Credit Allocation Decisions: Fish Selectively, Stay Above Water

A mixed picture across industries and big macro questions set the stage for quality spread decompression in 2023.

Curve jockeys and credit junkies will have their hands full…

During 2022, the market has suffered through a brutal total return period for fixed income generally. IG returns have really felt the duration pain in the head-to-head comparison with US HY. The LQD ETF is running at -18.2% YTD total return though the end of last week. This performance was worse than HYG (-10.8%), GOVT (-12.5%) and SPY (-15.6%). None of that is pretty, but HYG won on duration and coupon.

Below I run through a few yield charts before breaking out a checklist of what I see as the main moving parts to watch out for into 2023. My view is that Investment Grade benchmarks will outperform US HY in excess return in 2023 as we move into a period of weakening credit fundamentals as both IG and HY credit asset classes sees credit spreads widen as 2023 proceeds. I expect loans to outperform US HY bonds based on the curve and the relatively more defensive position in the capital structure.

As we have covered in prior commentaries, the relationship between fed funds and CPI remains uncomfortably wide (see Fed Funds-CPI Differentials: Reversion Time?) even with the sequential improvement in headline and Core CPI last week and a narrowing of the differential to come in December with the next Fed hike. That means the market needs to see more progress on the CPI and PCE front or there will be fresh rounds of anxiety over the potential for protracted inflation fighting. The winter season will be a challenging one on the energy front and in terms of consumer signals.

We should also see quality spreads continue the decompression process and widen out from the middle of the credit spectrum down into the lowest tiers. The weakness in spreads in 2022 was coming off a post-COVID credit cycle peak of 2021, when US HY took the honors in both total return and excess returns. As I covered in last week’s US HY commentary, US HY is in a median range OAS, and we do not in any way see the period ahead as a “median risk” market. The current business cycle may end up as one of the shortest cycles if we do in fact see a recession called in 2023 by NBER (see Business Cycles: The Recession Dating Game). Such an outcome would cause the HY-IG differential to widen. IG spreads are above the 1997-2002 OAS median now and above expansion period medians also. I will look at IG OAS in a separate commentary.

