Footnotes & Flashbacks: State of Yields 8-6-23

We look at the yield curve moves of the past week as steepening creeps into the picture and the inversion shapeshifts again.

The US credit downgrade influenced some equity market instinctual responses but brought little new information to the UST markets where broader macro trend lines and Fed policy overlap is higher on the main event list ahead of this week’s CPI release.

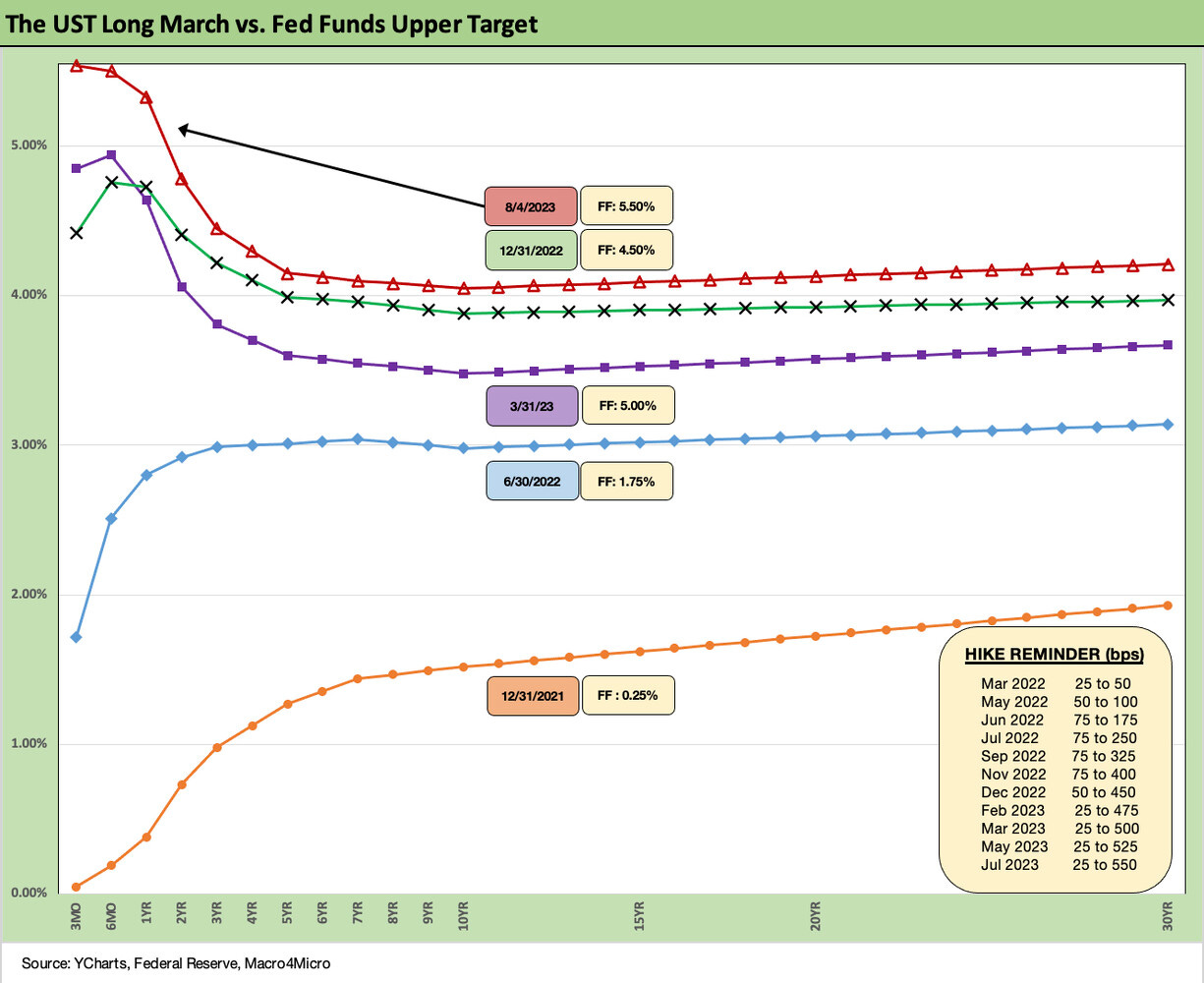

We saw the full UST curve again above the 4% line with the range out to 1Y above 5% as the markets continue to wrestle with the handicapping of contraction risk.

During the week, job growth softened but still drove payrolls higher on ample job openings as detailed in the latest JOLTS numbers.

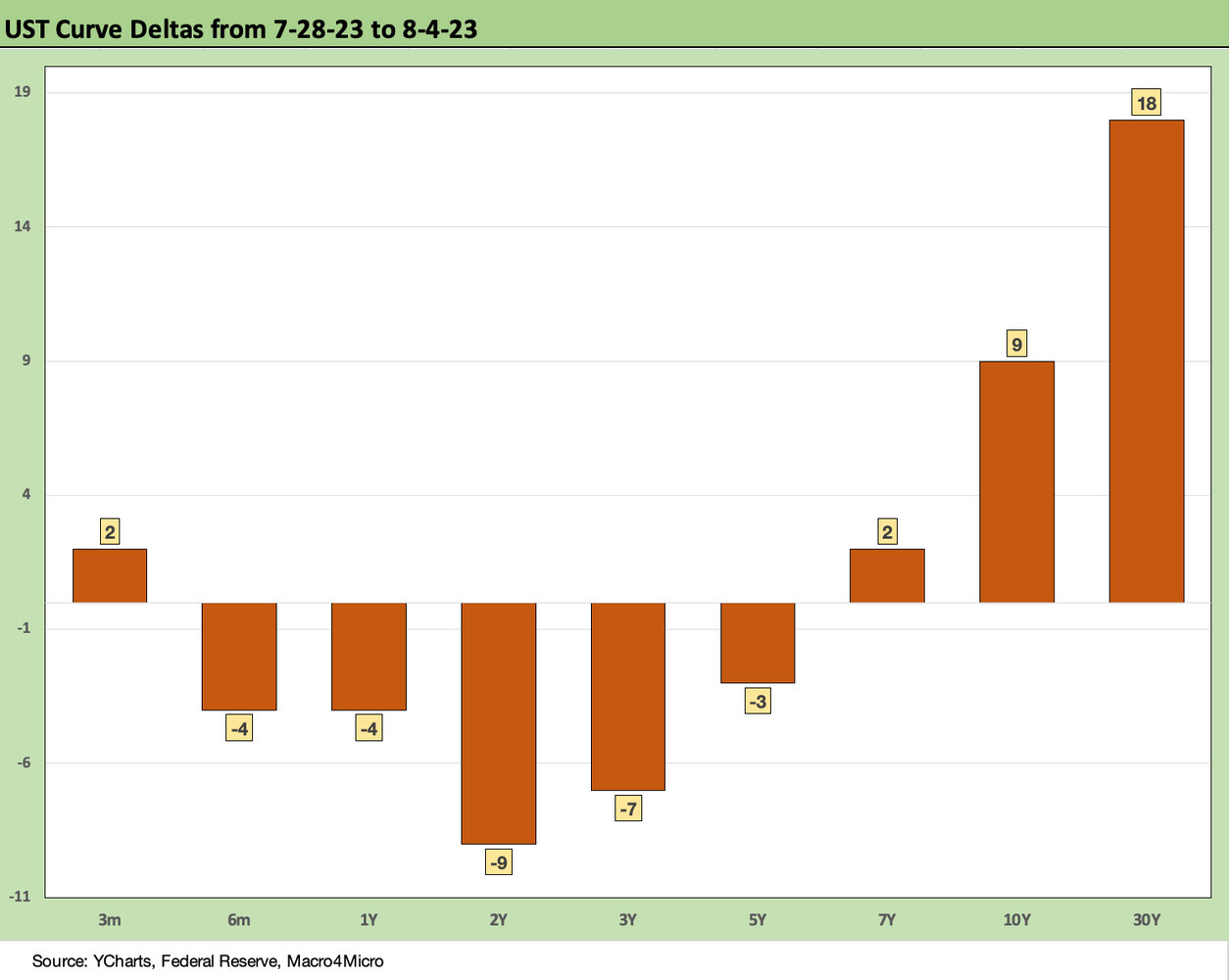

The steepening of the curve past the 7 year maturity bucket was bad news for duration, but the jobs number helped ease some of the fear at the end of the week.

The above chart updates where the UST curve has moved in recent weeks. The most important contrast in the chart for recent asset performance is where the curve has shifted from the 3-31-23 UST curve as economic releases have pushed more investors out of the recession risk camp and into the sustainable recovery camp for at least the second half of 2023.

The week had a few major headlines to wrestle with including a UST downgrade by Fitch (see US Downgrade: Pin the Tail on the Sovereign Ratings Criteria 8-2-23). We break out our views on this action just like we did in prior lives back in the late summer of 2011. The credit ratings do not set demand for UST. Market depth and secondary liquidity still rule.

We don’t see the UST credit rating downgrade as all that significant since new information value is not there. The fact that sovereign debt metrics are much worse now than in 2011 at the last downgrade date is an objective fact and a well-recognized one by market participants. The sequential improvement in the Biden term from the Trump term is a fact, but the numbers are much worse than the 2011 metrics. The numbers were ugly then and are uglier now, but the governance element has deteriorated even more.

The topic of “governance” is steeped in euphemism for a completely destructive dysfunction where political opponents seek to generate a crisis to undermine the other party. That includes a ready willingness to trigger a default that was barely averted and would have required an unprecedented response. There are no polite words to accurately describe how messed up Washington is right now.

The likely coming government shutdown is actually normalized at this point, so that lacks the headline value it used to have. The fact is that a ceremonial downgrade of the US credit rating to AA+ this past week did not trigger much self-awareness in Washington, and that is no surprise. For the market realities, UST debt is still AAA quality by virtue of being where investors go when they are nervous (or frightened) given that it is the deepest and most liquid market in the world. So far that remains the vote in the debt markets. The bigger worry is losing value in a UST curve shift.

The reality is that the US “would not” default (essentially “could not” according to the constitution), but that “could not” idea might have been tested in a UST work-around in violation of the debt ceiling. As covered in earlier research, that “pay it anyway” move by the UST would have been the last stand for the UST default scenarios. Fortunately, we did not get there, but a notch to AA+ is not extreme considering the Congressional actions almost tested the various theories.

The macro picture is another story, and the news has been good enough to worry UST curve watchers. The bullish releases of recent weeks have the UST curve shifting higher and that has been a headwind for bond returns in higher quality fixed income. The relief at a below-consensus 187K for job additions to end the week was a sign of the times as it implied a slowing of growth (see July Employment: Fine Tuning but No Setbacks 8-5-23, JOLTS: Job Openings Lose Some Velocity 8-1-23).

The above chart updates the yield curve deltas this past week as the market saw a steepening from 7Y to 30Y. The wrestling match around whether to extend out the curve and take the duration risk had been picking up tempo in late 2Q23 and is now spilling into 3Q23. The performance of bonds and duration has not been good news. US HY performance has been the exception on the income components, tight spread resilience, and shorter duration.

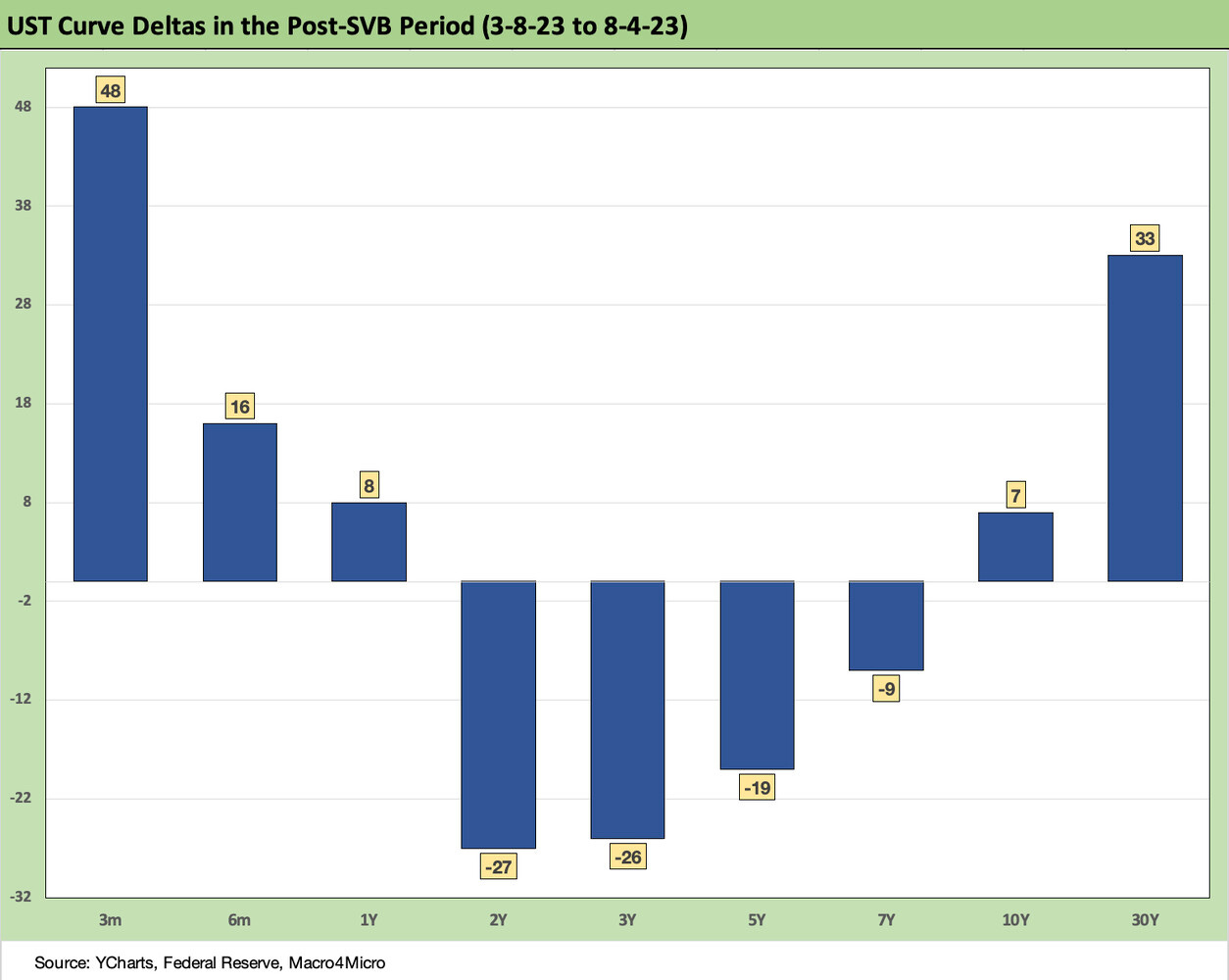

The above chart updates the post-Silicon Valley Bank UST deltas. The steepening from 2Y to 30Y is self-evident.

The above chart gives a yield curve visual of the post-SVB deltas. The steepening on the long end has been very distinctive.

The above chart updates where the current UST curve and mortgage rates stand vs. the peak years of the housing bubble in 2005-2006. The recurring theme is lower UST rates now but higher mortgage rates today as well. We have discussed this history in numerous prior pieces. Mortgage spreads are a wildcard for housing markets, existing home sales, and homebuilders as this peak season winds down and we get into the 2024 handicapping for the supply-demand imbalances in housing.

The above chart updates the 2Y to 30Y inversion as the recent steepening has eaten into the scale of inversion from the March 2023 highs.

The above chart takes a closer look at the 2Y to 10Y UST slope moves using the shorter time horizon of the post-ZIRP period. While still inverted, we are seeing the inversion declining rapidly but still at a level that leaves room for more steepening actions in the curve if the economy stays resilient. That is the essence of the debate around extending duration earlier in the game.

The CPI release will be the next big input this week. We are still defensive on the duration story and have been all year. The “no guts, no glory” trade for duration is to sit on 5% yields on the short end and take your risks in targeted equity selections and leveraged loan product alternatives (including BDC equities).

We wrap with our usual summary of the UST migration from March 1, 2022, the month that ZIRP ended and the Fed hiking cycle kicked into high gear. We include a 12-31-20 UST curve as a frame of reference as a period before inflation really started to accelerate in 2021. We detail the UST deltas in bps in the box within the chart.

See also: