Footnotes and Flashbacks: Week Ended April 9, 2023

The market warms up for a crucial earnings season on the heels of all the post-SVB noise with the bank 1Q23 wave starting on Friday.

“Analysts warm up to pin down regional bank management.”

This Week’s Macro: Asset class and ETF sector returns; yield curve migration trends; recent curve deltas in the downshift; updating the 3M to 10Y UST slope as it hits a new inversion high.

This Weeks’s Micro: We look at the FedEx restructuring as a bellwether freight player overhauls its strategy; we update stock returns for a broad sampler of oil and gas names after OPEC+ surprises the market in the face of cyclical headwinds.

MACRO

The 1Q23 earnings season is about to kick into gear this coming week with the biggest banks starting on Friday and then rolling into waves of regional and consumer-focused financial issuers in the following week. Analysts’ questions for many regionals could prove demanding, and the banks can’t spin generic answers this time. The market needs more color on the plans to manage uninsured deposit flight risk, liquidity planning, CD rates, and what it all means for net interest margins, risk appetites, and credit contraction.

The loan haircuts at SVB will raise questions around carrying values. Meanwhile the planning around broader cyclical risks in consumer credit will require analysts to wrestle more information out of bank management. The banks (or the analysts) cannot use last quarter’s template, so a few forcefully ambiguous statements will not be a good game plan.

We assume a lack of clarity will more likely be punished by the market (it should be). This is not just another quarter for many of the banks. Most banks are quite healthy, so they need to make the effort to get granular and candid. On the consumer finance side, the details there will be watched closely from cards to autos.

Among earnings reports this week, we highlight CarMax as one that could hold some significance for Carvana bondholders (see Carvana: Prisoner’s Dilemma, Used Car Getaway 3-22-23, Carvana: Credit Profile 3-5-23, Carvana: Wax Wheels 12-8-22). CarMax numbers and guidance could shed some light on the franchise dealers and how they are doing in the used car game where a few (e.g. Lithia, Sonic) have been expanding aggressively (see Market Menagerie: The Used Car Microcosm 11-29-22). With the spring selling season upon us, the state of the consumer and credit availability will see some very useful color once regionals and consumer-heavy financials start rolling out numbers the week of April 18.

