look across key lines within Gross Private Domestic Investment and Government Investment that are other major drivers of GDP.

Equipment investment recently experienced pressure in Transportation lines, but it bounced back meaningfully this quarter with aircraft hitting a new high. Combining that with continued strength in information processing equipment, the Total Equipment line hit a new high, up 3.2% vs. 1Q24.

Manufacturing structures saw another good quarter coming in over 3x the pre-Covid levels. It was a bright spot for structures investment that saw a modest decline overall.

The above chart details the long-term time series for investment in Structures and Equipment. These lines are found under Gross Domestic Private Investment (GDPI) that totals 17.8% of the total GDP. These provide a good enough proxy for Capex trends and color for the underlying drivers. We start in the 1970s and show the cyclical highs and lows across the TMT years, GFC, and COVID and update for the latest release.

We break out more detail in the tables below, but the overall story is impressive in the context of the higher interest rate environment. The continued growth to near or at all-time highs is a strong signal around a healthy investment cycle and in markets where companies see constructive prospects. The direction of the time series tells a positive story.

The capex planning process in the private sector can be influenced by myriad complicating factors (tax incentives, political uncertainty, economic cycle questions, etc.). The economic assumptions underlying the capital budgeting process run the gamut with the direction of interest rates, contraction risk, inflation expectations, and the risks of trade turmoil all serve as challenging inputs to the decisions.

Replacement cycles run their natural course as do modernization and efficiency investments, but growth in capacity is a higher bar for some industry groups than others. The “reshoring theories” are still very much just that – as in theories – and that is where there could be a considerable amount of policy tension and moving parts of the risk profiles in 2025. A fresh wave of tariffs can set off chain reactions.

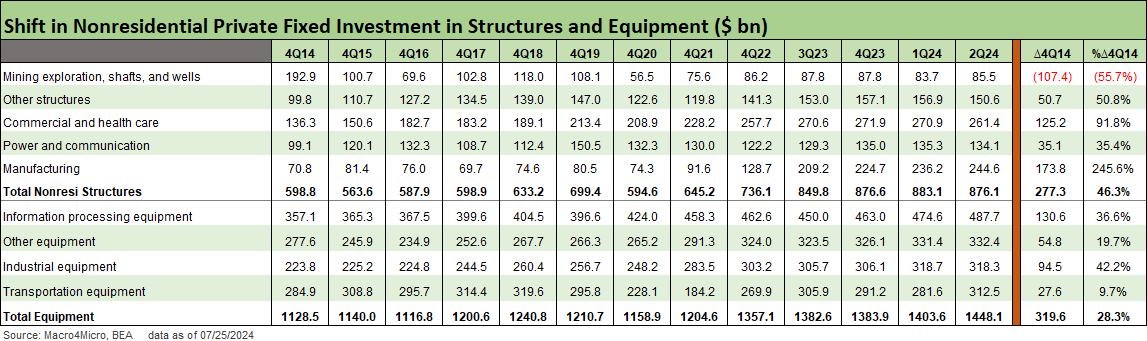

The table above breaks out a recent history of the underlying sector details for the Equipment and Structures lines. Both have seen strong and stable growth since in the post-COVID era and have remained steady even if slowing in a higher rate environment. Structures saw a small contraction down 0.8% vs. 1Q24 and Equipment is up 3.2%.

Mining stands out in the chart with the only negatives vs. the 4Q14 starting point. The 2016 E&P crash saw investment levels slashed dramatically and we’ve seen a stabilization to levels slightly higher than 2016 for the past few years.

Commercial and Healthcare dipped meaningfully but remain at very high run rates supported by secular and demographic trends. The big shift still is on the Manufacturing line that has seen investment more than double since 4Q21. The recent boom in Manufacturing investment is heavily tied to EV supplier chain capex and the buildout (IRA) and semiconductor ramp-up (CHIPS Act).

Equipment grew on the quarter based on a strong bounce in Transportation equipment and continued growth for Information Processing equipment, which is the largest category. A major contributor for the bounce-back in this month was a recovery in Aircraft equipment that has faced its share of negative headlines and volatility. The recovery contributed 1.7% to overall Equipment investment growth, punching well above its weight class given that it is less than 5% of the gross Equipment investment.

The chart above and below provides the next level of granularity to the Structures and Equipment investment lines. We covered Manufacturing as the bright spot this quarter, but Mining also saw positive growth while Structures investment overall slowed down.

The Commercial and Healthcare weakness for the quarter was fairly broad-based with all three subcategories lower. Healthcare saw the worst relative performance, but the Office line is where attention is likely to stay focused for signs of weakness. Fixed investment in Offices is not that far above the 4Q19 levels despite all the gloomy headlines around the asset class. The primary worries around the sector are more tied to excessively leveraged, weaker assets in CMBS structure and problem assets the on books of the regional banks.

The Equipment lines above cause a bit of eye strain to look at the various buckets, but the category presents a very diverse set of assets. We’ve already addressed the recovery for Aircraft for the quarter.

The underlying story does not show such broad-based growth in investment across the board, but we would highlight where the AI boom is showing up in the Computers and Peripheral Equipment line. That line grew 5.1% vs. 1Q24 and it is reasonable to expect continued growth as companies find more end market applications for the underlying models (revenue generating or not).

The above chart includes the trend line for Intellectual Property (IP) products with the Equipment line that we’ve already covered above. The side-by-side shows the steady evolution to a more technology and services driven economy. The notable trend is that the IP line barely paused across the pandemic and over its history has been much less affected by economic cycles than the Equipment line.

The last chart here brings in the Government investment line and frames it against the total GDPI whose parts we’ve looked at in detail. The short story is that these are both at all-time highs totaling over a third of the GDP (Government investment 17.5%, GDPI 17.8%). Government investment and consumption has been steadily trending higher, and all the talk about Washington spending tends to ignore the fact that the majority of it is at the state and local level (see GDP 2Q24: Banking a Strong Quarter for Election Season 7-25-24).

See also:

GDP 2Q24: Banking a Strong Quarter for Election Season 7-25-24

State Unemployment: A Sum-of-the-Parts BS Detector 6-30-24

1Q24 GDP: Final Cut Moving Parts 6-27-24

Construction Spending: Stalling Sequentially at High Run Rates 6-4-24

1Q24 GDP: Second Estimate, Moving Parts 5-30-24

1Q24 GDP: Looking into the Investment Layers 4-25-24

1Q24: Too Much Drama 4-25-24

4Q23 GDP: Final Cut, Moving Parts 3-28-24

4Q23 GDP: Second Estimate, Moving Parts 2-28-24

GDP and Fixed Investment: Into the Weeds 1-25-24

4Q23 GDP: Strong Run, Next Question is Stamina 1-25-24

Tale of the Tape: Trump vs. Biden 12-4-23

Construction Spending: Timing is Everything 12-1-23

3Q23 GDP: Fab Five 11-29-23

Fixed Investment in GDP: The Capex Journey 10-30-23

GDP 3Q23: Old News or Reset? 10-26-23

Construction: Project Economics Drive Nonresidential 10-2-23

GDP 2Q23: The Magic 2% Handle 7-27-23

1Q23 GDP: Facts Matter 6-29-23

US Debt % GDP: Raiders of the Lost Treasury 5-29-23