Regional Banks Contagion and the SVB Loan Carry Question Feeds the CSFB Panic

Excerpts from Footnotes and Flashbacks: Week Ending March 26, 2023

The bank sector brings another week of crazy and anxious…

The bank turmoil started the week with a new crisis as holder of AT1 bonds were bailed in and zeroed out by the Swiss regulators. Meanwhile Deutsche Bank was drawing the next round of headlines but for nothing specific other than it is a major European bank that had some similar bouts of volatility during times when CSFB was feeling the same heat (notably early 2016). German leaders and Deutsche Bank made a good enough defense. The French were also talking up their banking system health.

The bank chaos leads into a more straightforward path to credit risk repricing ahead in 2023. The mental gymnastics exercise of debating what “kind of landing” was ahead for the US economy was still a real battle before SVB. That was why 50 bps was suddenly on the table (but was gone after SVB). As we said back on 3-15-23 after the regional pain was rolling in: “The fundamentals left the soft-landing crowd with a solid hand, but bank system stress is usually the time to go from “hold ‘em to fold ’em” on balanced cyclical thoughts and expect repricing of credit risk over the coming months” see (Risk Appetites Get Bloodied 3-15-23).

Whether it was 1989-1990 or 2007-2008, when the banks/brokers face funding pressure, bad things happen. The 1989-1990 years have been discussed in other commentaries (see Greenspan’s First Cyclical Ride: 1987-1992 10-24-22). That does not mean we see this as 2007-2008 at all (see Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22, Wild Transition Year: The Chaos of 2007 11-1-22) and we would argue it is not in the same hemisphere let alone the same zip code given the behavior of the banks and brokers at the time. 1989 has more than its share of parallels now that depositors have been spooked and the inflation and rate backdrop is clearly a headwind.

The regional bank problem is stubborn….

Below we update the same mix of regional banks we looked at in the last weekly (see Footnotes and Flashbacks: Week Ending March 19, 2023). We add a trailing week time horizon to the mix. As noted in the earlier commentary, we selected a cross section of banks based on a few different metrics, and the mix was weighted toward banks in single digit billion market caps. We line up the bank equities in reverse order of performance in a “worst first” list for the 3-17/3-24 period.

The period since March 9-10 when SVB took over the screens has been a wild one given that the mass deposit outflow was sparked by one very unusual bank. That systemic anxiety by depositors probably was not on most short lists (or long lists) for a risk-off trigger to start the year. Geopolitics, inflation, energy, asset quality, fear of recession and other scenarios were there for debating, but a push-button run on regionals was not in any discussion I read or heard.

The one-week price action was mixed, but at least we see some of the regionals were able to post a positive week. First Republic was in a class by itself at -46% with a very distant second place for Comerica at #2. The trailing 1-month pain still tells the bulk of the story. We include the Russell 2000 in the mix, and that small cap benchmark was slightly positive on the week but a high single digit negative for the trailing month.

In trying to frame how successfully the week went after regulator jawboning and implementation of the liquidity backstops, we still see market commentators continuing to try to “isolate the virus” of SVB and highlight its distinctive features. We would say the results were still overwhelmed by the deposit fear and the wave of alternative facility use by the banks and a mixed review for Powell/Yellen jawboning. In addition, the 25 bps hike in fed funds gave some more excuses to consider using T-Bills as a cash substitute for uninsured deposits or even Money Markets (despite bank exposure in some of those funds).

Those trying to stake out the position that SVB was uniquely bad in many ways did not help as much as more evidence of government support. The SVB yardsticks on securities exposure and unrealized losses vs. capital were defensible differentiators. The growing base of evidence that the regulators had warned them (and Blackrock had offered their services before the blowup) added to the pile of evidence of negligence and incompetence at SVB. The fear is still pervasive given how many bank equities have been pummeled. CSFB certainly did not help as regulatory seizure was played out in brutal fashion on the AT1s.

The macro checklist of worries from the regionals…

As soon as SVB collapsed and was soon followed by Signature with First Republic starting to hit the skids, the extrapolation of negative scenarios began in logical fashion. SVB was followed immediately by the UST move we detailed last week (see Silicon Valley Bank: How did the UST Curve React? 3-11-23) and that rolled into this past week as the Fed tightened by 25 bps. Tightening and fighting inflation is the top priority for the Fed but now it has a financial stabilization juggling act to do. That could conflict with the QT side of the game plan at a time when banks need to shed some assets such as MBS at SVB.

As investors started to list the ingredients, the checklist of worry kicked in as follows:

Fear of credit contraction by lenders: If banks have worries about depositor nerves and outright depositor flight, the banks certainly cannot afford to get too aggressive in the loan book whether in loans or in unfunded commitments. That means credit contraction, tighter terms, and a need to potentially build liquidity. That hits the corporate sector (services and manufacturing), household balance sheet flexibility, and targets consumers and small businesses alike.

