Footnotes & Flashbacks: Asset Returns 6-23-24

This week, we break our Footnotes into 3 separate commentaries: Asset Returns, State of Yields, and the new Credit Markets.

Is today the "Migrant League" fights?

We look at comparative running asset returns updated for the most recent week with equities posting a more modest week for the mega-techs, the small caps and Dow positive, but duration feeling another slight adverse move.

We add the short duration UST ETF 1Y-3Y (ticker SHY) this week to raise the number of our benchmarks and ETFs that we track from 31 to 32.

The 1-week scoresheet weighed in with a heavily positive week at 25-7 after a few mixed weeks while 1-month and 3-month stayed more balanced across negative and positive, and 1-year is still at 30-2.

We saw 4 of the 7 bond ETFs in the mix posting negative weekly returns, but we see all 7 bond fund ETFs in positive range for the 1-month with 3 of them in the top quartile. The 3-month horizon also shows all 7 positive with all 7 in the second quartile.

The above chart updates the returns for the main high level benchmarks we watch in debt and equity. The debt markets have been performing well for the rolling month, and we cover a range of bond ETFs in the section below. The UST posted a muted move higher this week as we cover in our separate Footnotes publication in yields (we will post that later today).

The UST curve saw a slight steepener this week with 2Y UST +3 bps, 10Y +5 bps, and 30Y + 5 bps. That slight shift was a net negative for duration in a much quieter week than we have seen of late. The debt benchmarks above are all positive for 1-month, 3-months, 6-months and 1-year. The 6-months UST return is now at 0.0%.

For equities, the Dow got off the floor this week with +1.5% after some choppy periods as did the Russell 2000 at +0.7% for the week, but it was not enough to climb out of a negative hole for the month. The S&P was slightly positive on the week and hit a record after moving above 5,500. We wonder if the debate this week will bring up stock markets. It does not play well to the left and the right will say “it is because we will win.” The debates can be important, but it tends to be more zoology than economy.

The above chart updates our 1500 and 3000 series, and the numbers are fading in the trailing 1-month period with only Growth still running strong. As we cover in the ETF/Benchmark section further below, the Midcaps (MDY) and Small Caps (RUT) are in the red for the 1-month period as tech runs ahead, but we see some fade in the SME sector and weakness in some key sectors such as Real Estate, Financials, Industrials, and Energy. Small caps especially have had a struggle and much of the small cap 1-year returns are concentrated just in the month of Dec 2023 (see Footnotes & Flashbacks: Asset Returns 1-1-24 1-1-24).

The rolling return visual…

In the next section we get into the details of the 32 ETFs and benchmarks for trailing periods. Below we offer a condensed 4-chart view for an easy visual before we break out each time period in the commentary. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

We just increased the tally from 31 to 32 with the addition of the UST 1Y-3Y index (SHY) for another bond index with a short duration flavor. The hope/expectation for an end to the very steep inversion from 3M to 5Y lives on, and SHY would capture that over time. If the inversion does not shift soon, that could mean bigger problems if we get into 2025 with no cuts and looking at what variables might be driving that (inflation stays stubborn, inversion flattens from the long end, etc.).

The above chart shows some rational balance for the 1-month and 3-month mix in the midst of a protracted tightening cycle, record highs in some large cap stock market benchmarks, and UST rates that are handicapped as being at peaks with a downward bias (even if that is no certainty).

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

The above chart allows us to track some headline mega-names and see which might have wagged certain ETFs or the broader capitalization weighted benchmarks. We line up some of the major large cap Tech-centric names in descending order of total returns for the most recent week.

We include the S&P 500 and NASDAQ along with the equal weighted NASDAQ 100 Equal Weighted ETF (QQEW) and the S&P 500 Equal Weighted ETF (RSP). A table of the big tech names from the Mag 7 to the broader collection of “headline types” streamlines the weekly review if one of the big ETF names is impacting performances.

The past week was a mildly tepid one for the NASDAQ as it was flat on the week. We saw 3 of the Mag 7 in the red (Meta, Apple, NVIDIA) with Amazon on top at just under 3% and Tesla trying to fight its way back into a more respectable set of returns.

The 1-week returns weighed in at 25-7 positive with bond funds comprising 4 of the 7 in red with the longer duration fund the worst of the pack with the 20+Y UST ETF (TLT) weakest at third to last and IG Corporates (LQD) 4 off the bottom with the UST Index (GOVT) and Agg Index (AGG) also in the red. The short UST 1Y-3Y ETF (SHY) edged across the line into positive range with EM Sovereigns (EMB) and HY (HYG) at under +0.5% for the week.

The top quartile was a diverse mix of sectors and includes numerous recent laggards including Transports (XTN) at #1. XTN sits near the bottom for 3-months and LTM. Midstream Energy (AMLP) and Energy (XLE) were in the top 5 with Regional Banks (KRE) and Financials (XLF) also in the top quartile with Industrials (XLI) and Midcaps (MDY).

