New Home Sales: Riding Higher, Steady Elevation

New home sales for May 2023 put up solid YoY growth as the calendar comps get easier and demand picks up.

Double-digit sequential growth (+12.2%) and even higher double-digit YoY growth (+20%) keep the housing sector front and center in the cyclical debate as two big ticket household items – homes and autos – show solid YoY increases.

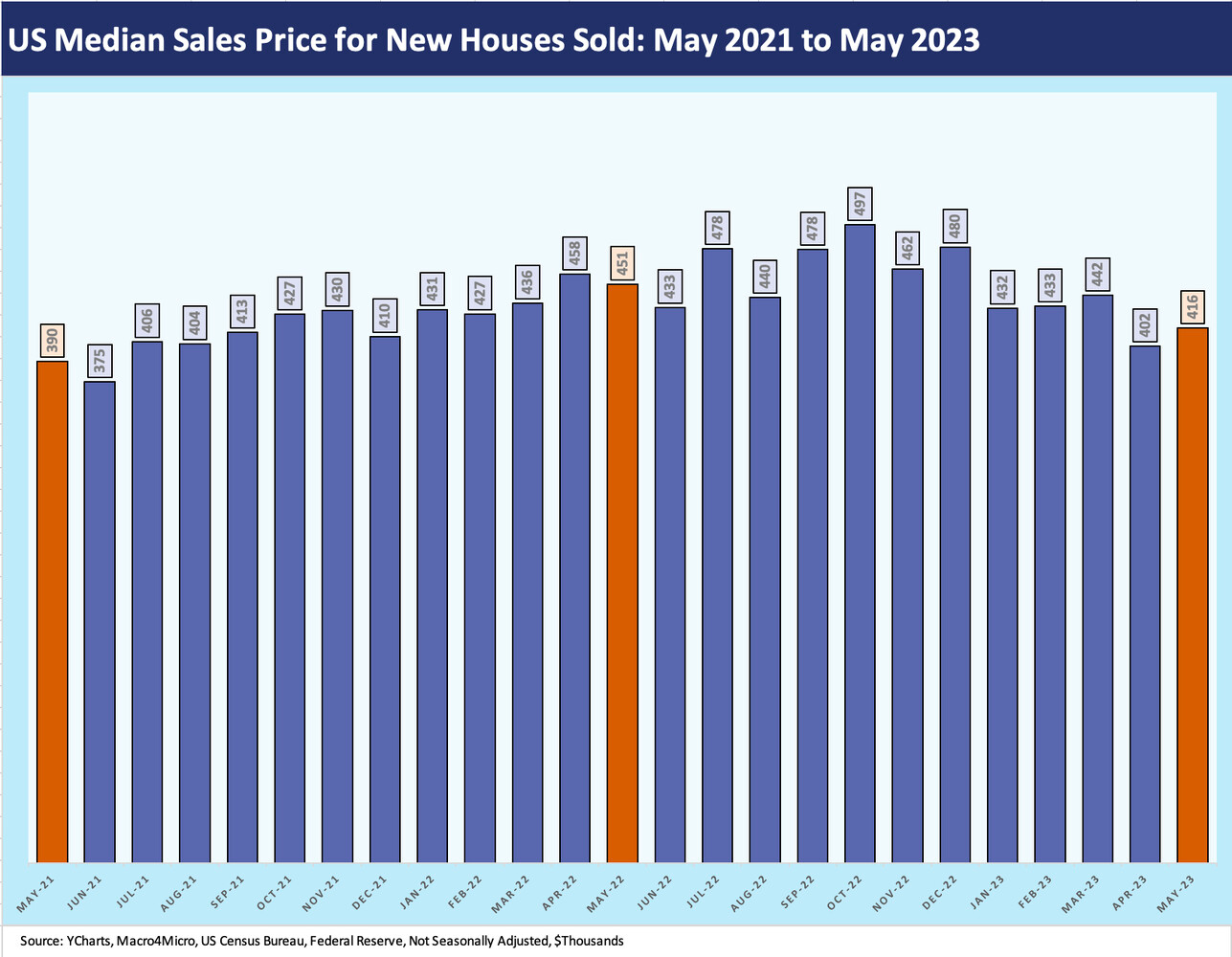

Median prices ticked up off the lows of April with median prices for new homes now at $416.3K vs. $402.4K in April.

Inventory months ticked lower to 5.8 (not seasonally adjusted) on stable units for sale but at higher selling rates with the inventory months on a SAAR basis at 6.7 for the lowest since the Fed tightening cycle kicked into gear.

The above chart plots the timeline of new home sales from the Go-Go 60s and stagflation 1970s and then across the bull market 1980s/1990s on through the housing bubble and systemic crisis years, the longest expansion in history, and a brutal pandemic. There is sure some variety in that history as we now move into a late cycle debate around whether we are in a late-cycle stage of a brief recovery post-COVID or whether we are still in the longest expansion in history – just with a 2-month recession timeout for a catastrophic virus.

One factor that remains intact (only more so) is that there are favorable demographics for housing and a recurring shortage of supply. That is all coming to a point where investors have regained confidence in the expectations for both price and volume in homebuilding.

South making it happen in housing recovery…

The critical South region (61% of SAAR) put up strong sequential numbers at +11.3% with YoY at +22%. That fed the overall total US numbers, which showed +12.2% sequential and +20.0% YoY. The only region down YoY was the West at -0.6% while the Midwest weighed in at +40.0% YoY and the small Northeast market at +110.5%. Those are good volumes framed against low relative inventories.

The inventory situation for new homes gets commingled with the trend line in existing home sales (see Existing Homes Sales: Feeling a Bit Flat 6-22-23) and inventories for sale. The traditionally dominant role of existing inventory in the total sales picture has created a very favorable macro backdrop for the relative share of new home sales. As evidenced in the monthly numbers, low existing sales and mortgage “barriers to sale and refi” create a great opportunity for builders. The stock market recognizes that.

The above chart plots price trends from the housing bubble through current times. That time series makes for one wacky chart. We plot sales volumes vs. median prices from the wild times of easy mortgage credit on the way into the 2005 peak building year and then across the crash and the rebound to all-time highs. The price charts tell a story of weaker affordability that tag-teams with a mortgage rate spike.

Sometimes industry watchers seek to inflation-adjust the numbers, but you buy and sell homes in current dollars based on current income levels. The main event in mortgages is current income vs. monthly payments, and that is a major headwind still. It just is not blowing as many buyers backwards as was originally feared. The latest uptick in price is an important turn even if these stats always come with the asterisk of product and regional mix.

The price trends in the market get a lot of airtime and headlines for good reason, but home prices still take a back seat to mortgage rates in the affordability crisis that comes with a rising monthly payment. The worry for homebuilders was that more price discounting and more expensive incentives (loan buydowns, fee relief, etc.) would continue to dominate their sales strategies, but that has not been a sustained problem for their gross margins or of the magnitude one might have expected.

We looked at a few builders in detail of late (see KB Home: Credit Profile 6-24-23, D.R. Horton: Credit Profile 4-4-23) and coming out of earnings season (see Signals and Soundbites: Toll Brothers F2Q23 5-24-23, Signals and Soundbites: PulteGroup 1Q23 4-25-23, Signals & Soundbites: D.R. Horton 2Q23 4-21-23). The color has ranged from constructive to upbeat on the slow and steady adjustment of homebuyers to the stubbornly higher mortgage rates. After all, we are really not that far from the housing bubble mortgage rates even if higher within the 100-bps range of 2023 for 30Y mortgages.

Getting back to sustainably high volumes in new home sales needs some easing of mortgage rates and a soft landing, but the excess demand and supply-demand imbalances are still a tailwind. For the builders, it is about pace vs. price and managing their costs and inventory. We are seeing a lot of sales of homes while under construction and also from completed homes as builders pursued more spec building heading into this season given the mortgage volatility. Sale of completed homes and move-in ready inventory has risen in 2023. Those details are anecdotal and also broken out in the census data for new home sales.

The above chart just gives another angle on the timeline of prices. We begin the time series just ahead of the onset of the pandemic. The market saw new home sales disrupted by lockdowns and fear of what the macro picture would look like as employment levels swung around dramatically, mortgage default fear was rampant, and regional lockdowns undermined buyer mobility. The Fed and fiscal support saw new homes bounced off the lows in volume and pricing. The rebound was dramatic on work-from-home decisions, urban flight from crowds, and a range of impulses that are still being sorted out. We highlight the Oct 2022 peak of ~$497K as contractual lag effects and limited supply supported prices.

The above chart shows the monthly median price trends for new home sales prices with each month’s median price level noted at the top of the bar. We highlight the three months of May for how the peak selling season was framing up in 2021, 2022, and 2023. The current May is well ahead of May 2021, but May 2022 had not yet felt the full impact of the Fed tightening as inflation was just getting ready to hit highs of 9.1% in June.

As we cover in our weekly yield curve recaps (Footnotes & Flashbacks: State of Yields 6-25-23 ), Junsee e 2022 marked the start of 4 consecutive 75 bps hikes by the Fed. The lag times on houses under contract and committed mortgages took some time to flow in, and many builders had some of their best years in history until the impact started to sink in.

See also:

Existing Homes Sales: Feeling a Bit Flat 6-22-23