Lower demand for credit: Real estate worries are already here in the commercial real estate sector, and that has been a major asset concentration for small and midcap banks as well as community banks. That could be more an asset quality problem than a loan demand problem, but other areas could see recession game plans revised by potential borrowers as well. If there is worry around recession, inventory management becomes a major priority. That means less economic activity, potentially shelved expansion plans, and perhaps the threat of less aggressive working capital, capex planning, and headcount appetites. Credit contraction is the Econ 101 path to recession.

Self-fulfilling prophecy on unfunded committed lines: Our favorite old expression of “balance sheets main, liquidity kills” fits in with “balance sheets don’t kill people, bankers do.” The stress on lending and liquidity for customers at SVB is still somewhat murky as was the strategic plan there (e.g., asset sales, merger, or liquidation, etc.). The plan remains unsettled. The carrying value of the SVB loan book at year end is more likely to get called into question in a transaction whether on pricing or quality or structure. The same could be true generally if the desire is to do a transaction with a tightening cycle underway, tighter financial conditions generally in the market, and higher odds in the bidding process around a recession.

Questioning carrying value of loans and reserve adequacy: The SVB situation has triggered more second-guessing on the loan book of almost $74 bn as banks and private credit players pour over the opportunities to grow their base of earnings assets in the SVB loan book. Doubts on the cycle might color the view of other regionals who might look to get defensive on balance sheet needs and grow their liquidity by shrinking the left side of their balance sheets while also reducing contingent demands on their balance sheet in the form of unfunded commitments. The risk to easing depositor and stockholder anxiety for the broad bank universe is that interest is low for the loans, and that could make confidence in quality of the asset coverage even lower.

Federal Reserve: 25 bps is not making life easier for deposits…

After all that pressure on deposits from the SVB scare and noise around uninsured deposits, another 25 bps on the short end could find its way back into the money market and T-Bill rates if the market anxiety eases up after driving a rapid front end rally in from the 5% area on short UST bills. 4.5-4.7% on short UST paper is down from close to 5%. In the context of higher yielding equities and many of the CD products out there, the bank-phobic have plenty of options.

For those in the truly panicky category, the inflows out of banks and into money market funds might still be tempered by the bank exposure in many money markets (prime funds). The MMFs tend to be UST-centric now, and that is just a matter of checking on the asset mix. A pure UST strategy is also a viable option. We also have seen the wave of products that are out there that disburse cash into the necessary number of funds that are at the FDIC $250K limit or less based on the entity. Whatever the game plan, there is room to realign deposit holdings near term. It will lead to a lot more action in deposits ahead if we see more seizure and bank volatility.

The European megabanks pile on with AT1 and counterparty anxiety…

The European bank madness of the past two weeks also did not help as investors are now going to start to question the value of AT1, potentially being sellers over time or just staying away from adding. That means more major banks in Europe will need to evaluate plans for the left side of the balance sheet if an important layer of the right side of the balance sheet goes on the “no fly” list for more institutional investors.

The theories will be bounced around and debated, but the middle market and small business lending in Europe is already getting some adverse headlines. Since many of the major European banks have substantial roles across the US credit markets (loans, securities, and derivatives) that also fits into the credit contraction theme somewhere. Just take a look at the signature pages on so many loan documents.