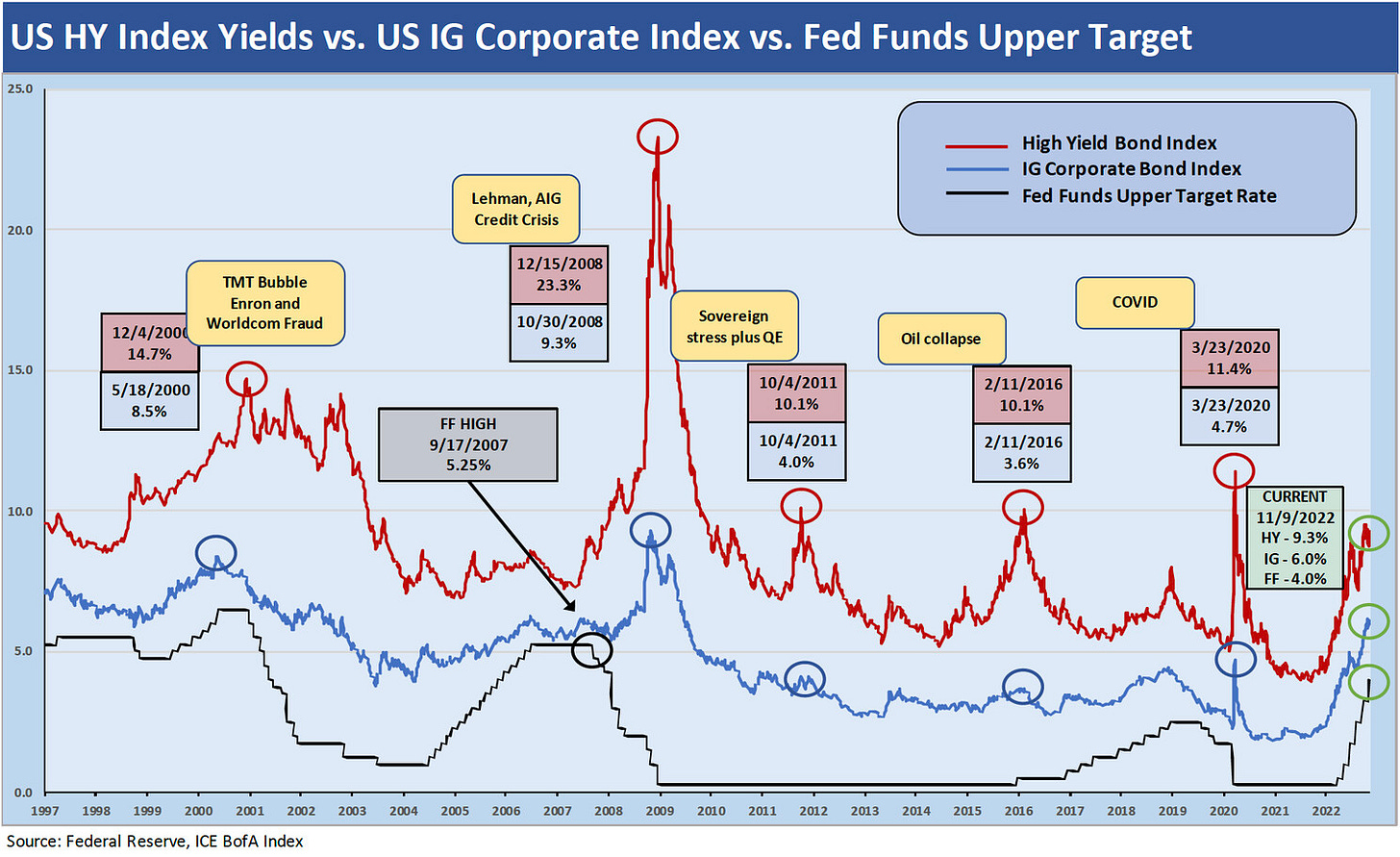

Above I post the first of the three yield charts for this commentary. The above chart plots the path of the US HY Index, the IG Corporate Index, and the fed funds upper target rate from 1997 through current days. No one needs reminding of how much more volatile the HY bond market proved to be across these years. The credit crisis spike seen in late 2008 flags what can happen during a systemic series of events. During 2008, the bank system was under siege, and such a backdrop meant the primary source of credit line liquidity support and secondary market-making was at risk. The very foundation of banks and brokers were cracking on a global scale. That risk premium spike thus hit the IG market in a way never seen before given the importance of the banks in the IG market. We had seen chaos in US HY before, but this was a new dynamic for IG.

I already discussed the journey into the credit crisis implosion in an earlier commentary (see Wild Transition Year: The Chaos of 2007). I see the major US banks as quite healthy as 2022 winds down despite some outliers in Europe, so the worst-case scenario for 2023 would look more like early 2016 and the oil crisis if the market saw material bouts of turmoil. The higher average quality in this market and the resilience of Energy markets make this is a very different type of market even if a sharp decline in oil came with a recession. One common feature to a past period of turmoil (2010-2011) would be Europe with the pressures those economies will face given Russia-Ukraine effects. Eurozone cohesion faces outsized challenges.

