Spreads Across Tiers: Decompression + Volatility

We give some color on the spread changes across the credit tiers YTD and since the SVB meltdown.

We look at the OAS deltas across the credit tiers for the YTD period and for the very brief timeline since right before Silicon Valley Bank fell through the trap door.

The quality spread widening pattern is not an unusual one, but the numbers and the speed in such a short time frame is one for the short list of rare moments even if well short of the pain of late 2008.

As sharp as the moves have been, the US HY spreads remain well inside early July 2022 levels and leave a lot of room for more volatility in both directions.

Bank system fears are what usually shorten the credit cycle and ends the debate on whether more trouble lies ahead with credit contraction usually the next phase.

The chart above just puts some granular details to what the market already saw in price action over the past 9 days through Friday 3-17 (SVB included the weekend for many). The flip side of the spread compression seen in January 2023 is the decompression of quality spreads and how it came on fast and furious as bank funding fears soared.

The decompression was just much faster and more dramatic. We saw such a move in 4Q18 in US HY, but with more reason. The Jan 2023 HY tightening was impressive in light of a sloppy Dec 2022. The tightening came despite all the noise around inflation and recession triggers that were on the table (see HY-IG Spread Compression 2-8-23).

The wide range of potential outcomes the market faced in late 2022 and into the new year were easy enough to list (see Risk Trends: The Neurotic’s Checklist 12-11-22). The discount factor on these risks were not seeing them showing up in the spreads yet. Many of those risks have not shown up yet in pricing (especially China trade disruptions), but the depositor run has shocked the world by being so unexpected. That fed an immediate bearishness tied to credit contraction as the next leg of this increasingly volatile period and general defensiveness around the cycle.

The repricing of spreads is well justified when banks come under a dark cloud. Some of those banks have already been hit by lightning. In the context of historical spreads, the compensation is not adequate. For the credit class constrained, not liking value is not enough (i.e., your mandate is credit), but defensiveness in US IG means move away from the speculative grade cusp and tamp down hopes for more rising stars. The penalty for the speculative divide as BB vs. BBB quality spreads widen.

For US IG portfolios, bank allocation is a tougher exercise, but asset risk fallout from the current backdrop will be where much of the next leg of bank quality debates will be focused once the deposit panics and funding uncertainty get under control (hopefully not too far in the future). As of now, that fire is still burning. The panic makes less sense than the thrift panic of the late 1980s, but that does not make it any less real. More on those topics on another day.

For US HY, “defensive” means BB is much more friendly with the total return opportunities available from duration more than excess return. The core B tier will be where the best issuer selection exercises will be concentrated while seeking to avoid BB disasters. CCC is always an issuer by issuer drill in a small sector where spreads get wagged and often tighten on defaults (the index dropout effect). That said, we expect more additions to the CCC tier in 2023.

IG vs. HY offers reminders of the duration risk vs. credit risk and excess return tradeoff…