Asset returns after a chaotic month…

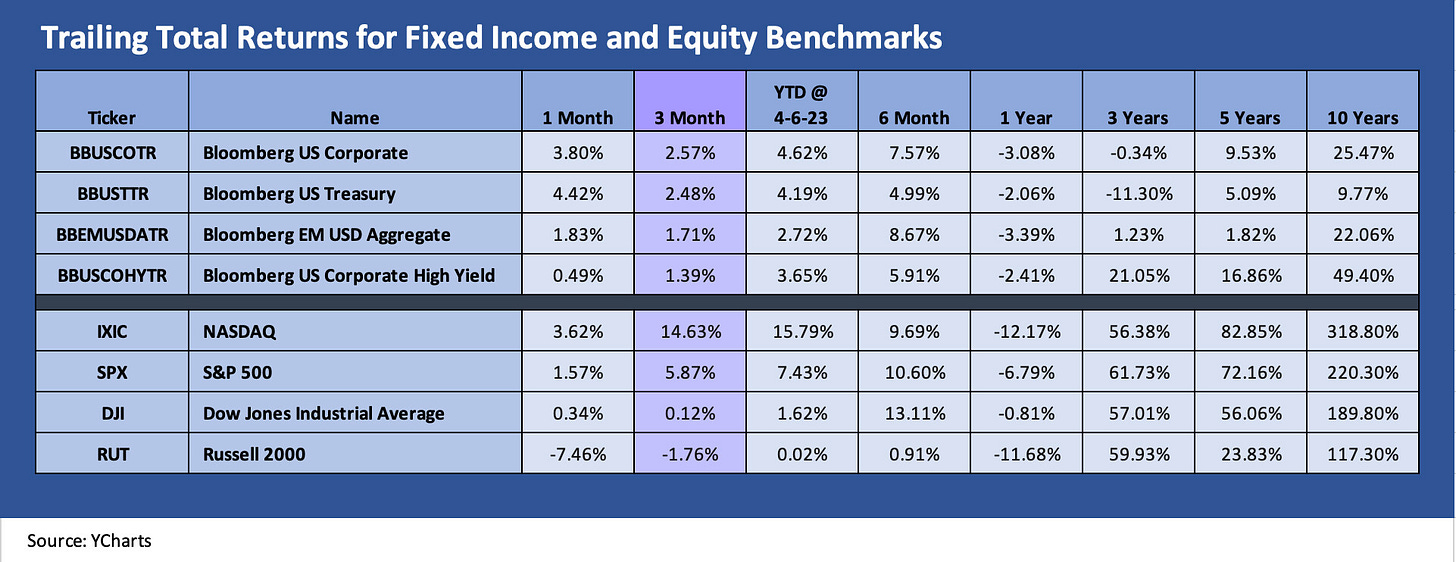

Below we break out the main debt and equity benchmarks after a stretch where duration was rewarded, credit risk penalized, and assessment of fundamental risk trends were confused. Growth and Tech rallied in part because interest rates were in check or perhaps because 2022 was so brutally bad for so many tech names that roll up into that broad category.

The past month showed duration rewarded (IG bonds and UST) and credit risk penalized in all the commotion of the SVB crisis and spiraling effects into regional banks and fear of credit contraction. We have covered those topics in earlier commentaries. The winner this past month in total returns was UST with IG bonds and NASDAQ close in # 2 and #3. For the YTD period, NASDAQ is the runaway winner with a very respectable performance by the S&P 500 and duration sensitive assets.

HY has been volatile, but the damage was contained. As we covered separately (see Risk Appetites Get Bloodied 3-15-23), the bank system developments created a whole new game on the forward-looking risk assessment. As the crow flies from the SVB events (we use the 3-8-23 trading day as the last “clean” day before the 3-9 meltdown and 3-10 collapse/seizure), HY OAS materially widened but remains well below the OAS wides of 2022 (see US HY Spread Histories: Weird Science, New Parts 3-19-23, Spreads Across Tiers: Decompression + Volatility 3-18-23).

IG bonds won on the UST downshift with muted spread action once the regional panic eased somewhat and IG’s largest sector (Banks/Brokerage) calmed down from the initial angst (see IG Corporate Spreads: Tough Pathway, A Few Doors Ahead 3-19-23). As a reminder, Banking and Brokerage as a sector comprise just under $1.8 trillion in market value and is a very important driver of IG Index returns directly (by its bond performance) and indirectly (by its lending policies and risk management practices serving other industries and issuers).

Longer tail of equities…

The more expansive groups in the “1500 and 3000” benchmarks offer a stark reminder of the lack of breadth and depth in the equity performance as noted in the charts above. The small caps were beaten up, financials were hammered, and the weakness in energy is getting a potential new lease on life from OPEC+ this past week. Sustained OPEC+ tailwinds for price is hardly a “gimme” given the cyclical question marks on the demand side in major markets across China, the US, and Europe.

