Footnotes & Flashbacks: State of Yields 8-13-23

Despite favorable CPI news, the market sees the UST curve hit duration and another equity fade.

The past week brought constructive news on CPI despite some PPI concerns, but good old-fashioned supply and demand for UST is creeping up the list of variables driving the curve higher.

A mixed but overall constructive earnings season offered decent underpinnings to support economic growth and resilient jobs, so the Fed debate on “to pause or not to pause” can still swing either way on a few more indicators.

The global picture is getting murkier with China noise and European sentiment not being helped by waves of windfall taxes and a war that will not end any time soon.

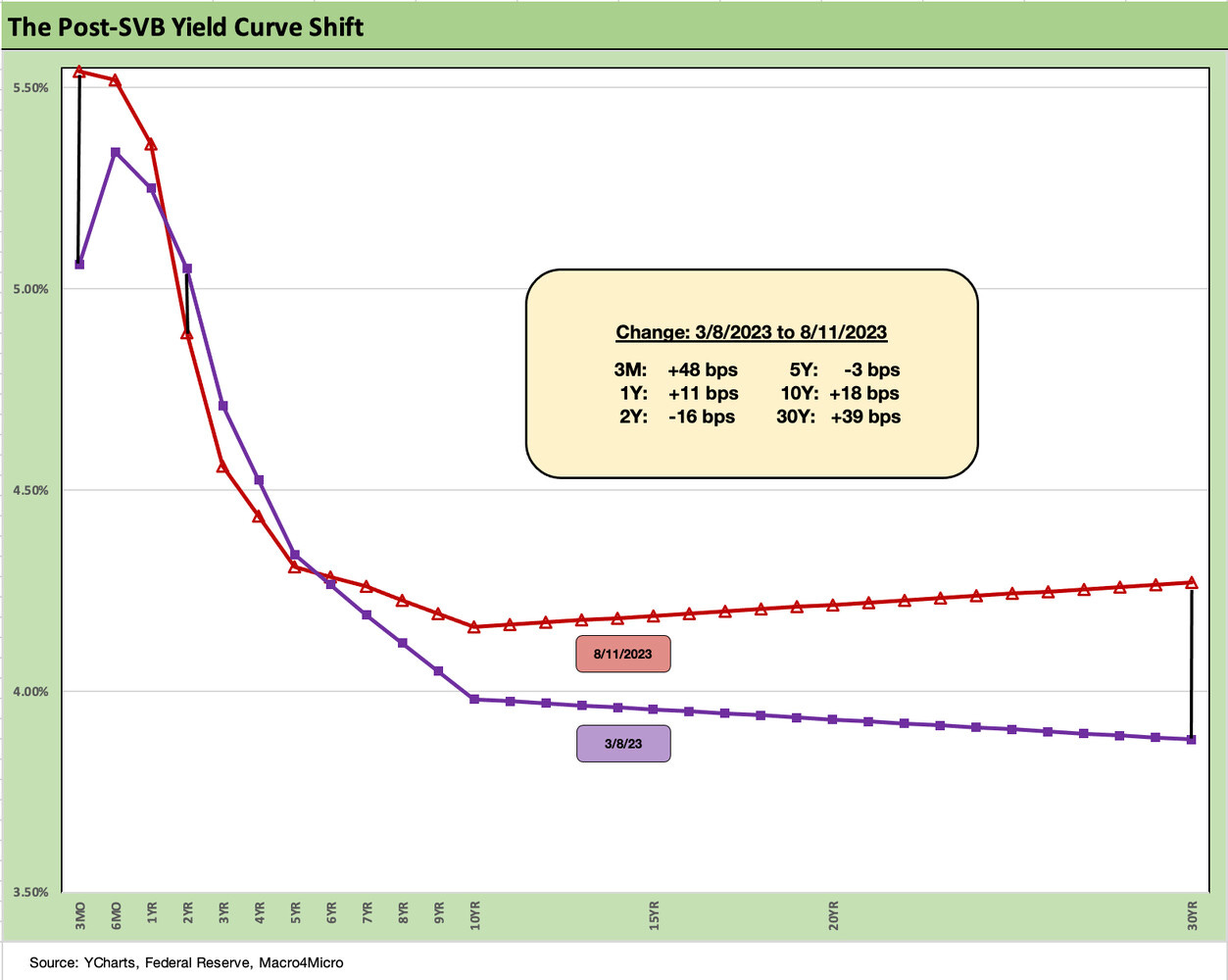

The chart above hammers home the setbacks for duration risk on the path from 1Q23 to the end of last week. Upward migration of the UST curve was discussed in last week’s “Footnotes” (see Footnotes & Flashbacks: State of Yields 8-6-23), and the duration headwinds have undermined benchmark bond indexes YTD and in more recent trailing time horizons (see Footnotes & Flashbacks: Asset Returns 8-6-23). UST and IG benchmarks in 2023 have underperformed cash while US HY has the edge on coupon income, carry, and less duration exposure. The curve has not been the friend (so far) of the buy high quality bonds game plan.

