Housing Starts: Slow and Steady Sequential Moves

We look at new residential construction as the May 2023 numbers post strong sequential trends.

Sequential housing starts saw a healthy increase as we move further into the peak selling season with double-digit SAAR growth driven by sustained single family metrics in the important South region as well as favorable multifamily trends nationally.

Multifamily completions and starts moved higher sequentially (on both SAAR basis and “Not Seasonally Adjusted” basis) as supply from multifamily should reassure those looking for rent inflation to decline in the somewhat dubious Shelter lines of CPI.

Permits showed more measured increases in both single family and multifamily, reflecting milder confidence in working capital management cycles and demand into 2024 and ample multifamily supply in the pipeline under construction (978K or +17.3% YoY).

We revisit the timelines of single family starts above with medians noted across notable periods from 1960 through current days. The swing in market share of new construction vs. existing homes sales has been a topic of focus for months as a spike in mortgage refinancing costs has reeled in existing home sales volume in a period of material housing shortages.

Whether one sees a shortfall of 4 million or 6 million, the intermediate term demand profile is very favorable and lower inflation helps sentiment even if near 7% mortgage rates remain the order of the day. Any move toward tighter mortgage spreads or a 6% area rate would create an even more robust backdrop.

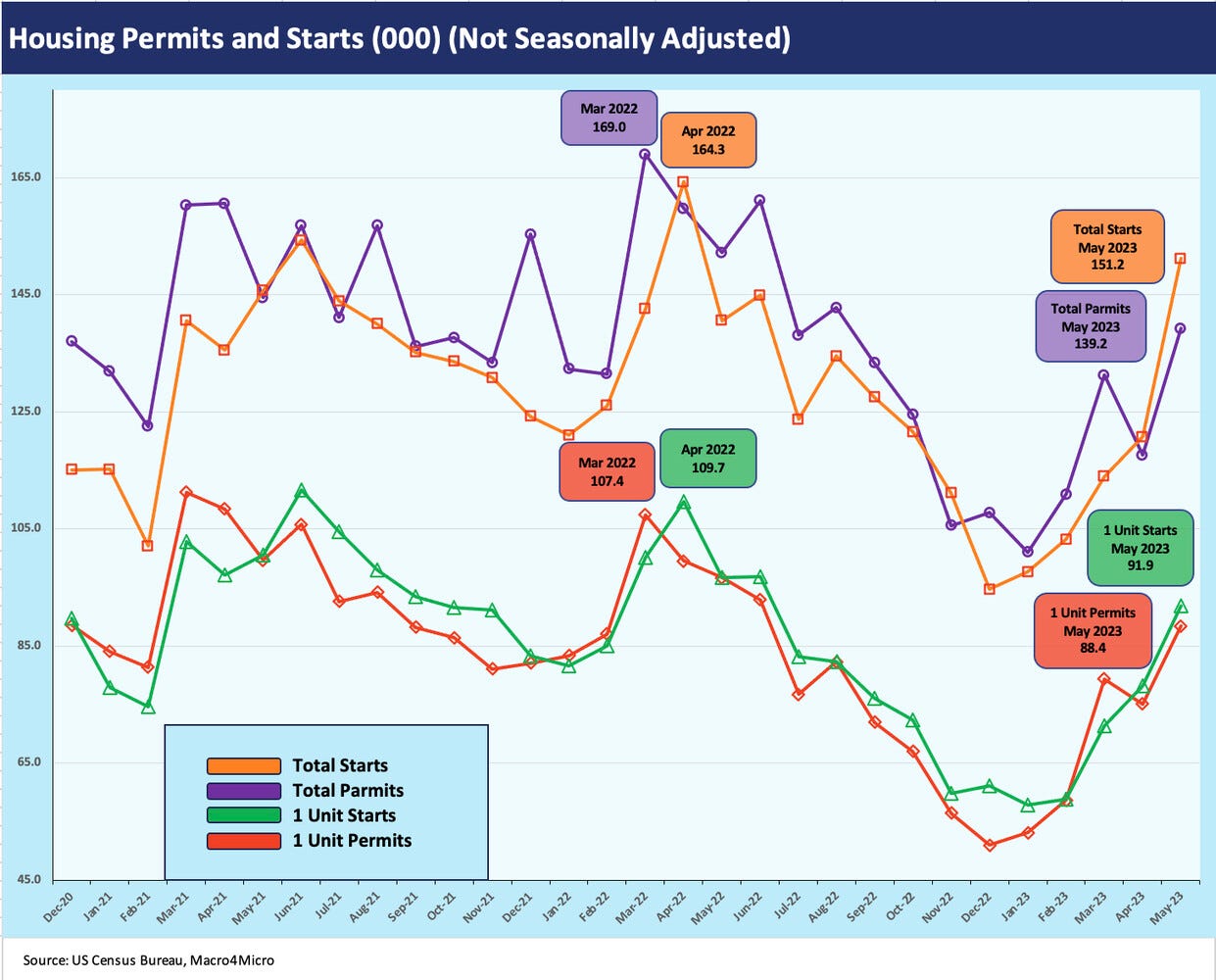

For May 2023, the +21.7 % sequential increase in total starts, the +18.5% increase in single family (SAAR basis), and +28.1% in 5 units or more tell a favorable story from macro to micro. Permits were more muted sequentially at +5.2% in total, +4.8% single family, and +7.8% multifamily on a SAAR basis. We look at starts vs. permits on a “not seasonally adjusted” basis in the next chart.

As we discussed in a recent D.R. Horton commentary on new single family rentals (see Single Family Rental: A Major D.R. Horton Asset Sale 6-6-23), the need to address the housing shortfall across some combination of the new single family and multifamily subsectors or via existing home sales will remain a closely watched variable for the housing sector broadly and the homebuilders narrowly. The fact that there is a shortfall in housing supply overall will keep the moving parts of new construction feeling some tailwinds from tight availability.

The above chart shows the path of starts and permits using the not seasonally adjusted data that is closer to the actual activity on the ground rather than the SAAR models. The commentary has pointed at seasonal factors being derailed by the pace of the UST migration in 2022 after the distortions of COVID in 2020-2021. The industry chatter sees seasonal normalcy slowly coming back in 2023.

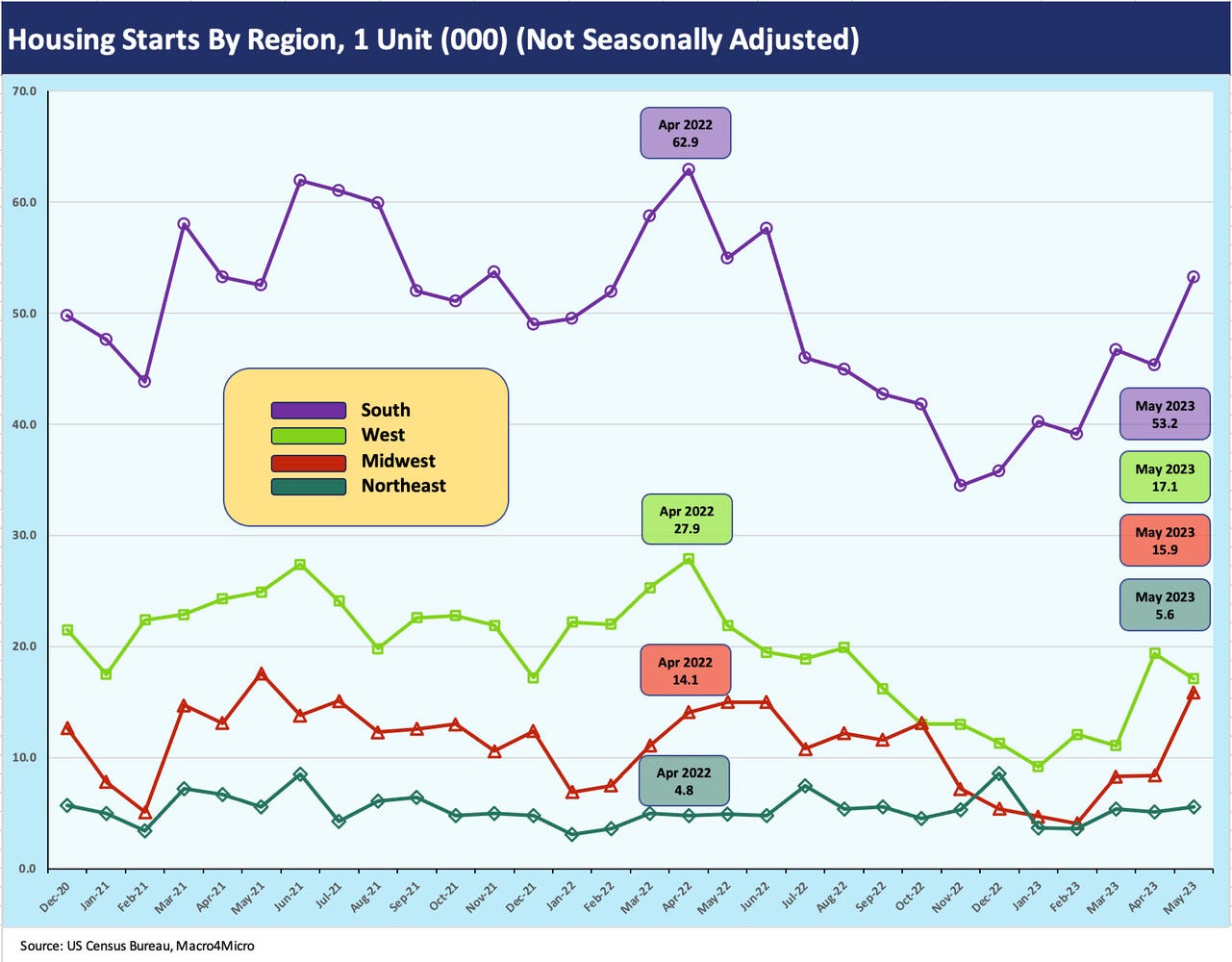

The above chart updates the regional flavor of single family starts (not seasonally adjusted) and reinforces how the south (with Florida and Texas) is in a league of its own. Total single family starts (not seasonally adjusted) for May overall posted +17.5% with the South, Midwest, and Northeast higher sequentially. Only the West single-family volumes were lower. Total starts, including Multifamily, were only lower in the small Northeast market.

The above chart plots the long-term time series for multifamily and highlights the rise of multifamily over the past decade. The high-point volumes in multifamily this cycle have not been experienced for a few decades. The current SAAR numbers of 624K have not been beaten since 1985. The current May 2023 multifamily starts number beats anything across the 1990s and new millennium. That said, the 1960s into early 1970s buildout still carries the day in multifamily.

The last chart plots the multifamily permits across the decades. Permits are well down from the Dec 2021 peak, but the 542K SAAR level for 5-units or more marked a solid sequential uptick even if down notably from the 600-handle levels that characterized most of 2022.

See also:

Recent Macro:

New Home Sales: Volumes Up, Median Prices Down 5-23-23

Existing Home Sales: Will the Party Start? 5-18-23

Home Starts and Permits: Performing with a Net? 5-17-23

Recent builder commentaries:

Signals and Soundbites: Toll Brothers F2Q23 5-24-23

Signals and Soundbites: Anywhere Real Estate 1Q23 5-4-23

Signals and Soundbites: PulteGroup 1Q23 4-25-23

Signals & Soundbites: D.R. Horton 2Q23 4-21-23

D.R. Horton: Credit Profile 4-4-23