ETF returns…

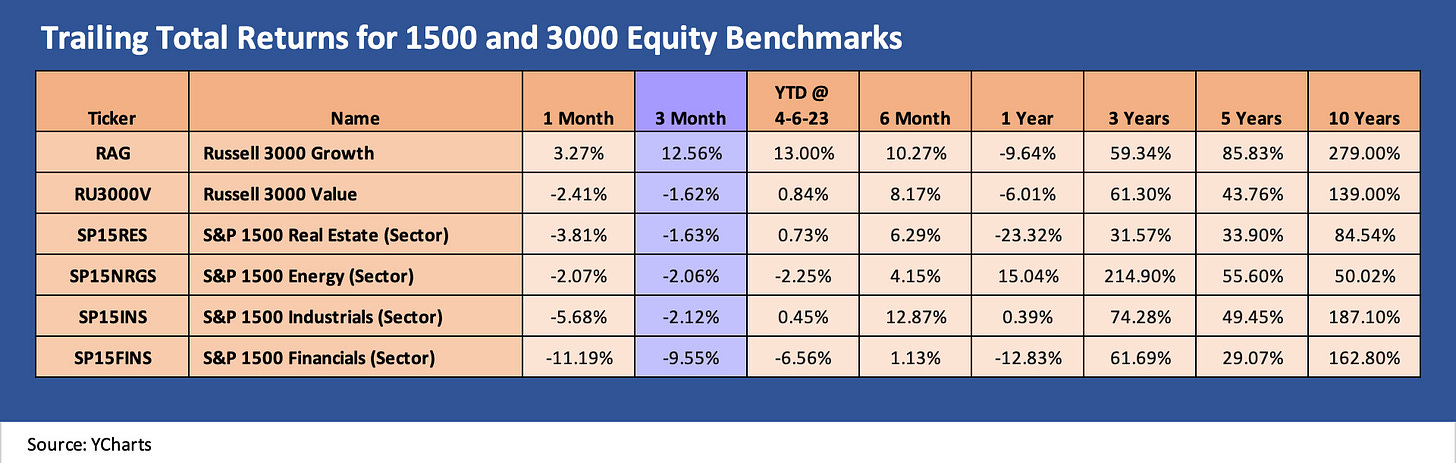

In the following charts, we look at some broad benchmarks and a mix of ETFs that serve as industry proxies and the same for fixed income as an asset class. We detail 21 different categories. The 1-month scoresheet once again showed 12 positive and 9 negative, the same as last week (see Footnotes and Flashbacks: Week Ending April 2, 2023). That was after posting an 8-13 record in the prior week’s issue as the two weeks of SVB pain were being worked through (see Footnotes and Flashbacks: Week Ending March 26, 2023).

The running 3-month tally this week faded sequentially and was 11 positive and 10 negative after 14 positive and 7 negative to wrap up what was a decent 1Q23 total return (even if 1Q23 ended very badly). The running, overall 3-month asset returns for now are still living off the fumes of a wild Jan 2023 rally.

1-Month ETF and benchmark returns…

The 1-month ETF return ordering is much like last week among the top performers with Communication Services, Tech, and Utilities in the Top 5. Duration-sensitive assets squeezed into the Top 5 of this performance chart with LQD at #4 and GOVT at #5.

On the right, we see the Bottom 4 unchanged with Financials (XLF) still in a double-digit hole with small caps (RUT), BDCs (BIZD), and E&P (XOP) still lagging. The jitters around cyclical prospects and guidance fear ahead in earnings season is evident in the decline of Industrials (XLI).

We do not include the regional bank ETF in our usual collection that we track, but we included it in the box in the chart above at -28.3% for the KRE regional bank ETF. That performance would have made for a less useful visual if we plotted that in the chart. The 1-month negative return for the regional banks is essentially the same in the 3-month ETF chart below.

3-month ETF and benchmark returns…

The 3-month running returns on ETFs and benchmarks saw minimal changes among the leaders with the same Top 5. We would note that #6 through #11 rounding out the positives are all income investments with four in fixed income (LQD, GOVT, AGG, and HYG), a high dividend sector in midstream energy (AMLP), and private credit ETF (loans) in BIZD. The right side of the chart with 10 in negative return territory are more compressed in a tight range (-0.1 to -2.7) with the exception of the beatdown for Financials (XLF) at -9.1%.

The post-ZIRP migration detailed…

The chart below frames the yield curve differentials from the March 2022 period when ZIRP ended through the most recent week. We also include a box that shows the peak of the migration to 3-8-23 or just ahead of the SVB collapse and depositor crisis that sent the UST curve rallying (see Silicon Valley Bank: How did the UST Curve React? 3-11-23).

The most recent week saw the curve rally and the differentials from 3-1-22 all tighten from last week. The differentials across the UST curve from March 2022 capture “inversion” as the upward delta in the 3M UST at 463 bps still makes a statement. The fed funds rate makes the short UST rates a bit stickier on the latest move lower while the market controls the long end.

