Footnotes and Flashbacks: Week Ending March 19, 2023

We look at the bank chaos fallout across asset classes, the latest UST shift, the 5Y to 30Y UST slope, and the carnage in regional bank equities.

This Week’s Macro: Bank chaos reigns; Broad index returns for equity and debt; ETF benchmark 1-month and 3-month returns; Running bear flattener differentials since ZIRP ended.

This Weeks’s Micro: All banks all the time this past week.

MACRO

The events of the past two weeks have been wild and this is the second straight week where we could date the “week ended” as Sunday night (so we use March 19). Gordon Gekko said “money never sleeps,” and the same is true for bankers trying to find buyers of SVB shrapnel and any or all of First Republic (FRC). FRC is still not making progress and the stock is getting slaughtered again today as we go to print with credit ratings downgrade risk piling on.

The prior weekend was about seizures and sales attempts while this past weekend continued the sales process from SVB to SBNY (Signature) assets with CSFB as the main headliner on Sunday night. SVB’s holding company filed Chapter 11 last week, so the former SVB family tree has two sales processes going on – one at the bank and one at the holding company.

A hefty base of Signature loans and deposits were sold by the FDIC to New York Community Bancorp (NYCB) at material discounts with some stock appreciation rights given to FDIC as part of the deal. The problem is that demand for the loan assets of problem banks so far has been slow to anemic. The process continues. The CSFB deal was for minimal stock value and a lot of commitments from the Swiss National Bank. The AT1s were zeroed out, and that is causing a lot of confusion in the investor base and market making.

In the market broadly, a week and weekend when a warrant was issued for Putin by the International Court (the charge: “unlawful transportation of children”) and Trump was posting that he would be arrested on Tuesday, the situation at CSFB and the US regional banks were still the important drivers of market focus.

The Washington noise is only relevant to the markets in terms of a steadily eroding international relations backdrop that can spill into trade and commodities if the geopolitics of the US vs. “Russia+China” keeps going in the wrong direction. The potential for trade policy setbacks could very easily unfold if China starts doing more for Russia.

The Trump noise spills into economic policy design since everything is “the other guy’s fault.” The views on everything from banking risks to regulators are run through a partisan strainer and often get conceptually amputated on the way to someone’s mouth. These are of course the same people who will soon face a UST default looming. That will not help the banks much. One Washington focus is whether any action will be taken in the context of small and midsized banks insured deposit limits. Let’s assume not.