The Cash vs. IG Credit Asset Allocation Option…

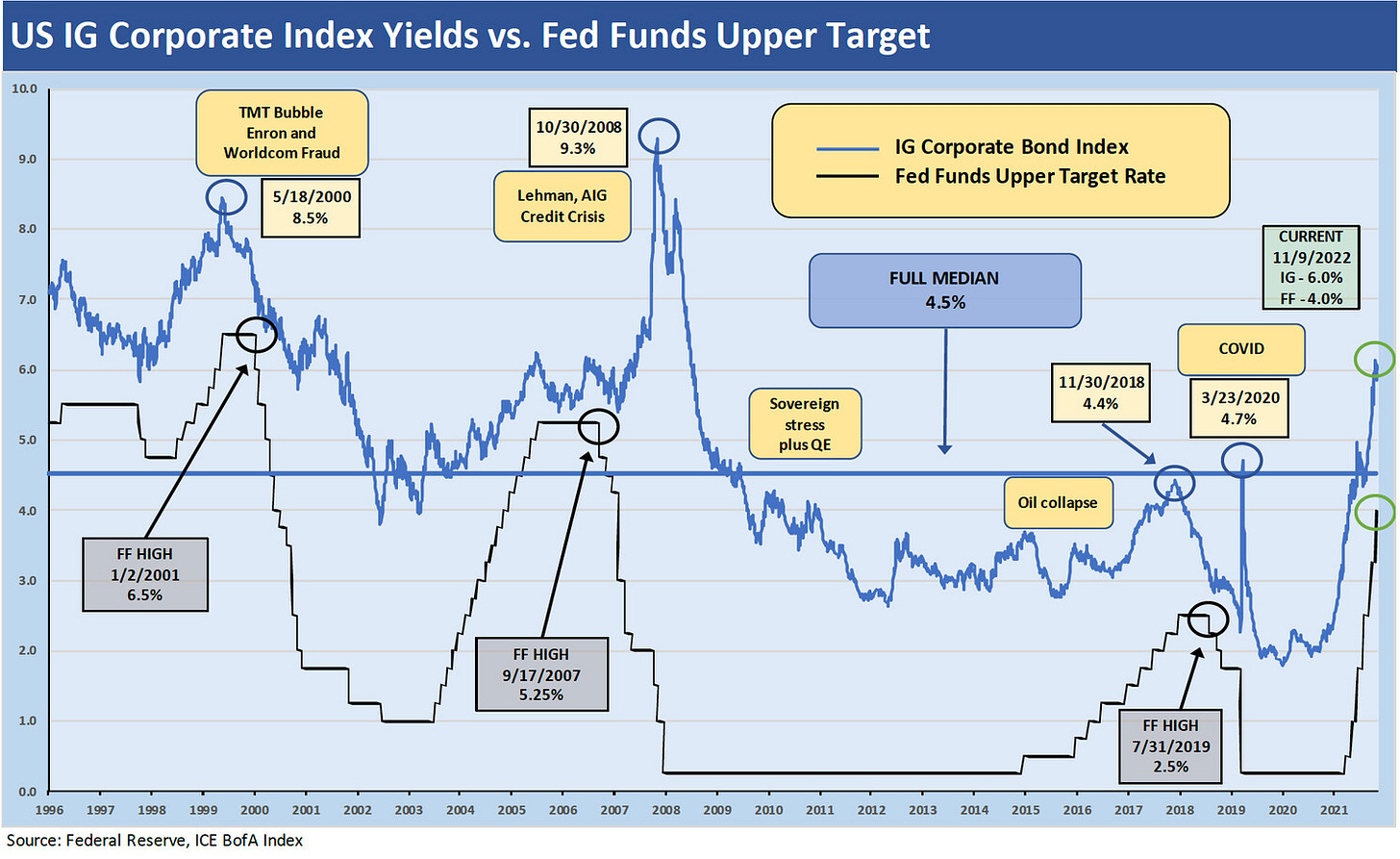

As investors wrestle with the challenges of asset allocation in an inflationary market and a punishing Fed tightening cycle, at least cash is once again on the table as a viable option. Before 2022, the penalty for cash in foregone income was so unattractive that more risk had to be taken for anyone looking for cash flow from a portfolio. Higher rates and a flat to inverted curve make a big difference today. The chart below uses fed funds as a short end proxy for cash yields and money markets. We see IG index yields pulling away from the lows in dramatic fashion.

