Footnotes and Flashbacks: Week Ending Feb 3, 2023

HY market parallels to 2018-2019 in Macro and bellwether capital goods, autos, and homebuilders in Micro.

This Week’s Macro: Broad index returns, 2019 Déjà vu in HY and IG?, ETF benchmarks, Fed action and UST curve migration, 2Y-10Y UST slope history, Jobs mania.

This Weeks’s Micro: Cap Goods sends signals from CAT and CNHI, GM and Ford diverge, Homebuilder earnings wave tells a story.

MACRO

Below we flag some events or trends that captured our attention this past week. We also frame some cross-asset class and subsector returns.

COMPARATIVE ASSET RETURNS

The chart below frames total returns for benchmarks across fixed income, credit, and the major stock benchmarks.

The Jan 2023 rally into early February has seen no asset class losers across the usual equity and fixed income subsectors that we track. Equities and US HY are clearly performing superbly on a trailing 1-month basis, YTD, and even trailing 3-months. An 8.3% number for S&P 500 and 4.4% for US HY for 1 month tells a story of steroidal “risk on” mentality in the market. Even bitcoin has soared so fast we leave it off our 1-month return chart below since it distorts the scale.

We have seen major pops in equities and US HY in the past coming off steep selloffs, but this one has the unusual feature of a tightening Fed and not a monetary policy that is accommodating market relief and supporting economic expansion. In addition, the US HY market’s deeply negative returns in 2022 and those of US IG was more about the curve in 2022 than the credit risk premiums. The spread contraction YTD seems to be running along with equities and trading through long term medians despite recession chatter and some long-tailed scenarios lurking.

The trends have been favorable for inflation of late, so that is positive. We are seeing low growth but not a sign of recession numbers by any stretch. Employment numbers are better and hit new 50-year lows. The PCE accounts of GDP are holding in, and the job story (see below) makes that sustainable barring major shocks.

Housing ranks as the worst fixed asset line in the GDP accounts, but the moderating inflation story has put some fire under homebuilder equities in the forward-looking view on the sector. As the year proceeds, the market will see some favorable YoY inflation comps to play with for political purposes. The Fed may then rethink their approach.

The 4Q18 to 1Q19 déjà vu?

A recent example for US HY and equities would be the transition from 2018 into 2019. The year 2019 was a year of flagging growth that led to Fed support and three fed funds cuts across the year. That may be the replay people might be pondering on the bullish side. The market had reached peaks in the broad market equity benchmarks in late summer 2018 and then US HY spreads hit a low in early October. Then the 4Q18 turned into a bloodbath in credit spreads with the HY index off the low tick of +316 bps (ICE HY Index) to end the year at +533 bps. As a reminder, the +533 bps was set against a 2.6% UST index and constituted a much higher proportionate risk premium. That was quite a swing.

The 4Q18 experience was ugly and included the last Fed tightening before three cuts in 2019. 4Q18 HY OAS widened for the full quarter by +205 bps (+217 bps off the early Oct lows). This OAS gap included a +104 bps widening in December. The CCC tier widened by +430 bps in Dec 2018 to end at +1,104 bps against a 2.5% 5Y UST yield.

At the time and in retrospect, there was not really a good reason for that magnitude of sell-off in 4Q18 with the exception of a modest Fed tightening of 25 bps (the last of the post-crisis and pre-COVID cycle). There was also a sharp decline in oil prices into the low $40 handles. The stock market was at highs and HY OAS at lows only a few months before.

The strained comparison of today to the 4Q18/1Q19 transition is that the spread wave and equity rally underway now has some similarities. HY spreads rallied 96 bps in Jan 2019 and then another 45 bps tightening in February 2019. We can look at more historical details in other commentaries, but the smoke cleared with a banner year in 2019 for equities (best since 2013), in US HY (spread tightening and duration both won) and US IG benchmarks. US HY and US IG were a dead heat on total return with duration and credit returns ruling in different proportions.

The 2019 home runs in spreads and duration as a 2023 idea…

During 2019, US HY posted a +915 bps excess return and a 14.4% total return with a +5.3% kicker from the yield curve. The 5Y UST ended the year at 1.7%. The IG index weighed in at a +6.5 % excess return and +14.2% total return with around 7.7 points from the UST curve.

The trajectory to get that type of performance in 2023 needs Fed relief (that is a tough sell), a bull steepener of the UST curve (usually reserved for downturns), a clean debt ceiling (it’s possible even if clouded by ruthless, reckless extremism at this point), and sustained consumer resilience (both likely and complicated since that flows back into the Fed and inflation). Equities can do better in such periods than US HY as 2019 also demonstrated. That year was one with all winners. It could happen again, but that is not our base case at all.

Both 2019 and 2022 were weak growth years but still in expansion mode at 2% handle GDP growth rates. The Fed and inflation make all the difference between the two years. For the easing to come from the Fed in 2023 would intuitively require weakness in fundamentals that hits spreads. The main difference in 2019 is that the Fed is tightening now, and the debt ceiling is a fiscal lethal threat. That is a big difference.

