Durable Goods: Playing Defense

We scan the durable goods release columns for MoM trends in new orders, shipments, unfilled orders, and inventories as the ex-Defense line starts to weaken.

Durable goods orders are trending towards soft as headline growth barely turned in a positive month but was negative on an ex-Defense basis for a second month in a row.

Unlike the previous month, when we saw continued low order volume from fallout in the nondefense aircraft sector weigh heavily, this month’s results show much broader weakness in the moving parts.

As the crow flies, durable goods orders are still below where we started the year and modestly below last May. Even if Boeing is the main driver of the decline, that is still less dollars and less activity along the supplier-to-OEM chain.

Shipments posted a negative month after a strong April as the pullback in aircraft spending flows through to the shipping numbers.

Headline durable goods orders reported a barely positive month propped up by defense spending in the wake of April’s foreign aid bill. The good news is that these past few months have shown steady recovery off the very rocky start to 2024. The not-so-good news is that durable goods orders are still below the beginning of the year and almost 6% down from the high-water mark set last November. The industrial production numbers for May (see Industrial Production May 2024: Capacity Utilization 6-18-24) saw an increase to the Durables line, so the recent orders trend has not flowed through to industrial production numbers just yet.

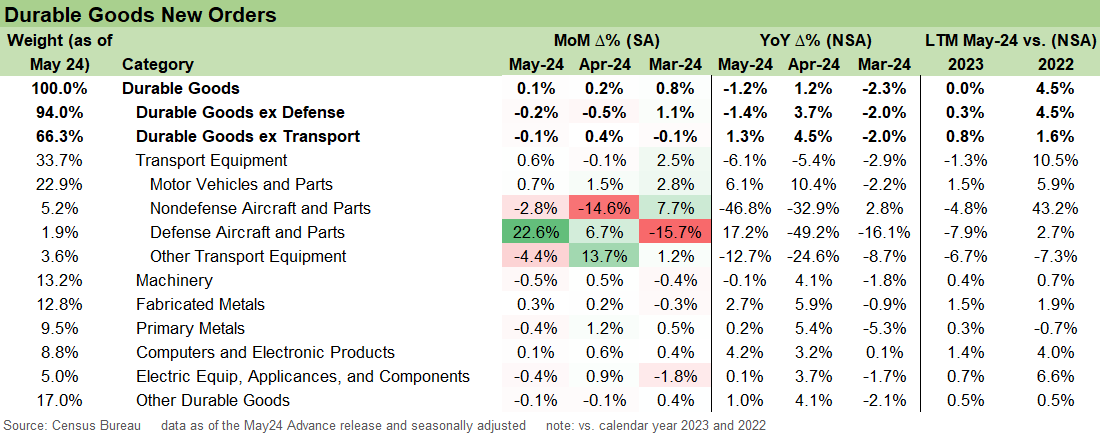

The above chart gets into the weeds of the line items and the major “Durables ex” cuts that accompany the headline number. Both the ex Defense and ex Transport numbers are negative this month, underscoring more of the broader softness when considering the impact of April’s foreign aid package. As we look over on the right-hand side of the chart though, the LTM results (Not seasonally adjusted) show a different picture as the headline is flat vs. 2023 as the non-transport related sectors have held up well.

There is no surprise that the Nondefense aircraft and parts line is in the red, but this month also sees Machinery, Primary Metals, and Electric Equipment lines with modestly negative MoM results. A bright spot in the release is the continued strength in the Motor Vehicles and Parts line that sits at an all-time high after three strong months.

This last chart above covers the shipments piece of the puzzle. Shipments were down across the board this month with only Motor vehicles positive.

The overall May 2024 results are mixed and starting to show a few more cracks outside of more localized stress to the aviation industry that dominated headlines in 2H23. This month was once again carried by the defense spending lines and is not the most durable source of order demand even if recent times may indicate otherwise.

See Also:

1Q24 GDP: Final Cut, Moving Parts 6-27-24

Footnotes and Flashbacks: Credit Markets 6-23-24

Footnotes & Flashbacks: Asset Returns 6-23-24

Footnotes & Flashbacks: State of Yields 6-23-24

Consumer Sentiment: Summer Blues or Election Vibecession 6-14-24

Income Taxes for Tariffs: Dollars to Donuts 6-14-24

HY Spreads: The BB vs. BBB Spread Compression 6-13-24

HY Spreads: Celebrating Tumultuous Times at a Credit Peak 6-13-24

FOMC: There Can Be Only One 6-12-24

May 2024 CPI: I Feel Good, Not Sure That I Should 6-12-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-11-24

Thank you Mr Calhoun. Glenn do you think that if Boeing gets it together that it could lift the entire pile of data back into green (wonder if production can ramp fairly quickly or like 1 extra airframe per month for the next 2 years kind of schedule) and would that be a good thing for rate decisions or a bad thing and maybe it is time and place dependent.

Thx