The Speculative Grade Divide: BBB vs. BB Differentials

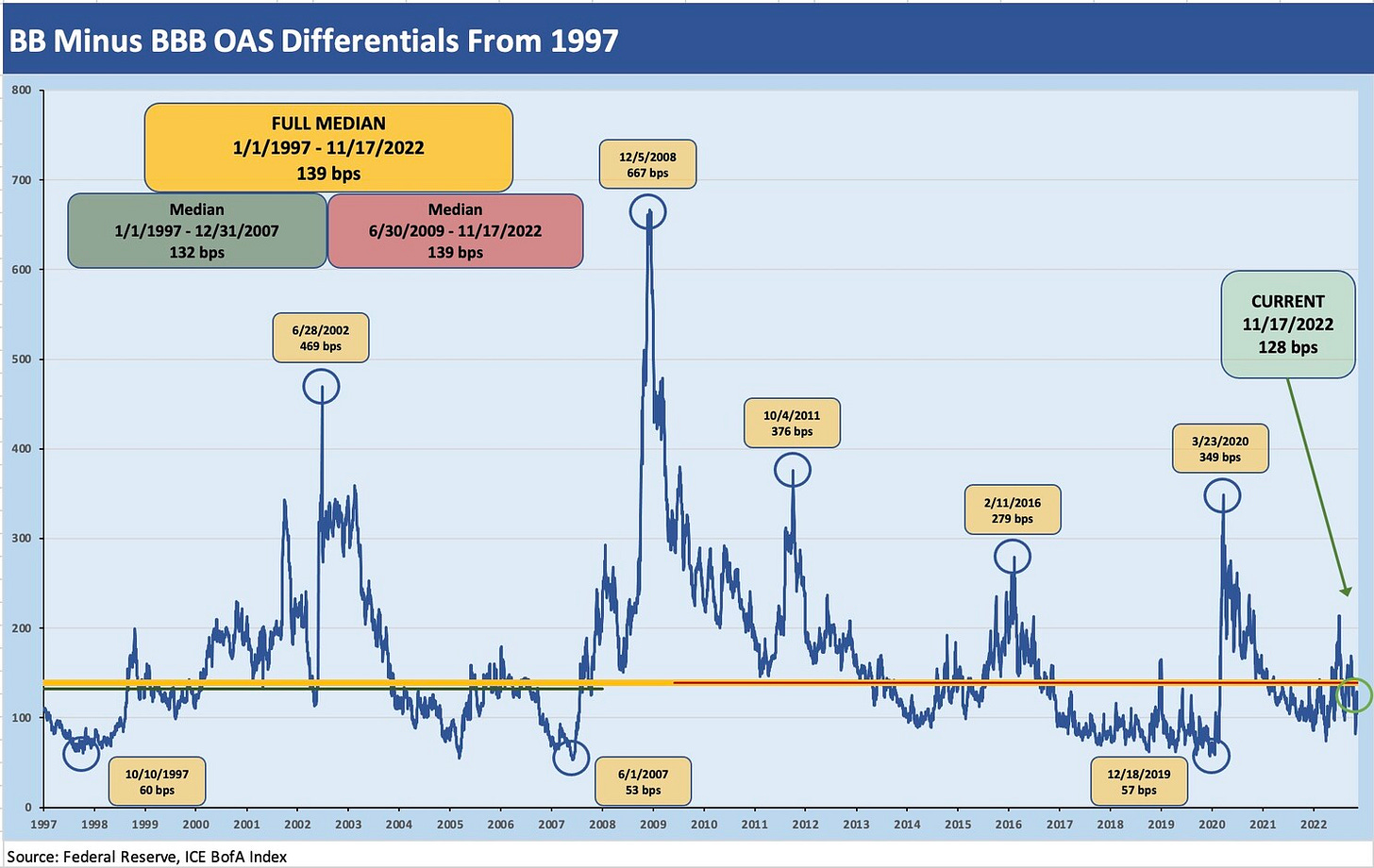

In this commentary, I look at the time horizon from 1997 through current days for the BBB vs. BB spread relationship.