The above chart plots the IG index yields across time versus the upper target for fed funds. The median IG index yield since 1997 is only 4.5% and fed funds is closing in on that number with the Dec 2022 Fed decision ahead. The 6M UST was above that to close last week and the same on UST 1 year. If we go back in time to the 1980s, that 4.5% looks low, but after the massive easing of the Greenspan years during downturns and the post-crisis Fed support, anything with a 4% handle strikes many investors as a healthy yield. The late 1980s had 8% 90-day T-Bills and we saw 9% handle fed funds, but that was a different world.

For those who see a wide range of potential outcomes across inflation, recession risk, and geopolitics, at least there is a place to park until a few more months of data play out. The best values in US HY are found in times of turmoil, but that has not come close to playing out in 2022. The year 2023 could see some unusual developments. The best risk-adjusted opportunities in high quality fixed income can be found on the front end or in cash with longer end of the curve volatile.

The idea of bonds as a hedge against equity risk and source of diversification in multi-asset context got a wakeup call for many advisors this year when the same underlying drivers slammed bond and stocks. Some funds kept it up for a while as they toggled between losses in correlating assets. Being heavier in cash for some wealth funds and retirement savings plans is a matter of changing allocation without trying to find the perfect timing. Scaling into credit would come later with some patience (and respect) for the less predictable variables. If income and cash flow is the overriding need, at least there are more options.

I looked at the reward for extension out of cash out the curve in a recent note (see The Cash Question: 3M-5Y Yield and Slope) by plotting the 3M-5Y UST slope. The “reward for extension” is the flip side of “penalty for cash” and that presents a very different profile today with the 3M-5Y UST inverted by over 20 bps to end the past week. For the income oriented (retirees, multi-asset managers pondering their next income product allocation, etc.) the waiting time comes with less “foregone income” these days when parked in cash.

Relative yields for US HY vs. US HG across cycles…

There are a lot of different number drills you can do around the curves for UST, IG bonds and HY bonds. Every timeline history should have a concept behind it, and the most obvious one is that “you should get paid more to take more risk.” That of course assumes a reasoned analysis around what the direction of forward risks will look like in terms of credit risk or interest rate risk. We saw the damage that can be done by duration risk in somewhat dramatic fashion in 2022. We also have seen no shortage of spread spikes in past years even during expansions. Those spread spike are often a leading indicator of recession risk. Timing those perfectly is a mug’s game, but a high tally of macro pressures will keep markets on edge.

The reaction of the Fed and the yield curve (see High Speed Inversion Gains Altitude and House of Pain: Markets Jump Around) in this inflation bout is gradually flowing into fundamental industry risk from Housing to Autos to Capital Goods as investment plans get reframed. Anticipation of steady setbacks in consumer spending or corporate capex could be in many minds now, but it is not in credit pricing.

