Consumer Sentiment: Multiple Personalities

We dig into the Consumer Sentiment numbers that reflect a solid consumer sector with more than a few emotional quirks.

The Jan 2024 Consumer Sentiment Index was up sharply, and that tells the Fed the consumer is still pumped up while short-term inflation expectations declined into 2% handles, both short-term and long-term.

The theory is that lower inflation expectations make it safe to ease, but PCE strength does not help as retail sales showed this week. In other words, the market gets back to the same debate as yesterday.

Looking back across history, inflation has been a sentiment killer with low 50 handles in May 1980 and June 2022 for the sentiment index even running below the credit crisis period of fall 2008.

When you look at the sentiment indicators by political party, you realize we should rename the country the United States of Crazy with the Democrats at 101.3 on sentiment, Independents at 73.2, and Republicans at 57.7.

Whether the consumer is spending because of improved sentiment or higher confidence or to escape their psychological pain (or to stock up on ammo, new age body armor, and bear spray), the PCE line seems to be holding in well with the income and outlays report (and PCE inflation) release teed up for next week.

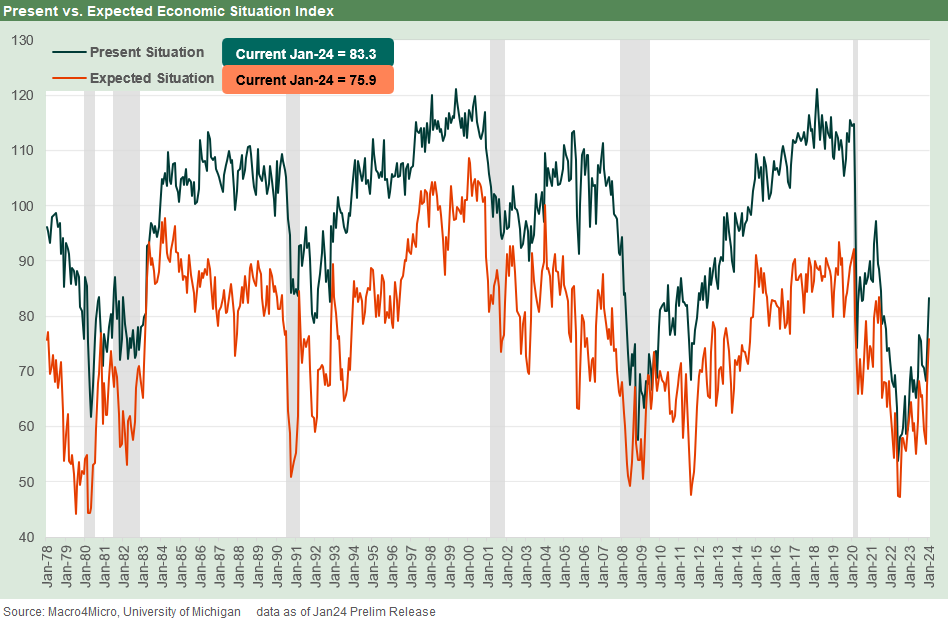

The above chart gives the history of the Consumer Sentiment Index since 1978. That means it cuts across the ugliness of 1979 and the near recession and oil price spike of that year (Iranian oil crisis). We then cut across the stagflationary double-dip recession of 1980-1982 (Volcker inflation fighting, soaring UST rates) and that was followed by the wild 1980s and early 1990s turmoil that saw multiple crises (oil patch collapse, thrift crisis, housing sector stress, securities industry meltdown, commercial real estate crash).

After a frenzy of easing by Greenspan to deal with the 1990 recession and financial sector fallout, the new UST curve profile of the 1990s saw a booming credit-fueled market (banks enter bonds, derivatives crank up, etc.) on the way to a TMT bubble and confidence excess (112 in Jan 2000) before a tech crash and fresh round of hyper-easing by Greenspan designed to ease the consumer plunge to only 81.8 in Sept 2001 (easing also to calm nerves after 9/11). Then came a housing bubble as the credit crisis arrived and drove that unsightly Nov 2008 number (55.3).

This cycle’s sentiment low (and post 1978 low) of 50.0 in June 2022 took the index all the way back below the 51.7 of May 1980. That speaks to how much damage inflation can do to the consumer mindset. The two low points on the chart above near 50 (May 1980 and June 2022) are tied to inflation. Both are modestly below the mid 50 handles of the credit crisis peak (Nov 2008) and the chaos of August 2011 when a few Washington geniuses were saying default was OK (a growing base took that view this past fall, including Trump). Aug 2011 was near default with the risky asset markets feeling plenty of pain with the Eurozone in chaos.

We plot the sentiment index vs. short term inflation expectations below.

The good news is declining inflation expectations have a lot of empirical support, but it will take some more good news in the next few months to keep the consumer on board. As we cited in the bullets, that may exclude GOP hardliners in an election year who want to stir up as much anger as possible even if the job market stays strong and they all get raises and the stock market rises. Then again, that has not happened yet.