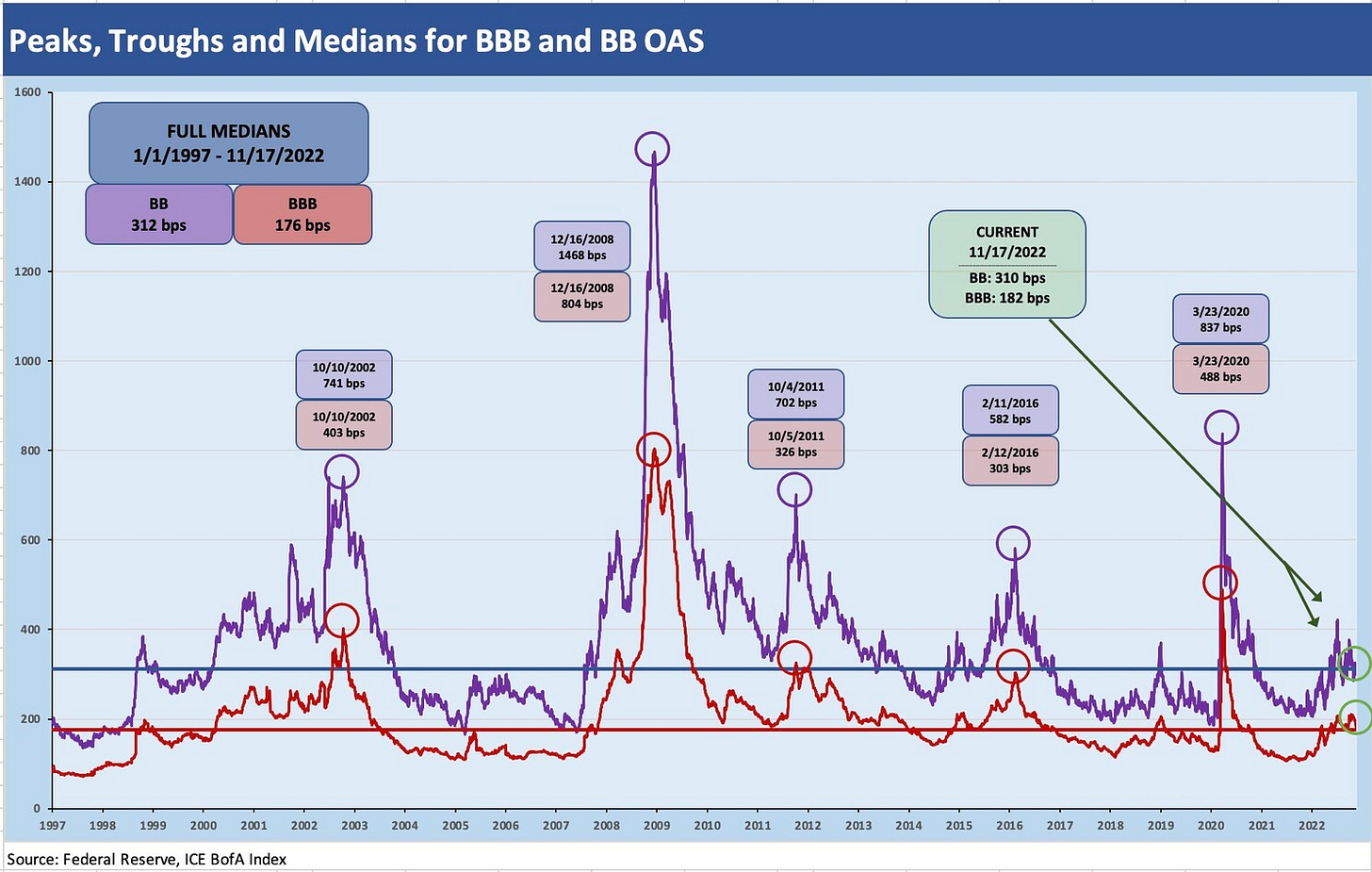

In this commentary, I look at the time horizon from 1997 through current days for the BBB vs. BB spread relationship. In the two charts herein, I plot the BBB and BB spreads (OAS per the ICE BofA Index) and the differential in OAS between the two credit tiers. The BBB tier is the largest tier in the US IG (approx. $3.6 tn) rated index, and the BB tier is now the largest in the HY universe (approx. $627 bn).

The current mix of ratings tiers makes for a sizeable middle tier in the credit layers, but the BBB tier has taken on a life of its own in recent years with the GDP of a major nation. The BBB tier by itself dwarfs the total IG index from back before the crisis. In the old days of the 1980s, the IG vs. HY markets were more “barbelled” in quality mix. The same was true when the eurozone HY market was launched in 1999. That has changed dramatically across time in both markets.

The technical whipsaw risk in BBB vs. BB…

The BBB tier is a multiple the size of the BB tier, so the theme of downgrades swamping the BB tier with too much supply of freshly downgraded debt has been common worry. The reality is that technical whipsaws are always expected in major industry repricings (e.g., TMT in 2001-2002, Autos in 2005, Oil and Gas in 2015-2016). That said, sophisticated holders generally will not sell into weakness. A well-developed investor base with a lot of history under its belt might be more inclined to add if they are prepared. The exercise is more straightforward when ratings migration is tied to cycles (as opposed to systemic shocks). In an OTC bond market with limited depth of market-making capital among fewer banks than ever in the post-Volcker-Rule world, the risks are still material.

The risk of getting too long, too early in the event of a surprise that roils spreads cannot be ignored, but it is usually temporary and creates opportunities. But surprises do happen. The systemic crisis confronting banks in 2008 was more about a “shock” than a surprise given the unfolding scale of counterparty risk from the mortgage and derivative side of the world. Bank interconnectedness ruled that spike in BBB and BB spreads in 2008 to a Dec 2008 peak. The Saudi price war in late 2014 was a surprise but not without precedent. The oil crash fell harder on US HY, but BB-BBB quality spreads were hit harder than usual for a purely fundamental pressure point in one industry (a very big industry). Similarly, major M&A headlines (including LBOs) are supposed to be a surprise to trading desks (sometimes not), but those are more idiosyncratic events. Some old school rules apply. Watch the macro picture and watch the micro level industry and issuer risks.

Below I plot the differentials…

I already looked back to the IG vs. HY history in a separate commentary for overall IG differentials in spreads (see High Grade Spreads: Defense on the Field ). I did the same for relative yields for IG vs. US HY (see Credit Allocation Decisions: Fish Selectively, Stay Above Water and Old Time Risk: HY Season Faces Challenges). The pattern seen in the charts herein are part of well-traveled histories. The main goal here is to give context to spreads and spread differentials that are very much in the median range at this point in late 2022. The question I always ask, “Do you see this as a median risk market?” (I don’t).

As the market looks ahead, framing credit risk (spreads) vs. interest rate risk (duration) allows for some permutations to play with in the risk variables. Negative excess returns could come with favorable duration returns under a logical scenario. That favors IG exposure. The 1979-1981 style version of “credit risk vs. duration” (i.e., stagflation) comes with buckets of negative all around. I don’t see that stagflation scenario playing out. Instead, I see the BBB tier as well positioned in some major industry concentrations with well capitalized Banks, Energy, Healthcare, and REITs among others. That said, there is always an issuer level drill to work on the closer the issuer’s IG credit rating gets to the HY cusp.

Key Takeaways

The quality spread differential spikes: The BB-BBB differential peaks are right in line with the stories of credit cycle volatility and crises since the late 1990s. The June 2002 peak coincided with the WorldCom fraud, but interestingly, during 2002 the expansion was already on (See Expansion Checklist: Recoveries Lined Up by Height). The Fed’s move in 2001 was to overreact on the easing front (see Greenspan's Last Hurrah: His Wild Finish Before the Crisis). The 1% fed funds rolling into 2004 set the stage for the subprime and structured credit meltdown that in turn set off the systemic crisis (see Wild Transition Year: The Chaos of 2007).

The Dec 2008 all-time high in differentials came first before a collapse in US HY from the top down as brokers failed, banks faced bailouts, and AIG and the GSEs required government rescues. That in turn brought a brutal credit crunch. Funding and refinancing risk soared and then the bottom-up risks took over in quality spread widening. The stressed financial conditions in the market then brought the world of ZIRP and QE.

