United Rentals: Nonresidential Construction Proxy

Excerpt from Footnotes and Flashbacks: Week Ending January 27, 2023

The nonresidential construction market is in the crosshairs of many as a highly vulnerable subsector of the GDP line items (see GDP 4Q22: Thin Sliced 1-26-23). Despite the mixed range of views, United Rentals (URI) weighed in with a bullish dividend, buybacks, and modestly positive guidance. As the #1 equipment rental player in the US, the company grabbed some headline time this week with a more optimistic view on its prospects. We see URI as a good proxy for activity in the nonresidential construction markets and a range of equipment-intensive industry groups. Their rental revenue mix is 48% Industrial, 47% Non-Residential Construction, and 5% Residential.

We have followed this company for some years in prior lives, and URI has been a major success story despite some periodic questions from some bears. They rose to the challenge in every recession and came through every volatile credit cycle positioned for more growth via acquisitions as well as organic capex. They were more acquisition oriented than Ashtead, another highly successful player in the space. We take URIs views on end markets very seriously since their touch points are so extensive across many equipment asset classes and regions and through an extensive branch network.

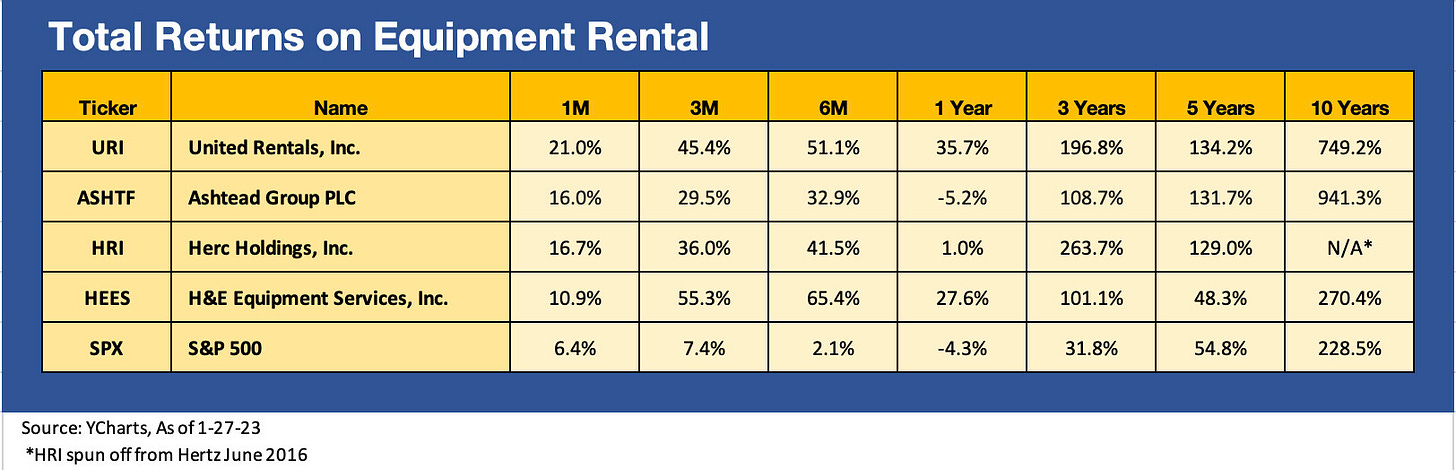

We look across the small peer group of major equipment rental operators in the chart above, and the industry leaders are trouncing the broader overall market with United Rental in particular a standout performer. United Rentals guided to free cash flow of $1.8 billion and initiated its first dividend to go with its substantial buyback program. The capex program guides to modestly lower on a net basis but appears to be balancing sustained expansion (including the recent Ahern acquisition) without risking pricing pressure on over-fleeting. The stock popped by double digits on the week.