Debt ceiling fights were not a worry in 2018 since the GOP had full control from 2017-2018. Then the House swung to the Democrats in the Nov 2018 election. Democratic Houses like to spend (the debate is on what the money gets spent on), so the debt ceiling was not a partisan risk with them holding the purse strings.

The debt ceiling threat is a material difference today not only based on the House party configuration and the relative love/hate relationship with debt, but the current extremes of the party in power in the House. Some of this crowd operates as if the Tea Party had put acid in the bag and left it in the cup too long. As a Boston guy by heritage (born in Dorchester), I always take exception to the misuse of Tea Party in history. We threw the British out in 1775 (through a joint effort heavy on Virginian leaders, some Pennsylvania riflemen, and waves of hard-edged New Englanders from all NE states).

The core swing votes in the House are still likely to surface (we hope) to prevent a default. There are better ways for the House GOP to torture the current Democratic administration without hanging a default around its own neck. The worry is also the more extreme left might be OK with that. To paraphrase that old war quote: “We must destroy it to save it.” That never works. The debt ceiling being off the table might even help justify this risk rally if the Fed cooperates.

Life on the sentiment couch…

The period is an unusual one when equities and fixed income both win in a Fed tightening market with high inflation and central banks hiking in both the US and Europe. Meanwhile, a majority of CEOs in the US still expect a recession. The markets get into rally mode, but the reporting season is not yet spreading a sense of certainty for the cycle ahead. A looming debt ceiling crisis is not new, but the last two in 2011 and 2013 ended well enough in the aftermath.

So far, we would say “stabilization” is more the market theme but with some major industries at a cyclical peak (e.g., capital goods). Some other sectors are still mired in supplier chain problems that have trailing run rates well below peak levels (e.g., automotive). Even autos just posted some good numbers from GM and bad numbers from Ford in a mixed outcome. We look at some bellwethers in capital goods and auto in the MICRO section below.

One certainly does not annualize early year rallies but the combination of factors in the consumer sector, cap goods, and autos are reassuring enough. Homebuilder sentiment has at least turned into a forward-looking mode even if for housing that is 2024. There are at least reassuring signs on near term fundamentals for US centric operations. The situation in Europe was more about the reality on the ground and economic war fallout. The GDP effects have not been as bad as feared in Europe relative to extraordinary bearishness on the way into winter and the energy sector in such turmoil.

ETF subsector returns show some differentiation…

The next two charts highlight returns for a range of ETF subsectors by industry groups. We update these each week for trailing 1-month and also 3-month periods to smooth out the short term volatility. We also mix in some broad index benchmarks with the ETFs.

The 1-month time horizon….

The 1-month returns in the ETF subsectors show last year’s losers for calendar 2022 making a big comeback (see The 2022 Multi-Asset Beatdown 12-31-22). The winners from Energy are diverging somewhat in the above chart with the income-heavy midstream (AMLP) edging ahead of the E&P ETF (XOP) and the broader universe of all energy (XLE). The real leader over the 1-month of the subsector was Bitcoin (BTC), but the scale would get messed up if we included it (38%). The turmoil in crypto gets more than a lot of airtime, and the YTD BTC move is chipping away at its -65% performance in 2022.

The performance formation above is spaced out and reflects some differentiation. With a wide range and asset classes posting around a 7% median for the month, the world is definitely chasing risk. The results are winnowing down the trailing negative return performance since inflation started hammering all asset classes.

The mix of assets in the HY ETF have a lot less of the juicier, smaller and less liquid names than one finds in the index. The BDC index is somewhat of an indirect play on small cap and microcap leveraged loans with high dividend payouts to those at the bottom of the capital structure. There has been a considerable range of performance across underlying names in BDCs, but the steady cash income flows and floating rate asset base have left that mix further on the left than HYG or LQD.

The 3-month time horizon…

The 3-month trailing ETF subsector returns show the winners of the year 2022 from the Energy sector sitting over on the right side in the negative zone. The winter season did not bring the disasters feared as the Russia-Ukraine conflict escalated and supply chains of all types in Energy were dislocated. The E&P ETF (XOP) sits on the bottom for the rolling 3-months with the broad energy ETF (XLE) and a Midstream ETF (AMLP) the last of three in the red during a period when equities have rallied hard.

Over on the left leading the pack are some of the 2022 losers including some highly sensitive to inflation fears and the yield curve pain of 2022. Communications Services (XLC), Tech (XLK), and NASDAQ are the top 3 line items as risk rallied and the UST curve anxiety eased for “long duration” equities. On a side note, “Long duration” in fixed income are mathematically objective metrics. “Long duration” in equities is a euphemism for “highly speculative forward valuation metrics with uncertain revenue streams and expense structures.” “Long duration” equities rolls off the tongue more easily. It is like “normalizing credit quality” which means “deteriorating.”

THE FED AND THE UST CURVE

The above chart updates the Kodiak of all UST curve bear flatteners. There has not been much change in recent weeks even with the Fed hike. The question for 2023 fixed income returns is whether the Fed will start to ease on the front end or at least level off. As we saw back in 1995-1996, the UST curve could also decide to push the long end down into a bull flattener (see Bear Flattener: Today vs. 1994 and Aftermath 10-18-22). We see this as highly unlikely during 2023.

