Footnotes & Flashbacks: Asset Returns 3-31-24

We look at asset returns across a holiday-shortened week with supportive macro releases.

With 27 of 31 benchmarks and ETFs turning in positive returns for the week and a 31-0 shutout with all positive for the trailing month, the 4-day period of relative calm brought good news for equities, muted spread widening, and mixed but minor UST moves.

The week ended with net supportive macro data (or at least no setbacks) across PCE inflation, consumer spending, favorable fundamental revisions on key line items in the final 4Q23 GDP numbers, and some decent news from manufacturing.

The Baltimore bridge disaster will keep inflation hawks and earnings modelers on alert for supplier chain disruptions and any rate increases in alternative freight and logistics channels and any volume warnings for shippers or customers in 1Q24 guidance.

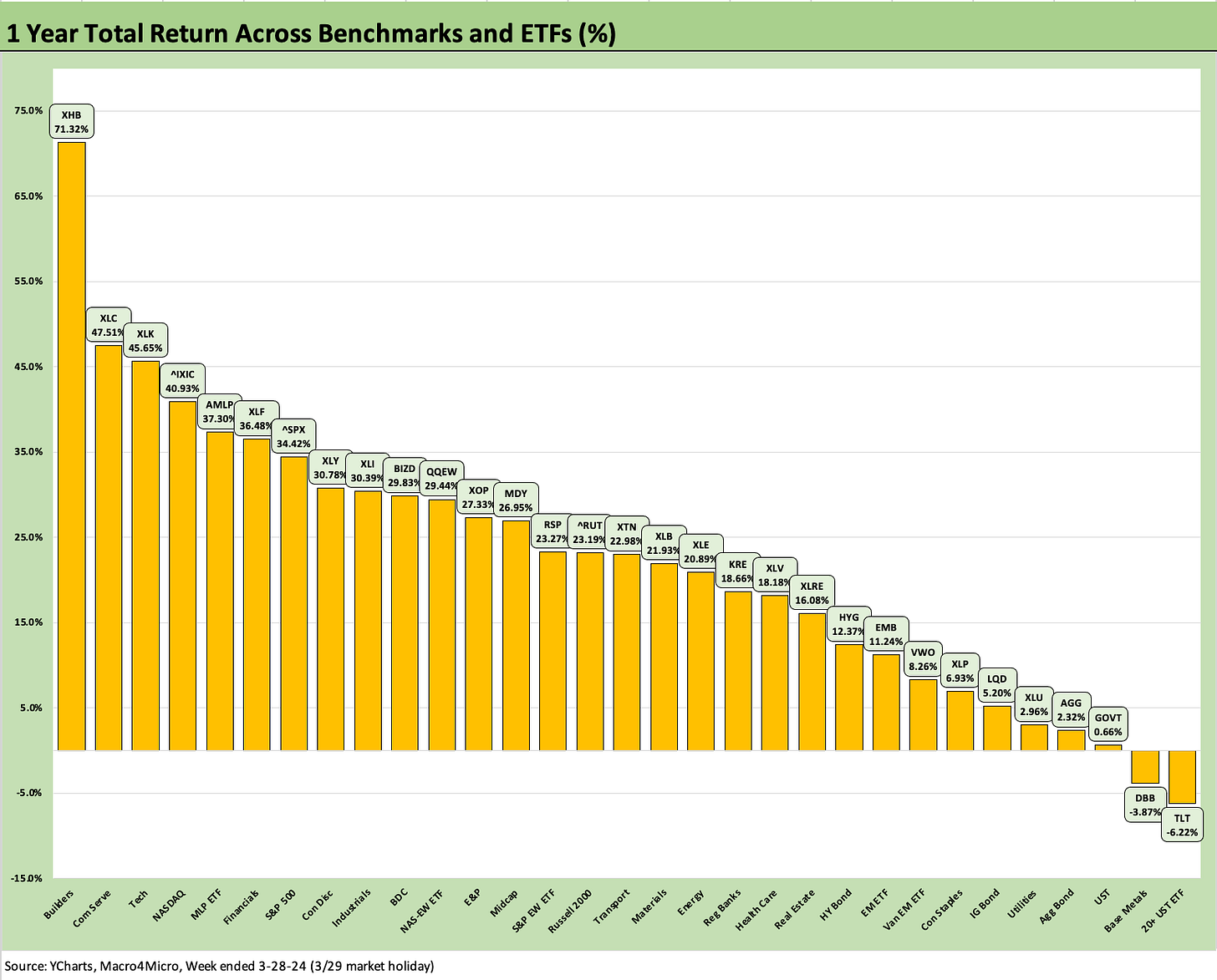

The above chart updates the key equity and debt benchmarks we watch, and the trailing 1-month numbers are holding in well even if the 3-month numbers carry some negatives in bond benchmarks tied to the adverse moves in the UST curve YTD. That setback in bonds comes after the big Nov-Dec rally in UST drove strong performance from the Oct 2019 UST highs.

We cover the equity ETFs and benchmarks in a later section of this commentary, but the phrase “new highs” keeps on being heard for benchmarks and individual stocks. The past week posted positive numbers for 4 of the 5 headline benchmarks (S&P 500, Dow, Small Caps, Midcaps) with only the NASDAQ coming in at a slight negative and Russell 2000 leading the pace. We look at the narrow mix in more detail below in the ETF section, but one of the main themes of late has been the return of breadth to the mix and the chance for staying power in more of the industry groups.

The above chart updates the 1500 and 3000 series with the main changes over the holiday-shortened week showing Energy, Value, and Real Estate moving more favorably for the 1-month measurement period vs. last week. Growth, Industrials, and Financials were steady for the rolling month. We see 4 of 6 lines in double digits for 3 months and 1 high single-digits for the YTD period. Only Real Estate is still in the doldrums YTD even with a few good weeks tossed in along the way.