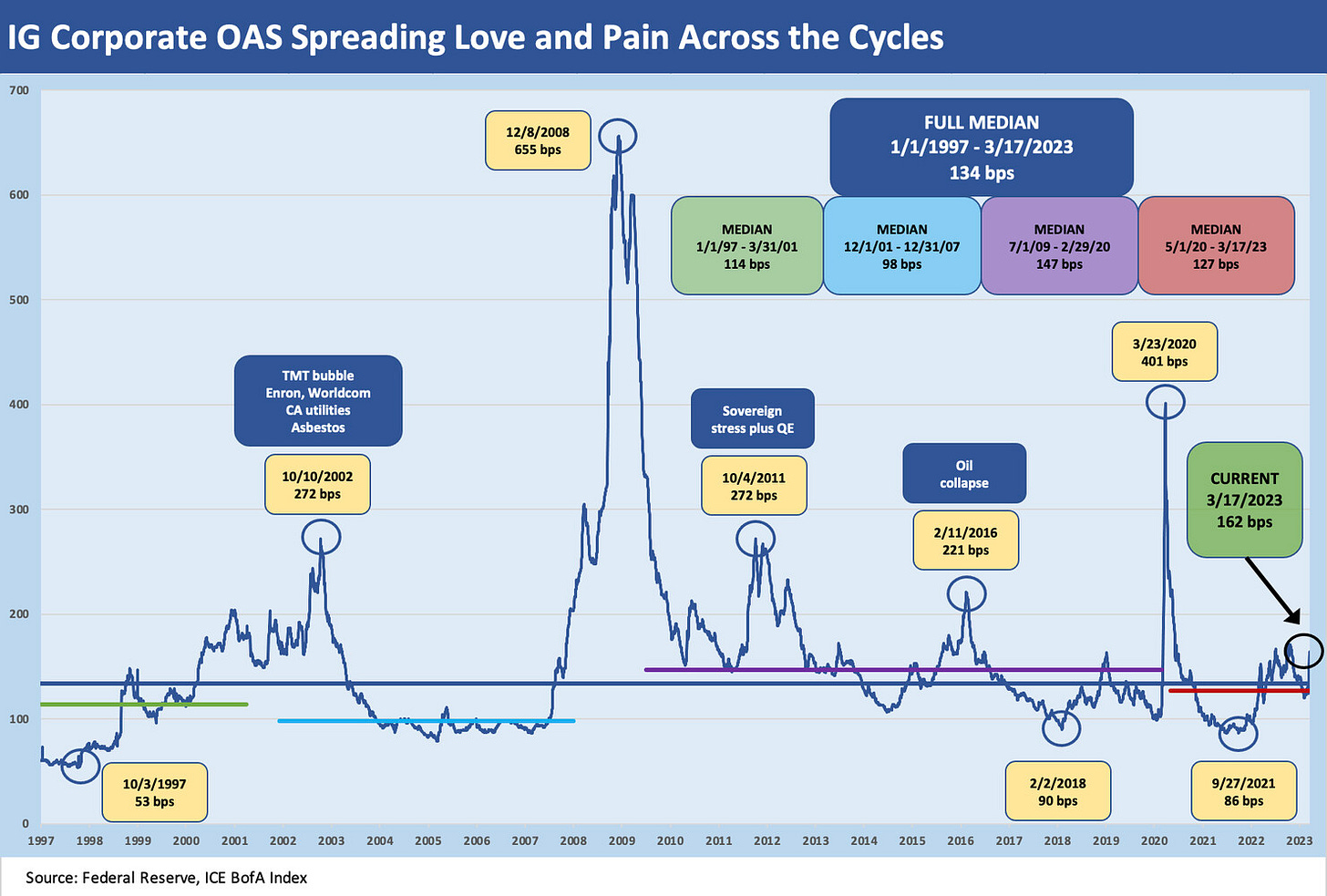

We looked at the IG Corporate Index OAS history in detail in a background commentary in the fall (see High Grade Spreads: Defense on the Field 11-14-22). The time series of medians across cycles and the highs and lows always help give flavor for today. We will be out with more updates in a separate note (see time series chart below).

Our expectation in the late fall was that IG Corporates would beat US HY in 2023 on a balance of excess return risk and duration risk across the two credit subsectors (see High Grade Spreads: Defense on the Field 11-14-22). At the time, our take was “Investment Grade benchmarks will outperform US HY in excess returns in 2023 as we move into a period of weakening credit fundamentals as both IG and HY credit asset classes see credit spreads widen as 2023 proceeds.” That commentary goes through the thought process in more detail.

Our view on the IG vs. HY benchmarks has not changed much since then, except now the IG expectations are colored by some major market concerns on regional banks that will hurt the largest industry concentration in the IG Index (Banking and Brokerage) with that sector posting an A3 composite quality mix (per ICE BofA). The Banking and Brokerage Index has moved +65 bps wider since 3-8-23, which was the day before the Silicon Valley Bank pyrotechnics were set off and other bank system headlines followed.

We would highlight that there is much to play out in coming weeks on the bank and securities sector issues, and the late 2011 to late 2012 time period is worth investors dusting off the nature of those events. The sovereign stress of summer 2011 into the early October 2011 IG OAS peak of +272 bps came before the summer 2012 “resolution” of the Eurozone issues (Draghi and “Whatever it takes” in July 2012) sent bank paper into an explosive, equity like rally. The USD credit investor is not so easily jawboned.

That was a big painful swing across 2011-2012 with a happy ending. Much of the volatility for the bank sector was confidence driven and tied into the then-recent experience of late 2008 in systemic bank fears. We see the “soft variable” of confidence today. We will revisit those themes in another piece. The SVB (and Signature/SBNY) experience in recent days had the unfortunate timing of seeing CSFB show up as well the past week as a much bigger and more extended Octopus of counterparty exposure and systemic overtones. Meanwhile, First Republic Bank has not gone quietly yet at this point as we go to print on this note.

One item the Neurotics Checklist missed…

What we did not list on our Neurotics Checklist (and it is a very neurotic list) was a mad dash to the exits for so many depositors across so many banks. Usually, the mechanism that transmits to spread waves in the riskier tiers of credit (BBB to CCC) needs some major fundamental trigger (oil crash setting off redemptions fears in 4Q15/1Q16, COVID) or some systemic headlines (Eurozone panic in May 2010 and summer 2011, China equity market crash in late summer 2015). COVID was extreme in terms of both the systemic and fundamental.

For US HY and the riskiest tiers, US HY saw a major spread gap to almost 600 bps by early July 2022 (above 600 on some non-ICE indexes) on a number of factors including horrible inflation numbers north of 9% (see CPI: Feb 2023 Big 5 and Add-Ons 3-14-23), fed funds anxiety, and forecasts for a much more severe economic effect on Europe from Russia/Ukraine.

We can even have relatively inexplicable market plunges such as 4Q18 coming off cyclical lows in HY OAS. The 4Q18 period saw CCCs and HY crushed in Dec 2018 only weeks after the cyclical lows. We also saw an oil plunge in 4Q18 (like now) and Fed policy confusion (Dec 2018 was the last hike before the easing of 2019). At that time, we saw an awful lot of trade tension (tariff wars) and political ugliness that looks mild compared to what is going on today. We also did not have a major land war raging in Europe, and the China relationship looked downright friendly then compared to now.

For IG bonds, the markets can have bouts of spread waves and material spread swings like we saw in early 2019 into the +160s bps and again in early July 2022 into the 160s. The obvious question is whether the IG market is riskier today than in July 2022 and Jan 2019 after some bad headlines. We would say it is materially riskier now. The usual mechanism runs through some trigger(s), and the monetary regime and economic resilience (jobs, demand, wages) have kept the catalysts for concern in place around the curve and inflation. The erosion of cyclical confidence just went into high anxiety with all this talk of credit contraction. This is a swirling set of risks.

The worst of both worlds shows up when the forward view of fundamentals deteriorates but in this case was also accompanied by an extraordinary rally and volatility in the UST market. That really hits spreads from two sides with expected risk premiums higher and getting inflated by the shock of a major surprise driving rates down.

Depositor flight was not a hot topic two weeks ago or even during COVID. Asset quality was the main event. One problem can lead to another, but this latest series of events saw the cart and horse reversed. The duration losses and asset-liability mismatches were not as much in focus. Broad risk aversion drives demand for UST, but that gets supercharged when bank fears show up right along with it and bank deposits start getting asterisks attached.