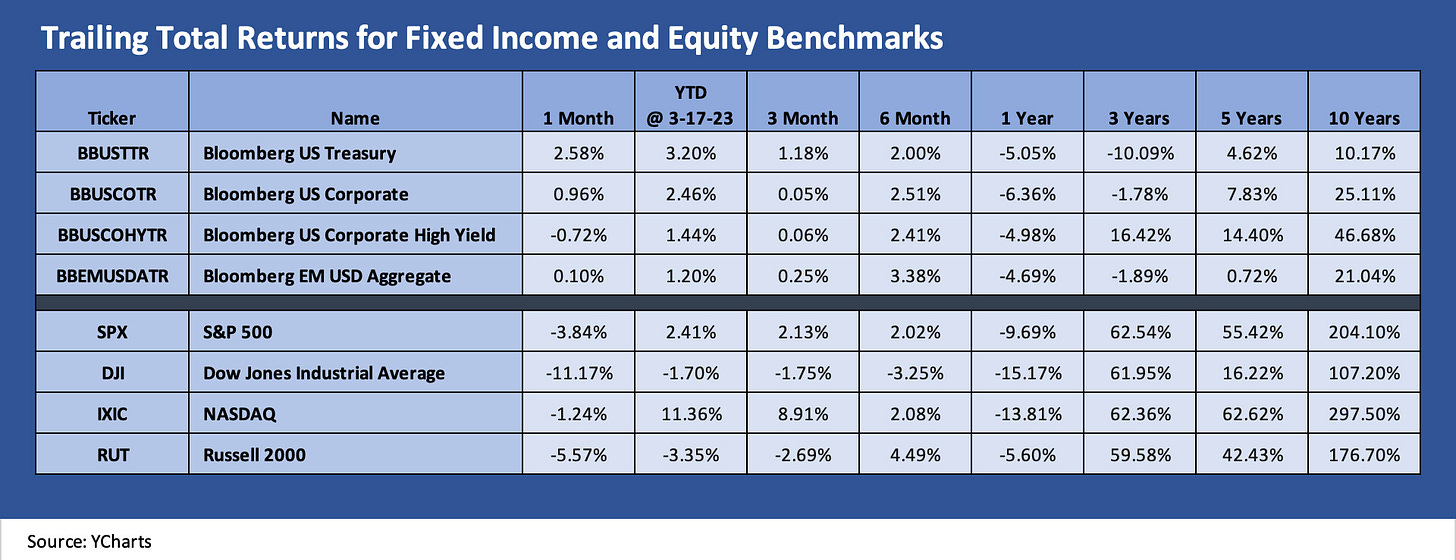

Comparative Asset Returns

Asset class struggle cuts across debt and equity…

The negative swing in performance from the booming January 2023 (see Footnotes and Flashbacks: Week Ending Feb 3, 2023) has been driven by the inflation factor and curve pressure that eventually – and quite suddenly – gave way to worsening bank fears. That risk sentiment crash came after Silicon Valley blew itself up and CSFB finally succumbed to a market where confidence was suddenly sent into shock.

The market got into a mode where no problem could be resolved within a bank. The mindset seemed to be “If it can be solved, then I will come back after taking money out but will still scale back exposure to your institution overall.” Even if SVB was a case study in breakneck growth giving way to negligent risk management, it is hard to fathom the pace of deposit outflows in such a short time.

The SVB plunge into regulatory seizure in what was less than 48 hours for a Top 20 bank could perhaps been explained away by SVB’s very “distinctive” nature (“distinctive” aka six deviations of SNAFU – spare the SN). The confidence plunge started bringing in the word contagion. Isolating the virus to SVB fell apart as the market saw SBNY (Signature Bank) closed on the weekend after SVBs Black Friday and Horror Thursday.

Meanwhile, First Republic (FRN) cannot find a buyer. The sell-off in regional bank equities is something we look at below in the Micro section of this weekly. The breadth of the stunningly negative stock return numbers this past month underscore the breadth of the anxiety and expanding base of risk aversion.

The longer tail of equities feeling the pain of contraction risks…

If you don’t like small and midcap banks as we detail in the Micro section at the end of this report, then your problem is worrying about credit contraction in the longer tail of US companies both financial and nonfinancial. The S&P 1500 Financials are down more than -15% this past month with Energy just shy of negative double digits and Real Estate right alongside Energy. One fear that is attached to the regional bank (mid or small cap) is that real estate lending is a major part of their business strategy for most. The asset quality problems and tenant risk could be on the rise in coming periods if this credit contraction theme actually translates into a sustained reality at sea level.

Rising interest rates are usually the dagger that shortens the real estate cycle, and that had been the course before SVB. Now the focus has shifted back to economic cycles and tightening financial conditions from banks and demand side weakness undermining tenants and valuations of real estate. Of course, then the stagflation debate will chime in as the FOMC meeting this week gets some airtime.

The combination of these factors will promote defensiveness in investing strategies whether it is simply “sell now, ask questions later” or more nuanced reallocation away from the cyclical and discretionary consumer subsector. There is also the upgrade trade in credit assets (buy high quality and avoid high credit risk). That gets back to the repricing risk in credit markets to attract more flows or retain more assets. We looked at the post-SVB, post-CSFB spread trends in detail over the weekend (see the links in the micro section).

ETF Returns as Industry and Asset Class Proxies

In the next section we look at a broad mix of industry ETFs, some asset class proxies, and broad equity benchmarks. We look at 1-month and 3-month time horizons through Friday’s close…

1-month ETF and Benchmark Returns

Looking back over the 1M period, we see only 4 categories in the black with 3 of the 4 in high quality fixed income who rode the curve to positive returns. The score of 4 positive and 17 negative makes a statement. One industry ETF back in the black is XLK (Tech) with the lower rates driving a rebound in long duration equities.

The “lower discount rate effect” and the ongoing hope for where long term growth trajectories will play out still must meet the realities of where IT budgets will look into 2023-2024 if the recession scenario plays out. The issuer selection game in those sectors gets tied into what products and services will be seen as indispensable and part of a necessary sustained capex and spending program to improve operations. That is the beauty of long duration equities in the sense that “there is always tomorrow” even if tomorrow may not be this year. That is why long duration equities and businesses are supposed to avoid high leverage (like Carvana). You have to make it to that tomorrow.

3-month ETF and Benchmark Returns

The 3-month trailing period shows 8 categories positive and 13 negative. The theme of tech and long duration equities bouncing higher is also in evidence with XLC, XLK, and NASDAQ in the black. We also see the UST (GOVT) and AGG from fixed income in positive territory with LQD slightly over the line at -0.3%. HY had been spotted a good lead earlier in the year, but OAS widening is taking a toll.

The ugly part of the story is again about Energy and Financials with the high flying E&P sector on the bottom on oil and gas price declines after a very strong 2022. We see BDCs sliding after a great start to the year on the mix of small and microcap fears that would come with a recession and also the theory that the floating rate structure will fade as the year goes on. The BDC equities also have a tendency to correlate highly with broad equity market benchmarks with the exposures more in line with the Russell 2000 names.

The latest path of the post-March 2022 bear market for UST…

We update the running differentials each week that post where we stand now vs. the March 1, 2022 UST curve at the start of the month when ZIRP came to an end. The big rally in the UST curve can only reverse so much from the steady upward migration that crushed duration in 2022. We break out the post-March 2022 UST increases through March 17 in the box. The UST curve downward shift is also happening for the worst of reasons for credit risk and equity valuation. The reasons include fear of fundamental weakness, systemic risk anxiety, and credit contraction policies.

The above chart breaks out the changes over the past two weeks in the “running score” for the UST deltas since March 3, 2023. We update the changes each week, and this chart breaks out this week’s Friday March 17 numbers vs. those posted in our March 3 weekly. The story is clear enough as the bank chaos flowed into the UST curve in dramatic fashion (see Silicon Valley Bank: How did the UST Curve React? 3-11-23).

Yield curve inversion erased in the 5Y to 30Y segment…

We already looked at the 5Y-30Y slope history in a recent commentary (see Footnotes and Flashbacks: Week Ending March 3, 2023) and do not need to replay those themes. We would highlight the big swings along the curve have now started to reshape the yield curve in a way that will influence relative all-in yields in the issuer security selection process.

An inverted curve in theory punishes longer duration spreads when the long end drops quickly and the front end rises. The theory is that you should get paid more in spread for extending out the curve and taking that incremental risk. Theory only gets you so far of course in a sea of technical compounded now with enhanced recession fears and spread decompression (see IG Corporate Spreads: Tough Pathway, A Few Doors Ahead 3-19-23).

The above chart shortens up the slope timeline on the 5Y to 30Y slope for better visuals. The -46 bps inversion on 3-8-23 we saw earlier this month has bounced to +16 in another sign of how much the shorter end of the UST curve has moved in recent days. The UST curve is now at 3% handles from 2Y to 30Ym which is a long way from earlier pain seen in the fall when so many 4% handles were seen along the curve (see House of Pain: Markets Jump Around 10-13-22).

MICRO

Even though we spend a lot of time looking at issuers and industries, it has been hard to look away from the banks in recent days. You can reward yourself for good behavior by looking at a Lennar or FedEx earnings results, but the fate of the economy from here in the US is more tied into the banks and the threats of credit contraction.

We had covered the spread reactions over the weekend across the credit tiers (see Spreads Across Tiers: Decompression + Volatility 3-18-23), in IG (see IG Corporate Spreads: Tough Pathway, A Few Doors Ahead 3-19-23) and HY (see US HY Spread Histories: Weird Science, New Parts 3-19-23 ).

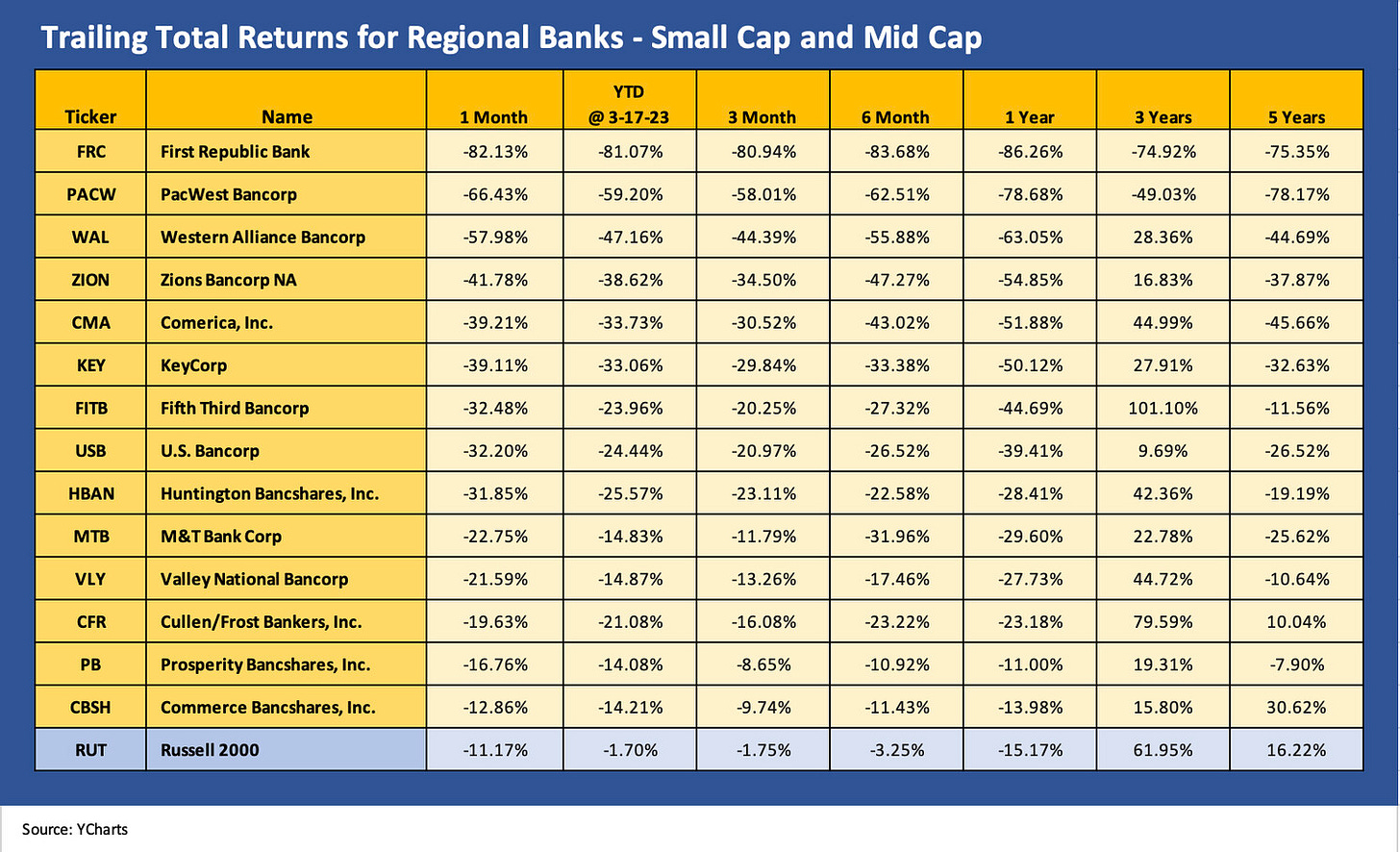

The story line is not pretty even if just in the question marks around the bank system risk appetites and funding profiles. The chart below hammers home how much the regional banks have been impacted as the stocks plunged. Some rallied today on the hope factor and the simple reality that the conversations are favoring additional support (even if contingent) for small banks and community lenders.

There is not much interpretation needed in the following chart.

The mix of banks above is more weighted toward small cap than midcap banks as typically defined, but the term “regional” applies. Only two are over $20 bn in market cap and only five are in double digit billions. The outlier on the high end of market caps on the list is US Bancorp (USB) as a large cap name at over $50 bn threshold which we added as a measuring stick and as a high-quality bank. All the banks are feeling the heat.

We looked at some of the myriad chart collections making the rounds the past two weeks and selected names that had high securities holdings in the mix or high Held to Maturity (HTM) and AFS portfolios or “all of the above.” We sense many are looking for the perfect ratio to capture a replay of SVB, but it is just not that easy. The easiest way to calm nerves is to focus on unrealized losses vs. equity since SVB was so hideous in that one metric.

The reality is that handicapping deposit flight risk (the push of a button in most cases) will not be handled by telling people you don’t have a bad ratio or two using some metric that highlight what a house of horrors SVB had become. Such actions also put you in the legal and regulatory crosshairs if you start narrowing investors’ attention – especially when they see the stock price action detailed above. Numerous banks are scrambling to retell their stories in a low confidence market backdrop, and that is only going to do some much.

We throw this chart in the mix here in part for dramatic effect (it looks like a shale oil or E&P chart from 2015) but also as a reminder of how broad the pressure is on bank management teams to watch out for shareholder interests and try to balance that with the major customers and communities. Tightening credit would be the opposite in terms of customers. That is no easy task and will roll up somewhere along the way into a view on credit contraction or defensive lending and what it might all mean in the coming months.