Footnotes & Flashbacks: State of Yields 4-28-24

We update the UST action after a muted week as inversions are dug in and the YTD UST shift got a little worse for bond returns.

Curves can cause tension...

While the 1Q24 GDP release (see 1Q24 GDP: Too Much Drama 4-25-24) and PCE inflation and consumption patterns vs. income (see PCE, Income, and Outlays: The Challenge of Constructive 4-26-24) raises more concerns around setbacks in inflation progress, the flag waving around “stagflation” rather then inflation lacks much support and leans on speculation.

The UST curve action moved modestly higher while credit spreads tightened with HY showing a solid rally back to the area of the early Oct 2018 lows, inside the June 2014 lows, but still materially wide to the June 2007 and Oct 1997 lows.

We update the 2Y to 30Y UST slope inversion as the shape of the curve remains a very long way from long-term medians.

As we cover in our separate asset return commentary, there will be a lot of action this week with major earnings reports, the FOMC, and payroll.

The above chart updates where the UST curve has migrated from the peak 10Y UST level date (10-19-23) to current levels. We also plot the current UST curve and the UST move YTD. The current UST curve is much closer to the peak date than the start of the year. We detail the delta from the peak and YTD in the boxes within the chart.

The above chart updates the longer-term migration across the tightening cycle with a memory box detailing the Fed tightening dates and magnitude of the moves. The proximity of the 12-31-23 and 12-31-22 UST curves from 10Y and beyond despite the 100 bps differential in fed funds is a reminder that Fed cuts can come without the longer duration benefits.

The dynamics of massive supply in 2024-2025 and uncertain demand out the curve will be a debating point on UST shapeshifting as the year goes on and UST liability management plans get more transparency.