With the Mag 7 and large cap tech showing relative weakness, the Equal Weight S&P 500 (RSP) beat the market cap weighted S&P 500.

The 1-month horizon was 14 positive and 18 in negative range. The 1-month period is finally starting to tell a favorable bond story with 3 of 7 bond ETFs in the top quartile and the remaining 4 bond ETFs in the second quartile. The long duration UST ETF (TLT) was #3 on the month with GOVT #7 and AGG #8 of the 32 lines. LQD at #9 and HYG at #10 are right there with the short UST ETF (SHY) and EM Sovereign in the second quartile.

Base Metals (DBB) has dropped into last place on the right after some recent commodity excess starts to fade while Regional Banks are one off the bottom as the real estate cloud and fear of more headlines rule. Energy is always volatile, but we see Energy (XLE) and E&P (XOP) in the bottom quartile. XLE and XOP have underperformed the S&P 500 YTD while Midstream (AMLP) with its high cash income component in returns has outperformed its energy peers and is in the mix with the broad market benchmark (S&P 500) but well ahead of the Equal Weight S&P 500 (RSP).

We highlight that small caps were in the bottom quartile for the month and midcaps barely made it into the third quartile and were negative. That long tail of small caps has struggled across the record highs for the large cap benchmarks.

The 3-month horizon shows 18 posting positive returns, one ETF (QQEW) rounds to zero (positive beyond 2 decimals) and 13 negative. We highlight that the 7 bond ETFs are all positive and all made it into the second quartile. That comes despite zero FOMC easing to date.

The most interesting in the mix to us is the Homebuilder ETF (XHB) sitting on the bottom at -7.3% as the valuation run on builders (+34% LTM) is fading on slower growth expectations ahead and stubborn mortgage rates. The rest in of the names in the bottom quartile have been frequent visitors with Transport (XTN), Energy (XLE) and E&P (XOP) along with small caps (RUT) and Midcaps (MDY) remaining weak. Regional Banks (KRE) have bounced around the rankings quite a bit but have not found stability since March 2023.

The top quartile offers a fair amount of tech centric exposure with the notable exception of Base Metals (DBB) at #1. The top line items mostly show a tech heavy mix including the Tech ETF (XLK), NASDAQ (IXIC), the S&P 500 with its Mag 7 numbers, and Communications Services (XLC). The BDC ETF (BIZD) has defied a lot of skeptics this year on the credit cycle and the floating rate feature as the front end of the UST stayed high and the asset quality broadly steady even without giving weight to the additional feature of structural seniority and liens for the dominant portfolio concentrations.

