Durable Goods: A Small Boost for Manufacturing Sentiment

A good enough set of Durables order numbers and shipments at least eases some of the bearish views on manufacturing.

After a series of muddling and mixed metrics for manufacturing over the months, the Durables sector got a small lift with this latest release.

For Feb 2024, durable goods order rebounded sharply from last month’s airplane headaches and related distortions, and ex-Defense and ex-Transport were both positive.

Rates still work against the Durables sector, but positive shipments are what flows into equipment data for GDP purposes.

Positive orders and shipments beats the alternative while offering a notch in the “ease” column for the Fed to consider with durables in deflation mode and activity on mixed to weaker side over recent months.

The headline Durables Goods order pushes back a little this month on the very mixed view of the manufacturing sector prospects. Manufacturing metrics generally do not arm the recession focused bears but do tend to offer more support to the UST bulls.

The above chart updates the running headline order trends with this month showing a bias toward a mix of positive growth numbers seen during a broadly uneven stretch of releases since mid-2023.

The above chart gets into more of the line items with somewhat of a split decision on how to read this into shipments potential into 2024. The highly volatile Transport Equipment bucket still has a lot of questions around Nondefense Aircraft trends with Boeing’s CEO announcing his exit planning this week. The news was accompanied by more than a few reports of “High Noon” moments with some major airline customers who could ponder delays in orders or changes in delivery schedules. Meanwhile, the flow of weapons systems to Ukraine in 2024 remains up in the air.

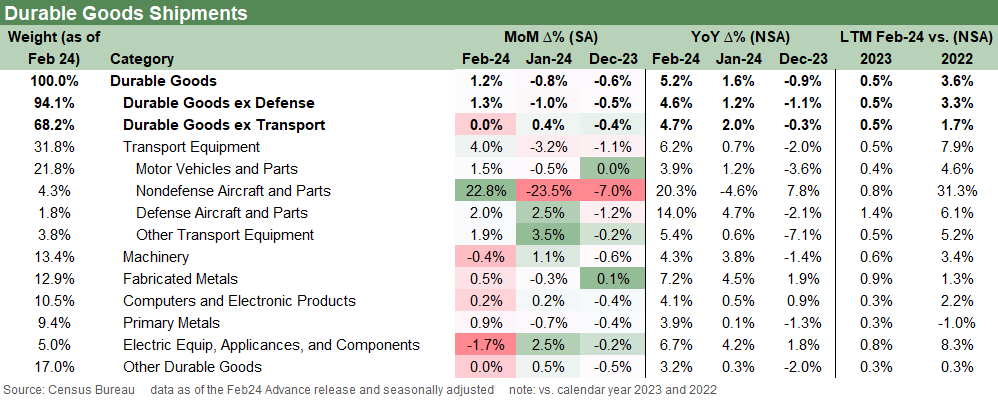

The above chart frames the shipments part of the equation. Shipments are what flow into current economic activities and the GDP. lines The numbers were positive across most of the line items including the headline groupings. The “nondefense aircraft and parts” line is the wildcard. When we move over to the Not Seasonally Adjusted columns, the numbers are solid for Feb 2024 and the same is true for LTM.

Overall, the numbers for Feb 2024 are positive and that will offer some hope for the breadth of sectors and indicate more are planning around those 3 cuts actually coming from the FOMC.

See also:

Industrial Production: Capacity Utilization Shows Manufacturing Edging Higher 3-15-24

Durable Goods: Forced Landing 2-27-24