Housing Starts: Multifamily Moonwalk

The summer begins with a big decline in multifamily starts with a heavy multifamily supply still under construction.

We look at the June starts numbers as single family shows the pace fading this month but multifamily off by more.

Some interesting news in multifamily shows heavy supply under construction and entering the markets, and that in turn prompts a backpedal in permits and starts.

Multifamily supply is a key variable to watch for the outlook on rent inflation into 2024, and the numbers in the market are well below where the CPI index show them already.

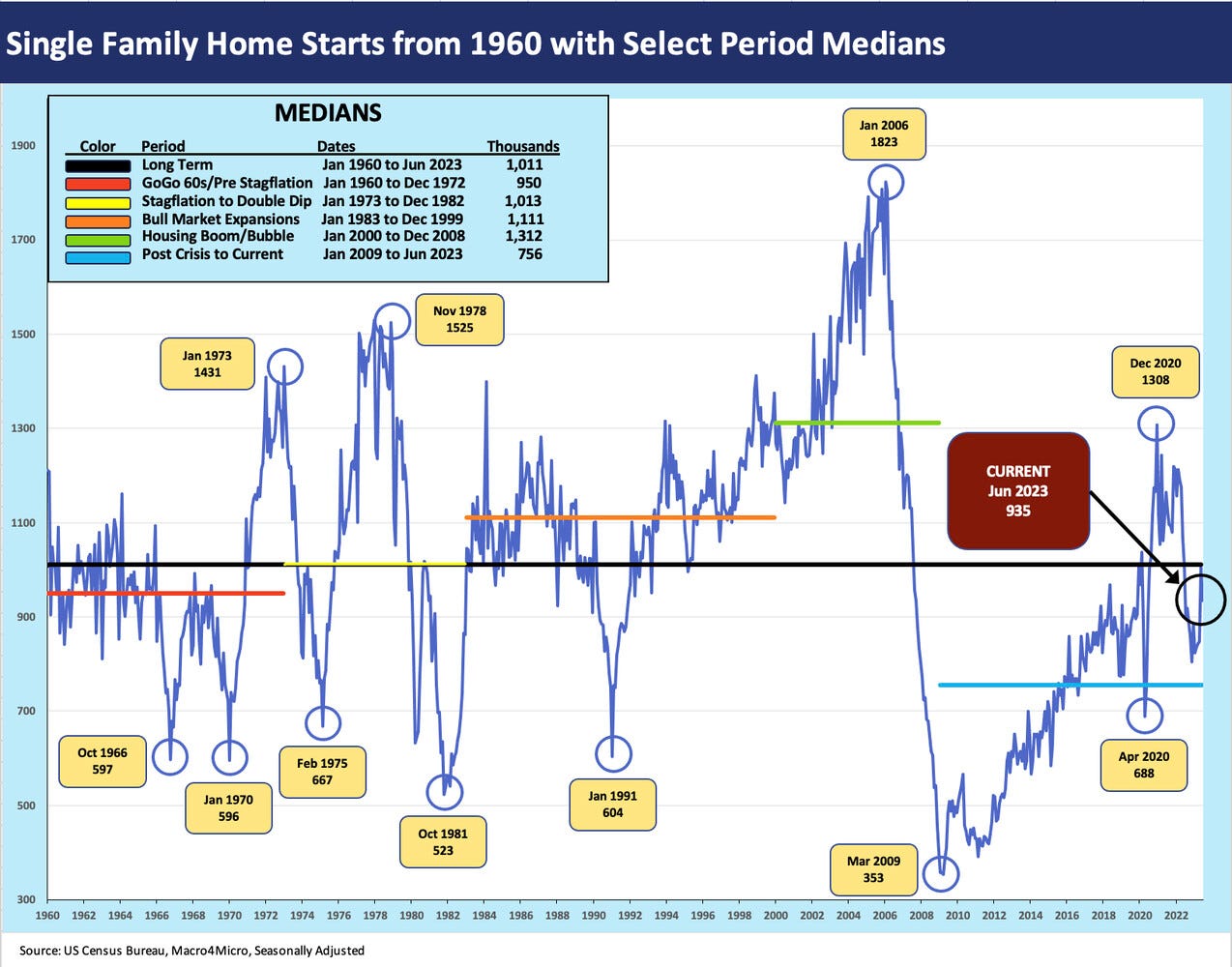

The above chart updates the single family starts number for June. The sequential move from May to June was -7.0% but still above the housing unit starts levels all the way back to June 2022. The single family levels were the second highest in 2023 and well ahead of the #3 month. So this rings no alarms and would be consistent with the heavy spec build evidenced in 2023 with an ample supply of move-in ready homes and homes under construction.

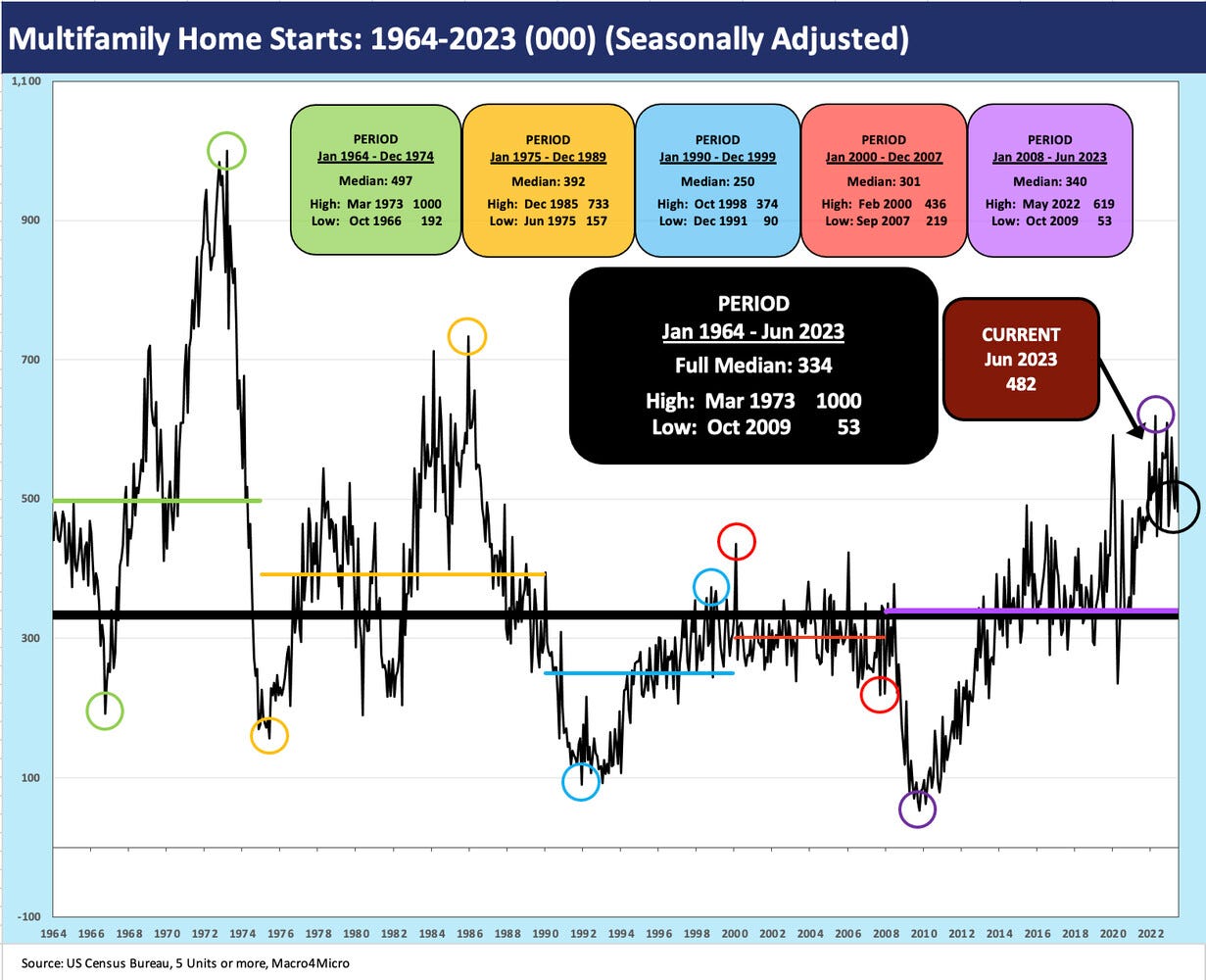

The multifamily starts were down -11.6% sequentially from May in 5+ units and a similar amount YoY at -11.2%. At 482K, that is the lowest level of 2023 and the lowest since Dec 2022. Multifamily 5+ units under construction are at highs at +977 with that number well above the 900K level all year.

The above chart covers multifamily permits and drives home that the brakes are being tapped for 5+ units. Looking back to mid-2022, the 467K unit permits are by far the lowest total. That marks a -33.1% YoY decline from June 2022 and a -13.5% sequential decline from May 2023.

The peak season is running along and watching inventory levels will be a regular exercise as inflation debates continue and with Shelter such a major part of the CPI index (see June CPI: Big 5 and Add-Ons…A Big Win 7-12-23).