Footnotes & Flashbacks: State of Yields 4-21-24

The market kept the UST curve moving higher after ducking the trade-offs of war vs. oil with this coming week bringing a fresh GDP and PCE print.

Don't do it Jerome! I'll haunt you.

The UST was unfriendly again this past week on the Mideast settling down as more constructive economic data has the market again braced for March PCE and 1Q24 GDP this week.

The UST deltas from the Oct 2023 highs are now much lower than the YTD increase in UST rates.

Mortgages saw the usually restrained Freddie Mac 30Y benchmark climb back above the 7% line again this week for the first time in 2024.

Credit saw HY OAS move wider by double digits (+12 bps) with IG barely moving at +2 bps.

The above chart updates the running UST delta from the Oct 19, 2023 highs on the 10Y UST and then frames the running YTD deltas. The 10Y UST as noted in the embedded box is now -36 bps lower vs. 10-19-23. We also see the YTD delta is at +74 bps higher as the UST continues to retrace with the 5Y UST at +82 bps YTD and the 2Y at +74 bps.

The above chart plots the running migration across some key dates in the tightening cycle. We include a memory jogger box with the dates and magnitude of the FOMC tightening actions. We start the history with a 12-31-21 UST curve as a frame of reference.

We see the dip in 1Q23 that came with the regional bank mini crisis before resuming the upward migration. We continue to highlight the convergence of the 12-31-22 and 12-31-23 UST despite the 100-bps differential in the fed funds upper bound noted on the chart at 5.5% vs. 4.5%. That recent history offers a reminder that the duration side of the equation will not necessarily move in lockstep with lower fed funds.

The above chart plots the weekly UST deltas for the week, and we see another double digit shift. This time we get a double-digit increase from 3Y to 30Y and a modest steepening from 2Y. As we detail in our separate footnotes publication on asset returns, this UST shift continues to be bad news for bond returns as we break out in the ETF mix in that commentary (see Footnotes & Flashbacks: Asset Returns 4-21-24).

The above chart updates another visual angle on the deltas and shape of the move in rates from the 10-19-23 peak. We see a bull flattener from 5Y to 30Y while the next chart documents some of the YTD reversal of the UST bull rally of Nov-Dec 2023.

The above chart updates the YTD setbacks for the bond bulls as we see a major move wider and upward shift from 2Y to 30Y with the FOMC on hold on the front end. The peak move was in 3Y to 5Y, an important part of the curve in such sectors as auto finance while the 10Y UST was a dagger in 30Y mortgage rates with the 30Y mortgage benchmark now back above 7%.

The above chart updates the weekly historical lookback that we do in mortgages. We frame the current mortgage rate and UST curve vs. those rates during the housing bubble period, when demand for housing and mortgages had soared. We use 2005 to mark the peak year in homebuilding and then mid-2006 for the time when the subprime RMBS issues were creeping into the picture.

The current yield curve at 4-19-24 is above the 12-31-05 UST curve and notably so on the front end with the FOMC sustaining a steep inversion while 2005 was upward sloping on the short end. The UST curve is lower than the mid-2006 UST curve. Spreads on mortgages are also wider now, and the housing market is not in a bubble given the combination of demand and tight inventories for sale. Prices have held up on fundamentals and demand - not easy credit.

This past week the Freddie Mac 30Y benchmark pulled further above the bubble period with 7.10% posted. That is the first time in 2024 that the Freddie benchmark exceeded 7%. Looking back over the past year, we see a 52-week range of 6.35% to 7.79%. Subject to variations in borrower quality, fees, and down payments, there are 30Y mortgage rates, conforming vs. nonconforming etc., that run well above 7% in this market.

As we cover routinely in our housing sector and single name work, the homebuilders are winning this battle and have been exceptional performers. This past week we posted a detailed update on the #1 homebuilder, D.R. Horton (see D.R. Horton: Ramping Up in 2024 Despite Mortgages 4-19-24). We also saw more constructive numbers in housing starts for the builders (see Housing Starts March 2024: The Slow Roll and Ratchet 4-16-24) while existing home sales remain constrained by affordability issues (see Existing Home Sales March 2024: Not Something Old, Something New 4-18-24). That has created opportunities for builders to pick up share.

The above chart updates the time series for IG Corporate and HY bond yields. The timeline is interesting given so many years of ZIRP before some “normalizing” from Dec 2015 to Dec 2018 as the Fed headed into easing mode in 2019 on signs of cyclical weakness. March 2020 brought COVID and a return to ZIRP until the March 2022 tightening cycle.

The relevant yield comparisons for today are the pre-crisis medians which show median HY at 9.3% and median IG at 6.1%. We are now operating in a post-ZIRP world after 14 years of minimal UST rates from late 2008. We moved into a series of rapid 2022 hikes (ZIRP to +450 bps upper range by year end) and the last 100 bps in Feb 2023 to July 2023. It’s a new world now.

The hiking cycle has shifted a lot of the focus to all-in yields and not a relative value view of spreads in historical context. This has not changed much of late, so that mindset seems to be on replay. It might take material evidence of credit quality weakness to shake that or more consistent repricing of equities that pulls spreads wider in a correlation effect. It is hard to find broad, material industry weakness in the BB and quality B tier sectors right now.

We look at IG and HY trends in the next two charts with the IG Corp index at 5.74% and HY bonds at 8.29% to close out Friday.

The above chart on the IG Corporate bond market does a similar version of an historical lookback like we did with mortgages except we use the credit cycle peaks in late 1997 and midyear 2007. We plot the UST curve for 12-31-97 and 6-30-07 and also plot the IG index yields for the ICE IG index on the horizontal line.

The UST yields are much lower today than 1997 and 2007, and the IG index yield is now also below Dec 1997 and June 2007. For this past week, there was minimal action in IG spreads at +2 bps over the past week. The Friday close on the IG index spreads at +94 bps (4-19-24) are slightly inside those seen at the end of June 2007.

The current IG OAS is just above the +93 bps average of 1H04 to 1H07. The 1H07 period alone averaged +86 bps. The all-time low for IG was +53 bps in Oct 1997 before reaching +70 bps at the end of 1997 and averaging +95 bps for 1997-1998. Current IG spreads are quite tight right now even if well above the Oct 1997 lows.

Those timelines of tight spreads speak to how spreads can remain compressed for a long stretch absent a major catalyst to rattle them. There was concern around Iran-Israel escalation and how that would drive the market to start thinking about oil spikes. Gauging how that transmission mechanism would play out in FOMC policy, consumer behavior, and corporate investment is not an easy exercise.

Risk aversion at a time of extremism in US politics and disputes among superpowers adds to potential drama on supplier chains and trade clashes yet again. We will need to see how that plays out in the coming months and especially the “I am tougher than you on China” gamesmanship with Trump vs. Biden. That is a lot to contemplate and factor into risk pricing in such subjective forward-looking scenarios.

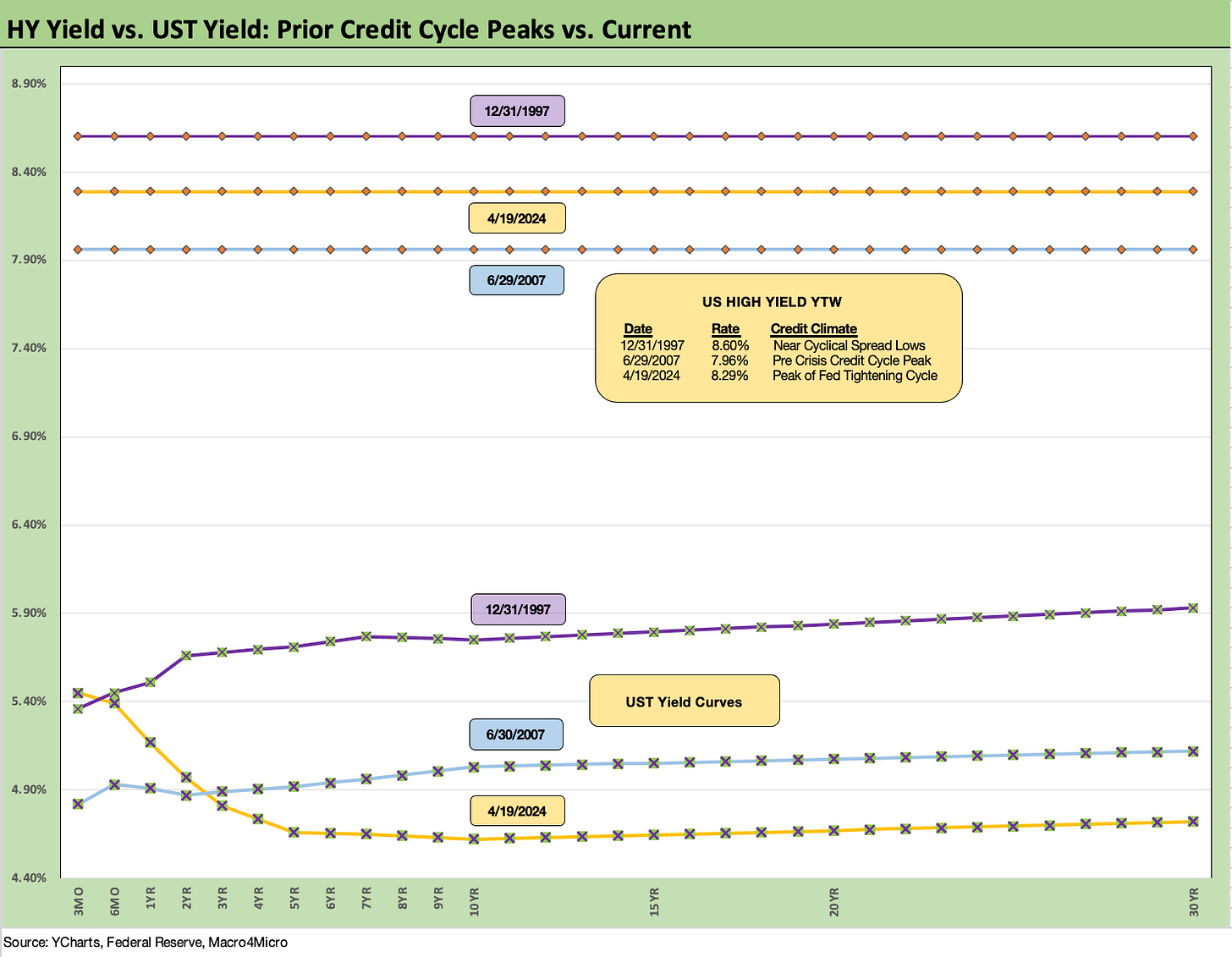

The above chart does the same exercise as IG but for the HY index. The 8.29% HY index yield is moving higher with the UST curve. The 8% handle US HY YTW levels are a long way from the low yields seen during the period of 2% and 3% BB tier new issue and 4% B tier names. BB and B tier names were routine below the current 3M UST of 5.3%. The market saw more than a few CCC deals printed at 5% handle levels or around current cash yields.

The 1997 HY index yield of 8.6% is above the Friday HY index close of 8.3%, but June 2007 closed out at just under 8%. The yields today are thus right there around some peak HY markets where HY OAS was tighter at the lows of those bygone years (sub-250 bps for the low index tick in the month Oct 1997 and June 2007). For the past week, HY OAS widened modestly by +12 bps to +337 bps for ICE HY.

The above chart updates the long-term slope history from 1984 for the 3M to 5Y UST. The current inversion of -79 bps is well inside the -197 bps high in May 2023. The box includes the recent slopes of the various UST segments we track with the related long-term medians. All the long-term medians are upward sloping and are a long way off from current slopes.

The interesting twist in the curve shape is the low compensation for taking duration risk. The intrinsic ability to move quickly out the curve in the push-button age and extend duration can calm fears of missing an opportunity to take duration risk. If conviction grows in a UST tally and a more rapid pace of easing, the UST exposure can be allocated accordingly.

Tight spreads in credit with an inverted curve, and the expectations of waves of UST supply don’t encourage rushing. Another reason to take one’s time is to buy more current coupon IG and UST longer dated bonds that throw off higher coupon cash flow for current use (retirement benefits) or for reinvestment.

The above chart shortens up the timeline from the start of 2021 and follows the trip to inverted. During that time frame, the median slope for 3M to 5Y was upward sloping at +36 bps.

The above chart is our usual chart to wrap the weekly yields. We post the UST deltas from 3-1-22 with March 2022 marking the end of ZIRP (effective 3-17-22). We show the running deltas in the box from 3-1-22 to 4-19-24. We also add the UST curve from the 10-19-23 highs (on the 10Y UST) as well as a 12-31-20 UST curve as frames of reference.

As of now, the UST market remains in a quandary around inflation policy that has not been deployed in a major way since the Volcker years. There is a lot of history to stir into the policy handicapping (see Credit Markets Across the Decades 4-8-24, Credit Cycles: Historical Lightning Round 4-8-24). The next fed funds cut is going to require some better numbers out of inflation, some declines in jobs, or one of those shocks with the “multiple standard deviation” labels.

See also:

D.R. Horton: Ramping Up in 2024 Despite Mortgages 4-19-24

Existing Home Sales March 2024: Not Something Old, Something New 4-18-24

Housing Starts March 2024: The Slow Roll and Ratchet 4-16-24

Industrial Production: A Healthy Sideways 4-16-24

Retail Sales March 2024: Until You Drop 4-15-25

Footnotes & Flashbacks: State of Yields 4-14-24

Footnotes & Flashbacks: Asset Returns 4-14-24

Consumer Sentiment: Do You Think Scary Thoughts 4-12-24

CPI March 2024: The Steeplechase Effect 4-10-24

Credit Markets Across the Decades 4-8-24

Credit Cycles: Historical Lightning Round 4-8-24

Payroll March 2024: Payroll Spike Brings a Political Theme Shift 4-6-24

JOLTS Feb 2024: Steady and Sideways 4-2-24

PCE Prices, Personal Income & Outlays: Sideways Tone 3-29-24

4Q23: Final Cut, Moving Parts 3-28-23

Durable Goods: A Small Boost for Manufacturing Sentiment 3-26-24