Ashtead 4Q23/FY 2023 - Company Comment

We look at the 4Q23 and FY 2023 numbers for Ashtead where the trends offer a good cyclical indicator.

4Q23/FY 2023 earnings and guidance keep the risk profile low, margins high, and cash flow flexibility reassuring.

High EBITDA margins, self-funded capex, tactical expansion through bolt-ons, and low leverage relative to the target range make for a very strong credit story at Ashtead.

Inherent financial flexibility across cycles offers a material resilience factor to both bonds and equities.

The mega-project X factor creates a favorable risk-reward profile for investors in both equity and credit relative to high fixed cost cyclical manufacturers in the BBB tier.

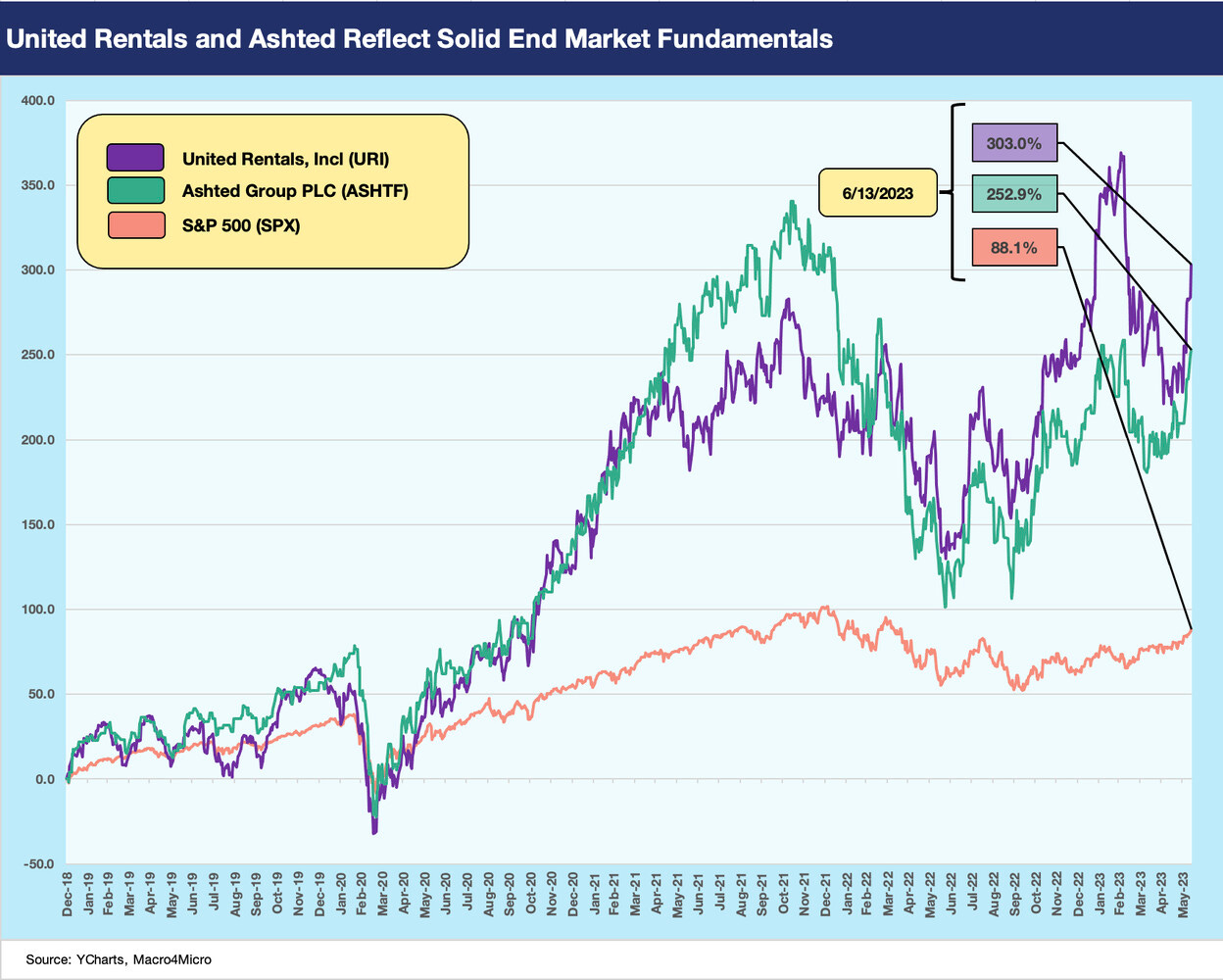

The impressive Ashtead 4Q23 results follows a very solid United Rentals quarter (see Signals & Soundbites: United Rentals 1Q23 4-29-23). Both of these equipment rental leaders presented a detailed set of positive inputs. We already reviewed the recent URI Investor Day (see United Rentals: Investor Day Backs Up Bulls 6-11-23), and many of the themes were similar with United Rentals and Ashtead’s Sunbelt brand operation fighting it out in many of the same markets.

The equipment rental industry has considerably more light shining on it now in the equity and debt markets than we saw back in the middle of the last cycle, and the industry has lived up to its promises despite COVID disruptions. Ashtead has been growing in lockstep with United Rentals although Ashtead has more focus on smaller scale roll-ups in M&A while also sustaining a high rate of growth capex.

The stock chart above is an update showing where Ashtead at #2 and URI at #1 frame up vs. the market. The outperformance is clear enough. As we covered in the United Rentals Investor Day commentary, the companies have ample room to squawk that they are still mispriced. The companies see their earnings multiples unfairly haircut vs. the market given their relative profitability, revenue/earnings growth rates, and return comps. That is for them to fight out on the conference calls and roadshow circuit.