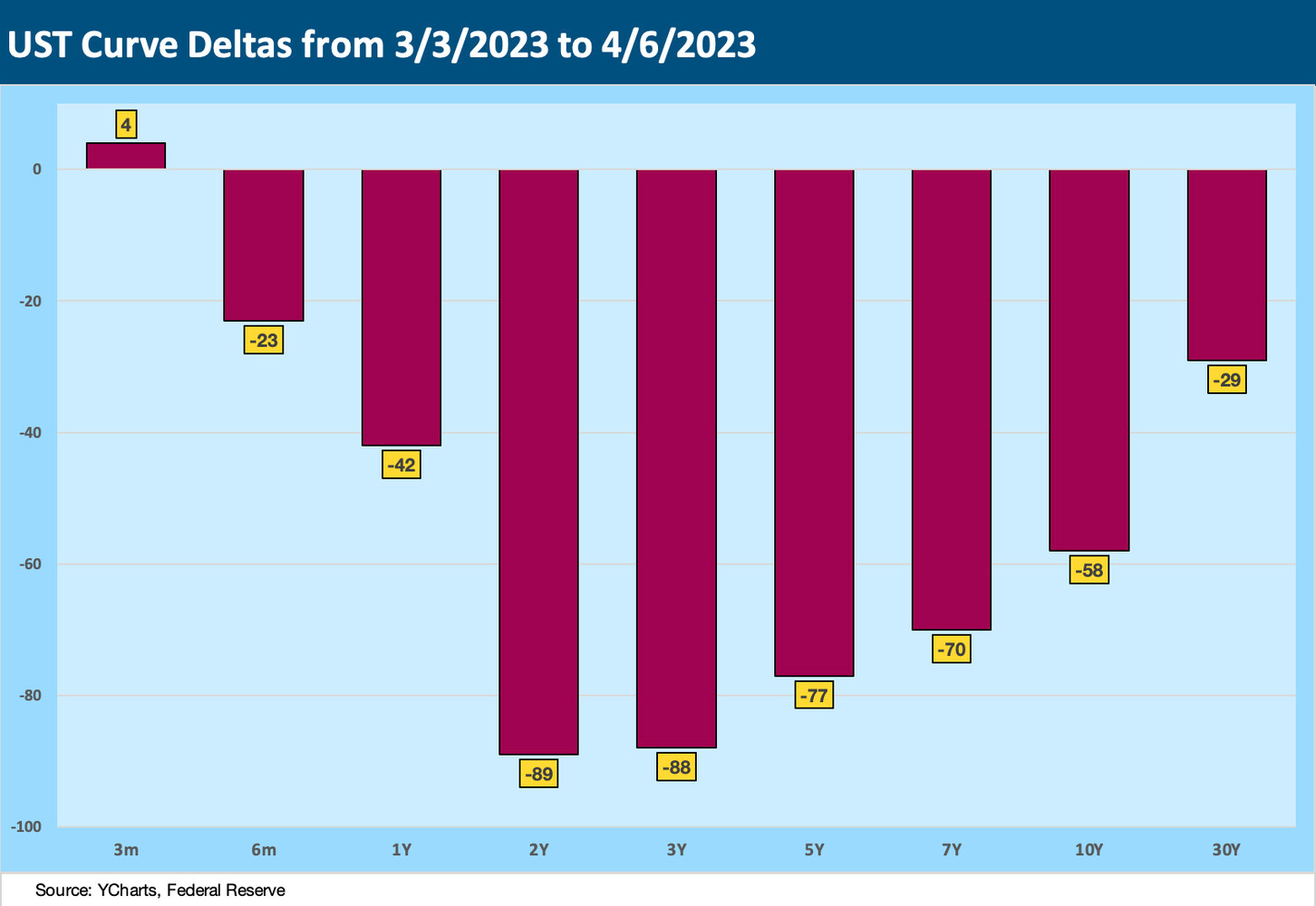

UST Slope 3M to 10Y…

The inversion of the 3M to 10Y UST curve just hit a new high this past week. The downward move in the 10Y is being closely watched by homebuilders and real estate agents for signals on where 30Y mortgage rates are going.

