Rental Equipment: A Cyclical Confidence Booster

We look at some reassuring cyclical input from equipment rental sector.

With Ashtead reporting solid numbers and guidance earlier this month, we see United Rentals and its largest competitor (Ashtead’s Sunbelt brand) giving positive color on some important cyclical indicators.

We look at the recent performance of the peer group in equipment rentals and some bellwether capital goods manufacturing names to see what the equity market is saying about the mix of industry players.

We have been ramping up our coverage of the Equipment Rental companies this year since it has always been one of our favorite cyclical petri dishes for a read on the real-world decision-making on equipment demand across many industry verticals.

United Rentals (URI) has been one of the biggest HY issuers for years while Ashtead (ASHTF) as the #2 player graduated from HY to IG. URI also now has an IG index presence with its 1L bond used in funding its recent $2 bn Ahern deal (closed Dec 2022). As noted below, they have been great stocks to own, but their credit quality has also steadily migrated upward even as they expanded at an impressive pace and were generous to shareholders. That is a nice combination and shows balanced policies.

We recently published one of our Credit Crib Notes on URI (see Credit Crib Notes: United Rentals (URI) 9-12-23), and it remains a name on our priority list since it is very useful in telling a macro story within its micro level color in earnings reports and investor presentations (see United Rentals: Investor Day Backs Up Bulls 6-11-23).

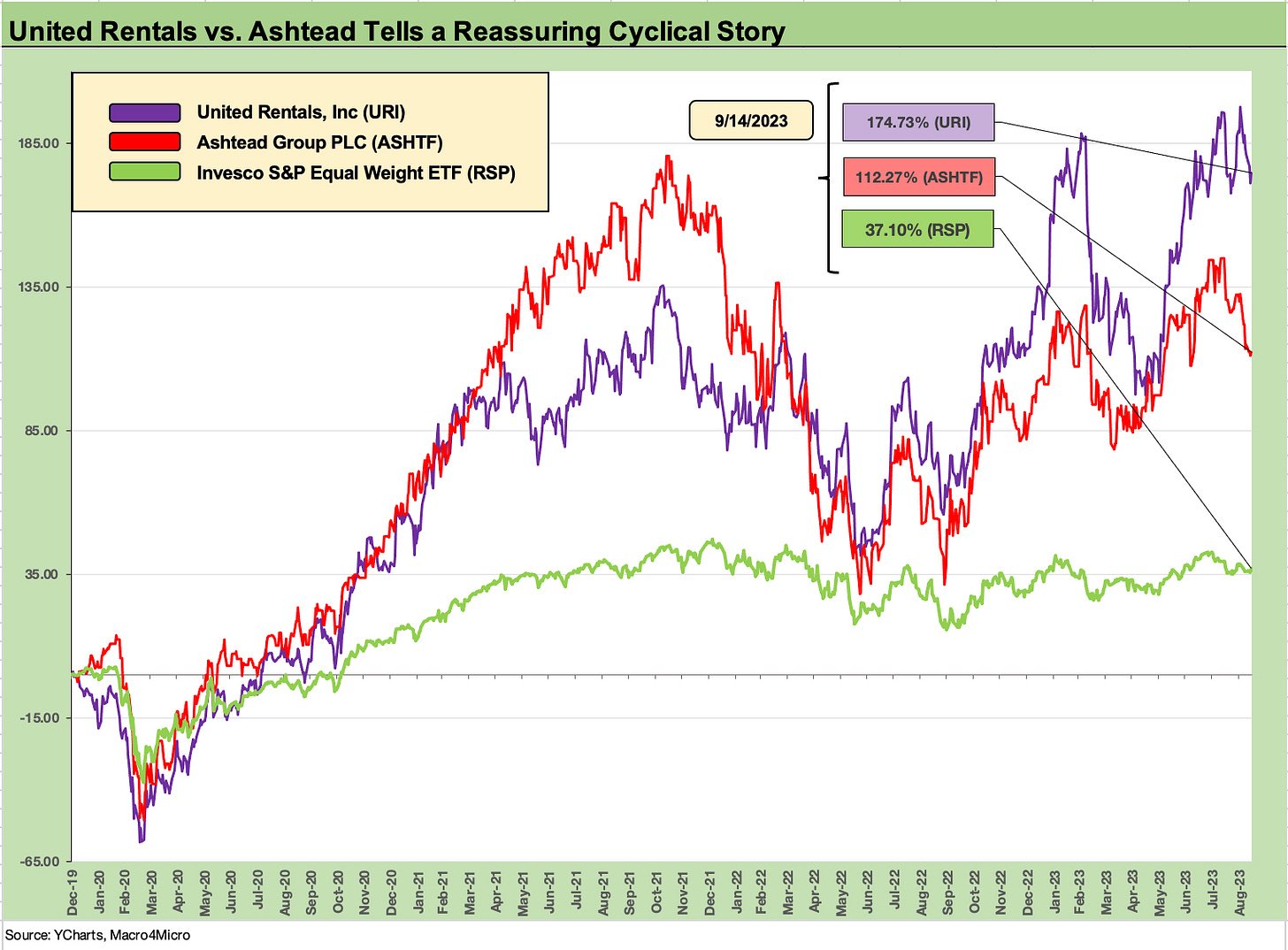

As detailed in the above chart, both United Rentals and Ashtead have materially outperformed the market on very strong revenue and cash flow growth that affords those industry leaders the ability to grow their earning asset base (equipment) while also taking care of shareholders (notably via buybacks).

For Ashtead (see Signals and Soundbites: Ashtead 4Q23/FY 2023 6-14-23), the same applies. Ashtead’s July 2023 quarterly results reported earlier this month offer a good update on the state of equipment demand. Ashtead’s Sept 5 presentation on its July 2023 1Q earnings period (April 2024 fiscal year) covered a wide range of details and included some construction services vendor data. Ashtead is looking at a 2023 peak in market construction growth at +12% with mid-single digit growth each year from 2024 to 2027.

As investors worry about the quality of a lot of leveraged real estate assets on the books, it is important to keep in mind the assets getting built today are a separate and distinct matter (see Construction Spending: Demystifying Nonresidential Mix 5-9-23).

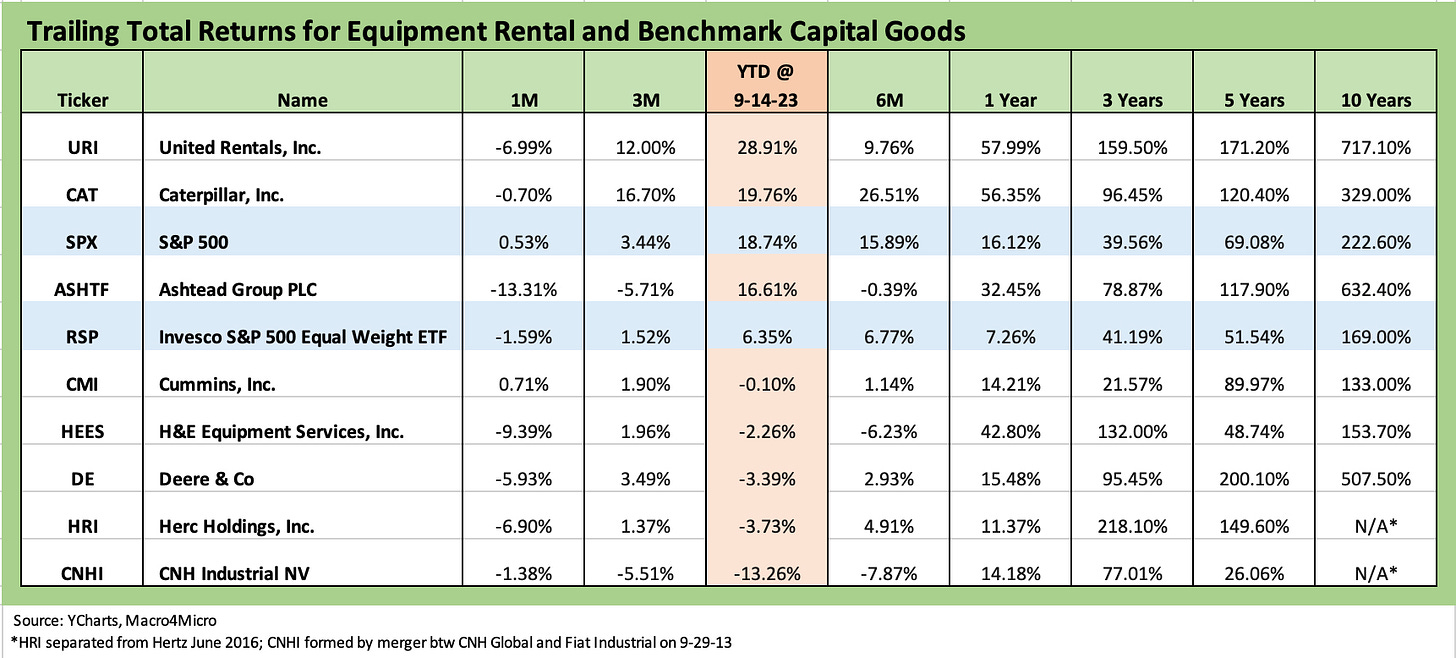

The above chart includes some stock performance data on the small peer group of equipment rental service companies (URI, ASHTF, HRI, HEES) and we also include some of the large cap heavy duty manufacturers that are good proxies for the capital goods cycle. We also include the equal weighted S&P 500 ETF (RSP) for a view on how they stack up without all the Magnificent 7 distortions. We line them up in descending order of total returns YTD.

We see URI and Caterpillar at the top of the list YTD and both of those are still looking good for the rolling 3 months. The nerves of August and early Sept are in evidence after such a heady run as investors pull back on some of the big winners and raise questions into the fall.

The massive equipment manufacturers are far more sensitive to unit volume shifts, but the smaller ticket leasing service operators have the advantage of being able to react with short lead time. The rental operators can fine tune pricing and portfolio planning to meet what they see on a very large scale across industry end markets and at a very granular level. We cover those issues in the company commentaries.