Consumer Sentiment: Summer Blues or Election Vibecession?

We look at another adverse mood swing in consumer sentiment and notable weakness in present economic conditions given steady jobs and wages.

Consumer sentiment may not be a measure to overly rely on for the short list of critical indicators, but another negative month is telling a story for those keying on the consumer as the wildcard for any tipping point in continued economic growth.

The negative print puts together two months that are very much tied to the move in the Current Economic Conditions index decline that mirrors the “vibecession” moniker that has been making the rounds in some headlines.

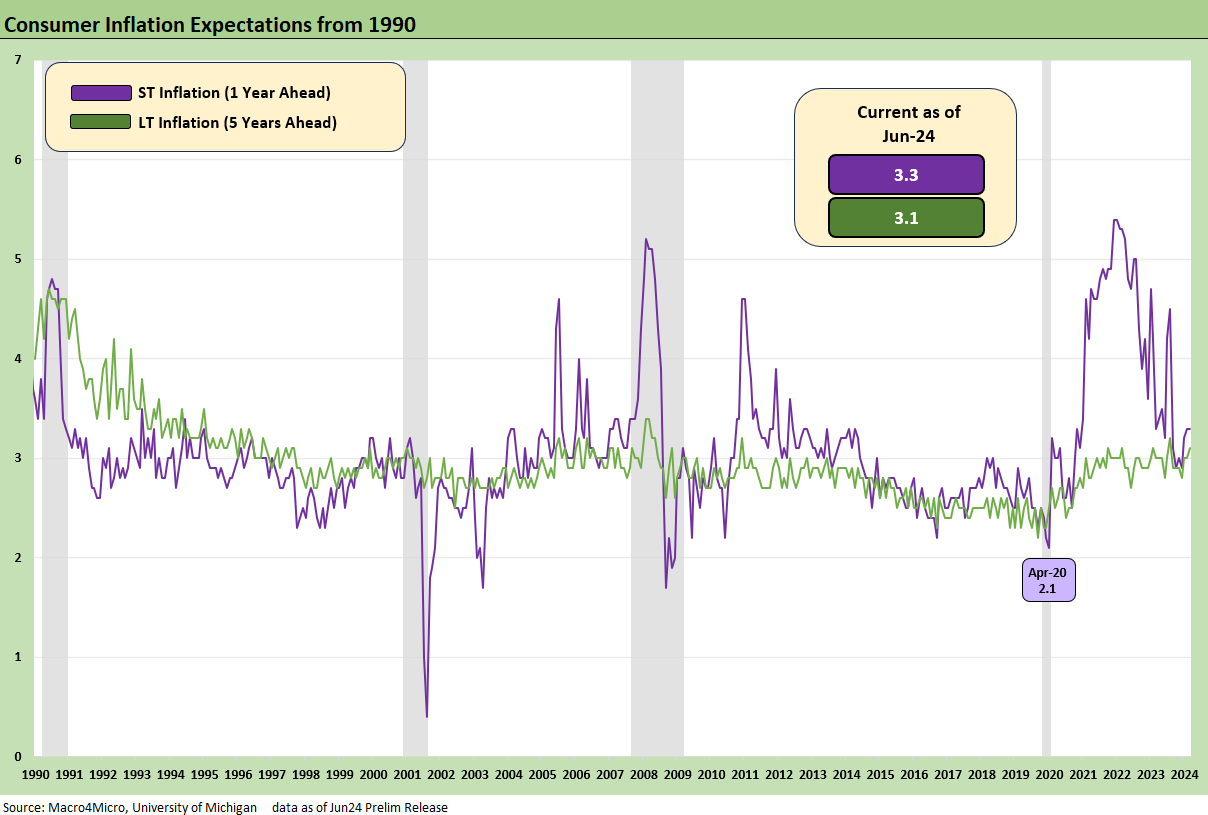

The short-term inflation expectations stayed flat at 3.3% with long-term inflation expectations inching up 0.1 to 3.1%, so that part of the update would not be likely to move the FOMC’s mood either way.

In last month’s numbers (see Consumer Sentiment: Flesh Wound? 5-10-24), we saw a sharp decline from the start to the year after an earlier period when consumer sentiment started to recover from the throes of inflation and rolled into a rosier view of the economy. Though short-term inflation did not move in the recent month, the consumer view of current economic conditions continued a sharp slide. That slide mirrors headlines around the affordability crisis (perceived and real) brought on by sticker shock after a period of high inflation (even with the decent coincident wage growth). The comparison of sentiment numbers with a May payroll print that saw strong jobs and +4.1% YoY hourly wage growth (see Payroll May 2024: The Wave Continues 6-7-24) is an example of why “vibecession” has been making the rounds.

We’ve previously covered what has been a monumental divide in consumer sentiment by political party (84.5 Dems vs. 52.6 GOP) where divergent “fact” sets drive different economic realities or fact-agnostic mindsets. However, all parties saw decreases across the board in sentiment this month again.

A likely contributing factor is recent data reflecting increased stress in consumer credit across credit cards and auto loans with record amounts outstanding. Though these may just be coming back to what is a historically normalized range, people care less about the headline level and much more about the recent changes and what is happening in their wallets. The high borrowing rates evident in debt bills is not helping the affordability story lines.

The above and below charts cover the present and expected economic situation componenets of headline consumer sentiment. Present economic conditions for June ranks as the 10th worst on record. That Top 10 list has seen a lot of shake up over the past few years as 6 of the 10 are from 2022 (including the worst) with 2008 having two spots and May 1980 rounding out the group. What really stands out here is the absence of a recession across the recent time period that had previously driven low present economic conditions readings.

The above chart looks at the differential of current and expected economic conditions to illuminate some of the irregularity of the most recent sentiment print. Looking back across time, we see that consumers typically think things are going to be worse in the future. Where we see breaks in that trend previously are deep in recession and on the way out of one. Today’s print reflects a break from that trend where we have no current recession but a better future outlook than the current one.

The chart above updates the time series for the U Mich Sentiment index vs. Short-Term inflation expectations. There is no secret that the consumer is particularly sensitive to short-term inflation and those periods of high inflation stand out across history.

The above chart updates the history of Short-Term and Long-Term inflation lines. The good news for UST bulls is that this month did not see expectations heading north quickly but still remains high enough to keep the Fed anxious.

Contributors:

Kevin Chun, CFA kevin@macro4micro.com

Glenn Reynolds, CFA glenn@macro4micro.com

See also:

Tariffs For Taxes: Dollars To Donuts 6-14-24

FOMC: There Can Be Only One 6-12-24

May 2024 CPI: I Feel Good, Not Sure that I Should 6-12-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Footnotes & Flashbacks: State of Yields 6-9-24

Footnotes & Flashbacks: Asset Returns 6-9-24

Payroll May 2024: The Wave Continues 6-7-24

JOLTS April 2024: Shorter Line but Not Short 6-4-24

Construction Spending: Stalling Sequentially at High Run Rates 6-4-24

PCE, Income and Outlays: Lower Income and Consumption, Sideways Inflation 5-31-24

1Q24 GDP: Second Estimate, Moving Parts 5-30-24

Retail Sales April 2024: Get by with a Little Help 5-15-24

Consumer Sentiment: Flesh Wound? 5-10-24