Employment Cost Index Dec 2023: Compensation Mixed Picture

We look at the Employment Cost Index as it hits an inflation cycle low for 4Q23.

The rally of the UST today comes with a backward-looking Employment Cost Index (ECI) reminding the Fed of higher labor costs with a wide range of 4% handles YoY (not seasonally adjusted) but still trending down sequentially by quarter at new lows for the tightening cycle.

The rolling quarter posted a 0.9% ECI (seasonally adjusted) for all civilian workers during 4Q23, down from 1.0% in 3Q23 and as high as 1.4% as recently as the March 2022 quarter.

Services and Goods producing industries weighed in closely in the 0.9 to 1.0% band for the quarterly period with some outliers in Service-providing industries such as Transportation and Warehousing at an outlier of +3.1%.

The YoY numbers can keep inflation watchers on edge for more lag effects, but the trend-is-friend school can highlight the new lows at +0.9%, the first sub-1% quarterly read for all workers since the market rolled into a tightening cycle.

The ECI is somewhat of an off-the-run inflation indicator, but the ECI came back in fashion with the first inflation spike in four decades. It is released quarterly and tracks compensation cost trends for civilian workers, private industry workers, and state and local government workers. It looks at compensation in total and across wages/salaries and health benefits.

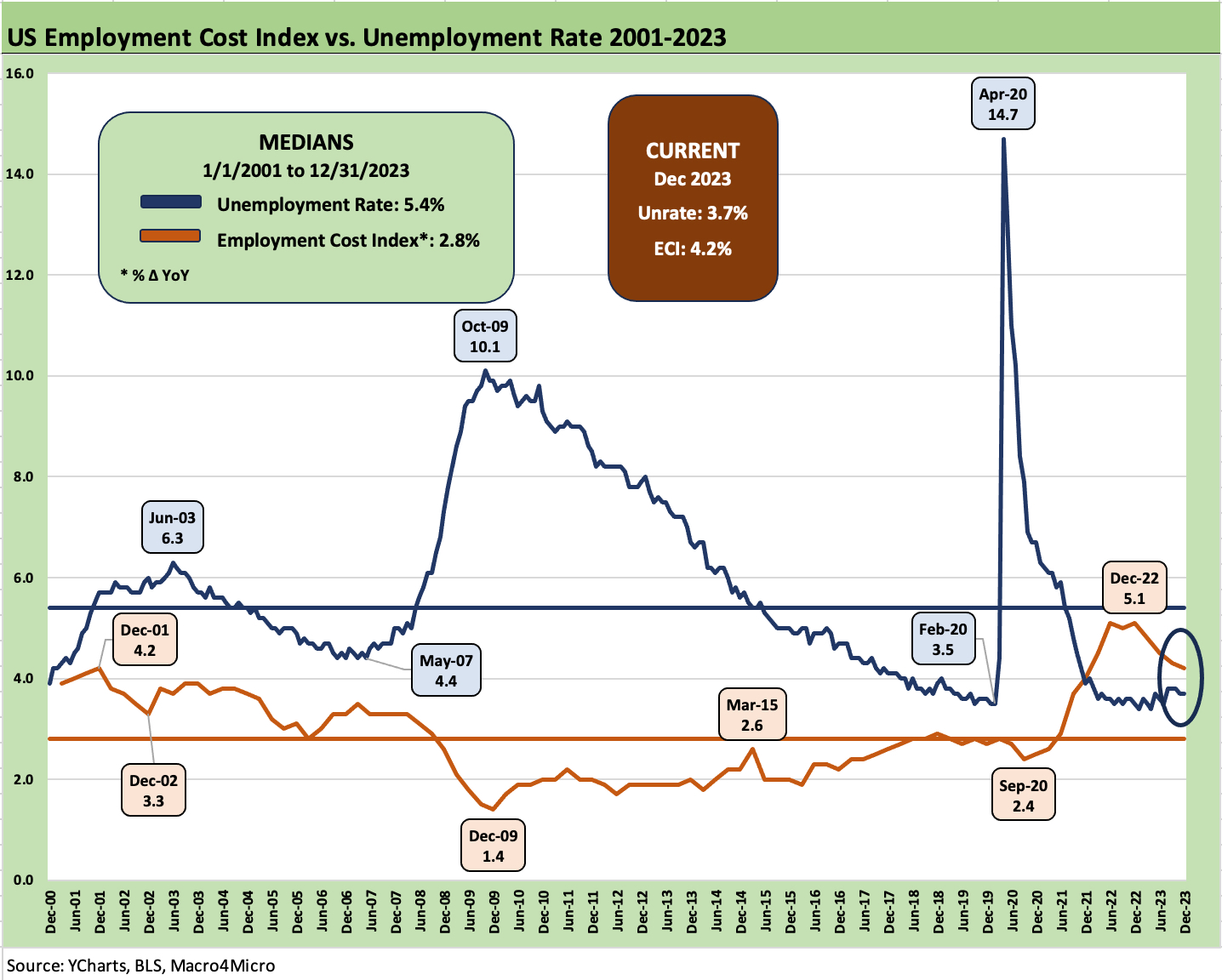

The above chart plots the ECI since the start of 2001 as the muted post-TMT downturn soon gave way to the longest expansion in history to that point. As a reminder, the “official recession dates” ran from the March 2001 peak to the Nov 2001 trough for an 8-month recession. That was before the housing bubble years, the credit crisis stretch, and then on to the Feb 2020 cyclical peak and COVID brought a wild 2-month recession.

It is no surprise that ECI is running hot at over 4% YoY (not seasonally adjusted) based on recent monthly data and notably the headline union deals struck across many industries. On a positive note, at least compensation is now increasing in real terms again for workers as CPI and PCE have come down. Both rising wages and lower inflation presumably played a role in favorable consumer sentiment trends (see Consumer Sentiment: Multiple Personalities 1-19-24).

