CarMax 4Q23: Wacky Market, KMX Stays Steady

We look at CarMax 4Q23 earnings and what it says about used car dynamics in auto retail.

CarMax results disappointed the bears and showed its resilience as the dominant incumbent in used cars with respectable YoY gross margin performance in the face of plunging volumes.

KMX also offered a reminder that its strong balance sheet, readily available liquidity sources, and that it holds the lead position in a very important consumer market, which provides latitude for recession risk without panic.

For some, KMX was going to offer context for Carvana’s valuation in the face of the unfolding liquidity crisis and whether stabilization of gross profit per unit offered rays of hope in the recovery value scenarios on CVNA debt.

We see KMX’s relative strength as another reason CVNA is doomed to a much more comprehensive restructuring since KMX can keep on investing just as the franchise dealers will keep eating into used car share.

CarMax (KMX) 4Q23 results and the related earnings call offered some tangible reassurance that KMX is seeing fundamentals stabilize. KMX is a minor factor in bonds (only a few small bonds) but is big in securitization with almost $16 bn in nonrecourse debt. KMX has a stable credit profile and can continue to stay the course on its plan in used car retail.

KMX took action to defend its healthy balance sheet by suspending its stock buyback at the same time it affirmed its targets for 2 million to 2.4 million retail/wholesale units by 2026. That target was articulated at its Investor Day back in May 2021 and restated in April 2022. At the time it was released, the growth projection from 2021 to 2026 was for a 12% CAGR in units or +75% in units. That aggressive game plan gets back to the company’s intermediate term view on cycles and where used vehicles fit into the consumer preference picture.

KMX volume weakness was no surprise as the company reiterated the challenge of rising monthly payments and the harm to affordability. The trend line in gross margins and unit profitability brought good news and especially so with used prices firming up and the differentials between new and used vehicles closer to being rational. The loaded average transaction prices in new cars are still supportive for the used car value proposition even if the economic cycle is under a cloud.

For the consumer, a record high payroll and some easing of rates from 1Y to 5Y are factors that are at least getting better in the affordability equation. Auto Finance is about the short segment of the curve, and the contract rate for CarMax Auto Finance (“CAF”) crossed above 10% in the recent quarter. That will take some of the edge off the squeeze in interest margins, but there is no hiding from weaker auto finance results on volumes, net interest margin weakness, and loan loss provisions. We look at the sea level statistics for CAF further below.

A look at CarMax, Carvana, and Lithia to capture the used car madness of recent years…

The above chart offers a stark reminder of what a crazy few years it has been in auto retail broadly but in used car retail especially. We start the time series at the beginning of 2019 shortly after the final Fed hike in late 2018 on the way into an uneven 2019. The 2019 period saw the economic expansion hit a record length of over 10 years, but the year saw some strain on economic growth that brought Fed cuts into the picture.

The real insanity began with COVID as supplier chains and retail networks were badly disrupted. Auto dealers as a distribution channel were badly impaired by COVID directly and then later by broken new car supplier chains that sent used car prices soaring and cleared out the lots.

The evaporation of inventory and strange distortions in new vs. used vehicles have already been covered in other commentaries, so we will not replay that here (see Carvana: Credit Profile 3-5-23, Carvana: Wax Wheels 12-8-22, Market Menagerie: The Used Car Microcosm 11-29-22).

The main point as we look back at the stock price action is that CarMax was a sea of tranquility and low volatility until later in calendar 2022. The problem with low volatility was that the stockholder upside was not there either, and the pack chased CVNA around the parking lot.

The KMX position as the used car leader is not in doubt, and the market waited too long to come around on the inherent advantage the legacy franchise dealers possessed and how that risk could threaten the CVNA model in what was an unsustainable market for used vehicles.

Meanwhile, the more asset rich and omnichannel-focused KMX could stay the course and get into the online retail business at its own steady pace. We include Lithia (LAD) in the chart above as one of the most aggressive dealers in expansion in recent years including used vehicles.

LAD was the clear winner vs. KMX in the equity markets, so the big question for KMX and its $11 billion in market cap is “How can I drive shareholder value like the franchise dealers?” For comparison, LAD’s market cap is around $5.9 bn, PAG is the market cap leader among franchise players at $9.4 bn, and AutoNation at $6.0 bn. KMX still has to show how it can get more competitive as an equity play vs. the franchise dealers in relative performance as it has stalled.

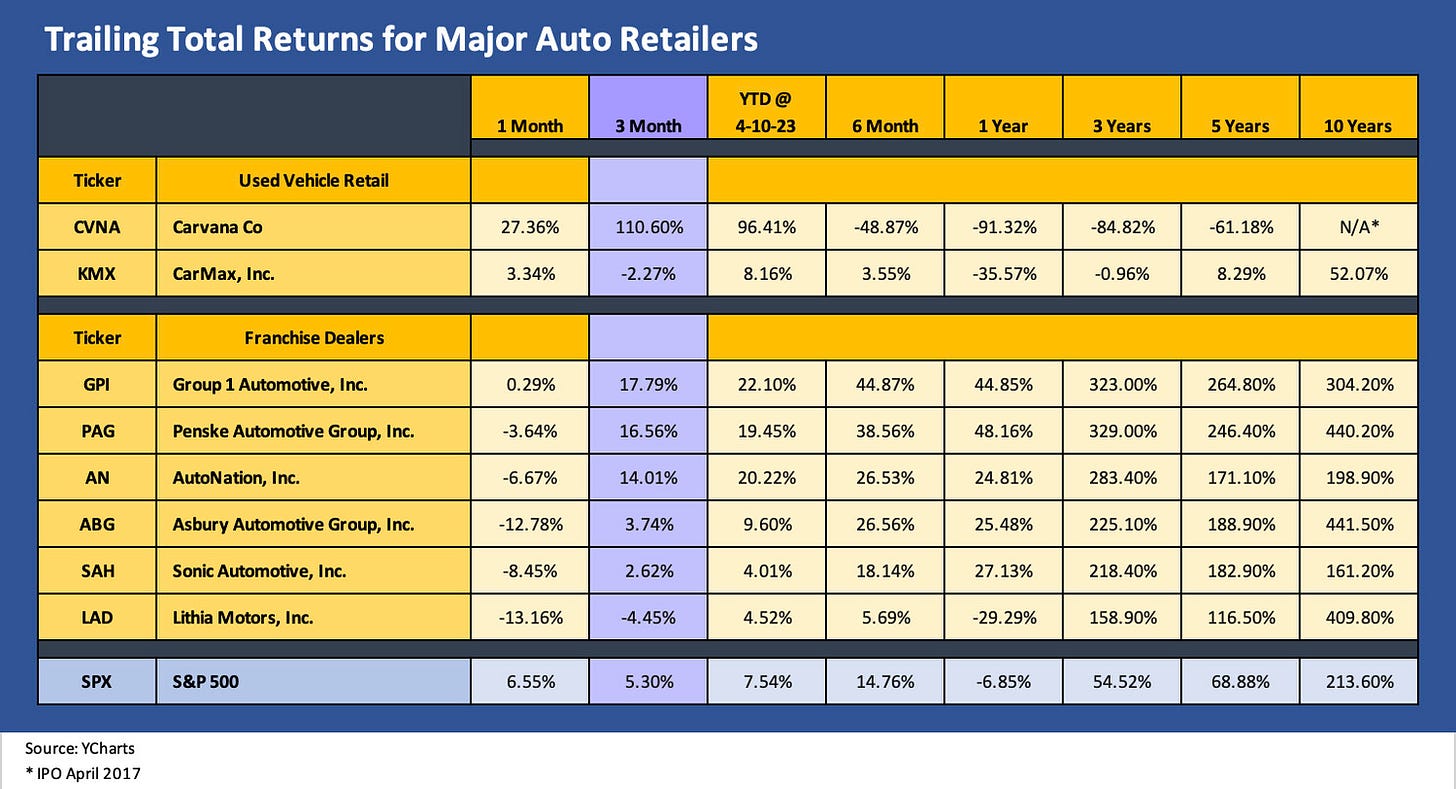

Putting CarMax into the broader context of the Big 6 franchise dealers, the chart above breaks out total returns over a range of time horizons. We line them up in descending order over the trailing three months with the used retail dealers detailed separately (KMX, CVNA).

The most relevant time horizon for auto retail right now is really the 6-month and the 1-year lookback as the yield curve started to hammer used car affordability on monthly payments. We just went through some months of correction of the almost absurdly distorted price relationships in the “new vs. used” car market in 2021 and well into 2022.

The story in the chart signals the market conviction that the franchise dealers have a lot of room to grow profitably in the future as new car supplier chains function better, more new cars are available for the spring selling season, payrolls remain around record levels, and replacement cycles can get back into gear. Affordability remains a problem.

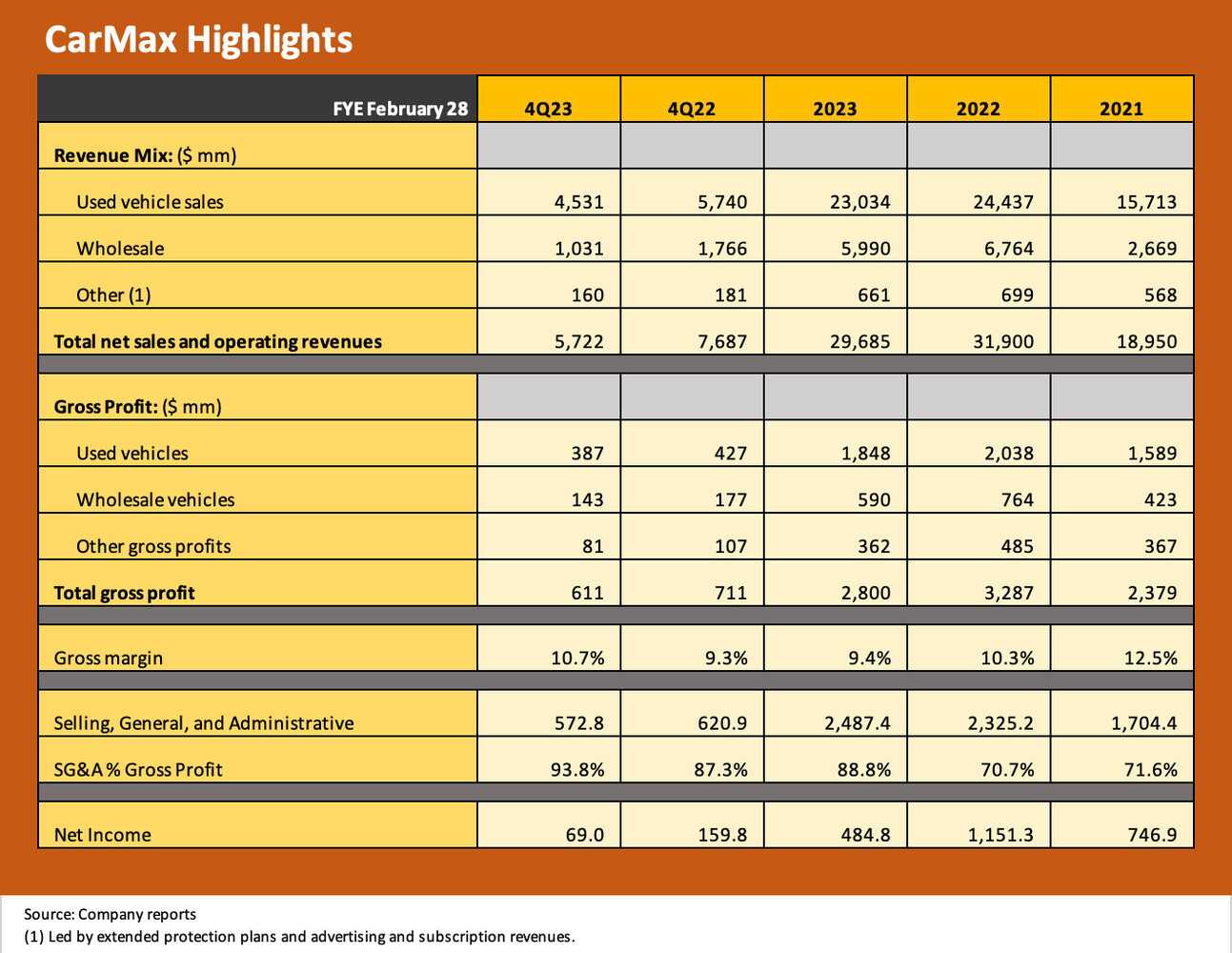

CarMax 4Q23 by the numbers…

The financial table above and operating statistics below tells a story of volume pain. As a reminder, KMX experienced COVID the most in the fiscal year of FY 2021 (Feb 2021 year end). FY 2021 was the year of COVID for KMX while FY 2022 and earlier in FY 2023 saw the wild price upside for used cars. Summer 2021 was the period that saw the outsized spike of CVNA equity to $370 (today under $10).

At the same time in 2020-2021, the franchise car players were getting very charged up about the used car business, so KMX was facing a competitive onslaught to be factored into its future. It is easier to plan expanding in used cars than actually doing it, and the strategy has been harder for some than others. Execution risk abounds and the various parties in online retail and bricks and mortar were all busy in 2020-2022. While it is an oversimplification, the pure online retail players failed and the franchise dealers that were most aggressive saw some setbacks along the way in their stock performance.

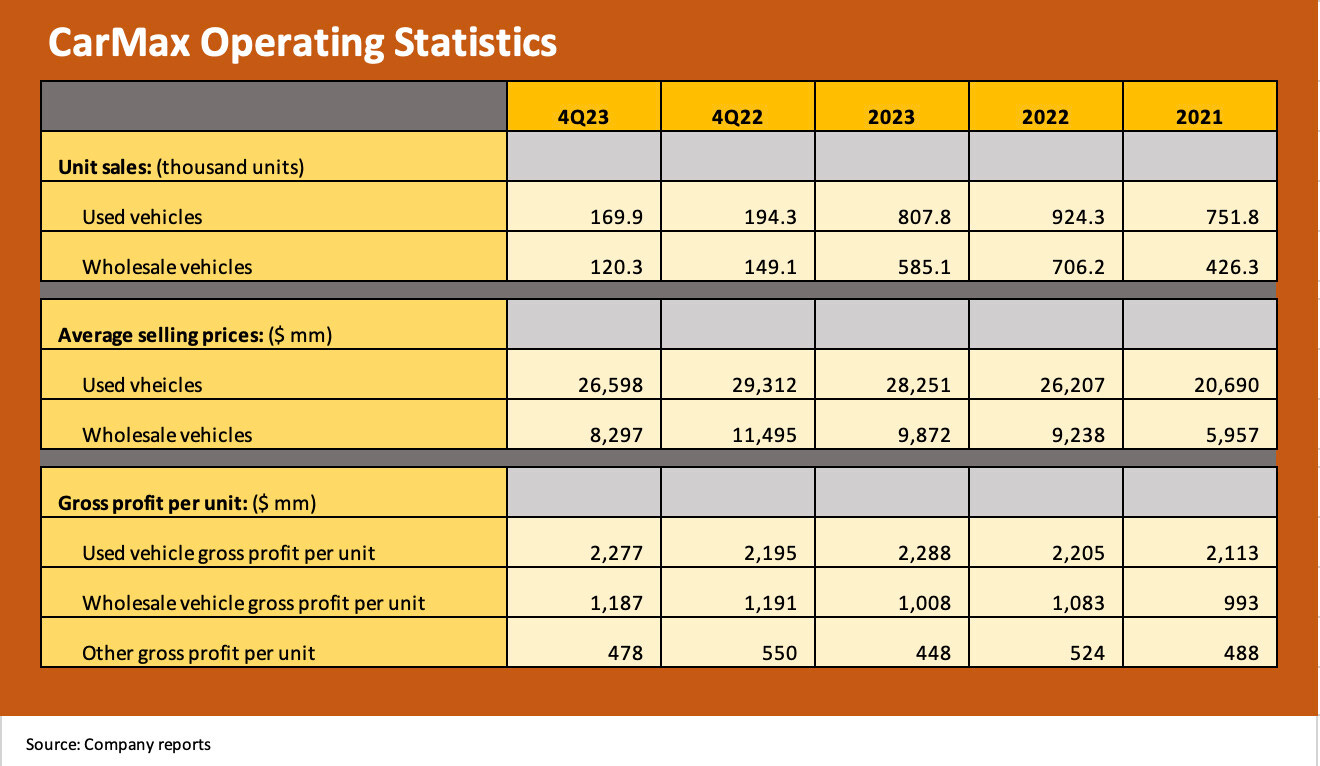

The chart above shows some good signs for KMX. Per unit metrics get a lot of focus in auto retail for obvious reasons, but they are especially important at a time when volumes are down so materially. Meanwhile, CVNA is running on fumes with its massive cash bleed and needs favorable variances in both volumes and margins. There is almost no way to come up with a meaningful stock value without an eraser, pathological optimism, and a very vivid imagination on what the multiple and discount rates should be.

In contrast, KMX can stay the course on investment and strategic execution even if it is not growing locations as quickly and is dialing back stock repurchases. KMX has committed to a leverage range of 35% to 45% and is now below that level with an undrawn $2 bn revolver.

KMX can take most any backdrop the market throws at them. The stock may feel pressure, but the financial health of the company is intact from the standpoint of the balance sheet or financial flexibility and liquidity dynamics in a recession. A recession would not derail its omnichannel strategy and steady expansion into a secular growing used car market supported by demographics and mobility trends. Interest rates would go down and used cars would be more affordable in a downturn. Asset quality would weaken and provisions would rise, but KMX would come out the other side even better positioned to exploit the growth opportunity. It will be interesting to see where CVNA is by then. Post-Chapter 11 strategic merger? Post-Chapter 11 stand-alone?

The CarMax Auto Finance operations got some airtime on the conference call. Relationships with their auto finance partners were discussed as was the fact that the securitization markets for them is still open and working. They highlighted their 10% contract rate in 4Q23 and the steady upward progression in loss provisioning and the buildup of the reserve cushion. We break those out in the chart.

We look forward to more auto finance reports next week including industry leading Ally.