The -156 bps is getting into the inversion range not seen since the most extreme periods of the Volcker years including some when the fed funds rate was allowed to float and when monetary aggregates were the main event (before the periods shown on the chart). The inversion of -156 bps dwarfs the other peak inversion periods since 1984.

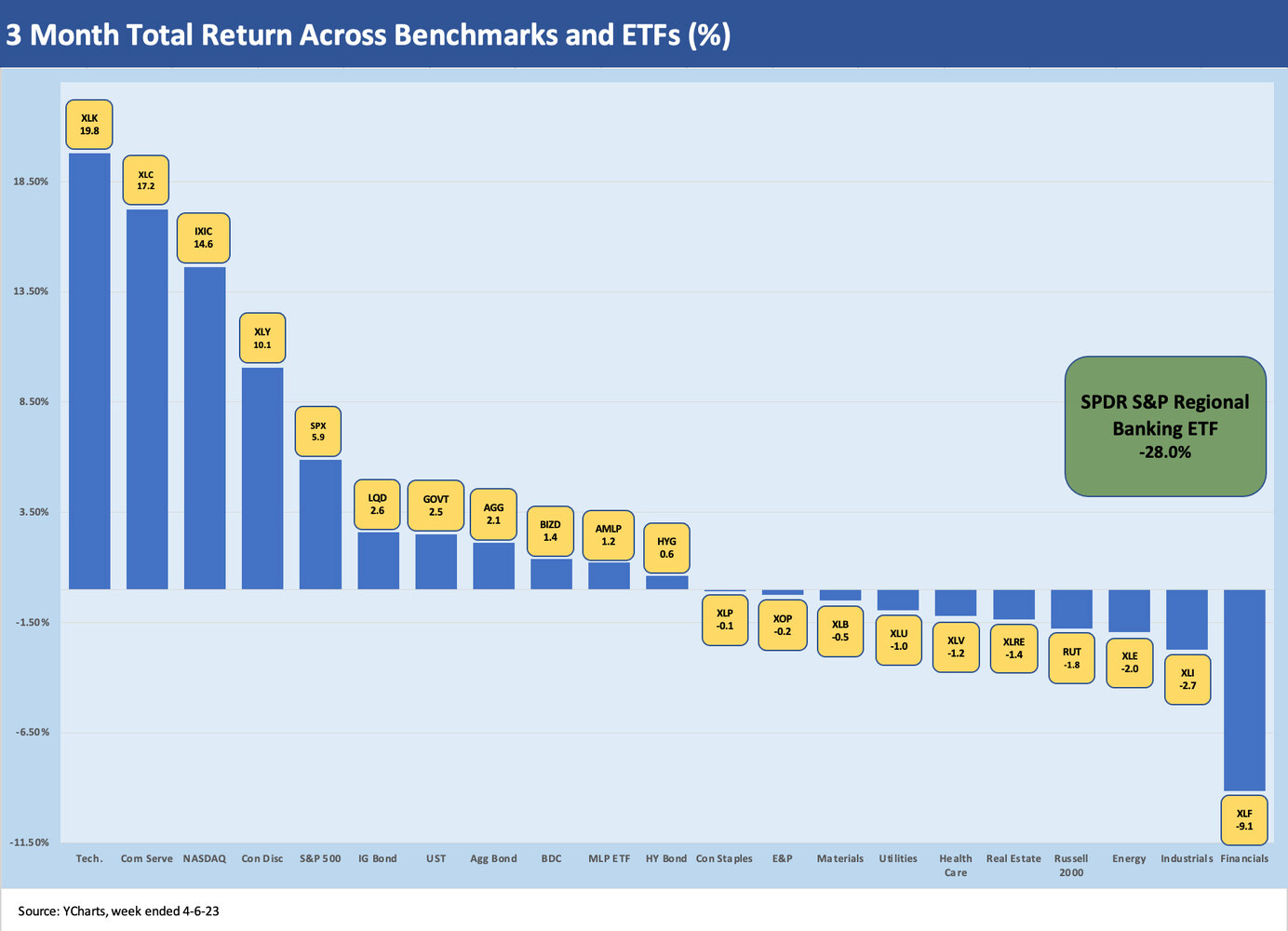

UST yield curve deltas…

The above chart updates the moves in the yield curve from early March (Friday March 3) before the market rolled into a very wild week that saw 3M UST highs and chatter around 50 bps hikes at midweek and then a plunge in UST markets with the SVB collapse and deposit flight headlines.

MICRO

FedEx moving to shore up execution and costs with structural overhaul…

For our micro section this week, we dug into the FedEx news as the company announced a sweeping restructuring plan that would include $4 bn in cost savings by fiscal 2025 with an additional $2 bn in the planning stages to be in place by FY 2027 for a total of $6 bn.

The company raised its dividend by 10% and dialed back some of its revenue projections (by $5 bn-$10 bn to $100 bn revenues) while targeting a 10% operating margin that still calls for $10 bn in operating income by FY 2025.

FedEx has had a rough time since its investor day and major planning presentation in late June 2022. Within a few months of that Investor Meeting, FDX had pulled its guidance for the year ahead of the F1Q23 earning report (August quarter, FDX is a May fiscal year). The announcement after the market close on Sept 15 sent the stock down by almost 22% the next day for its worst trading day ever.

As detailed in the chart below, that performance led FDX to lag UPS as a freight bellwether but also lag the overall Transport peer group. FDX has been digging out of the hole since. Last week’s news showed the seriousness of its commitment to move the needle on its financial performance and earn back some market credibility.

As noted, the plunge in FDX equity in mid-September was the worst in the company’s history and was worse than the FDX equity decline in the stock market crash of 1987 (FDX modestly outperformed the Dow decline of over 22% that day). The above chart starts the total return comparison on March 1, 2022, just ahead of the end of ZIRP as inflation forces were rising with the Fed needing to embark on an aggressive round of inflation fighting that came with the steady tightening we have been covering in other commentaries.

For a capital intensive and cyclical business, the question marks have weighed heavily on FDX and raised many questions on the direction of the major freight and logistics players who were fighting their way through a few years of massive supply chain disruptions on the sea, on the land, at the ports, or in the air. The challenges to the major freight players have been splattered all over the headlines since COVID, and FDX had it harder than most.

A few years of struggling in the market for FDX…

The chart below looks at the period from the “Vaccine Day” of 11-9-20 (the day the news broke on the vaccine) on across through the current period. We frame FDX vs. UPS and the XTN ETF. We chose XTN (the SPDR Transportation ETF) over IYT since IYT had a high issuer concentration with over 1/3 in UPS and UNP. In contrast, XTN has a more comprehensive cross-section of transportation related names with low single digit concentrations in the Top 10 holdings. Both UPS and FDX are large cap S&P 500 names with UPS at around $161 bn in market cap and FDX at $58 bn.

The mega-freight players are always useful bellwethers for economic cycles globally as well as in the US. Whether tied to tonnage or some other volume metric such as miles, they are often viewed as key leading indicators used as proxies for the cycle. They lose some of that value when they have structural setbacks (e.g., excess capacity) or execution setbacks (network efficiency), but the volume signals still matter as cyclical sentiment shapers. What the market is seeing in intermediate term retrenchment on the revenue line is a bearish signal measure.

It’s a difficult fact for FDX fans to absorb that the company is pulling back from its longstanding model of individual units operating more as stand-alone businesses by shifting to a new structure that integrates Ground and Express (“One FedEx”). FedEx Freight is the LTL Trucking business and will continue to operate as a stand-alone operation. Ground and Express comprise almost 85% of revenues, so that restructuring of operations is the main event.

Going into all the segment and operating history takes a deeper dive than we can do here and will be for another day, but the main point is taking action (and the execution risks that comes with it). The plan is to improve services and efficiencies and make changes to the operating model that will take out $6 billion in costs.

The terms Network 2.0 and DRIVE programs are not new and have been discussed for some time now. The headlines this past week were more about infill on the details and clarity on the structural changes that will allow FDX to take on the next round of challenges facing the industry. There was some discussion on topics such as fleet size and mix, lower aircraft capex, retirements (MD-11s) and modernization, but there will be a lot more details ahead.

There was a mixed reaction from equity commentators from what we saw apart from the sense of good news that more action was being taken. FDX is still near the top on some bull lists but there are also skeptics around how much was new in the latest headlines as opposed to a continuation of what in substance were actions on the list already around costs and rationalization of their asset base and network. The setbacks and reversals in 2022 leave some in a wait-and-see mode.

We would say it is hard to doubt that FDX will make significant progress given the history of this iconic company and the scale, breadth, asset base and cash flow of FDX to deploy. It is easier to get comfortable with the credit quality than the equity picture given the execution risk and the shifting tides and operational challenges of freight and logistics in global context. There are a lot of moving parts.

The COVID disruptions and geopolitical risks got the world thinking a lot more about how fragile supplier chains can be as well as freight and logistics functionality. The uncertainty, as well as the importance of where companies that move supplies fit into the picture was hammered home in 2020-2021 and in China into 2022. The more you read trade rags like Journal of Commerce, your head starts to spin with many developments across markets and freight services subsectors.

China is a cyclical question mark and trade tension runs high. With Taiwan that could get worse. There is a major land war in Europe with cyclical concerns. Meanwhile, the US is now staring at inflation (even if lower) and possible stagflation. We see higher fears of credit contraction after the regional banking mess. The role of Amazon in freight has been a hot topic in recent years with worries about excess supply flowing into pricing. The same is true with global growth of air freight carriers as that intermittently raised capacity fears and pricing fallout.

For bondholders, FDX has enormous flexibility around its capex programs, which the company indicated would be scaled back relative to revenue. We will see more network changes and outsourced solutions as part of the next evolution.

OPEC feeling its cartel oats again…

The latest OPEC+ cuts to start last week surprised the market, but after an initial upward pop settled down to end the week. OPEC was making a point that did not register as meaningfully as the last one did in the political realm. The Russian-Ukraine war did not have the scale of damaging effects that had been expected and CPI has been moderating, so US markets are more focused on bank deposits than oil deposits right now.

After popping by over 6% to an $80 per bbl handle, the price range hung in around that level to close out the week. WTI is up almost 20% from the low tick in March, so the change is not a small one in the context of earlier stretches in the year as oil equities sagged.

With the CPI release this coming week, the discussion could turn to how the OPEC action might reverberate along the refined product stream ahead of peak driving season. There will be some consideration of how it might play along the petrochemical chain in raw materials, but low natural gas is more important on that front in the US.

There will be more chatter around what oil could in theory do from here, but many will take the view that global cycles (with China at the top) will be the main event. Demand questions will still be something that cannot be resolved until the economic stories play out. The capex updates from the E&P players with earnings season will get a lot of attention with natural gas having crashed and oil spending in flux after a period of oil prices well below expectations in 2023.

Above we update the running stock performances of numerous bellwether names cutting across shale leaders, major Permian players, some leading oil sands companies, and some of the diversified global majors. We line them up from highest to lowest returns over the trailing 3-month period.

We entered the weekend with Pioneer as one of the top Permian players potentially being targeted for acquisition by Exxon. That would send more M&A and consolidation scenarios back into action. E&P is highly fragmented relative to many major industries, but more power in the hands of the larger players would get tongues wagging in Washington. Diverting cash flow to M&A costs rather than development and increased production could ironically show up as a theme.

Commentators tend to get colorful after an OPEC move. We were reading some of the trade literature, and one complaint in the chatter was that OPEC members can trade on inside information while also being in a cartel. Essentially, the major members can play in leveraged commodities market trades ahead of any action (you would think it was the US in the 1980s). They control the news flow and the information and can trade ahead of any decision to cut or increase production. Sweet deal.

In the end, that OPEC cut may simply be a forecast of cyclical expectations.