The transition into the post-crisis turbocharging of reach-for-yield saw bursts of origination volumes in 1H11 and then again in 2012-2013. The 2H11 period took a timeout for a “systemic flashback” on European sovereign risk that peaked in early October 2011. Then came the oil crash in late 2014 that grew materially worse in 2H15 and peaked in early 2016. Last but not least came COVID and the March 23, 2020 lows as Congress and the Fed came to the rescue.

The quality spread lows: The tightest differentials naturally happen in credit market peaks such as Oct 1997, June 2007, and late 2019. Deal flow gets manic, the credit risk cycle is friendly, and the “deal-too-far” becomes many deals-too-far before it all blows. For 2006-2007, the corporate sector was more measured in aggregate despite the record LBOs. Mortgages and derivative excess lit the fuse as covered in some of the commentaries linked in this piece. The post-crisis credit markets were especially erratic in a ZIRP world and the reach for yield was a very strong impulse.

The earlier TMT cycle and the 1997 lows are the stuff of legend at this point. The main issue is that Oct 1997 came just as the Asian crisis was starting to spiral with EM contagion to follow in late 1998. TMT was the star of the equity IPO and HY bond underwriting show, but HY defaults climbed quickly into late 1999 even with the NASDAQ soaring to record highs. The 2001 (Enron) and 2002 (WorldCom) highlight reel was major news, but the ongoing default cycle broadly was the longest (not the highest) in history even if a few major fraud cases stole the headlines. With the TMT cycle implosion, the Greenspan easing frenzy took fed funds to 1% three years into the recovery, setting the stage for credit risk maximization in the markets. June 2007 saw the all-time low in BB-BBB quality spread differential of 53 bps. We revisited 50-handle lows at +57 bps in late 2019.

The spread swings of BBB and BB: The peak OAS periods for BBB and BB are generally much like the quality spreads. One period that stands out as an outlier was the peak as late as Oct 2002, when the BBB tier was facing pressure from a series of telecom related freefalls. The timing of the BBB downgrades to BB (and down to CCC and default for some) came in rapid-fire stages from spring to the fall of 2002. BBB auto paper was getting crushed in the aftermath of even more operating questions and watchlists and downgrades.

After WorldCom filed Chapter 11 in the summer (June fraud headlines notched the entire HY index lower by a few points in one day), the telecom sector broadly was falling out of bed. Names such as Qwest, Nortel, Lucent, and Motorola (among others) and fears around BBB wireless valuations sent the BBB tier and HY tiers into a brutal but temporary period of repricing. The 2001-2002 years proved to be a double dip spread wave. Another mega-issuer making the junk migration was Tyco in that same year.

Life in the median lane: The median BB tier OAS across the cyclical time frame from 1997 through the end of last week was +312 bps vs. +310 to end last week. Meanwhile the BBB tier OAS median as posted above was +176 bps vs. the recent +182. This median theme seems to be the order of the day as we covered in the other IG and HY commentaries.

I don’t see this is a median risk market for BBBs or BBs with the likely trend of quality spread widening into the new year. In my view, the more likely scenario is wider BB spreads in 2023 with BBB tier widening lagging. Much needs to go right (or pivot) in the months ahead to make it go the other way. A major X factor in 2023 will be oil prices and the auto cycle. Oil marches to its own beat and cartel strategies at OPEC. The potential for higher capex in the US and more shale production is tied to drilling budgets, but that action by US E&P is linked to the same OPEC game plan. The consumer pressure as it flows into autos has been muted in its effect on new cars at this point in 2022 since supply chain problems arguably left the new car business at recession levels through much of 2022. That leaves pent-up demand for new cars. Meanwhile, capex will remain high on EV investment.

A brief comment on the history and value of the BB-BBB OAS differential…

The move from investment grade (“IG”) to speculative grade (“HY”) is just one notch along a full risk spectrum from AAA to CCC. The one notch move from low BBB to high BB historically was given disproportionate weight with names such as “regulatory arbitrage” attached to the outsized relative gap in pricing. The distinction was heightened by regulatory fiat or easy-to-define risk parameters (“investment grade only”). That was of course supported by good marketing by ratings providers.