For the credit markets, this industry offers a rare set of converging variables across earnings, margins, and leverage. This comes at a time when there are a range of top-down factors in industrial and nonresidential construction activity (public and private) that favor a high rate of utilization, solid demand, and firm pricing even in a recession scenario.

Equipment Rental keeps winning…

For now, the industry is coming through a multiyear timeline since the energy crash (4Q14-1Q16) where the strong (URI, Ashtead) got stronger, the weak (HRI) got stronger and the small (H&E) got bigger and stronger. That all ties back into the favorable secular trends in equipment leasing and the consolidation formula. The M&A is working well for the big players with a demonstrated track record that allows investors to factor in less integration risk uncertainty.

The Ashtead guidance in 4Q23 results showed optimism across the regional operation of the US (85% of FY23 revenues, 90% of EBITDA) as well as Canada and the UK. Guidance for Ashtead Group Revenue for FY 2024 (that takes you through April 2024) is for 13% to 16% with 15% to 20% in Canada where Ashtead is expanding. The US operations are calling for 13% to 16% revenue growth. The US is the main driver of cash flow with its 48%-handle EBITDA margins for FY 2023.

The NA-centric nature of the operations is a major positive in our view given the extreme uncertainties around China relations and what that could mean to equipment supplier chains. “Fleet in hand” has some optionality (pricing) if the world continues to “go dark side” on trade policy. That also flows back into more ambitious reshoring and onshoring and what that means for the trend line in industrial and manufacturing construction activity.

China is thus a wildcard for equipment markets into 2024 when the election rhetoric heats up around who is the toughest guy on the block on China. Trade policy affects supply and costs in the US market. Supplier chain risk is now a permanent part of the risk checklist and higher on the list than it was before COVID.

The demand side of the equation remains favorable as the mega-project theme attests. Meanwhile, the “normal cycle” is still very much a debate on expansion vs. contraction. As we have covered in some construction commentary, there are some big growth numbers getting put up on the board (see Construction Spending: Demystifying Nonresidential Mix 5-9-23).

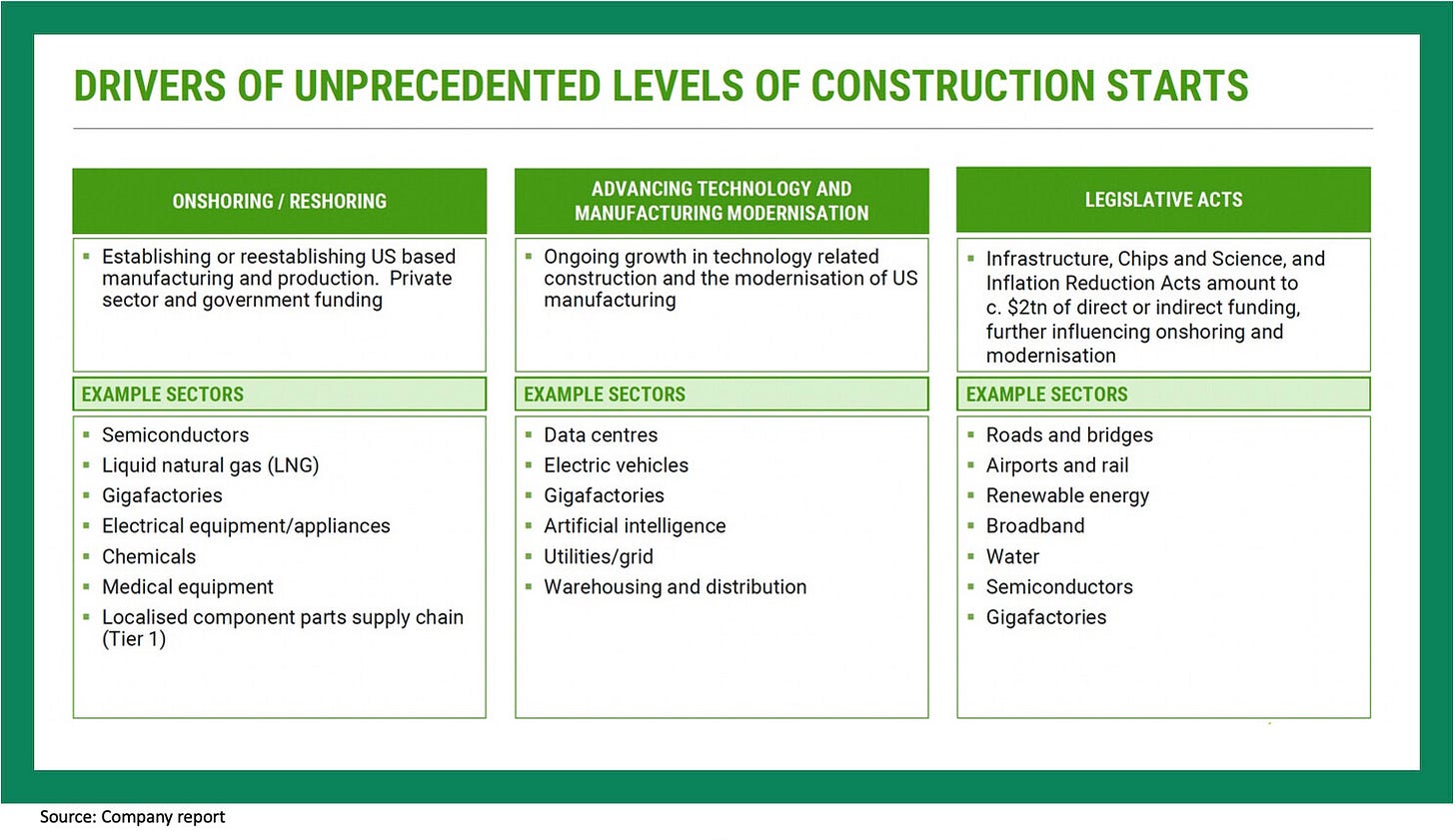

One thing the equipment rental majors do very effectively is break out disclosure on the booming activity in multiple areas of the construction markets and get down into the level of specifics. A few pages of the URI and Ashtead presentations hammer that message home. We include a useful Ashtead summary they provided on the call above. Some other pages got more into the weeds.

We sometime see confusion around what all the commercial real estate headlines mean. The somber tone around office and overleveraged commercial real estate and that category of problems is very distinct from the question around what needs to get built (or renovated) today. That cuts across the “what, where, and how much.” The needs show up in the numbers and guidance for both United Rentals and Ashtead.

Ashtead harped on the theme that 2022 was actually a very strong year in construction that saw construction starts in current dollar terms cross the $1 trillion mark for the first time (their Dodge slide they presented uses 2000 dollars). The cumulative effects of public, private, and legislated spending really add up.

Going through the URI and Ashtead presentations offers a lot of macro detail every quarter. The granularity that Ashtead offered on discrete individual projects gave it more of a micro level feel. The broad categories are more secular than cyclical in numerous cases such as onshoring/reshoring (e.g., semis, component supplier chains), climate initiatives (e.g., LNG, carbon capture, solar, etc.), and advanced tech investments (EV assembly plants, gigafactories), and changing freight and logistics patterns after a supplier chain crunch (“smart” warehouses). Anyone following manufacturing or autos is aware of the challenge, and the investment by US and non-US companies in EV assembly plants and batteries is a recurring headline in the auto trade rags. The billions add up and play to rental demand.

Then there is the wave of legislation that has been driving dollars into the equipment space with the Infrastructure Investment and Jobs Act (“IIJA”) signed into law in Nov 2021. The $1.2 tn IIJA ($550 bn for new projects) covers a diverse range of project types even if the roads and bridges line is #1 and gets the most headlines.

The IRA is encouraging more US investment and jobs and a catalyst for more economic activity (if we can take the politics out of it). You know the legislation has real impact when the IRA infuriates our European allies on the topic of “where to build” and how quickly. The need to streamline the permitting process in energy should be a major positive (eventually) even if for now only the Equitrans MVP project got legislative support (see Footnotes and Flashbacks: Week Ending June 4, 2023).

The 4Q23/FY 2023 highlights…

Note: When looking at the revenue and earnings trends of Ashtead, keep in mind the April 30 fiscal year date. FY 2021 was essentially the “Year of COVID” when for most calendar year reporting companies you have “2020” seared into your memory.

The above chart frames the comparative 4Q23 and FY23 income statement items. We include the % changes in 4Q that underscores the theme of growth as well as margin improvement with EBITDA and Operating Profit rising faster than Revenues.

“Records” are the order of the day for Ashtead and United Rentals as they keep growing both sides of their balance sheet with steady growth in their earning asset base (fleet, equipment). Volumes and rate (pricing) have both been favorable, and Ashtead expects that to continue in its outlook. The supply-demand balance remains in a good place.

Specialty equipment services rose 30% for Ashtead, which continues an industry theme for the major players. Ashtead is also expanding in non-construction end markets (they refer to that under the MRO category of Maintenance, Repair, and Operations markets) where their operations spill outside the classic equipment rental zone and face some other competitors. An example is Facility Maintenance. We have looked at some of those non-rental players in past lives, but that topic is for another day.

Ashtead hammers home that they see a future targeting a broader range of addressable markets and services. That is another way to get stockholders more excited.

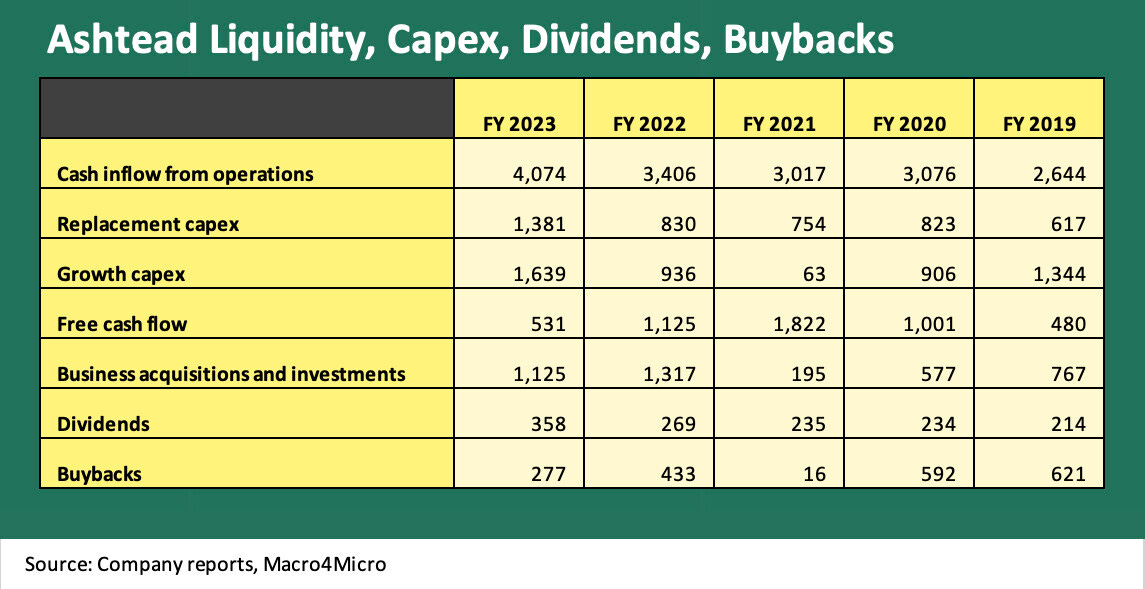

The above chart breaks out the moving parts of the cash flow and capex line items. The easy way to break down the cash flow lines is to frame cash flows vs. capex (growth and replacement capex). The M&A and shareholder rewards lines tell a story of what has sustained growth while shareholder rewards show the relative priority balance in financial policies. The consistency across time is an attribute in the markets since the track record is predictable. They don’t surprise you. They just have to execute and bring some new themes to the story.

