House of Pain: Markets Jump Around

We detail the scale and pace of the UST migration as 2022 unfolds. We consider bond duration risk vs. loans and BDCs.

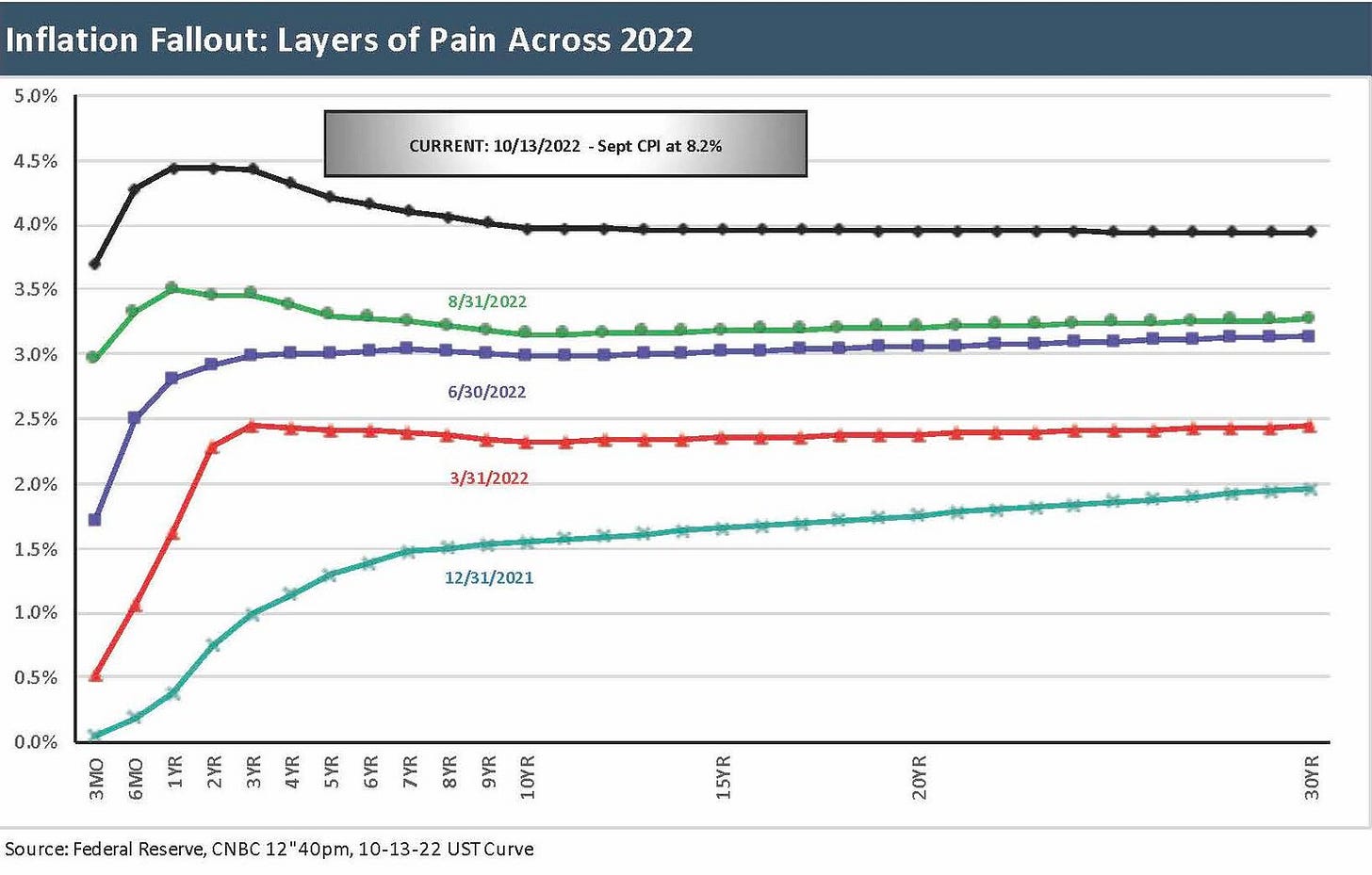

In the face of some troublesome CPI numbers, we look at the steady upward shift of the UST curve across 2022 in each quarter from 4Q21.

After posting a heavy mix of 2% handles in August, the UST curve is posting a majority of 4% handles, including a brief move above 4% for the 30Y UST early in the trading day before settling back under that line.

The news on the Social Security COLA adjustment of 8.7% (the highest in 40 years) comes on the same day that this CPI number was posted and not long after the solid job numbers. For now, demand destruction is an optimistic outcome for inflation hawks.

The bottom line for us is that the yield curve upward migration will continue in fits and starts with a lot of pricing power still in evidence even if gradually diminishing.

The House of Pain was always a useful phrase to capture certain markets, and the string of inflation setbacks and UST curve shifts qualify. That pain runs across negative duration returns, the body blows to discount rates in stock valuation, and scaled back earnings forecasts for the corporate sector. When we looked for a House of Pain visual from bygone years (they heavily play the Irish imagery card), I found one with a four-leaf image. Even the shamrock has inflated by a leaf. Rough times.

As we show in the chart above, the steady migration across each quarter from 4Q21 to today tells a tough story. The shapeshifting and migration of the UST curve shows a bear flattener into some variations of inversions along the trail. That is pure agony for many investors and a wake-up call for those who thought toggling across stocks and bonds was a risk mitigating game plan.

Interest rates and fundamentals both take a hit in securities pricing…

The UST shift is as bad as it looks, hitting the bond markets hard as duration takes some nasty body blows. Meanwhile, fundamental risks in equities and credit have also been feeling the effects of risk pricing. For a simple snapshot of how the migration and curve turmoil has hit duration (UST and corporate bonds), the ETF returns-to-date tell a story with SPY (S&P 500) at nearly -25% YTD total return in late morning trading, LQD (IG bonds) at -23% YTD, JNK (HY) at -19% YTD, and GOVT (UST) at -14%.

So far, cash has been the winner even just by loss avoidance in 2022. Looking ahead, the forecasts on cash income rates are a lot more user-friendly for many investors who are not asset class constrained or seeking income. Cash sees expectations for mid-4% to 5% run rates at some point in 1Q23. If you were (are) sitting on low-single-digit dividend yields, the cash vs. stock view comes down to an opinion on equity price action from here with respect to timing of repricing in what is supposed to be a forward-looking market.

The relative return expectations across credit or versus equities is not today’s topic. Even for those of us who built up cash in recent months to await more turmoil creating opportunities, many (including me) likely have no interest in selling good names into weakness if time horizons are longer, income streams acceptable and the default and financial stress risks minimal.

Underwater does not mean drowning if properly equipped with a plan and a set of assumptions (just try not to be wrong!). Financial media talking heads give regular updates on the tally of equity market corrections each cycle in equities (a lot) with the bear market count somewhat smaller (but also a recurring fact of life). As a reminder, we had a bear market across some equity benchmarks in late 2018 when the cycle was still rolling (no one died from it). The problem now vs. 4Q18 is the overriding inflation factor.

The direction of credit and the BDC gut check in times of cyclical pressure…

From here, I see volatility and a multi-month struggle of market players trying to call the credit cycle and when (for some, whether) that credit cycle will turn ahead of the business cycle. We looked at the contrast of the “credit cycle” vs. the “business cycle” in yesterday’s comment. If you believe spreads will be wider into early 2023 (I do), expect that credit loss exposure will rise in loans (I do) from major banks to BDCs, and expect UST rates to migrate higher over the rolling 3 months ahead (I do), then there is no reason to rush. There is also no reason to go overly defensive in core risk strategies in credit. Most institutions are asset class constrained, so it is matter of degrees and more subtle shifts.

The irony of the inflation problem is that it is rooted in pricing power whether exercised by companies (goods or services) or workers (“pay me more”). That can be a positive characteristic as Pepsi showed this week (more than 100% of its double digit positive variance was pricing not volume). In other words, it takes a lot more to derail pricing power since it takes a lot more to sidetrack demand. How that can be seen as anything other than tough for the UST market is hard for me to fathom. The migration will not be as rapid as the chart above, but where does the core inflation relief come from?

Since I started assembling an income portfolio (an “old man” portfolio), I have routinely been in BDC positions. I own fewer now than I did in the early summer in terms of number of stocks and portfolio % share (in portfolio context, none of the single names are of material size, i.e., low single digit % per name), but I like the dividend yields at the equity level and think they have very credible story lines around navigating downturns. They are also managed by some of the smartest guys in the credit business. The BDC equities are generally IG bond names (even if cuspy IG) at HY spreads in debt. The trend of locking in lower-coupon, fixed rate unsecured bonds against the secured floating rate asset base makes for interesting play. That is especially the case in a demand-heavy, pricing-power-intensive economy with the front end of the UST curve rising and flowing into asset repricing. There is room to maneuver, and the trade-off of income vs. loss provisioning will need to be watched.

Our mini-summary view is that we like BDCs as long-term holdings and have a longer-term view (e.g., into 2024) on the space to ride out the volatility. There are worse outcomes in riskier securities than to clip some high cash-on-cash total returns annually as the journey continues. More on that topic some other time. I find it very useful to review the output of BDCs and read the transcripts. The managers of the BDCs are on the A Team in credit (even if a few of the “brands” evoke bad memories in leveraging events with names like KKR et al).

The inflation story lines from here…

For those who expected sustained high inflation and decent (if deteriorating) demand indicators across many industries (as I do), the Sept CPI numbers were not all surprising. Economists have a tough time forecasting that many line items with so much happening (from energy to the dollar to tight labor). The inflation out of Services and the stubborn (sticky) line items in the BLS accounts again generated a lot of morning dialogue just as in the August numbers. The release generated wild swing higher from the lows in equity benchmarks. The story in Sept inflation is not a major catalyst for revising general views or adjusting our balanced view. Some CPI lines were reassuring by hanging flat or moving lower, but more lines were negative in the eyes of those who expected positive trends. The more bullish who expected better news are rounding up a lot of adjectives conveying shock and disappointment. The market settled down after a morning fire drill.

For now, labor remains tight, and that in turn brings wage pressure. That translates into an exercise of pricing power and inflation (goods and services). Raw material costs and rising energy expenses from prior periods are realities still working their way across the system via inventory restocking and the cost of sales line. Work-in-process is not an instantaneous working capital cycle.

Cost inputs that flow into inventories and pricing that inventory are not that complicated in theory. The goods get delivered over time (too often delayed). Those goods were attached to contracts/orders that do not get suddenly marked to market to what the next order would be priced at. Think about a furniture store for arguments sake. When the furniture arrives at the buyers’ or intermediaries’ point for subsequent resale to the consumer, the furniture store has a price and margin in mind. The fact that the raw material costs are lower today does not change the product pricing strategy of the seller. They try to get the best price they can.

The goal of any business is to at least cover costs, so if they can pass costs on to the customer, they will. There are many different operating cost lines that are rising, and it takes lasting and more damaging demand destruction to roll that back. We covered those topics in some of the earlier commentaries this past week.

PPI as a reminder on pricing power that will need to be exercised…

The PPI numbers the day before CPI signaled input costs are rising, so the consumer and CPI will be on the receiving end. With a constructive demand profile, that means those with pricing power will use it. Those without pricing power might not be able to use it, but that does not mean they will be bulk ordering pink slips. The old punchline of “it is hard to get good help these days” should be “hard to find reasonable functional help these days” or even “I need a body now!” Labor shortages are feeding more of the “labor hoarding” themes. In fact, it is more than a theme. It is a sound and prudent view for the employers to consider the other side of a recession scenario (i.e., the recovery).

The recession worry also brings the logical business reasoning of “call me when we get there.” Many industries are still starving for labor (e.g., healthcare among one of the biggest components of national GDP at around 18% typically). Loan officers in mortgage businesses are in that proverbial House of Pain, and some dealmakers and banking professionals may have to reel in their vacation and golf budgets. The 50-year low on employment, however, still makes it very hard to frame massive demand destruction “benefits” in lowering inflation without inflicting massive pain from the Fed first.

We took a closer look at more specific CPI line items we have been tracking, and the overall mix was not too much of a shocker unless you were banking on material relief. The headline CPI was basically consistent with August even if the Core CPI surprised consensus. Shelter is climbing on Rent inflation with Services ex-Energy the main line that jumped uncomfortably. One line that has not gotten enough focus is Health Care Insurance (in my view), which has been going off the rails hitting 28% in September. Health Care Insurance is just under a 1% weight in the CPI but usually punches above its weight class as a political topic.