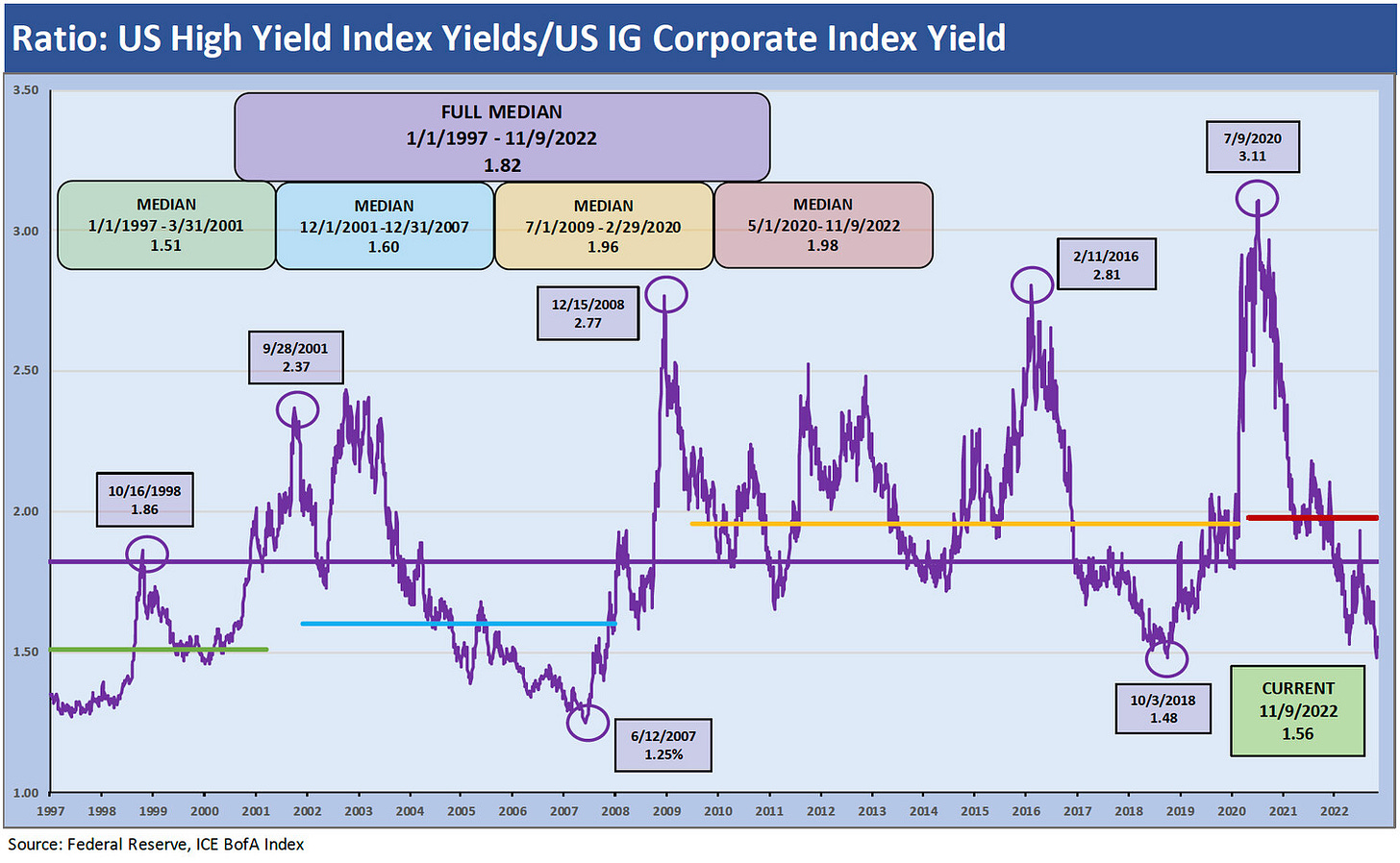

Below we plot the ratio of US HY index yields vs. US IG Corporate Index yields. In my HY commentary last week, I plotted US HY vs. the constant 5Y UST as a frame of reference for HY index yields. The scale of risk premiums across cycles and varied risk backdrops and UST curve shapes (flat vs. steep, low vs. high) offer food for thought. I plot the US HY/US IG below instead of using a UST denominator. After all, the IG index is the more logical investment alterative. I also plot the median of the ratios across the full timeline and the median for the periods of economic expansions (as dated by NBER).

We see the big swings in US HY risk pricing vs. IG debt during credit cycle downturns such as the TMT swoon and the double dip default wave of 2000-2002. The sell-off in late 2007 rolled into the crisis year of 2008. The systemic risk flashbacks of 2010-2011 saw the fed expand its efforts from 2010 to 2012 to get the UST curve flatter through QE2, QE3, and Operation Twist. Then the energy market mayhem of 2H15-1Q26 sent the ratio flying higher again to the 2-11-16 level of 2.81x on the ratio or just above what was seen in the credit crisis. Unlike the credit crisis, when the IG banks/brokers were facing stress, the 2016 peak was about US HY and redemption panic tied to the default spike in the US HY’s #1 sector – oil and gas.

The current relationship between US HY and US IG shows 1.56x or well below the long-term median of 1.82x. When we look at the moving parts of HY vs. IG and weave in spreads, we see the HY side of the equation as rich in relative terms and the IG side as cheap. The 1997 to early 2001 median ratio of 1.51x did not end well in a sign of mispricing of US HY during those late TMT years. That period also mispriced sovereign risk globally in Asia and Eastern Europe. Some of that blew up in 1998.

The mid-2009 to early 2020 expansion was a case study in Fed support that drove more investors to take risks but at 1.96x the compensation relationship looked more attractive for US HY given how low the UST curve was across that time. The UST yield drove more than a few to view IG bonds as UST surrogates with more coupon. The BB tier also saw major increase in its share of the US HY index.

Moving Parts to Ponder

Interest rate risk vs. credit risk: Those who are optimistic on inflation or pessimistic on recession risk can “mix and match” their view on interest rate risk vs. credit risk. For example, lower rates and higher spreads in a recession can bring positive curve returns but partially offset by wider spreads. If you believe “stagflation” and a hard landing lie ahead, both IG and HY will get pummeled again in excess returns. For the asset-class constrained (e.g., IG only or HY only), the duration vs. credit trade-off is more about where you are positioned in the credit tiers and in portfolio duration. Interest rate risk is managed at the portfolio level (in theory), but it all rolls up from the industry/issuer concentrations and where you choose to position yourself on the curve. Too much long-dated cusp BBB exposure can lead to major dislocations (aka “pain”) if they face ratings downgrades. If bearish on credit and quality spread outlooks, you would see HY focus on the BB tier or loans and stay on watch for dislocated pricing later. Then you go hunting for total return.

The search for income: For the asset class constrained (e.g., dedicated investment grade funds), those encumbered by regulatory standards (Insurance), or subject to somewhat more conservative “HY Lite” criteria (e.g., pensions), there are only so many options to generate respectable levels of cash flow. For those with the highest risk appetites and asset class flexibility, income can be found in such subsectors as HY bonds, Leveraged Loans, or equity categories such as REITs, MLPs, and BDCs.

The idea of the UST market framed over/under the 4% line is appealing to some, and the main decision from there is to tack on more yield. That comes down to risk appetites and the ability to face volatility. The yield in High Grade bonds is now in a compelling range in historical context since the credit crisis. Higher coupons can be found in IG bonds after low rates drove call-protected bond dollar prices off the charts in the post-crisis years. The upward shift in the UST curve has brought many of these premium make-whole bonds back to earth in dollar prices.

Fed funds vs. inflation trade-off: The initial reaction in the equity markets to the September CPI release (plunged then soared) vs. the October release (immediately soared) is a reminder of the hair trigger being cocked in risky asset markets around inflation (see CPI: The Big 5 Buckets and the Add-Ons). That was certainly a major rally last week including a 5% handle day for the S&P 500 with the CPI release. Those types of reactions can rattle markets when the market gets a negative surprise. The move underscored that inflation remains a hot button (no kidding). Last week obviously brought a very positive reaction, but the market now heads into a winter with a lot of potential global dislocations in commodities and possibly in trade.

The recession scenarios of hard vs. soft landing: The hard landing scenarios include a few more points tacked on the unemployment rates (5% to 6% handles) and material contraction in demand (durables, services) that flows into market valuations. Homebuilding, mortgage rates, and eroding home equity is catching a lot of headlines now, but layoffs and job reports will be a more constant focus into 2023. The valuation part of the equation is tricky since low inflation and a Fed pause could send the equity market into a more optimistic forward-looking mode after such a steep sell-off. Weaker fundamentals and rising default rates still weigh more towards credit risk repricing into 2023.