The rolling return visual

In the next section we get into the details of the 31 ETF and benchmarks for trailing periods. The collection of four time horizon charts below shows some very solid trends this week and for the past month. The symmetry and mix of the sectors and benchmarks are covered further below in the ETF section, but the breadth has been impressive with a diverse range of sectors taking over while some Tech and Mag 7 names have had a tougher ride in March. That has not stopped the S&P 500, Midcap and Small Cap benchmarks from climbing.

The past 1-week, 1-month, and 3-month periods have shown consistent strength with the weekly scores overwhelmingly positive. Two weeks ago, the score of 9 positive and 22 negative in total returns was the worst week since the start of January (the mix was 6-25 in week #1 of 2024). We saw 9 of the past 10 weeks winning on the scoresheet and most by a wide margin.

Equities carries the ball on the sheer numbers of equity ETFs in the mix in a bull market. The bond side of the ledger has been weak on the UST curve shift during 2024 with 4 of the 6 bond ETFs we track in the red YTD and only the HY Bond ETF (HYG) and Emerging Market Bond ETF (EMB) slightly positive.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include evidence issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry/subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

The weekly numbers feature a rebound for the Regional Bank ETF (KRE) at #1 for the week as that group continues to recover from the NYCB-driven beatdown and mini-wave of regional bank anxiety and real estate asset quality jitters. As noted below, KRE has climbed back into the Top 5 for the rolling month but remains in last place for the rolling 3-month period.

The leaderboard for the week shows some interesting breadth with E&P (XOP) at #2 on the move in oil higher (WTI climbed above $83) with Utilities (XLU) at #3, Transport (XTN) at #4, and BDCs (BIZD) at #5. We see Small Caps (RUT) and Midcaps (MDY) beating the large caps this week while seeing interest-sensitive Utilities (XLU) and Real Estate (XLRE) both in the top quartile in line with the Powell pep talks of late on the curve.

It is hard to identify a pattern in that mix during a 4-day trading week waiting for PCE to be released on the market holiday. That PCE release was supportive of the recent trends in place (see PCE Prices, Personal Income & Outlays: Sideways Tone 3-29-24) but was still leaning more to the bullish side on fundamental trends. Powell immediately weighed in with what sounded like his FOMC message again (see FOMC: Hail Powell the Consistent 3-20-24). He does not signal the “good is bad” message these days, and the market seems to like that.

The above chart tells a relatively easy story to interpret at 31-0 positive. Seeing a Mag 7 heavy ETF name in last place with Consumer Discretionary (XLY) for the month after seeing Tech (XLK) in last place for the week is getting the debates heating up over a tech-driven correction and some anxiety filled headlines this week.

The winners for the 1-month include E&P (XOP) at #1 followed closely by Energy (XLE) and Builders (XHB) staying consistent as we head into the spring selling season. Materials at #4 is another sign of investors looking to more cyclically colored sectors with Industrials (XLI) at the high end of the second quartile for the month with Financials (XLF). These names are posting very solid 1-month numbers.

We see 5 of the 6 bond ETFs in the bottom quartile with only Emerging Market Bonds (EMB) able to edge over into the lower end of the third quartile. This week was mixed but mild for the UST curve, but we cover that in our separate Footnotes publication on yields.

The above chart highlights some very solid performers that helped drive the best 1Q period since 1Q19, which for its part unfolded after 4Q18 saw a collapse. In contrast, the 1Q24 period comes after a very impressive Nov-Dec 2023 rally. The top quartile of the 3-month performance saw all the names posting double-digit returns. We see a median for the total mix of 31 at around 5% total return for the group.

We see the winning ways of the Builders (XHB) YTD, but the results also flag the strength in energy-related names with Midstream (AMLP) at #2, Energy (XLE) at #3, and E&P (XOP) at #4. The Top 5 are rounded out by Financials.

The negative ranks on the right side include 4 of the 7 in red being bond ETFs with the long duration 20+Year UST ETF (TLT) in 2nd to last with only Regional Banks (KRE) worse. The HY Bonds ETF (HYG) made it into the lower end of the 3rd quartile with modestly positive returns (+1.1%) on the back of spread compression and shorter duration. Just ahead of HYG was Emerging Market Bonds (EMB) with a small positive return and a 1% handle for the 3-month period.

The rolling 1-year return profile has not seen the needle move much with a 29-2 score and only the long duration 20+ UST ETF (TLT) sitting in last place with Base Metals ETF (DBB) in second to last. There is no questioning whether that is a strong overall performance with the median line of just under +23% total return.

With long term nominal returns on equities around 10%, the mix has 23 of the 31 above that line even in a tightening cycle. A look back across the years from 2016 will reaffirm that the LTM period posted a very good performance (see Histories: Asset Returns from 2016 to 2023 1-21-24). The “all-time high” headlines routinely have made that clear enough.

See also:

PCE Prices, Personal Income & Outlays: Sideways Tone 3-29-24

4Q23: Final Cut, Moving Parts 3-28-23

New Home Sales Feb 2024: Hope Springs Eternal, but Demand Seasonally 3-25-24

Pension Profiles: Benefit Drain Rates and Returns 3-22-24

Existing Home Sales Feb 2024: Surrendering to Mortgage Market Reality 3-21-24

FOMC: Hail Powell the Consistent 3-20-24

Housing Starts Feb 2024: Rites of Spring on the Doorstep 3-19-24

Retail Sales: Consumers Will Stop Shopping…Someday 3-14-24

CPI Feb 2024: Extra Innings 3-12-24

Employment: Real Numbers vs. Fictitious Dystopian Hellscapes 3-9-24

Payroll Feb 2024: Record, Revisions, Reality 3-8-24

Histories: Asset Returns from 2016 to 2023 1-21-24

Credit Performance: Excess Return Differentials in 2023 1-1-24