The above chart plots the ECI index vs. unemployment rates. The tightness of labor in cyclical peaks and low joblessness translates into higher ECI trends as logic (and Econ 101) would indicate. In this market, the question is more about how much higher and whether that will flow into pricing power from Services and Goods providers at a time of fed tightening and inflation fighting. Alternatively, the question could be whether that slows the Fed down.

Failure to pass the higher wages along is supposed to squeeze margins or promote rationalization of operations whether by headcount reduction or through the use of automation or technology as the long-told story on labor setbacks has recounted over the years.

The old-time Newtonian rules are supposed to kick in when real wages rise and in turn the cost structure is impacted. Something has to give in terms of efficiency/productivity or prices or headcount as it all rolls into the income statement.

With the ECI down sequentially and hitting lows with jobs teed up for Friday, the market is voting with the slower economy and “friendlier Fed” school as the UST shifted down today with the 10Y UST down by over -9 bps as we go to print.

In the end, the 4Q23 numbers are favorable based on the sequential trend line, but the YoY 4% handle is a reminder that labor has pricing power as very recently demonstrated in spectacular fashion in some collective bargaining (airlines, autos). Union wages were up 5.4% YoY vs. 4.2% for non-union. The heavily unionized State and Local workers were up more than the Private Industry.

The market awaits the FOMC color later today and payroll on Friday.

See also:

JOLTS Dec 2023: “Little Changed” on Replay 1-30-24

PCE Release Dec 2023: Consumption Strong, Inflation Favorable 1-26-24

Consumer Sentiment: Multiple Personalities 1-19-24

Dec 2023 CPI: Big 5 and Add-Ons, the Red Zone Challenge 1-11-24

Dec 2023 Jobs: Not Feeling the Early Ease 1-5-24

Employment: What 200K Handles on Initial Claims Means (Not Much) 12-16-23