Asset quality erosion: Recession scenarios would include some noisy consumer credit and corporate credit quality metrics along the way that would at the very least send credit spreads wider in IG if banks started to feel it more. That would bring more quality spread widening to bond investors who move down the credit spectrum. The banks would see some earnings pressure and material loan loss provisioning quarters. The balance of factors in a hard landing would favor IG Index total returns but a soft landing could easily play to US HY as investors look past the muted fundamental pressure and more focus is given to the UST curve benefit for duration.

UST curve shapeshifting: If we start to see real recession signals in weakening employment, stalled retail sales, soft industrial production, reduced order rates, slow inventory destocking (in anticipation of weaker sales and not due to supplier chain issues), then life will get more interesting around the Fed narrowly and market inflation expectations more broadly. Then we all debate the shape and level of the curve. In the absence of inflation, that usually starts with the bull steepening (lower short rates) or a downward shift. Unfortunately, we have inflation now, so cuts in fed funds are unlikely. That would mean an even more inverted curve in expectation of a recession (if inflation remains a challenge to fed easing). Then US IG beats US HY on duration gains but spreads would stay sloppy. “Volcker Lite” would be a scenario in that case. That is not what anyone wants of course.

HY default rates and a repairing of US HY: I have a hard time seeing how default rates get back to a long-term average level with the downside case being a 3% handle and not a 4% handle at a lag into 2024. In credit markets, the default rate is a lagging indicator, so that is not the main event. A rise into 3% with sustained weakness in earnings still underway would not be lagging. That would be the start of more trouble.

The quality spread widening cycle: The differentials in spreads from single A tier down so single B tier will be important variables. Those tiers make up the bulk of IG and HY. When the market starts running the wrong way on deteriorating fundamentals or risk aversion, then the differentials across credit tiers move wider and can do so quickly. CCC can gap widen quickly on industry concentrations vs. the B tier. Meanwhile, the “cost of being wrong” at the BBB-BB speculative grade divide can get unfavorable quickly. This is the danger zone period for long-dated BBB paper given the thin natural buyer base in US HY market for long dated falling angels with IG covenants. Market makers are not kind.

Credit strategy meets in the middle BBB/BB: There will be a recurring debate across UST bears and bulls around whether we are going to hang around in a “4% UST world” in 2023 or be on the way to a 5% zone. The potential for sustained 5% an 6% handle on IG bonds will be appealing to some and especially those that can ride out any modest setback on the curve that hits duration. That downside of getting slammed in a stagflation scenario with duration pain and spread widening would leave US HY worse off on more material credit risk repricing.

The “spread + UST yield” mix can be broken down in the thought process, but the permutations of recession severity plus a UST rally and curve reshaping may drive more investors to cash until they put more CPI releases and Fed color under their belt. For the more swaggering HY type, a defensive strategy in US HY is “no guts, no glory” (i.e., “real men don’t eat quiche or buy BBs”), but most PMs like the idea of making the top quartile more than making top decile one year and bottom decile the next year by swinging too hard too early. You can hit home runs, but you strike out more that way. Longer term (i.e., multi-cycle), the BBB and BB tier generally frames up with better long-term risk adjusted returns (e.g., Sharpe Ratios). The past cycle saw a lot more HY Lite players in pensions even if just out of necessity on income needs for benefit payments.

The global cycle as a high-level backdrop: There is no shortage of action ahead across the usual cyclical debates (durable goods vs. services, asset quality in the banks and finance companies, trade flows during periods of supplier chain stress and rapidly shifting currencies, etc.). We also see more-than-normal geopolitical debates with China and the US at odds and Putin potentially losing his grip on reality as Ukraine keeps winning. Putin keeps firing at civilian targets and critical infrastructure as the countermeasure. Finding peaceful solutions is hard when a dictator is caught in an embarrassing quagmire. That means energy stress for Europe and tight global food supply that will make it hard to dial back inflation across many nations and notably in Europe. The role of China in commodity demand is still overwhelming, so the macro backdrop in China will loom as it always does in global energy and metals consumptions.