JOLTS Dec 2023: “Little Changed” on Replay

We look at a Dec 2023 JOLTS report that does very little to move the needle on employment trends with the important payroll data due on Friday.

The latest JOLTS data was heavy on a mix of “little changed” and “changed little” with 9.0 million job openings framing up pretty well against the 6.3 million unemployed to start the year (3.7% unemployment) with fresh payroll numbers for Jan 2024 due out Friday.

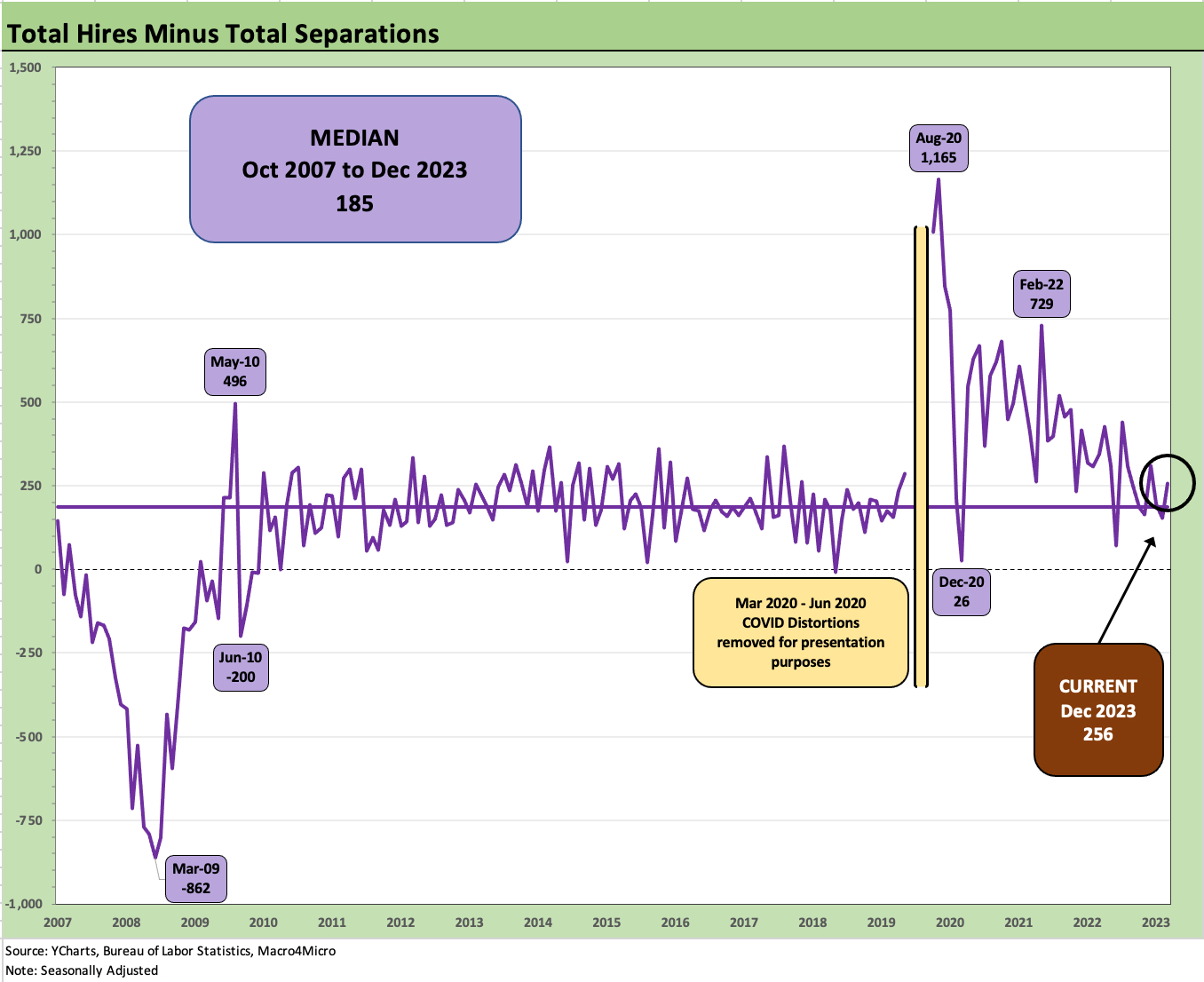

The gap between hires and separations improved sequentially with Hires up and Separations down.