The biggest revenue theme in product mix trends is around specialty equipment and the higher margins and growth rates there. The other big theme is “mega-projects” which is a term that keeps showing up in industry presentations. We highlight some of those main categories in other parts of this report. To the extent the US economy can avoid a recession, those mega-project and specialty equipment themes add pricing power. If a recession does in fact show up in 2H23 or 2024, those mega projects and shifting secular trends in the supply chain will mitigate downside risks to volume and pricing.

A few takeaways from the liquidity lines above:

Cash flow covers capex with lots of room to spare: There are a few ways to look at free cash flow. One angle is to consider how much free cash flow is required just to maintain that level of EBITDA. That requires a number that can be viewed as “replacement capex” (we discuss replacement vs. growth next). For Ashtead, operating cash flow covered replacement capex with $2.7 bn to spare for other discretionary applications or other requirements such as non-rental capex (not shown in chart) that was around $510 mn. Then you pay interest ($628 mn in FY 2023) and you have the natural, recurring disposal of used equipment ($615 mn in FY 2023). After that you still have well over $2 bn to fund growth capex that is further accretive to the forward EBITDA line.

Replacement capex vs. growth capex: The extremely high EBITDA margins come with an asterisk such as what you see with Exploration & Production companies. These very high EBITDA margins include a need for recurring capex to sustain that rate of EBITDA. Whether you view it as replacing depreciating assets (with an inflation factor for the equipment) or protecting the quality and pricing of the fleet, it is a number that has to be recognized as a haircut in the EBITDA margin in economic substance (EBITDA-Replacement Capex metric). Then Ashtead funds growth capex of $1.6 bn, and they still have free cash flow to deploy.

Asset grows and debt grows: If we keep in mind the growth rates of EBITDA and the ability to sustain leverage organically (via EBITDA growth), we need to look at Ashtead as a company that not only will NOT pay down debt but also SHOULD NOT pay down debt. The company is supposed to grow, and they do. That is why the equipment rental leaders complain about unfairly discounted multiples. The risks of the equipment rental players are lower than one would expect at even 2.0x leverage since they can adjust fleet size to deal with shocks just by haircutting growth capex, dialing back acquisitions, and reevaluating the timing and scale of buybacks. Basically, the flexible “cash use” lines (especially growth capex, used equipment sales, acquisitions) offer a lot of comfort to creditors.

We still do not see Ashtead or United Rentals bonds as fairly rated based on the discussed mix of factors and especially in the area of margins and cash flow flexibility. These are very strong companies in terms of financial metrics and relative risk.

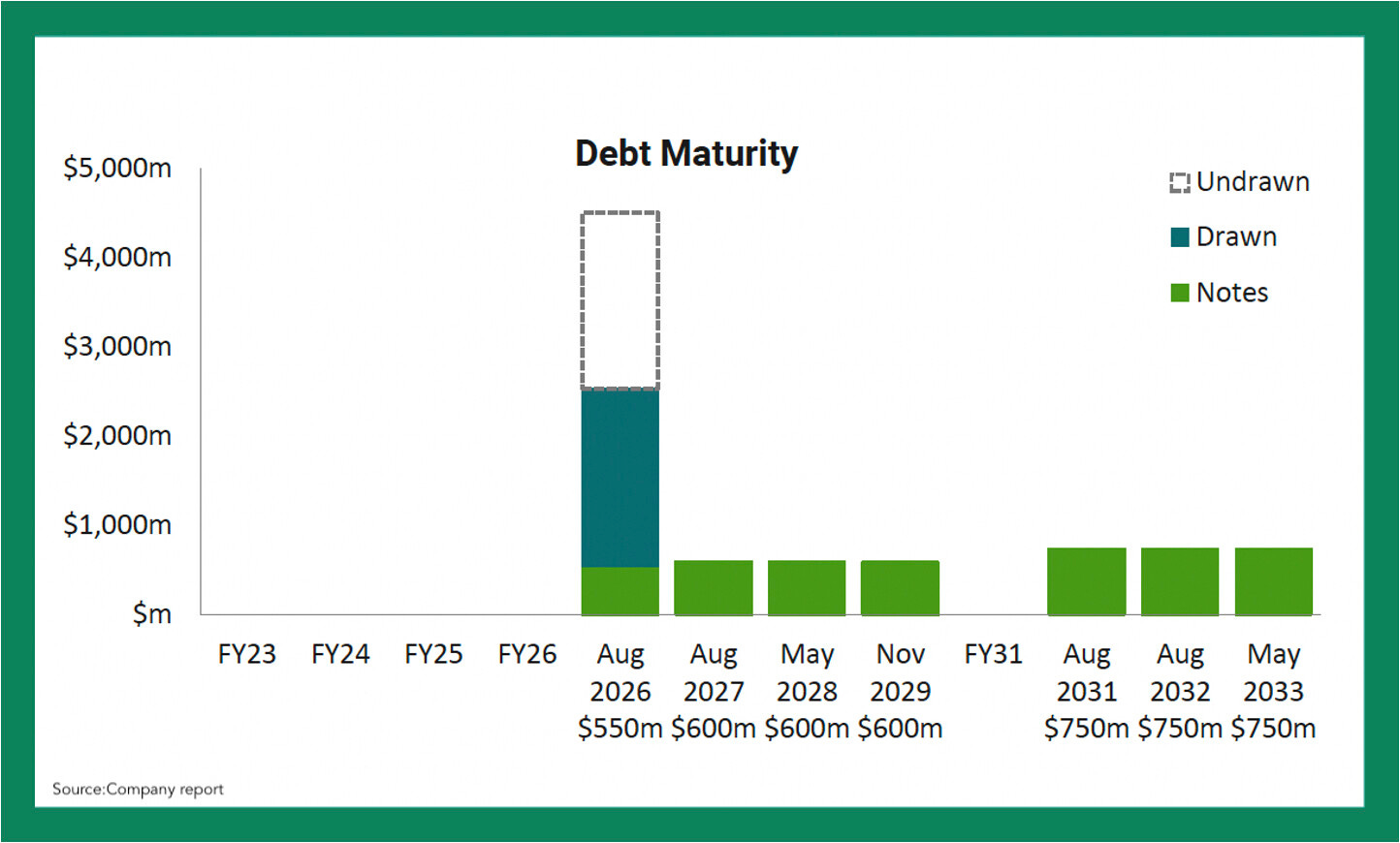

Balance sheet remains strong, and a clean maturity schedule adds more comfort…

Ashtead has a target range of 1.5x to 2.0x on leverage and is currently at 1.6x. That leverage is modestly stronger than United Rentals, but we would argue both are very strong in the context of the cash generation and free cash flow histories across some wild periods in the market. The balancing act of replacement capex vs. growth capex and M&A allow for discretionary management of the leverage levels.

The above chart frames the forward maturity schedule as Ashtead has locked in a few years of discretion in how it wants to approach the market. They can hope the FOMC succeeds, and inflation gets dialed back. Ashtead will not face near term refi and extension needs from its current capital structure.

Ashtead issued $750 mn of 2032 bonds in Aug 2022 and $750 mn of 2033 bonds in Jan 2023. The cap structure includes $4.55 bn in notes and $2.0 bn in secured bank debt at the end of 4Q23. When the company rolls up its net debt numbers, it drops in leases and translation effects. Their 1.6x excludes leases, but they provide a 2.0x number as well for the leases. We only look at leverage excluding leases in this case.

The current yield curve backdrop is unfriendly to floating rate debt to fund major deals, but that did not stop URI from a $2 bn Dec 2022 deal. Ashtead also has been acquisitive but using a smaller average deal size than the more aggressive and acquisitive URI. The much higher rates on ABL lines and acquisition financing would factor into any new M&A. It is a matter of valuation and price on the deal. It is not like smaller less creditworthy competitors are heavier an easier time of it in a market with sharply higher borrowing rates.