IG Corporate Spreads: Tough Pathway, A Few Doors Ahead

We look at IG spreads after a week of bank turmoil and widening in its largest subsector, Banking and Brokerage.

“Inflation? Safe deposits? Credit contraction? Right after this break.”

With the wild swing in the UST curve caused by bank problems, duration is suddenly the friend of IG bonds but for a very bad reason with the UST rally tied to the risks of IG’s biggest sector.

We look at recent spread trends in the IG market as IG OAS is back above long term median but still not sufficient compensation for the basket of risks.

The markets have had a wild ride the past two weeks as we have been detailing along the way. We took a look at the spread widening since 3-8-23 across the credit tiers from AAA to CCC in a separate note this weekend (see Spreads Across Tiers: Decompression + Volatility 3-18-23). The bank noise essentially carried the day in IG bonds but hit the HY market harder as the bank story line holds a key to the cycle via the transmission mechanism to credit contraction. That swing in spreads across the IG tiers since the SVB and CSFB turmoil flipped the IG index and each IG credit tier to wider on a YTD basis.

The key driver of IG spreads was the Banking and Brokerage Index ($1.75 bn market value, $1.9 tn face value) with its A3 composite rating (ICE BofA index). Banking and Brokerage had widened by 65 bps since March 8 or the night before the real adventure began with SVB and the regionals. The losses in the Available for Sale portfolio was a trigger point, but then the infection spread to any regional that had a material loss in the Held to Maturity portfolio (see SVB Reprieve: Hail Powell the Merciful 3-12-23, Silicon Valley Bank: Depositor Frames of Reference 3-12-23, Silicon Valley Bank: How did the UST Curve React? 3-11-23)

The old news by now is that the SVB collapse was quickly followed by the Signature (SBNY) seizure last weekend while the hunt for a First Republic (FRC) buyer continues. SVB’s parent filed Chapter 11 this past week, and that dealmaking exercise continues to sell off the nonbank units as well. The lack of a short list of buyers of more assets is one more thing to keep the worries up. Some tumblers will need to fall into place soon or more market players will assume the due diligence found bad news. That was already a taint on CSFB but at least that deal is now done.

CSFB was quickly in a state of freefall across the past week that was not stemmed by the Swiss National Bank liquidity support. On Sunday came a fire sale to UBS at a substantial discount to Friday close. We see on the screen now that the price was cited as $3.25 bn after seeing $1 bn earlier in the day and then $2 bn until the official news. That sounds like a real scramble. The absence of disaster for now has stock futures rising.

The term around what the Swiss National Bank offered as contingent support appears to include some loss guarantees and backup lines. Details will be clear enough soon. The AT1s were bailed in, and those capital risks could drive some turmoil in market making for other banks as the street goes defensive on inventory and some holders seek to eliminate the questions by just selling. This could be a rough week for bank analysts.

The Swiss Bank rollup over the decades includes SBC rolling up UBS back in 1997 (closed 1998) in a megadeal that kept the UBS name (but the SBC management team dominated the upper ranks). UBS is now buying Credit Suisse for somewhat less in the current circumstances. For its part, Credit Suisse had gone seriously global by starting to consolidate First Boston long ago after the infamous hung bridges and operating problems of the late 1980s.

The challenge of consolidation for the market and employees is that 1+1 does not equal two. The deal will necessarily entail credit contraction and headcount reduction. At least the balance sheet credit is contracting by choice and not by default, which can create even more problems. The action will reduce counterparty risk anxiety and stem outflows, and balance sheet management actions will unfold quickly to restore financial strength of the combined entities. That is something at least.

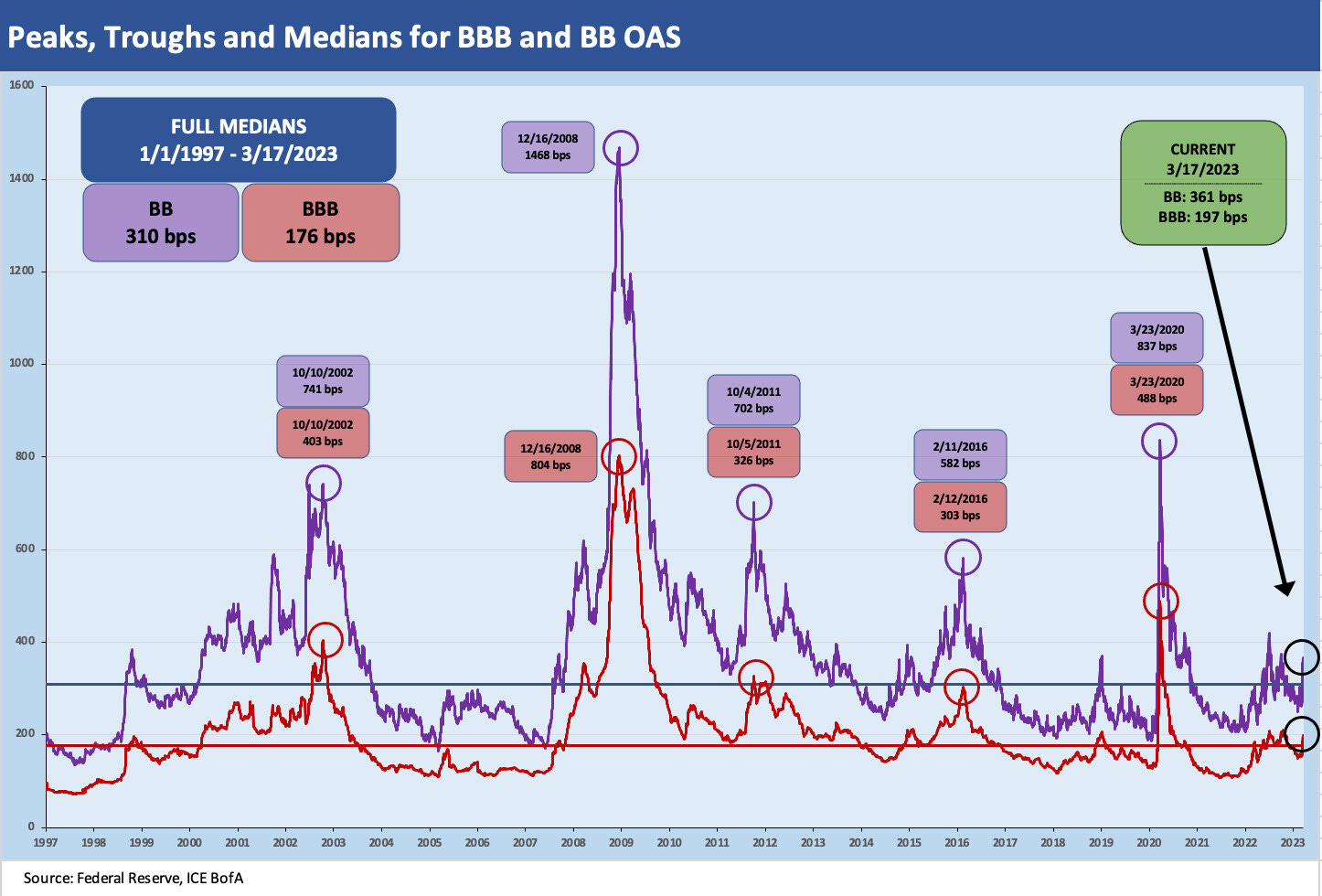

The above chart plots where the BBB and BB tier OAS stand at this point. We looked at this relationship in some detail in a parallel piece we published on US HY spreads (see US HY Spread Histories: Weird Science, New Parts 3-19-23). The BBB piece of the picture is modestly above median now at +197 bps after a +39 bps widening since March 8. The +197 bps is vs. a long term median of +176 bps. The BB tier widened by +89 bps since March 8 to +361 bps, which is further from the median of +310 bps.

One the one hand, the fears of credit contraction will weigh heavily on all credit spreads and especially in finance and cyclicals. We have seen energy equities take a beating on lower oil and recession fears, but the credit quality in IG energy is very strong. The turmoil in financials will have a lot to handicap in a week with CSFB fallout, continued questions on regionals, and the ability to extrapolate a crisis at will. The reality is the asset quality metrics have been solid enough even if most expect to see weakness in commercial real estate. Most expect more cyclical pressure on a range of consumer, manufacturing, and materials sectors if the contraction does spread to an expected recession in 2H23. That debate can get back on track after more bank actions get digested.

The above chart just frames the single line for differentials derived from the earlier BBB vs. BB OAS chart. We see +136 bps as of Friday after some quality spread widening along the tiers. The +136 bps is in the neighborhood of the longer term medians as broken out in the box. All three medians have 130 handles. In our view, that makes quality spreads at the BB-BBB differential quite vulnerable to widening.

The final chart is a simple ratio of the US HY Index vs. the US IG index that captures the history of the additional yield for taking on the higher risk. You can play with these other ways and consider duration adjusted yields (see Yield Per Unit Duration: It Turns on How You See It Feb 22, 2023), but the main goal is just to offer a simple snapshot of how the yields capture the conceptual relationship. During credit bubble periods such as June 2007 or in 1997 the metric is compressed. For this latest measurement date, the ratio is comfortably inside the long term median but vulnerable to a move higher in light of current events as we discuss in our separate US HY spreads commentary (see US HY Spread Histories: Weird Science, New Parts 3-19-23).