The surveys, financial media flavor, and some facts on payroll retrenchment from companies in earnings season might make the FOMC a bit bolder, but it is hard to find cyclical worries so far in the broader mix of economic releases.

The recent consumer confidence and spending data and guidance (including consumer finance asset quality) is relatively balanced, so the market may see more anxiety around UST forecasts than major consumer sector setbacks.

The above chart plots the job openings numbers since the recession started at the end of 2007. We see the 9.0 million current number, down from the March 2022 peak when the tightening cycle began. With a median job openings number of 5.6 million, the current level holds up well against recent cyclical history. The high point in the Trump years was 7.55 million and the lows coming off the post-crisis early in Obama ‘s first term saw 2.25 million.

The JOLTS data and recent consumer indicators are not signaling much to move the needle on the hard landing probability meter. While that is not something a few escalatory (or retaliatory), well-aimed missiles by the US in the Middle East would not quickly change, lower inflation and rising consumer sentiment cannot be simply ignored any more than a rising stock market and a post-Oct slide in UST rates.

In the recent JOLTS release, I counted 10 versions of “little changed/changed little” in the 2-page summary of the JOLT release before the tables started. We saw one “unchanged” in the form of the “Job Opening Rate” at 5.4% (job opening rate is the job openings number divided by “employment + job openings”). That 5.4% number is flat to Nov 2023 but well down from 6.8% in Dec 2022.

After a banner year of job additions in the midst of 3% handle unemployment rates (see Dec 2023 Jobs: Not Feeling the Early Ease 1-5-24), the market is understandably waiting for the party to come to an end. It takes a lot to move the needle on the scale of the nonfarm payroll that was employed to start the month of January (over 161 million civilians employed at end of Dec 2023). We will get that payroll update Friday.

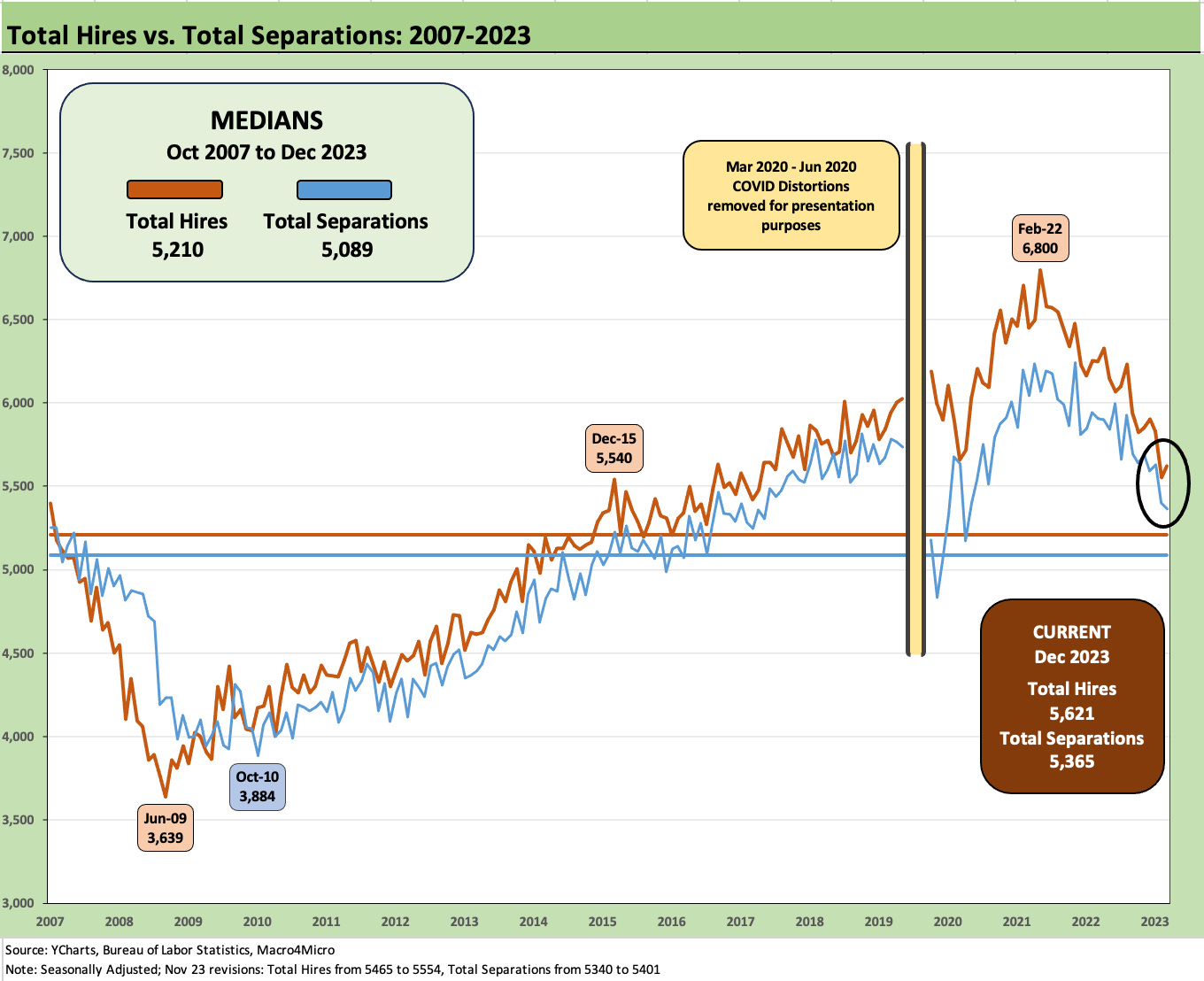

The above chart details the time series for total Hires vs. Separations. We break the chart around the COVID spikes for a better visual on the time series and detail some of the insanely wild swings during the pandemic in the box below. Those swings dwarf the numbers from normal cyclical times, so it was easier to disclose in the text below.

The Hires number for Dec was 5.62 million vs. Separations of 5.36 million with Hires ticking higher sequentially from Nov and Separations ticking lower. Within Separations, Quits ticked lower (see Quits further below) while Layoffs and Discharges ticked higher. That is something the FOMC can put in the “OK to ease” column, but this data is 1-month lagged. The Friday payroll numbers will rule sentiment at this point as the monitoring these days is more about “When does payroll decline?”

The above chart does a brief recap on the COVID swings. The March 2020 Separation total of 16.3 million is one the labor force never wants to see again.

The above chart updates the Hires vs. Separations differential. The most recent set of numbers vs. the medians show the differential comfortably above the median at 256K after dropping below it last month.

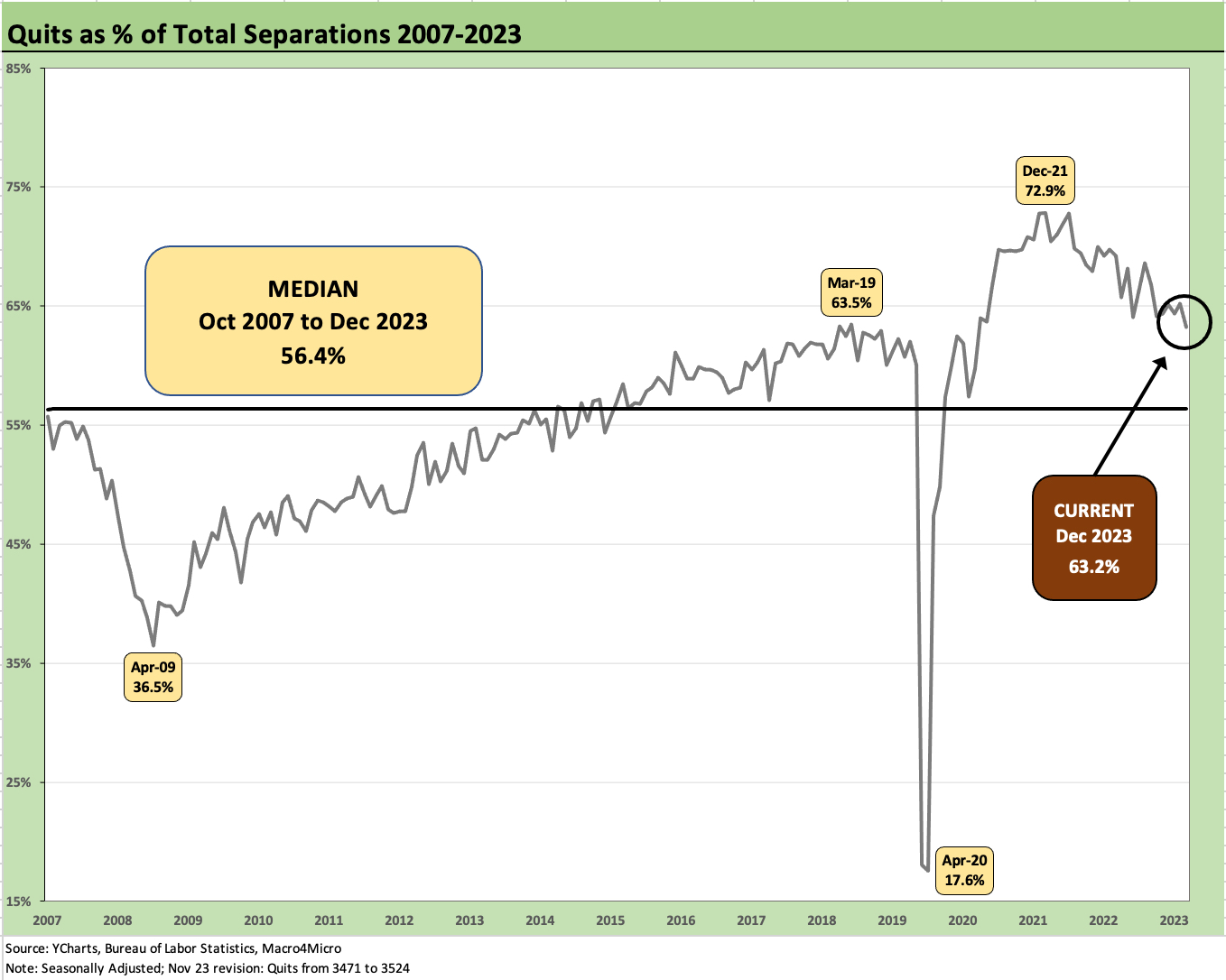

The above chart shows the Quits share of the overall separations. The Quits rate cited each month in the JOLTS data release (Quits % total employment seasonally adjusted) was flat in Dec at 2.2% vs. Nov 2.2% but down from 2.6% last year in Dec 2022. The theory is that declining Quit rates imply lower confidence in quickly finding a job. On a not seasonally adjusted basis, the Quits rate was 1.8%, down from 1.9% in Nov 2023 and down from 2.3% in Dec 2022.

See also:

Dec 2023 Jobs: Not Feeling the Early Ease 1-5-24

JOLTS Nov 2023: Let the Games Begin 1-3-24

Employment: What 200K Handles on Initial Claims Means (Not Much) 12-16-23