That upward shift across the UST curve since 1Q23 comes after a bearish view of the macro picture sent rates down into a collection of 3% handles from intermediate to the long end earlier in the year. The cyclically defensive move of the UST curve was further supported in March by the regional bank mini-meltdown and fears of more pronounced credit contraction and asset quality problems.

That regional bank fear has been dialed back materially from the mid-March peaks as two earnings reporting seasons made way for a partial rebound in regional banks (though with a few names no longer on the map). Moody’s downgrades this past week brought a mild setback, but the Regional Bank ETF has been one of the best performers over the past 1-month and 3-month time horizons even with the past 1-week price action in the red zone.

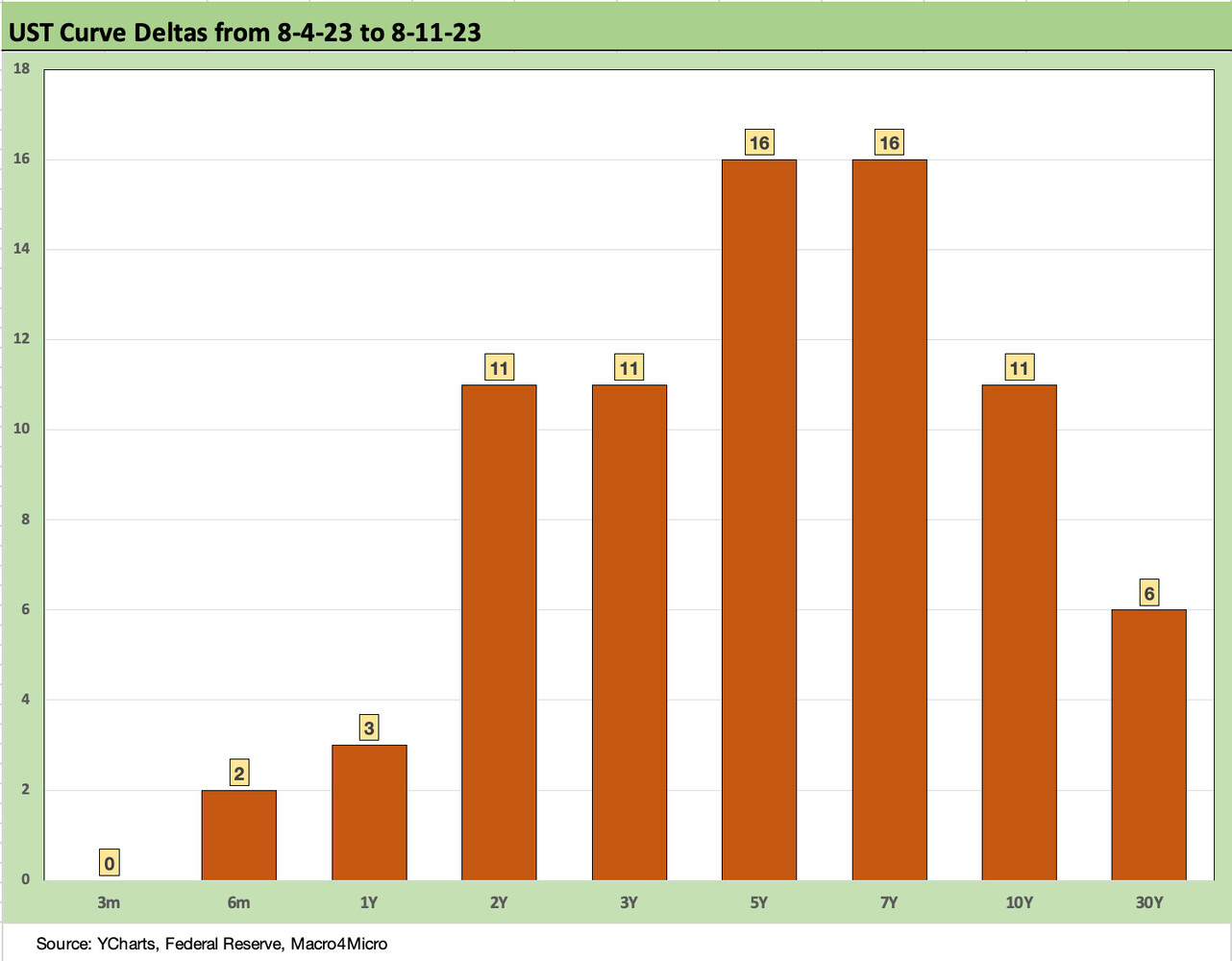

The above chart highlights the curve deltas over the past week. Following last week’s steepener, this week sees a push higher in 2Y to 10Y with higher moves in 5Y to 7Y. The balance of economic indicators in recent weeks has been on the sustained growth side of the ledger with CPI supportive again this past week (see July CPI: All About the Bass 8-10-23) even if PPI followed with some negative noise. Meanwhile, fears of supply-demand imbalances for UST funding and secondary trading supply have kept the market on edge with the UST curve feeling pressure on market clearing levels.

The “soft landing vs. “no landing” debate has seen numerous brand name street forecasters waving off recession entirely for 2023 or materially scaling back the odds. Fundamentals are mixed, and the ability to craft a bull or bear outcome has plenty of ammo. As the old school saying goes: “That’s what makes a horse race.”

Manufacturing indicators see consistently negative-to-mixed survey bias (ISM, etc.) but for some major sectors such as autos and construction we see some solid indicators in economic releases. We see resilient guidance and solid recent equity performance across some bellwether names (e.g., United Rentals, Caterpillar) that show the demand backdrop holding up in some key multiplier effect markets.

We will get some more color this coming week with releases on Retail Sales, Industrial Production, and some of the usual monthly housing indicators (starts, existing home sales).