As time went by and the corporate credit markets evolved (usually the hard way), the “regulatory penalty” lost some of its market power. The “junk” tag can still loom large as a convention in debt markets (mutual fund contracts, pension risk parameters, counterparty terms, etc.). The IG vs. Non-IG tags can carry surprisingly high weight in equity markets also (“downgraded to junk”). The idea that a speculative grade rating should bring a haircut on EV multiples or implies higher dividend risk is not without some merit – except when the numbers don’t back up the ratings move. That is a separate debate.

BBB vs. BB gets complicated by the structure and the maturities…

The main point from here is that over time investors who were IG-constrained worked to give themselves more flexibility in parameters (translation: less forced selling that the street and flexible buyers can exploit). The “ability to buy” BBs at new issue is sometimes different than the “ability to hold” the bonds after a downgrade. The structure of new issue IG bonds are quite distinct with punitive make-whole terms (in substance not callable). The IG bonds offer structural protections (covenants) that have more room than the Grand Canyon, and that is not appealing to HY managers accustomed to at least some (if weak) covenants. The lack of subsidiary guarantees in IG usually doesn’t help comfort levels for bondholders looking at fallen angels. Furthermore, the proven template used in structuring leveraged transactions easily falls prey to the limited language in the IG indenture. In other words, when bonds get downgraded, there are more legitimate reasons than the rating itself for spreads to face a bit of extra widening.

The post-crisis years of ZIRP and minimal IG bond yields offered incentives for many investors to reconsider that IG-HY line of demarcation and step down across the divide into a sector with higher coupons and only modesty more risk at a fraction of 1% long term default rates. The default rates rise exponentially moving from the BB tier to the B tier, and then again on the move from B to CCC.

A fallen angel with a full yield curve and term structure of bonds usually includes long-dated paper without a natural buyer base in US HY. That means a spread curve that gets hit hard on the long end in downgrade scenarios. An investor taking well researched BB new issue risk can face less of the “technical risk” than an investor with a slew of long dated, minimal-covenant bonds who faces the pressure of finding market clearing spreads on the downgrade across the speculative grade divide. We have seen that many times. Often the price move is excessive and corrects (Kraft, Ford, etc.). Of course, sometimes the issuer passes go and heads to CCC (TMT in 2002). Like any other developing credit situation, each of these credit scenarios needs to be taken one issuer at a time.

About the picture at the top of the piece…

The picture of the chasm is from an old historical epic film Taras Bulba starring Yul Brynner and Tony Curtis. The plot is from an 1835 Russian novella and has been done more than once in films across time and in other countries. Tony Curtis was on a roll with the Vikings in 1958 (with Kirk Douglas), Spartacus in 1960 (Kirk Douglas again, Laurence Olivier, and Jean Simmons), and then Taras Bulba in 1962. The visual shows a gorge with a group of Cossacks pondering their fates if they are forced to leap across it (as one test of manhood and honor requires in the film plot. The big scary guy loses. Tony Curtis wins. Shocker.).

I emphasize the BBB to BB gap is quite a bit less threatening than the gorge even if the rating agency market clout and power of the term “Investment Grade” would have had you think otherwise in the early years of growth in the corporate bond market in the 1980s. While I see it less frequently these days, I still see comments in some equity research (especially on investment advisor sites) bemoaning a downgrade to junk as a material pricing issue for the equity and dividend safety. After all these years, the lesson should be “everything is AAA at a price” to quote an old trader colleague from bygone years.

The spectrum of credit risk and ratings layers from BBB down into HY entails a risk-reward continuum like most asset classes. How you allocate from the old 60/40 mix (60% equities, 40% bonds) is in the eye of the beholder and needs to be tailored to the security in question. I would allocate the BBB tier and BB tier from “the 40” (bonds) and not “the 60” from the equity part. The same in pension plan allocation. There are plenty of HY bonds across the cycles that should come out of the equity risk allocation, as we saw with oils in late 2015/early 2016, names like Hertz in 2020, and airline unsecured bonds from time to time over the decades. The choice is a judgement call on the trade-off of income needs, risk appetites, and key driver of pricing (default risk, level and shape of curve, rank in capital structure, etc.).

See also: