Footnotes & Flashbacks: Asset Returns 4-7-24

With a wild finish from payrolls, the past week was bumpy again on too much good economic news.

Here we go again…

The “good is bad” theme was suddenly back with the UST curve feeling the risk of very strong March payroll numbers after a prior week of inflation asterisks (PCE) and favorable final revisions to some key 4Q23 GDP line items.

The CPI and PPI risk will likely see the market’s heightened sensitivity and notably around the Services lines, some energy anxiety, and any more signs of sustained lags in Shelter.

A negative stock market week and weak debt performance is not a major issue, but the UST history tells a story (think 2013 Taper Tantrum) where stocks can still outperform even if the UST curve can go the bear steepener rout again.

The short term worry revolves around whether the “FOMC cut debate” heads south (as in downgraded to 1 or 2 cuts or even zero) and drives more volatility.

The above table details the trailing returns for the top-level debt and equity benchmarks we watch. We line them up in descending order of 1-year total returns. The debt categories show the wear and tear of adverse UST moves recently and YTD with high grade corporate bonds and the UST benchmarks back in the red zone, including UST for the trailing 1 year. The benefits of the late year curve rally and spread compression are evident in the 6-month returns but 2024 has been unkind to duration.

Equities have been the clear winner in these markets with breadth evident in the 6-month numbers as small caps came storming back late in 2023. The tech-centric leaders and broader group of industrials underscore this has been about a lot more than just tech. We also see that in our broader ETF mix that we look at further below.

The above chart updates our 1500 and 3000 series, and we see strong numbers in the 3-month performance. We also line these up in descending order of 1-year total returns. The notable exception in the healthy recent numbers is Real Estate, which has fallen back into disfavor after a few impressive rallies late in 2023. The broader base of Financials and Industrials have been solid performers even if the Regional Banks have not (see ETF details below).

Energy has come storming back in 2024, and we see a very strong month. The geopolitical premium (even if much lower than prior cycles from bygone decades) is getting back into the picture with the latest Israeli strike on Iran targets. An Iran escalation that pulls more players into the picture could be catastrophic for the inflation story and global cyclical handicapping. Iran generally seeks to work through proxies and would not look to make itself a target. That scenario goes into the unlikely category while applying the “never say never” school.

The rolling return visual

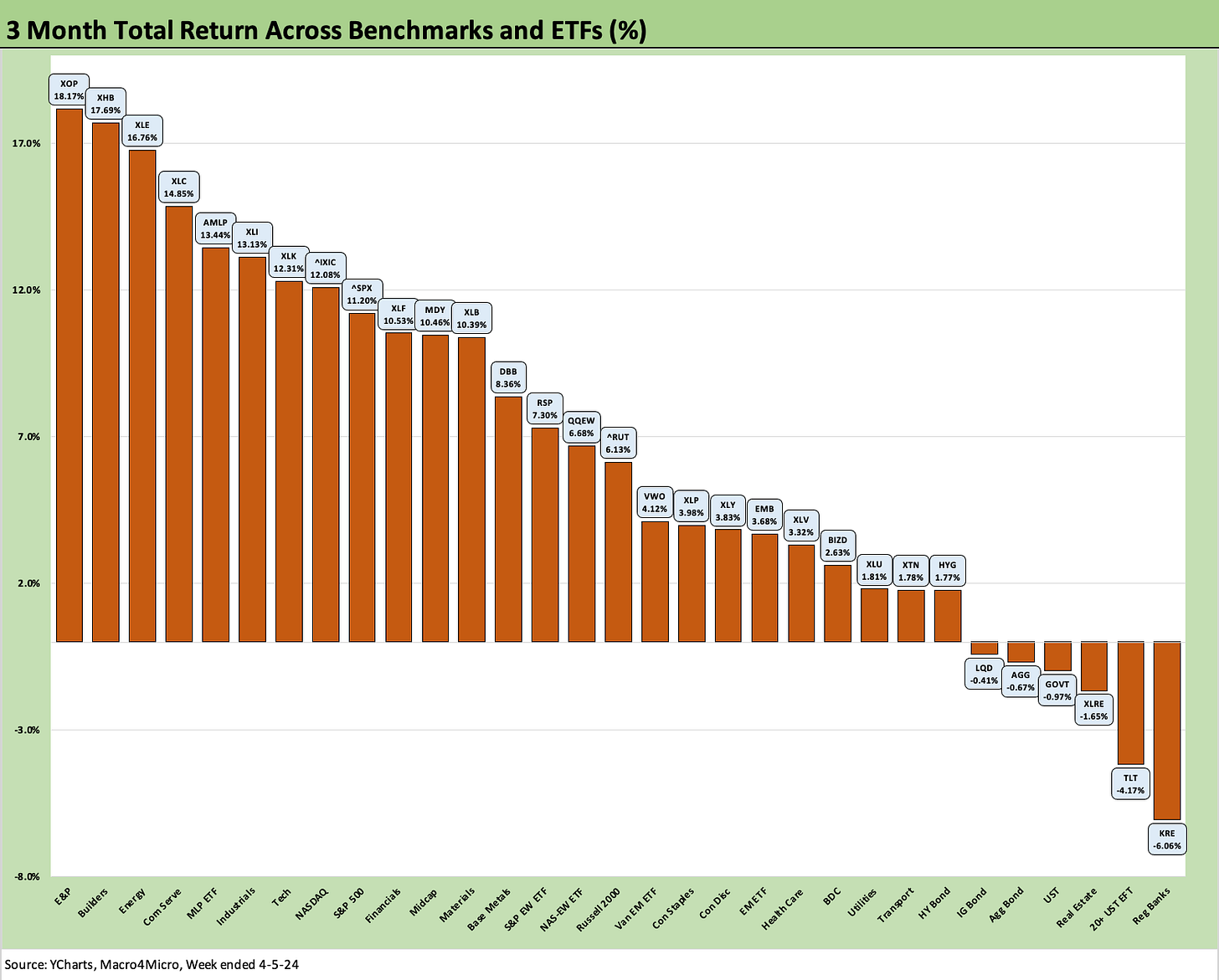

In the next section we get into the details of the 31 ETF and benchmarks for trailing periods. The collection of four-time horizon charts below shows a poor week. All the bond ETFs and all broader stock market benchmarks were in the red for the week despite a Friday rally after the job numbers. Meanwhile, the past 1-month and 3-month horizons are solid with the 3-month numbers especially impressive with a strong and broad 1Q stock market performance (see Footnotes & Flashbacks: Asset Returns 3-31-24).

The above chart still shows a heavy weighting to the left side and positive numbers for 1-month and 3-month periods as well as the LTM period. The weeks in 2024 have been dominated by the positive side of the scoresheet after a mixed January. We have run through those scores in earlier “Footnotes” commentaries. For equity markets, it is certainly easier to deal with negative weeks when they are infrequent and come on the other side of good economic headlines tied to UST jitters and FOMC uncertainty.

Running through the ETFs and benchmarks by time horizon…

It is hard to argue with the shape of the 1-month, 3-month, and trailing 1-year numbers below. That goes in the “old news bucket” at this point as earnings season now kicks into gear and parsing results and guidance dominates the exercise for the next few weeks. The market will also have Fed watching as a daily habit with UST curve and UST fixation. We get FOMC minutes this week on the same day (Wed) that we get CPI numbers followed quickly by PPI on Thursday.

The UST market will remain a major focal point not only for the fixed income asset class investors, who have faced a rough time YTD on duration and an unfriendly UST shift, but also for the “How many cuts? And when?!” debate and what it means for tech stocks or income stocks. The UST curve and equity valuation exercise is as intertwined as it has ever been. That is only getting harder to sort through with the FOMC and non-FOMC Fed “speechifiers” staying noisy on the topic and often with conflicting views.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include evidence issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry/subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta. The recent diverging performance of the names is stirring debates on new monikers lately, and we are losing track (“Fab 5”, “Fantastic 4”, The “Not So Hot n-1” etc.).

The above chart plots the 31 ETFs, and the scoresheet shows 6 positive and 25 negative. That comes after a stretch where the run of weeks was overwhelmingly positive as we detail in earlier Footnotes weeklies. That 6-25 score ties the first week of January for the worst week in 2024.

What came after that poor start to 2024 is worth keeping in mind. Equities had a fantastic quarter while bond investors struggled mightily with an adverse UST shift after a banner rally from late Oct to close out 2023. We look at those trends in our separate Footnotes publication on yields which we will publish later today.

Drilling into the mix above, it is worth noting that 4 of the 6 in positive range were in oil and gas or commodities. We see the Base Metals ETF (DBB) jump to #1 on the week after regularly being mired in the bottom quartile across the past year (and still in the bottom quartile for the LTM period). China has been a drag on base metal performance, but if the cycle heats up globally or in select major markets, raw materials from energy to metals will not help the inflation story line even if the economic growth story works well for many sectors and the broader economy.

This past week also saw the broad Energy ETF (XLE) at #2 and E&P ETF (XOP) at #3 with Midstream ETF (AMLP) in the bottom half of the high quartile at #6. We saw oil (WTI) at the end of the week close to $87 from an $83 handle to start April.

The Iran-Israel escalation is far more serious to markets than Israel-Gaza. That $86 handle could change fairly dramatically (inflation debate over). The war games aren’t that complicated on oil impact (US role, Strait of Hormuz risks, etc.). That would be the latest parallel to the stagflation launching pad of 1979 (Shah gone, Iran oil embargo, hostages, Carter loses in 1980, etc.).

The politics of military action between Iran and Israel makes for complicated geometry. Russia is in bed with Iran, and Russia is in bed with China and North Korea. Trump and various/numerous right-wing types are in bed with Putin and don’t care if he slaughters tens of thousands of Ukrainians running out of ammo (Ukrainians won’t surrender. No bone spurs epidemic there).

The Democrats love Ukraine and Biden is fighting with Netanyahu, so Trump will thus fall back in love with Netanyahu. It makes your head hurt. We would put the Russia-Iran-North Korea-China-Trump links under the heading of the “transitive property of politics” (If A = B, etc.). Beware the company you keep.

The 1-month score weighs in at 23-8, so the YTD equity winnings hung in enough to keep the equity markets optimistic with the earnings season for 1Q24 offering new inputs for the market to digest. The UST market has been rough on bonds during 2024, and this month shows 4 of the 8 ETFs in the red zone and in the bottom quartile are bond ETFs (LQD, AGG, GOVT, and TLT).

As the long duration 20+ Year UST ETF, TLT is sitting on the far right in last place. Some coupon income, shorter duration, and higher spreads allowed the HY ETF (HYG) to edge into the positive zone with a minimal positive return of 0.15%. EM Sovereign Bonds (EMB) were at least across the +1% line.

Way out in front for the 1-month period is the E&P ETF (XOP) at over 14% and the Energy ETF (XLE) at almost 14% followed by Base Metals (+9.5%). That is a sign of trouble for inflation metrics if that plays out as the equity market sees it. The fact that Materials (XLB), Builders (XHB), and Industrials (XLI) are in the top quartile for the period underscores some bullish cyclical sentiment.

Over on the right in the negative zone along with bonds we see Real Estate (XLRE) and Regional Banks (KRE) in the bottom 3 just ahead of TLT. That is another vote against the yield curve as well as real estate valuation and the commercial real estate cycle broadly.

The 3-month chart underscores the powerhouse quarter in equities during 1Q24 with the scoresheet at 25-6. As we saw with the 1-month results, bonds carry a heavy amount of the negative baggage with 4 of 6 of the negatives being bond ETFs (TLT, GOVT, AGG, LQD) with Real Estate (XLRE) again in the mix but Regional Banks (KRE) dead last.

Regional banks are having a rough time and have been volatile since the NYCB headlines. The combination of deposit costs and deposit outflow risk (and stubborn short rates), memories of last year’s “push-button run on the bank,” and serious reservations around asset quality and asset class concentration risks continue to weigh on regional banks. The case has been made by many that most of these banks are exceptionally well managed and low risk, but the market has been on edge around “what the other guy thinks” and potential sellers.

The LTM returns move slowly in a bull market for risk. We see only 4 in the red with 3 bond ETFs (AGG, GOVT, and TLT in last) and the interest-sensitive Utility ETF (XLU). The bottom quartile generally is a function of the UST curve (includes LQD with a small positive return) or names that are interest sensitive by nature (XLRE) or are defensive income equities such as Utilities (XLU) or Staples (XLP). Base Metals (DBB) has been rallying recently as covered earlier but remain a bottom quartile line item for LTM.

The big winners for LTM are the usual suspects with Builders (XHB) way out in front followed by 3 tech-centric benchmarks and then Financials with the bounce off the regional bank mini-crisis in March 2023. We see Midstream Energy (AMLP) with its high dividend yield rounding out the top quartile along with Industrials (XLI) and the BDC ETF (BIZD).

The BDC challenge…

The BDC group will remain on the high interest list given the massive yields and burgeoning interest in private credit. Many investors (including me) have been “going to school” on this sector (disclosure: I have owned, bought, and sold more than a few the past 3 years).

The fact that BDCs as a group have been good performers on high short end rates and sound credit quality metrics (so far) offers a view on the potential for winning and losing given some material dispersion across this sector. Hot growth sectors draw interest and at times excess. That never changes.

There are clearly good opportunities in the private credit sector with respect to the cash income component of total returns (see Pension Profiles: Benefit Drain Rates and Returns 3-22-24). The trick in the private credit sector is a need to “go to school” but to also respect the risk of “getting schooled” in the process.

There has been plenty of green and red in the return performance of individual BDCs. As shown above and in earlier publications, the aggregate results for the public BDCs and BIZD ETF have been favorable. Some brand names have fallen down, and some have been exceptional. That is a topic for another time.

See also:

Payroll March 2024: Payroll Spike Brings a Political Theme Shift 4-6-24

JOLTS Feb 2024: Steady and Sideways 4-2-24

Footnotes & Flashbacks: State of Yields 3-31-24

Footnotes & Flashbacks: Asset Returns 3-31-24

PCE Prices, Personal Income & Outlays: Sideways Tone 3-29-24

4Q23: Final Cut, Moving Parts 3-28-23

Durable Goods: A Small Boost for Manufacturing 3-26-24

New Home Sales Feb 2024: Hope Spring Eternal, but Demand Seasonally 3-25-24

Pension Profiles: Benefit Drain Rates and Returns 3-22-24

FOMC: Hail Powell the Consistent 3-20-24

Retail Sales: Consumers Will Stop Shopping…Someday 3-14-24

CPI Feb 2024: Extra Innings 3-12-24

Employment: Real Numbers vs. Fictitious Dystopian Hellscapes 3-9-24

Histories: Asset Returns from 2016 to 2023 1-21-24

Credit Performance: Excess Return Differentials in 2023 1-1-24

Inflation Timelines: Cyclical Histories, Key CPI Buckets 11-20-23