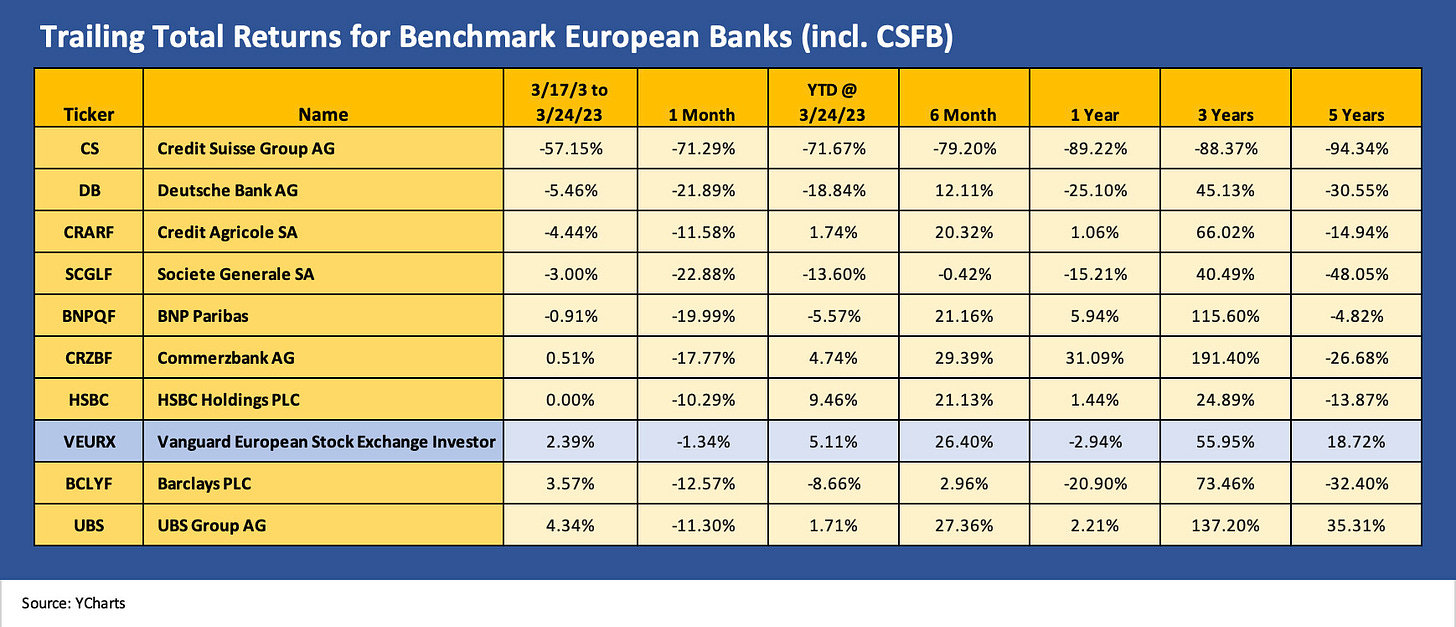

Below we add a trailing return chart for a major peer group of European banks. We stuck with the Germans, French, UK, and Swiss for the sampler (including Deutsche Bank, my employer in the late 1990s). Some of these banks have gone through extraordinary changes over the years and continued to revamp business mix priorities and strategic ambitions.

The shifting strategy was most notably the case with CSFB, but the overhaul got sucked into the undertow of some high profile setbacks. For European banks, here we are with a new headache in the form of an AT1 confidence crisis. CSFB and Deutsche have had their share of volatility down the capital structure with the AT1 turmoil also in the headlines back in early 2016. This one was not only more severe, it was in fact fatal for AT1 holders.

The CSFB implosion over last weekend and carnage in the AT1 sector roiled the credit markets. We would argue that CSFB was a much scarier potential outcome than SVB in that a bank with the business line exposure of a CSFB brings to mind the overriding risk of bank interconnectedness. This would feed the flashback domino fears that come with that counterparty profile. The Swiss made sure that such a contagion was headed off.

The good news as you peruse the stock returns above is that the stock market reaction was mild in the context of the CSFB and AT1 headlines and the attempts by bears to tag Deutsche as a “me too” CSFB. In very general terms, investors tend to have deep faith in the expectation of government intervention in Europe to provide support on the credit side regardless of their protestations that there will not be bailouts. This latest event made a clear distinction in the case of AT1s and used them as bail-in bonds for loss absorption securities as they were designed to be (in theory).

The controversy around preserving some equity value while zeroing out the AT1s has raged in the press all week and the threats of litigation we assume will be acted upon. From a macro standpoint, the effect of the CSFB implosion is to take a big slice of capital support out of the bank system not only in the reduction of credit risk from CSFB but also the retrenchment that will inevitably unfold in the AT1 market in the future. In the case of UBS+CSFB, the sum of 1+1 will not be 2. That again is credit contraction on a global scale.

The focus on keeping banks safe and inflation lower was also on display again the past two weeks in Europe with steady rate hikes continuing to run alongside reassurance by bank regulators and politicians. (We don’t believe the market will be overly convinced.) ECB President Christine Lagarde made clear the two parallel priorities last week of fighting inflation and being vigilant around the banks. There will not be an “either or” plan in the battle against inflation vs. supporting banks.

Generic counterparty fears and domino risks…

Another factor that gets little airtime but which has weighed on bank risk in past periods of extreme volatility is counterparty risk credit exposure. Those counterparty risks get heightened during periods of extreme volatility and especially by major leveraged bets on underlying markets or instruments that move against a trade in dramatic fashion.

CSFB itself had a major blowup with Archegos and Viacom stock on breakdowns in risk management on what was a plain vanilla transaction that had been extended to an “other worldly” scale in early 2021. Another management shakeup ensued. Hedge fund losses have also been on the screen of late around the bank stock pain and bond market volatility. We have a hard time believing we will not be seeing more headlines around hedge fund losses or parties falling down on counterparty exposure.