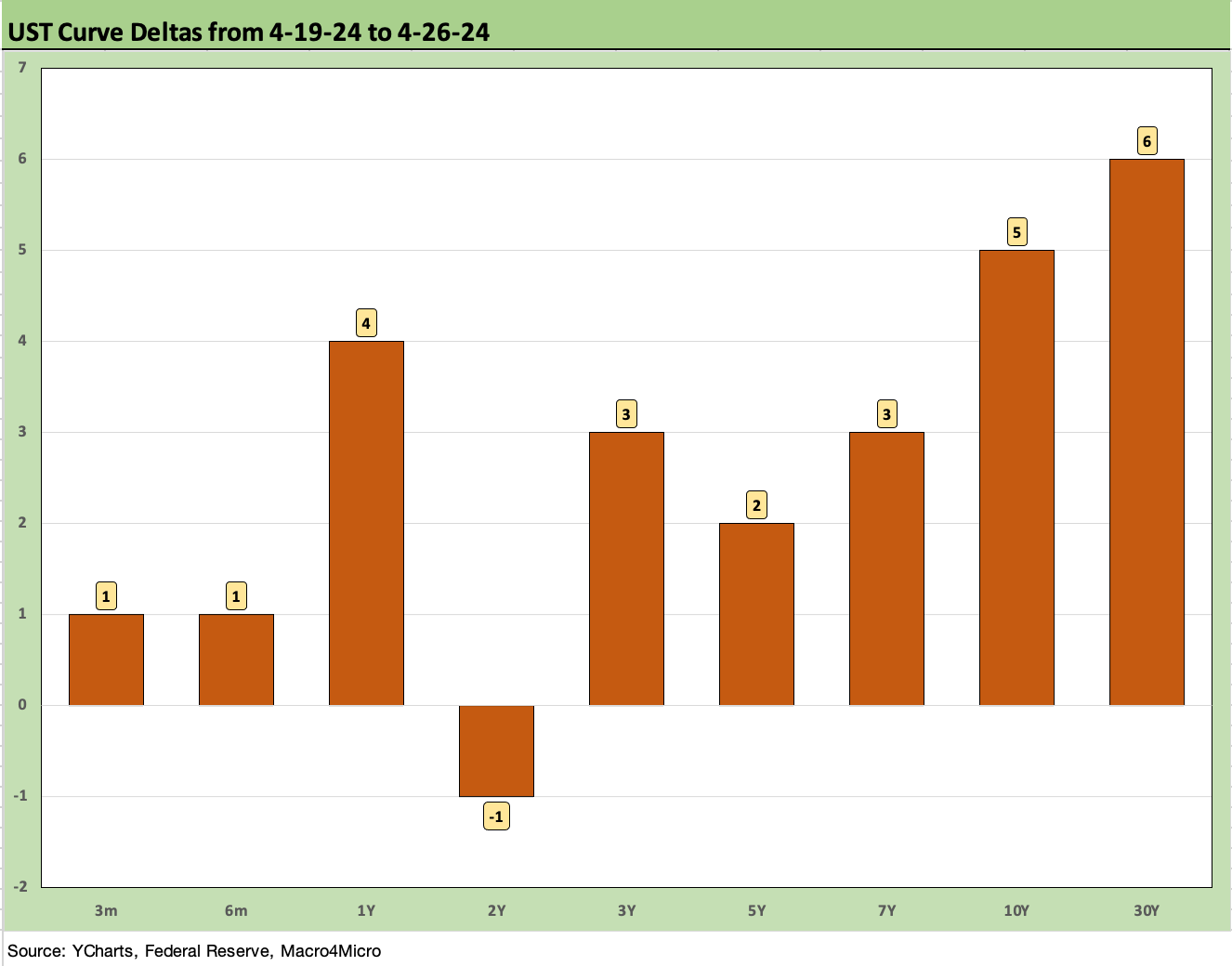

The UST deltas over the past week do not ring the excitement alarms like some of the more recent weekly moves, but the rates moved higher with a modest steepener and enough to notch some negative 1-week returns for some bond ETFs.

The above chart updates the UST deltas from the 10Y UST peak date (10-19-23). The bull flattener has lost some of its force since then given the YTD reversal as we see in the next chart.

The YTD UST shift higher as detailed above has been tough on duration and fuels more than a little anxiety into the bull UST trade. As an example, we see the long duration 20+ UST ETF (TLT) down by almost -11% on price YTD and almost -10% on total return. Duration has not been treated kindly. We cover the time horizon returns in our Footnotes publication for returns (see Footnotes & Flashbacks: Asset Returns 4-28-24).

The above chart updates the state of mortgages using the Freddie Mac benchmark 30Y UST. We saw another tick higher this week to 7.17% from 7.10% last week, which had marked the first time that the Freddie rate had moved to a 7% handle in 2024. Despite this backdrop, the builders keep cranking out good March quarters (see PulteGroup: Strong Volumes, Stable Pricing 4-24-24 , D.R. Horton: Ramping Up in 2024 Despite Mortgages 4-19-24) with strong order rates.

For some historical perspective and a frame of reference, we include the UST curves and mortgage rates (horizontal lines) from the peak homebuilding year (2005) and the mid-2006 time frame when RMBS was beginning to crack and the UST curve had shifted higher.

The Friday close for the UST is positioned between the 2006 and 2005 UST curve above, but the mortgage rates today are the highest on the chart. The fact that housing activity was booming in 2005-2006 offers some idea of how builders can be doing so well now, in part supported by the golden handcuff effects after the rate shock that left so many homeowners with sub-4% mortgage rates.

That “inventory for sale” variable has had the effect of constraining supply and giving the edge to builders. Home prices have thus remained high, but the monthly payment shock from 2021-2022 mortgage rates cedes share to the builders as we have frequently covered in our housing and single name work.

The above chart updates the IG index yields vs. the HY index yields. The relevant frame of references are now the pre-crisis medians since we are in a post-ZIRP world again. What is “normal” should include the 9.3% HY median and the 6.1% IG median. The challenge today is the tight spreads and the trade-off of cyclical peak credit pricing set against the risk of a downturn that hurts credit quality, maims HY spreads, but rewards duration. That helps underpin the choice of IG for many in this market vs. HY. That said, HY has been the total return and excess return winner.

The above chart on the IG Corporate bond market does a similar version of a historical lookback like we did with mortgages except we use the credit cycle peak in late 1997 and the midyear 2007 credit cycle peak. We plot the UST curve for 12-31-97 and 6-30-07 and also plot the IG index yields for the ICE IG index on the horizontal line.

The UST yields are much lower today than 1997 and 2007, and the IG index yield is also below Dec 1997 and June 2007. For this past week, there was minimal action in IG spreads at -4 bps tighter over the past week. The Friday close on the IG index spreads was +90 bps (4-26-24) which is modestly inside those seen at the end of June 2007.