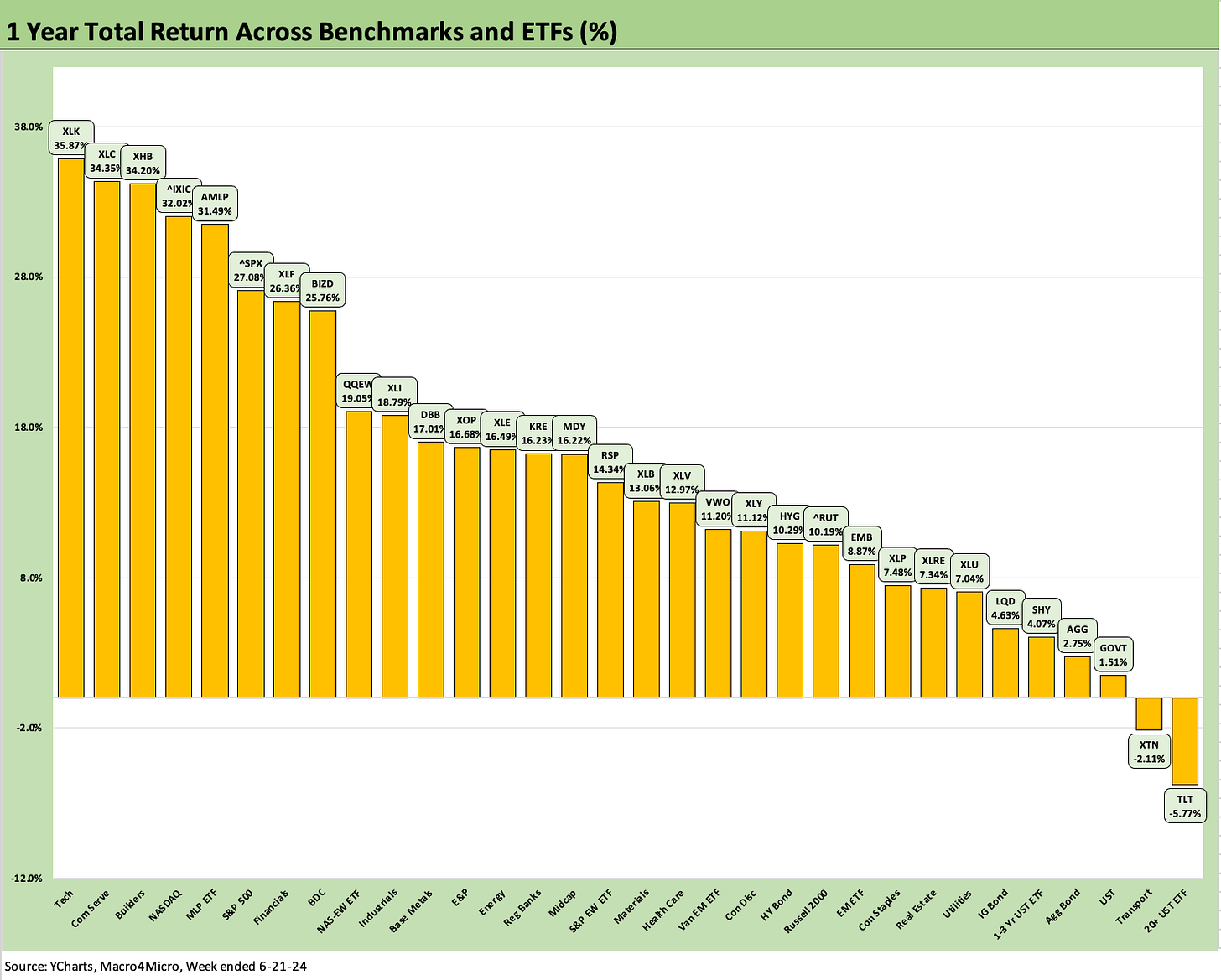

The 1-year time horizon still sits at 30-2 with only the long duration UST (TLT) and Transports (XTN) in the red. We see 5 of the 7 bond ETFs in the bottom quartile with HYG and EMB making it into the third quartile. The most impressive aspect of the 32 bars is that 22 are in double digits. The highest performer in the bottom quartile was the Real Estate ETF (XLRE) at +7.3%. For a bottom quartile performer, that is not bad news.

For the top quartile, we see 4 with strong tech influence including XLK taking over at #1 from the Builder ETF (XHB), who fell to #3 behind Communications Services (XLC). NASDAQ stood at #4 while the Mag 7 helped keep the S&P 500 in the top quartile LTM. The BDC ETF (BIZD) and Financials (XLF) sitting in the top quartile also offer some reassurance on the market’s perception of asset quality and profitability trends.

For BIZD, the many names with 10% and above cash dividend yields help. The private credit buzz may also help those wondering how careful the managers will be. The BDCs are like a commercial for asset gathering ambitions, so they have an incentive to do well beyond the more obvious ones.

This week, politics will reign, but doubletalk will rain harder…

The week will be at the very least interesting with the first debate gearing up (Thursday 9 pm). The only thing assured will be a high supply of toxicity from both sides. For the economic policy questions, Biden’s age and mental clarity questions will square off with Trump’s inability to state something grounded in facts or concepts on most any major macro topic other than inflation is bad (he gets to that one right even if he ignores the concepts on how we got here). Biden has to show up on game day and Trump needs to check his behavioral excesses and put some dressing on his word salad.

The economics of immigration and the costs and logistics of an 11 million mass deportation program might get some airtime. That is the scale of the peak WWII mobilization with very daunting and negative economic ramifications (see Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-11-24).

We have low confidence that CNN is up to the task of asking for specific clarification on how that will be achieved and asking each candidate to briefly cite the risks to labor, trade, inflation, growth and what the costs would be, etc. Shutting the border has trade risks, but moving 11 million people out of 50 states? That topic and eliminating income tax for tariffs could get downright interesting as topics for these two to navigate.

Immigration is a massive problem, but the question of what is real, what is nonsense, and what is just hateful needs some fleshing out. On Saturday, we just heard Trump recommend a “migrant league” for the UFC to his audience, which was the Christian Conservative Faith & Freedom Coalition. My childhood Easter season memories still are intact, and I always remember The Robe and Demetrius and the Gladiators (see picture at the top of commentary) as mainstays on the handful of channels we had in those days. Easter TV options are not what they used to be (I had 4 priests and a nun in the family, so certain movies were not optional).

I think the Christian crowd listening to Trump on this topic might want to go watch some reruns from those movies. They were made in 1953 and 1954 when a war hero was President, and the Korean stalemate was wrapping. The idea of Romans throwing Christians into the coliseum was about Christian history but also in part a metaphorical attack on recent and emerging dictators (Hitler, Mussolini, and Tojo were recent memories). The new enemy was “Godless Communists” (a common phrase of the time). Stalin (Putin’s hero) had just died in 1953. Senator McCarthy was censured in 1954. Eisenhower signed a bill to add “one nation under God” to the Pledge of Allegiance in 1954.

Maybe I missed something, but Trump invoking the idea of migrants pitted against one another in violent encounters in our “one nation under God” is part Caligula and part Calvin Candie (the DiCaprio character in Django). Sick times. People should pay attention.