New recent highs for sentiment and new recent lows for short term inflation…

The takeaway from the morning’s University of Michigan report was a net positive for how the consumer feels about life, even if the consumer is deeply divided along partisan lines in how they share their feelings and optimism (or their dulled senses and state of anxiety).

The Jan 2024 index number of 78.8 was a healthy jump from 69.7 in Dec 2023, so that bodes well for the propensity to spend and borrow. The latter impulse (to borrow) comes as some names (e.g. Discover) are guiding to a likely material rise in consumer asset quality problems (charge-offs).

The headline index was the highest since 81.2 in July 2021, when the stock market was also smoking hot and “growth stories” were soaring. Some were legit growth stories, and some were ticking bombs in the asset lite services sector burning cash.

The present vs. expected economic situations index is broken out above. We are running at the highest levels for each since 2021. The favorable move in the present economic situation delta was notable. For the Present Situation increase, we see that 10 point moves are rare and have only happened 7 other times before. This was #8. Negative changes of that magnitude are similarly rare, having happened 10 times since 1978. By comparison, an 8+ point move on Expected Situation has happened 29 times now.

The two lines can diverge over the short term when big changes are afoot. We see that divergence when current conditions are very strong (rallies out of downturns, strong markets and growth periods). When concerns lurk around major changes in the economy (regional crises, oil price spikes), or changes in policy governance (i.e., elections), we can see declines in the future expectations. Another problem there is the deep political divisions will bring very intense, divergent feeling now with a lot of seriously inflamed politically driven reactions to any event. And there are many events ahead in courtrooms.

The above chart frames the present vs. expected economic index differentials. These are always tricky as a net number. Two very high and two very low numbers can frame out to a small differential. The current market shows rebounding sentiment but well below prior highs on short-term as noted in the prior chart.

The 83.3 present economic situation index is lower than 2021 peaks but well below the 2019 highs of late 2019 (115 in Dec 2019) or the triple digit numbers from late 2014 through the end of 2016. Of course, Obama’s two terms and Trump’s single term had not yet brought election denialism, rejection of the DOJ, disavowal of the jury system, sacking the capital, rising dictatorship risk, and ceding Eastern Europe to a Stalin wannabe to the sentiment checklist.

Currently, the record payroll, lower inflation, and solid markets (Dow had hit a record high in recent weeks and the S&P 500 did today even if they don’t hold up) should probably matter more in the index scoresheet. For now, the effects of the good news in aggregate at least still trumped the oceans of bile and swirling hatred. So far.

Inflation expectations helping the consumer story and maybe the UST bulls…

The best news was lower inflation expectations even if a strong uptick in sentiment is also good news. The Fed is more likely to pay attention to next week’s income and outlays data than the market’s latest “psychiatrist couch” indicators. I used to watch consumer confidence and sentiment indicators a lot in prior decades, but they always seemed more coincident than leading. The weatherman can tell you it is snowing or sunny or you can look out the window.

What is most striking is the divergence of sentiment strictly along party lines. That will only get worse. We cannot even get people to agree to economic facts in this world. That at least makes it easy to recruit violent meatheads and their collective social circles to barnstorming rallies and then feed off each other. Meanwhile on the left, “millionaires and billionaires” have been in repeat so often that the words have lost their meaning.

Trump has now armed the left with something more real with his Seal Team 6 scenario flexibility and de facto pitch to be above the law without limitations. Even for someone who grew up in a home with Goldwater, Nixon, and even Wallace votes (with his trusted running mate “Bombs Away LeMay”), this is all very strange.

The visceral index will matter more than the economic facts in areas like tariffs (“America First, consumer last” or energy dependence (ignore that record oil and gas production and the record exports behind the curtain) just to name two. The election year will only make that effect worse.

The good inflation news was more about how consumer behavior flows into expectations. The Fed likes to see lower inflation expectations. The inflation expectations ticked lower with short term inflation down to 2.9% (lowest since Dec 2020’s 2.5%) and the 5Y outlook down to 2.8% (lowest only since Sept 2022’s 2.7%). The last time we saw 2% handles in both columns was Dec 2020, when 2.5% was paired up both short term and “next 5 years.”

The above chart zeroes in on a shorter timeline since the end of 2019 for a better visual on how inflation expectations have swung for the more volatile short term indicators from a low in April 2020 to a high in March 2022 and then back below 2.9% now.

Odd but explainable trends in the recent numbers…

Having a job in a country with record payroll counts, rising wages, declining inflation and a freshly minted 4.9% 3Q23 GDP (the advance 4Q23 release is next week) typically would elevate confidence. As history shows, however, inflation will tend to depress a consumer’s mindset for a good reason.

Some of us who were at working age through the late 1970s and early 1980s stagflation remember the unemployment office with its long lines (It was next door to the city’s library and YMCA). The 1970s was also a lost decade for markets with negative real stock returns.

Today, having a home that you own running near record prices and low mortgage rates locked in with a regular paycheck also gives the consumer more time to “bitch and complain” since you don’t need to spend as much time panicking. Thus, the ironies of human nature and behavior patterns (like spending and borrowing) when objectively better times can be scored lower by virtue of an entirely different set of current facts that shape future expectations.

Contributors:

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com