The current IG OAS is just below the +93 bps average of 1H04 to 1H07. The 1H07 period alone averaged +86 bps. The all-time low for IG was +53 bps in Oct 1997 before reaching +70 bps at the end of 1997 and averaging +95 bps for 1997-1998.

Current IG spreads are quite tight right now even if well above the Oct 1997 lows. In other words, these spreads are not without plenty of precedent in prior cycles. The IG index was able to hold onto such tight spreads for protracted periods and fundamentals are solid right now.

For those looking to play the potential duration rewards in a downturn with less exposure to a dramatic repricing of credit spreads on the low end in HY, the steady repricing of coupons into higher income/coupon new issue will be attractive. The abundance of low coupon discounted bonds with low single digit coupons can get a different reaction from those portfolios seeking current cash flow (retirement funds etc.).

The question of “How do you like your mix of returns? Accretion or coupon?” is an interesting one for various portfolio types for call protected IG bonds. We prefer the higher coupon. Bondholders have seen how coupon reinvestment and compounding pays off across time for the asset class.

Over in HY, the refi wave will bring a pull to par effect that is not shared in IG, where the corporate treasurer loves the low coupon and simpler decision on liability management. In HY, fear of market conditions can sometimes rule, and extension of liabilities is often a major priority.

The above chart does the same exercise as IG but for the HY index. The 8.12% HY index yield has been moving around with the UST curve. The 8% handle US HY YTW levels are a long way from the low yields seen during prior periods of the post-crisis cycle with 2% and 3% BB tier new issue and 4% B tier names.

BB and B tier names were routinely below the current 3M UST of over 5.3%. The market saw more than a few CCC deals printed at 5% handle levels or around current cash yields.

The 1997 HY index yield of 8.6% is above the Friday HY index close of 8.12%, but June 2007 closed out at just under 8%. The yields are thus right there around some peak HY markets where HY OAS was tighter at the lows of those bygone years (sub-250 bps for the low index tick in the months of Oct 1997 and June 2007). For the past week, HY OAS tightened by a solid -21 bps to +316 bps for ICE HY.

The above chart plots the running UST slope from the start of 1984 through the Friday close of -18 bps. The box includes the various UST slopes we track, and the median slopes over the same time frame are set against the Friday close. Materially upward sloping is the norm for these UST segments. The current -18 bps for 2Y to 30Y is a very long way from the +127 bps median.

The above chart shows the shorter timeline on the UST 2Y to 30Y UST slope from the start of 2021. We see a -3 bps median across that brief period on the way to the current -18 bps after a peak of +229 bps at the end of March 2021.

We wrap with our running UST delta chart from 3-1-22, which was the month the tightening cycle got underway (effective March 17, 2022). We include the running UST deltas in what was a rapid bear flattening into a bear inversion. That inverted curve continued across 2023 and into 2024.

We do not see how that inversion does not last through the year at this point. It would take an exogenous shock or the mother of all cyclical reversals. Such a scenario would more likely than not lead to more UST borrowing – not less. Clearing the market under such a scenario presents more than a few supply-demand quandaries to fund a record US deficit.

See also:

Footnotes & Flashbacks: Asset Returns 4-28-24

PCE, Income, and Outlays: The Challenge of Constructive 4-26-24

1Q24 GDP: Too Much Drama 4-25-24

1Q24 GDP: Looking into the Investment Layers 4-25-24

Durable Goods: Back to Business as Usual? 4-24-24

Systemic Corporate and Consumer Debt Metrics: Z.1 Update 4-22-24

New Home Sales March 2024: Seasonal Tides Favorable 4-23-24

Footnotes & Flashbacks: State of Yields 4-21-24

Footnotes & Flashbacks: Asset Returns 4-21-24

Existing Home Sales March 2024: Not Something Old, Something New 4-18-24

Housing Starts March 2024: The Slow Roll and Ratchet 4-16-24

Industrial Production: A Healthy Sideways 4-16-24

Retail Sales March 2024: Until You Drop 4-15-24

Consumer Sentiment: Do You Think Scary Thoughts? 4-12-24

CPI March 2024: The Steeplechase Effect 4-10-24