The scenario of much lower long rates and bullish fundamentals in the face of today’s very inverted curve would run counter to what we saw in the backdrop of 1995-1996. That period had low inflation and strong economic fundamentals that pushed the market much tighter and into a cyclical low in credit spreads in 1997. As a reminder, a bad year for risk assets in 1994 gave way to a strong rally in credit but also the best year for the S&P 500 in 1995 during the bull market 1990s.

2Y-10Y UST curve slope trends…

We look at the slope of the UST curve routinely, and not much has happened since the 2Y-10Y was inverted in the low 80 bps handle range in early Dec 2022 (see UST Slope Update: Some New Inversion Highs 12-8-22). The above chart plots the timeline back to 1984. As a reminder, the Volcker years set all-time inversion records, but by 1984 the path to a normal monetary policy was underway with the start of an impressive economic growth period (recession ended 11/82).

As plotted in the chart, the yield curve did not see an inversion period like this during those decades. The April 2000 inversion was during a period when the NASDAQ had just peaked (March 10, 2000 NASDAQ peaked). The fiscal health of the US was much stronger as Clinton and his GOP tag team “partners” in Congress posted a budget surplus. Technicals in the UST market were causing an inversion in part on a shrinking supply of UST bonds. That also made for challenges in hedging positions and distorted spreads wider as UST rallied (rumors at the time hinted some investors were trying to corner the long UST market as supply was pressured).

The spring 2000 period faced the reality of a default cycle that had arrived as the markets would be paying a price for so much dubious TMT underwriting. We have an uptick in defaults now, but that period in 2000 was posting a multiple of current default rates. That spring 2000 inversion was well short of what we see today. The cycle peaked in March 2001 into a muted downturn but a very ugly and protracted default cycle. We covered those cycles in other commentaries.

The main point today is that the inversion has been here for some time, and the backdrop of slowing growth ahead will not change the core of the discussion. The HY market is much higher quality now than in 2000-2001, and the banks/brokers are healthier (mainly because all the large securities shops from that time are gone or part of large regulated banks now.)

That mix of factors are part of what makes it easier to push back on the hard landing theme today. We would also point at the fact that the 2001 recession was the mildest in postwar history despite the most inverted curve in the timeline shown in the chart – that is, until this current curve in late 2022/early 2023.

JOBS, JOLTS, and WAGES

Jobs, wages and inflation keep the Fed in discipline mode…

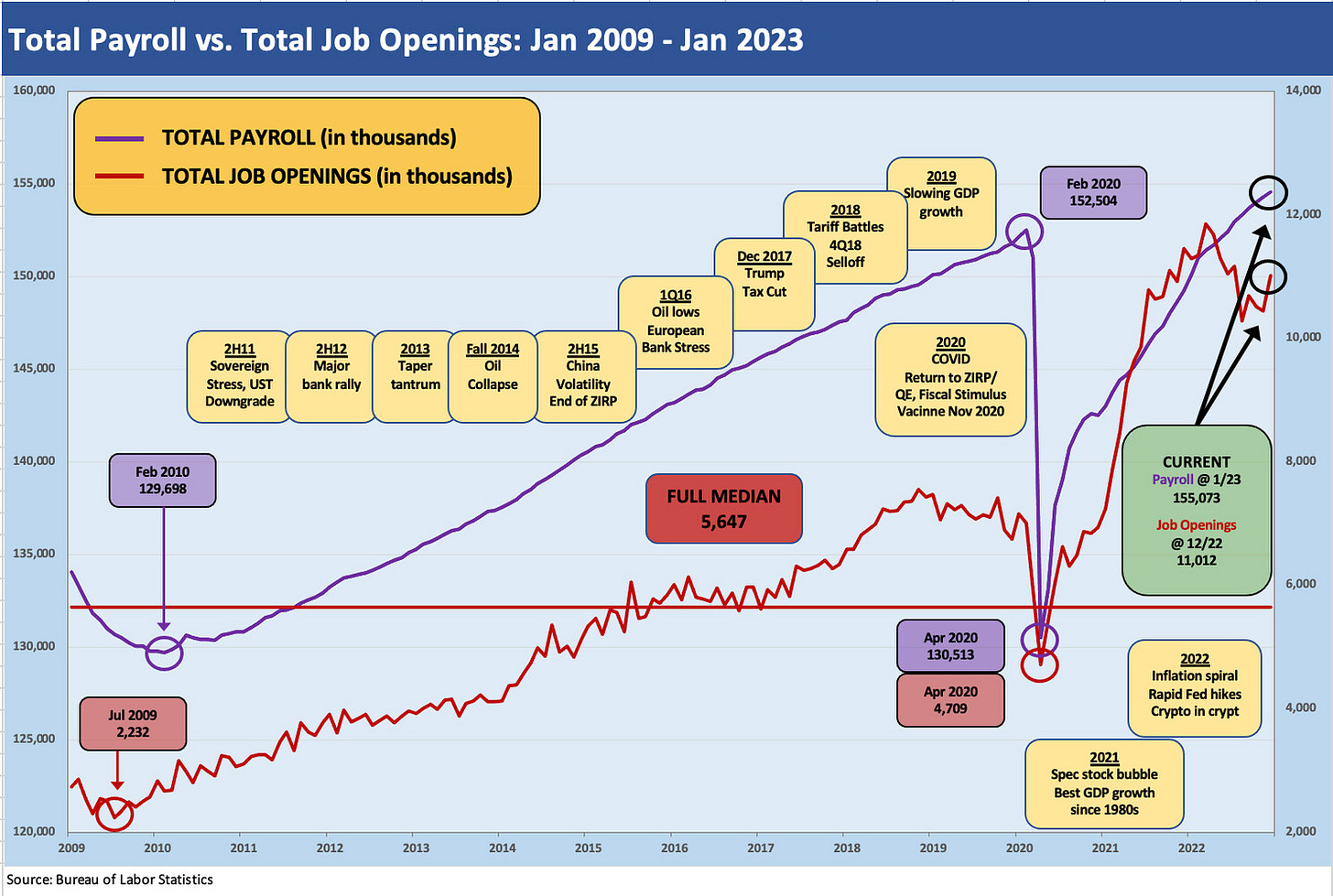

As we covered during the week as events unfolded, this past week made it demonstrably clear that the job market was not stalling yet and in fact was strengthening on the combination of job openings in the JOLTS report (see JOLTS: More Bodies for More Jobs, Demand is Strong 2-1-23) and in terms of what was added during the month (see Jobs: The Human Wave Continues 2-3-23).

The wage trends were moving down from highs in the Dec 2022 jobs numbers. We also saw good news on wages after getting some constructive numbers out of the quarterly Employment Cost Index as well (see Employment Cost Index: Labor vs. Capital…Tide Turning or Swirling? 1-31-23).

The overall takeaway from the recent spate of employment and wage information is that the appetites of employers to hire remains high, and the consumer sector remains healthy just on the body count number on payroll. The amount of paychecks keep rising even if purchasing power per capita is not great. Having a lot more “capitas” on the payroll does not scream recession in aggregate.

The purchasing power in nominal dollars matters for companies seeing demand for goods and services rise. From the standpoint of the UST curve, however, it is hard to make a case that the Fed will be cutting this year unless a lot goes wrong in a hurry. When the next round of CPI data comes out, there will be fresh inputs to sort through, and especially so in the stubborn services categories.

MICRO

Capital Goods

Caterpillar and CNH Industrial as capital goods cycle bellwethers…

The 4Q22 earnings and guidance released by CAT and CNHI this past week offer a good view into customers across a range of key end markets including construction, mining, energy, and agriculture among others. Along with Deere (who is a 10/30 fiscal year with a Jan 1Q23 quarter release ahead), CAT and CNHI rank as the global cap goods bellwethers with Komatsu of Japan. CAT and DE are by far the largest and most valuable with CAT the dominant player in construction and earth moving equipment and Deere the undisputed King of agricultural equipment.

CNHI is more geared to farm equipment as its lead business. Like CAT, CNHI has a concentration more in North America with its history of acquired companies (JI Case with its Tenneco and International Harvester legacy and New Holland with its Ford history). CNHI had spun of its Iveco truck unit in mid-2022. CNHI’s US focus is reflected in its news last week that it will delist from the Milan exchange and list only on the NYSE.

CAT generates more than twice the annual revenue of CNHI and is valued at almost 6X the equity market cap across a more diversified mix by end markets and geographic regions. CAT thus gets more focus for a read on global market conditions. With any recession talk inherently casting doubt on the cyclical Machinery and Equipment markets, CAT in particular can serve as a good bellwether and proxy for what lies ahead. CAT is so big and wide in product reach it is hard to sum up. The results sure did not signal signs of material weakness.

From the chart above, one can see the stock action across capital goods names are not flashing red by any stretch even if last week was a tough one for the equities of CAT and CNHI alike. The lack of bullish guidance was enough for a sell-off, but anyone who has watched CAT’s stock on earnings day over the years gets used to it. The revenue growth of 20% ended on a very strong note, margins expanded for the full year and ended with a 4Q22 best, volume variances were materially favorable, and the financial services unit had very solid credit quality metrics.

CAT sounds no cyclical alarms at all, but 2022 is a tough act to follow…

For CAT, the story lines around where capex cycles could go from here in commodities markets is in the optimist’s camp. That is where inflation has a silver lining for those who want to expand commodity capacity. Margin expansion proves CAT’s ability to deal with inflation in its expense base and supplier chain.

Very healthy free cash flow allowed for a hefty base of shareholder rewards in buybacks and dividends, so CAT’s performance in an inflation-tainted market set the company apart. The margin expansion proves CAT’s pricing power with price realization broken out in its information as the leading driver of their operating profit.

The main takeaway looking back was that 2022 was a great year for CAT with respect to growth and margins. The 4Q22 adjusted operating margins were the highest ever, so the idea of there being not much upside in profit performance is the downside of such a good year. Guidance was tepid in the sense that CAT could not get too bullish on volume when dealers went into inventory building mode during 4Q22. That would be a long shot to replicate.

The tone overall was one of guarded expectations with some optimism around what can unfold in commodity markets with Mining and Oil & Gas wildcards to the upside in the often-unpredictable metals and energy markets. Volume will be hard to exceed in 2023, but pricing will be favorable. Supply chains are more supportive now also.

Nonresidential construction has generated a lot of views since it has so many subsegments from commercial to industrial to energy and mining. Many hear “nonresidential” and they think Office Buildings and Retail. As we covered in last week’s issue, United Rentals gave a constructive view on why a base case can be made for stability and sustained high demand. CAT’s nonresidential markets cover a wide swath where the climate initiatives (from mining to battery factories to chip factories) and infrastructure spending can play a key secular role outside the usual cyclical forces. Nonresidential markets are 75% of revenues for the Construction Industries segment.

The segment top line numbers saw +19% in Construction and +19% in Energy and Transportation in 4Q22. Those two largest segments drive just under 80% of segment revenue (before eliminations). Resource Industries is smaller at around 20% but grew by 26% in sales. That level of economic activity is hard to match in 2023. If the midstream expansion programs pick up pace even faster (pipelines are always a challenge) in the push for more LNG exports, CAT will be a winner there also. Power Gen equipment demand serves such markets as Data Centers as well as Industrial and Energy markets.

The good news for the broader capital goods cycle with all of its diverse end markets is that CAT guided to higher revenue and profits in 2023 vs. 2022. The upside is in North American construction markets. The non-China Asia Pacific markets were called out for growth, but China could remain soft. Latin America is expected to be flat. Middle East will be strong and Europe “uncertain.”

The China X-factor has upside potential on reopening themes and could promise some upside in the regional market but more importantly in mining customers serving China. That said, COVID handicapping is more about the dark arts than reality. Infrastructure bills, energy transition investment, questions around Upstream and Midstream expansion all tend to favor stability or upside for CAT. CAT’s financial services activities also came in strong with the delinquency and charge-off data putting up good numbers. Past due percentages at quarter end were the lowest in 15 years. Write-offs in 2022 were down by 77% vs. 2021. The allowance cushion ticked up modestly at year end at a 1% handle.

The CNHI Ag connection…

CNHI results are more tied to Ag Equipment, and they are much smaller in construction. The CNHI results were quite strong for 4Q22 and the full year. The sell-off in the stock was more linked to guidance. Some theories indicated the planned delisting from Milan exchange prompted some selling, but the fact is that a range of sell-offs last week included Deere and AGCO in the direct peer group serving similar markets. As indicated, CAT also saw stock pressure last week despite a great quarter.

The guidance was underwhelming and caught some grief in the equity markets for being overly conservative, but Deere should help give more clarity to the ag sector market outlook when it reports in two weeks. The product and geographic guidance by unit was heavy on the use of the word “flat” teamed up with negatives and that sent the CNHI equity into a bad day. Net sales guidance targeted at +6% to +10% for Industrial Net Sales with free cash flow +$1.3 bn to $1.5 bn. It is hard to find a good reason for a sharp sell-off even in an off week for cap goods names.

The 4Q22 and FY 2022 numbers were very favorable. Industrial sales overall were +27% in 4Q22 and +21% for FY 2022. For 4Q22, CNH posted a material increase in sales and EBIT margins. Ag sales rose by 29% and EBIT margins widened by over 3 points. Ag EBIT featured the “highest profit in more than a decade.” The growth was 2/3 organic and the remainder deal related.

Construction sales were up by 17% and EBIT margin widened by 110 bps on the quarter. CNHI is not competitive with CAT in profitability metrics, but CNHI is also a free cash flow generator with ~$1.6 bn in FY 2022. The net debt position at year end 2021 swung to a net cash position at year end 2022. Solid sales and margins with healthy free cash flow and net cash position is not a bad way to enter a period of uncertainty. The global food challenge is supposed to set the stage for more investment in the customer base.

Automotive

GM and Ford diverge -- for now…

The legacy Detroit 3 always could diverge in dramatic fashion across the cycles, but there is nothing normal about this auto cycle given a combination of factors. The rise of EV investments and related launches is one major aspect of the new beginning for this industry. The test of the OEMs post-credit crisis cyclical resiliency presents another set of theories that will get checked. The breakeven SAAR rates the industry cited after the massive restructuring of 2009 now faces the onerous investment demands of the EV transition.

The EV capital requirement has given rise to speculation that the EV units of OEMs will get spun off to shareholders. That way, they can be valued on a more speculative set of forward valuation metrics. Then the old school ICE models would stand on their own financial metrics and not be clouded by the heavy expense burden of the transition.

The EV challenges extend from product evolution to establishing the right supplier chain structure for the new vehicles. The new demands for battery production and lithium supply also brings the recycling challenge and the best plan for working with dealers. The EV education process for dealers and related F&I products and remarketing capabilities for used EVs is certainly not a simple subject. The trade rags are filled with commentary on the challenges for the retail end as well as the product part of the puzzle A to Z. The theory is that dealers and their capabilities in services and finance are an ace in the hole to combat Tesla and Musk as they move down the price spectrum.

The stock action over various time horizons as detailed above show very solid performance for OEM equities given the backdrop for auto production, which has been more like recession levels than peak cyclical numbers. We just saw a tick higher in January SAAR rates to more robust volumes.

The supplier chain problems for chips have been one major factor holding back production. The detoured investment capital into EVs without a lot of earnings to show for it today is something the market looks past for now. The growth prospects and valuation tailwinds for EV success is likely to outweigh any cyclical worries for now.

GM lights up the screen with 4Q22 earnings…

The stock chart underscores that there is quite a bit of shifting in the stock performance rankings across various trailing time horizons. Under the “what have you done for me lately?” school, GM surprised the market to the upside while Stellantis and Hyundai are navigating the industry headwinds better across the combination of product launches and supply chain headaches (among the short list of major challenges). GM set the doubters back with its guidance and the market reacted accordingly. Very strong earnings, cash flow, and some cash deployment color on assuring lithium supply got the market justifiably excited.

The full year of 2022 saw GM putting up a record $14.5 billion in adjusted EBIT. The results included some bragging rights on market share performance while investment activity offered GM the opportunity for some pep talk marketing around where they are in the EV evolution. Cash flow is being heavily directed toward EVs and AVs, so the company is in turn jawboning investors to get more bullish on multiples. The worries from the bearish crowd wonder what sort of return the capex will generate as they materially outspend Ford in capex on such programs. “Is it too much in relative terms?” was the question. Time will tell.

GM provided detailed guidance including $10.5 to $12.5 billion in EBIT, cash provided by operations of $16 bn to $20 bn and capex estimates of $11 to $13 billion. The free cash flow frames out in a $5 bn to $7 bn range. When you ponder the size of these numbers and map it across more OEMs who face many of the same investment demands and product segment targets, it gets easier to see how the investment cycle in the broader economy has some tailwinds. These investments are also supported by legislation out of Washington to support a portion of these initiatives.

The GM Financial (“GMF”) part of the picture has the usual concerns the market sees all across the consumer finance universe on what “normalization” means in terms of risk exposure. GMF provides detailed stand-alone slides and strategy outlines, and its own 10K offers plenty of data points as well.

The prime-heavy portfolio offers a good microcosm of a quality lender’s exposures. The real action in auto retail and lease losses will be more in the world of the specialty nonprime and subprime lenders and the expanded lender partners brought in by the independent dealers and used car players. That is a topic to look at as more companies report.

GMF has a weighted average FICO score of 748, and the portfolio is around 73% prime. GMF charge-offs ticked higher in FY 2022 at 0.7% vs 0.6% in 2021 while annualized charge-offs from 4Q22 remain below 1.0% (at 0.9%). Repossessions are only 0.1% of average retail finance receivables, so that is not a major risk factor here.

Losses on repossessions rise when used car values decline, but the employment backdrop is supposed to take some of the edge off repossession fears and residual value erosion from too many repossessions. That does not change the probability of GMF portfolio metrics getting worse whether you call it normalization or cyclical erosion. The delinquency rate of 31-60 days is 2.1% (vs. 1.8% 4Q21), the 60+ days is 0.7% (vs. 0.6% 4Q21), and repossession adds 0.1% (essentially flat to 4Q21) for a total of 2.9% delinquency vs. 2.5% in 4Q21.

GM’s main event is still going to be about EV execution and its continued ability to make its case.

Ford takes a minor wound in the 4Q22 reporting derby…

While GM was getting its blue ribbon on Friday, Ford was getting taken to the woodshed by the equity markets as it ended -7.6% on the day but off the lows. For the week, Ford’s legacy Detroit 3 peers posted the best results with Stellantis (a legacy peer with an asterisk) with GM materially outperforming the group of Ford, Stellantis, Toyota, Nissan, Honda, and Hyundai. STLA ran a solid second on the week.

STLA and Hyundai have been the equity winners over three months as well. In some ways, they are all fighting the same battle around chip and supplier chain stress and EV transition. They all face disproportionately large capex demands for revenues that will not come in scale for years relative to the upfront outlays.

Getting into the weeds on Ford’s headline earnings misfire, production problems tied to the supplier chain issues was a problem in the US and Europe while China is still losing money. Adjusted Automotive EBIT for 4Q22 was weak and concentrated in North America with Europe and China in the red and South America minimal. Ford Motor Credit was down in 4Q22 and materially so for FY 2022. The good news is that adjusted free cash flow was strong. During 2021, the auto operations did receive an outsized distribution of $7.5 bn from Ford Motor Credit that declined substantially in 2022 to $2.1 bn.

The swing in Ford Motor Credit (“FMCC”) earnings was enormous at a $2.5 billion negative YoY decline. The 2022 FMCC earnings was only $349 mn below FY 2020. The expense demands for provisioning (after booking profits on credit losses in 2021) added up. As we discuss below, the 2021 used car market brought some financial positives that were highly unusual for those engaged in leasing, used car sales, or in car rental among others.

FMCC booked a lofty $4.5 billion net income in 2021, but that declined to $1.99 bn in 2022. The Ford FMCC earnings come with some moving parts in the trend line around loss provisioning that needs some additional consideration. Distributions to Ford Motor were down to $2.1 billion from $7.5 billion in 2021 and $3.3 billion in 2020.

FMCC included the following in its 10K: “We expect full year 2023 EBT to be about $1.3 billion, down about $1.1 billion, primarily reflecting unfavorable lease residuals and credit losses and the non-recurrence of derivative gains. We do not expect to pay distributions to our parent in 2023, reflecting anticipated growth in receivables.” We have been down this path before on cash flow upstreaming to the parent companies with the major auto names. The earnings outlook for FMCC is under pressure and it appears it will not be a major source of cash flow to Ford Motor in 2023.

Ford Motor Credit drives home how the accounting line items leave a lot of room for (completely legit) and GAAP-compliant massage therapy. During 2021, FMCC booked $310 million in income for its credit loss provision (as in not expense) vs. $39 million of expense in 2022 and $828 million in expense in 2020. For the years from 2017 through 2019, that expense line averaged just under $400 mn per year.

Booking income instead of expense is defensible in audits and is not a new experience on the credit loss provision expense line. In a market where people are debating “recession” risk, however, a $39 million expense line for credit provisioning is bold. That swing alone was a $349 mn negative variance in the expense line from 2021, but it is one that will be much higher in periods ahead.

Another favorable expense line that exploited the super bullish used car market valuations was the operating lease depreciation rates in 2021. Those declined by over $600 million and bolstered the 2021 bottom line. That same depreciation popped back up in 2022 by $544 million and hit the bottom line as used car economics started to move back into a rational relationship vs. new as 2022 wore on. The combination of the lease depreciation expense effects and credit losses on receivables was a negative expense variance of $893 million. It adds up as the assumptions and estimates swing around.

The moving parts of the income statement on asset quality do not signal major problems during 2022, but the sequential trend does hammer home that normalization (aka deterioration) of credit quality is underway. The loss to receivables metric is very manageable at 0.11% for the year but ended in 4Q22 at 0.25% or a multiple of those posted in the first two quarters. Reserves as a % of end-of-period Receivables were down to 0.82% from 0.96% in 2021 and 1.18% in 2020. In other words, FMCC will be adding a lot to reserves in periods ahead to get them back up to a bigger cushion.

Ford’s expectations for 2023 include a mild US recession and moderate European recession. They expect a sharp decline in FMCC as detailed above and are clearly anticipating (and hoping) for better supply chain conditions to hold during the year. Adjusted free cash flow will be down to $6 bn from $9 bn. Capex will climb to $8 bn to $9 bn from $6.5 bn. Ford has a lot on its plate as do all the OEMs. Getting back to investment grade in 2023 will be an uphill battle.

Housing

The homebuilder earnings season has not stalled the stock rally…

The past week saw a slew of earnings reports from the major builders with earnings releases from Pulte, NVR, Meritage, and MDC among the larger builders and Century Communities and M/I Homes among those below the Top 10 in the stock chart.

The homebuilder equity list materially outperformed the market again last week for various reasons even in the face of what will be continued bad YoY numbers from the top down in starts and home sales (new and existing). Rising jobs, easing rates, and creative homebuilder incentives have tag teamed with the longer-term realities of a housing shortage to keep buyers in the game as this year wears on. This could help housing perhaps duck a hard landing.

The YoY math for inflation is on the side of the more optimistic around inflation. The things that can go wrong are things that can go very wrong (think debt ceiling), but that problem should be resolved (or the Congress disaster will be upon us) one way or the other before the summer peak for home sales. The “crazy extremist” X-factor has to be put in portfolio context anyway, and the builders have impressive cash flow profiles and flexibility in a way that many industries do not.

The moderating of inflation has changed the forward-looking mentality around builders as the yield curve threat eases somewhat with mortgage rates now sitting on top of 6%. As covered in numerous commentaries, the high 5% to 6% mortgage rate zone was what the market saw in the 2005 housing bubble peak. Then the battle is about price and what builders can design and communities they develop for a reasonable profit margin and acceptable price to the buyer. The challenge of late has been about managing the suddenness of the mortgage spike for communities in process and contracts in hand and prices that are on the table.

As we have covered in some other commentaries, the strength of the homebuilder equities after a very tough period in early 2022 has been remarkable. The worst of the pain for homebuilders in equity markets was in January 2022. Looking back over the LTM period, we see only a single builder in the Top 10 builders by market cap (MDC) underperform the broader market. None of the names shown underperformed over trailing 6 months, 3 months, or YTD.

Each builder has their own distinct set of operating profiles across price tiers, regions and financial policies, but most major issuers have demonstrated their financial resiliency over time. The builders have shown their ability to adjust quickly to conditions given their high variable cost (read “low fixed cost”) business lines where weaker markets generate cash even if earnings suffer.

Below we offer a few highlights from the latest round of releases:

PulteGroup: The #3 homebuilder posted very strong 4Q22 numbers with impressive revenue and earnings growth and sharply higher average selling prices and higher margins to go along with lower leverage. PHM delivered 28.8% gross margins and net debt to cap of 9.6%. That is a rock-solid credit. With unrestricted cash + inventory at 6X notes payable, that is a very low financial risk profile.

PHM stock was a big winner this past week and has been delivering very strong performance and playing catch-up with leader D.R. Horton, another top name that has IG rated bonds and a bullet-proof balance sheet. PHM posted Average Selling Prices (“ASPs”) of $571K (up 17%) but new orders declined 41%. We see over 40% of closings overall are in Florida and Texas and 60% of closings if we add in the other Southeast states.

NVR: NVR was one of the only “zero worry” homebuilders during the crisis as it ran a cash rich, low debt balance sheet. The history of the company as “option heavy and land lite” kept risks low and made it one of the strongest equity performers in bad times and across cycles. NVR essentially traded off margin for lower risk through a heavy use of land options (“finished lot purchase agreements). That approach has been embraced by more builders during the post-crisis housing cycle since it worked so well for NVR.

The company’s performance has earned a following and the right to not do earnings call. They earned being cocky by way of the housing crisis performance. The disclosure is good, and the results are consistent. The company’s cash alone is almost 3X notes payable. Cash + Housing units under sales contracts with customers are 4.5X debt. New orders were down 27% in 4Q22. Average selling prices were up 9% to $464K.

Meritage Homes: MTH also posted a strong stock performance week behind only PHM of the four cited here among the Top 10 builders. MTH’s 4Q22 themes sounded a lot of similar favorable notes with higher volumes in 4Q22 (+29%) and higher average selling prices (+3%) to $437K.

The negative noise was also evident. MTH saw gross margin compression on rising incentives with gross margins down to 25.2% in 4Q22 from 29.0% in 4Q21. We would expect to see more of that in the coming periods as more competition for a declining homebuyers base and more challenging affordability erodes pricing power. These gross margins that the market has seen are very high in historical context. MTH is guiding to 21% to 22% gross margins for 1Q23.

Total sales orders were down for MTH by 46% with a high mix of entry level buyers at 89% in 4Q22 vs. 82% in 4Q21. The cancellation rate was 39%. Net debt to cap was 6.8% at year end with total debt to cap at 22.6%. MTH is in a very strong financial position with cash and real estate at 4.6x senior notes. The operating risk is higher here with a spec-heavy mix of homes in inventory.

Given the traditional customer base, mortgage rates play a bigger role with MTH than some other builders. The company bills itself as an “affordable spec builder” so the job headlines and rising wages are a good macro signs for MTH if sustained. The strategy of focusing on move-in ready specs when many other builders do not have inventory is a strategy they embrace. It is also one to watch closely for how they execute.

MDC Holdings: The past vs future dichotomy continues with MDC, who cited FY 2022 as one of the best in their history. Unit deliveries were down (-4% to 2,554), but average selling prices (+8% to $582) rose in 4Q22. Revenues in turn rose on the greater ASP impact by 4% to $1.49 bn.

The future question marks come with the 55% decline in gross orders and cancellation as a % of beginning backlog increasing to 24.6% from 8.7%. That makes a statement on mortgage rates and buyer fears of being underwater if mortgage rates do not turn around. Gross margin for MDC was squeezed slightly to 22.4% from 23.1% for the year with 4Q22 gross margin really feeling the pressure with a decline to 15.0% from 23.5%.

So where is the housing recession?

It sometimes gets to be a challenge to look at the quarterly earnings results of the major homebuilders and reconcile strong revenues and earnings with the YoY plunge in starts as well as the scary headline on mortgage rates. As we have covered in recent commentaries, the sequential action has been more constructive and mortgages rates have trimmed back to around 6.0% with some quotes even just below the cusp at high 5% handle seen in some of the trade rags.

The timing of contracts under build-to-order and the long lead time for working capital and customers occupying their homes makes the wild action along the yield curve, at the Fed, and in inflation metrics seem so fast when the homebuilding process and closing seems to move at a glacial pace. That reality shows up on the very strong revenue lines, pricing, and profitability of the homebuilders.

Beyond the good quarterly numbers on the income statement, the crosscurrents show up in high cancellations rates, creative incentive programs, mixed pricing strategies by builders, and downward land spend trends. The companies are preparing for a very slow period of new business ahead unless the economic forces turn more in their favor.

Mortgage rates and jobs and wages and how that dovetails with home prices gives all parties a fresh game clock into 2023. The builders will need to see how much they want to eat on their options and how they want to plan new communities with a sound pricing strategy.

The customer needs to make decisions on whether to buy at higher mortgage rates with a view to perhaps refinancing later. Some will pay cash and exploit the lower prices ahead. Failure to buy the home now could mean it trades away to someone else. Buying a home is an emotional decision and a family planning issue in many cases (town, school system, relationships, etc.).

A 6% mortgage rate is not that high at all looking back before the credit crisis. Homes in good areas generally appreciate, so a few incentives here and there can make a difference. Builders figure these things out and lower materials costs and some changes in design can make the next community competitive in a 6% mortgage environment. They are usually just loathe to undermine pricing structures for communities completed and in an ongoing selling process.

The pressure to adapt strategies will be subject to the swings in inflation, the monetary policy reactions, and what surprise the fiscal chaos in Washington will bring. These companies have become used to challenges and how to react.