Consumer durables demand might appear to have softening prospects on the goods side, but US and North American auto production volumes are up. Auto demand is solid ahead of a period of UAW contract risk. Homebuilders are riding a wave of tight existing home supply (see Existing Home Sales: Bare Cupboards, Hungry Crowd 7-20-23) to gain more business in the supply void. The favorable demand has held up positive home equity balances on average (see Consumer Debt in Systemic Context 7-13-23).

Jobs matter in demand for autos and homes, and employment is bullish for demand. Then it gets back to price and affordability and “rent vs. buy” dynamics. With respect to high financing costs, there is nothing to prevent the Auto OEMs from using financing incentives, which is a well-worn path to mitigate interest rate impact. Discount financings via captives are a de facto marketing cost for the OEM (the finance unit gets made whole by the parent).

Similarly, homebuilders have been very successful using mortgage buydowns to ease near term affordability pressures than can “buy some time” for the buyer to do a later refi if mortgage rates get back into a 5% handle or lower.

In other words, demand is strong for the two biggest tickets in a household purchase decision – homes and cars. The other big ticket for many households – tuition – might get caught up in the student loan quagmire, but the services chains supporting autos and housing get some positive knock-on benefits from sustained demand and sequential improvement (or stabilization) in transaction volumes.

Pockets of pressure are in evidence…

The upbeat economic news does not mean “ignore the dark clouds.” China worries are picking up on multiple fronts beyond the China real estate headlines. The trade flows have been showing signs of China economic problems (see Midyear Trade Flows: That Other Deficit 8-9-23). China will blame the US in part, running the risk of more trade conflict ahead.

Overall, China questions will thicken the plot around commodities pricing and especially oil, where the market is getting worried about setbacks in inflation even as those who are exposed to upstream equity and credit in E&P names have a lot to be happy about with the material upside moves in energy fundamentals the past month. Energy equities have come roaring back as we look at in the separate “Footnotes” publication covering asset returns.

The above chart updates the post-SVB UST move. We use March 8 as the last “clean” date before the meltdown and seizure over the following two days. The post-SVB curve shows a curve steepener past 5 years but 2Y to 5Y still lower. We see the effect of front-end Fed hikes keeping the plot interesting as short UST offers a safe place to park as decision points on asset allocation get worked through.

Meanwhile, banks are feeling some headwinds on net interest margin pressure and weaker loan demand broadly in both the US and Europe. US banks indicate an expectation of tightening of standards across all categories in the July SLOOS report (Senior Loan Office Opinion Survey). Loan demand has been weak in Commercial and Industrial (C&I) and in Commercial Real Estate (CRE). The anxiety around CRE is a daily headline while C&I is mixed depending on the sector. One challenge that borrowers cannot escape is a bigger interest expense bite on floating rate exposure.

Whether loan/credit terms tighten on structure or in pricing or with respect to the size of credit line commitments is a separate discussion and varies by sector and borrower. Banks in the SLOOS report also cite concerns around the direction of collateral values. That can in turn flow into advance rates and the value assigned on the other side of that estimate. When looking at the SLOOS report, it is always worth remembering that the major banks are just one source. They certainly matter and notably for revolvers and working capital funding.

It is important to highlight that the surveyed banks in the SLOOS report are not the only game in town, and the fixed income markets (HY bonds, BBB tier term funding) and private credit can march to their own beat.

It gets harder to make a definitive statement that “credit is tightening” when HY OAS levels are on the tight side and tighter on the year. The old saying “Everything is AAA at a price” still applies. So far, credit market pricing is tight considering the cyclical turning point to-and-fro discussions. “Tight credit” is a short walk from asset repricing and better value.

The above chart updates the post-SVB UST curve shift with a different visual presentation than the earlier bar chart. Credit is the lifeblood of growth and expansion, so any bank’s view on trends is important. The steepener since SVB beyond 10Y is evident while 5Y to 10Y has also moved towards flatter.

From another angle beyond the SLOOS report, the growth of credit activity away from the banks in the private credit market and the broader appetite for credit risk in the capital markets can offset banks tightening terms for borrowers. Disintermediation of the banks (especially regional banks) is alive and well.

Since the 1980s, every cyclical turn has had its share of distinctive complexities in terms of market structure, regulatory framework, industry level trends, idiosyncratic risk profiles, and global/regional nuances along with the usual top-down issues of fiscal and monetary side effects. In other words, never oversimplify (sometimes that is the enemy of brevity).

For this cycle, regional bank structural change could be on the short list. The challenge to the regional banks this past spring will have continuing importance since it was the first shock of what a “push-button run on a bank” looks like. That concern will linger when (not if) the cycle contracts. It always does; it is a matter of “when” and “how much.” We expect more consolidation along the way with so many challenges for regionals still facing a tough stretch ahead in asset quality and in funding costs.

In the above chart, we update the current UST rates and the Freddie 30Y benchmarks vs. the 2005 peak housing market and follow-on into the 2006 bubble period. UST rates are materially lower now while mortgages are notably higher than 2005 and modestly above 2006.

Even if 2023 mortgages have swung in a 100 bps range, the combined effects of home prices and mortgage levels have been daggers for homebuyer affordability. If a potential seller is sitting on a 3% mortgage, he is more likely to stay put and wait. That golden handcuff topic gets a lot of airtime in the markets.

Our view since last year was that the existing home supply factor was going to be a mitigating risk variable for the builders and would mean a muted price decline (disclosure: I have owed DR Horton and Lennar for more than a year, but holdings are less than 2% of portfolio). That inventory swing factor has become more obvious in the 2023 peak selling period. That is also a barrier to more economic activity and brutal for real estate brokers and mortgage lenders with refi volumes plunging and existing home sales in the tank.

The 30Y mortgage rates key off the 10Y UST, so there were plenty of housing sector watchers hoping to see the market get back into a 5% handle mortgage range. That would free up more home sellers in the existing homeowner base. That has not been looking like a near-term reality for those potential sellers with the UST curve heading north during the peak selling/buying seasons. That is why the homebuilders are picking up market share of total home sales given their ability to navigate this backdrop (see New Home Sales: Low Bar for Comps YoY, Sequentially Mixed 7-26-23).

The SLOOS report also cited that Residential credit exposure will be seeing the brakes tapped. The survey cited tighter terms from the banks for non-GSE residential credit as well as tightening for the developers that supply the builders. The credit in residential for developers and smaller private builders promises to gradually tighten up housing supply in some regions and product segments. That favors the big healthy builders.

That residential tightening will only come as an extraordinary amount of new multifamily supply comes on the market. The 2022-2023 period has seen the biggest multifamily build periods since the mid-1980s (see Housing Starts: Multifamily Moonwalk 7-19-23). That multifamily supply coming online has been regularly cited as a factor that keeps downward pressure on rental rates and shelter inflation.

The market rental rates are already well below where they get recorded in the monthly CPI numbers, so that is one more positive in the inflation picture. CPI for All Items ex-Shelter was 1.0% this past month. All Items less Food, Energy, Shelter, and Used Cars was +2.5% (Used cars are now negative YoY and MoM in CPI). All Items less Food and Shelter was 0.0%. That is a constructive backdrop for headline CPI and core inflation metrics.

Some curve slope lookbacks…

We like to look at the UST curve shapeshifting trends, and this week we framed the 5Y to 30Y slope. The above chart looks at the longer-term timeline from 1984 as Volcker was warming up for his inflation victory lap for beating the worst of it (CPI hit a 1% handle with the oil collapse in 1986). The next chart shortens up the time horizon to the 2022-2023 period for a look at the slope moves across the biggest tightening cycle since Volcker.

The 5Y to 30Y frames the symmetry of duration risk incurred when moving from intermediate corporates out into longer dated funds in high grade corporates or UST. We see the long-term median slope of +75 bps for 5Y to 30Y vs. the current small inversion of -4 bps. That underscores the steepening risk in typical markets. Of course, this is no typical market, and UST bulls or bears can easily craft their scenarios. The market had been fighting the Fed’s macro view for a while, and the market has started losing as evident in poor returns for UST and longer dated benchmarks.

We still see the risk of bear steepening as high, but the moving parts of the cycle deserve close scrutiny on a global scale with the US potentially tightening again in the fall, China flailing, and no shortage of negative spin on the broader European economy.

For the shorter time horizon on the 5Y UST and 30Y UST slope across 2022 and 2023, we see recent trends swinging from -46 bps inversion just ahead of the Silicon Valley turmoil to upward sloping one week ago. The relationship is now back to a small inversion after the 5Y jumped this past week (detailed earlier).

The feared bear steepener has arrived and the question is whether a few more bullish economic indicators can keep the flattening process unfolding (the “steepening” is in this case a move toward a flattening just to really confuse the jargon). The curve carries 5% handles out to 1Y UST and then 4% handles across the curve. A few weeks ago, we had 3% handles from 5Y UST to 30Y.

Below we add a chart that shows the actual moves in gross yields for the 5Y UST and 30Y UST. We add in the 2021 period to highlight the path from ZIRP to the hiking cycle.

The bottom line is that the UST shift has hurt bondholders in total return even with tight spreads ruling the credit markets. The total return in bonds during 2022 was obviously a much bigger fiasco, but the struggle to win the duration trade in 2023 remains a challenge.

To get relief on duration implies a threat to credit spreads depending on what drives rates lower. That is a classic old school trade-off. For asset allocators thinking about current income in bonds (i.e., coupon vs. accretion of price), the lower par weighted coupons add another element to ponder. It is another reason why short UST will stay popular since there will be no shortage of supply in T Bills. The handicapping still favors a hike in the fall over a reduction if there is a move at all.

We wrap the commentary with the running UST migration visual from March 1, 2022 through the latest UST curve on 8-11-23. ZIRP ended mid-March 2022, and the box in the chart details the running moves along segments of the UST curve.

The move into a material inversion is self-evident, and the wildcard from here is around whether a steepening move (which in substance means “towards a flattening”) will be a necessary reality if the economy sustains growth on the backs of consumer spending, some logical reinvestment cycles by manufacturers, and extremely low unemployment. There is also the fiscal support/incentives for mega-projects that bolsters new construction activity and in turn generates a multiplier effect along the supplier chains and supporting services.

We also include a 12-31-20 UST curve in the chart above for a frame of reference. The UST market was casting its vote on where the UST curve was headed long before the Fed moved. Inflation was a fact of life in 2021 as the spike in demand drove bullish performance in economic growth and equity market valuations.

The supply side imbalances with the demand side also turbocharged inflation across a range of product categories with used cars proving to be a symbol of how dislocated supplier chains were in terms of the fallout for new car production. The freight and logistics mishaps spread the inflation impact well beyond big ticket durables.

The flip side of these effects is the view that an inversion always eventually sees a downturn even if many of us see the UST curve as a symptom rather than the cause. At some point, that curve inversion and the “recession sentence” has a statute of limitations. We always have cycles, but this time around there are many structural features in the post-pandemic period that add more than a few asterisks on what logically has to play out and when. That is why the interplay of Macro vs. Micro is in some uncharted waters this time around. It does not make the job easier.

See also: