Industrial Production, Capacity Utilization: A Mild Fade

We look at the latest trend in Industrial Capacity Utilization as bulls and bears battle or grapple for a direction.

In a mixed report, the IP and capacity utilization indexes showed a very mild sequential decline for the month but an uptick for 2Q23 vs. 1Q23 and good YoY comps.

Durables were essentially flat and held in better than Nondurables with the more volatile Utilities sector being the only major headline category with a 2-point move lower.

The ISM and purchasing manager metrics have been flagging softening expectations for a while, but the effects have been mild so far in the IP numbers.

While more eyes stay on the critical consumer sector (see Retail Sales: Canary Syndrome 7-18-23), the Industrial Production highs traditionally are associated with the dates when the NBER recession dates and turns in the cycle (even if dated well after the fact). Weakness in the consumer sector can flow directly into order books and production rates for the Manufacturing sector via the Goods line, but PCE has been solid with heavier outlays into Services (see Good (Mixed) News: Sub-4% PCE Wins 6-30-23, 1Q23 GDP: Facts Matter 6-29-23).

As we head into earnings season, we will get a better handle on inventory cycles and end market conditions in the manufacturing sectors and capex and investment effects. That runs from consumer durables and related supplier chains to capital goods end markets such as construction and agricultural equipment. There are more than a few cross-currents for downstream demand with some subsectors showing a mild softening while others benefit from the mega projects that have firmed up construction trends (see Construction Spending: Demystifying Nonresidential Mix 5-9-23).

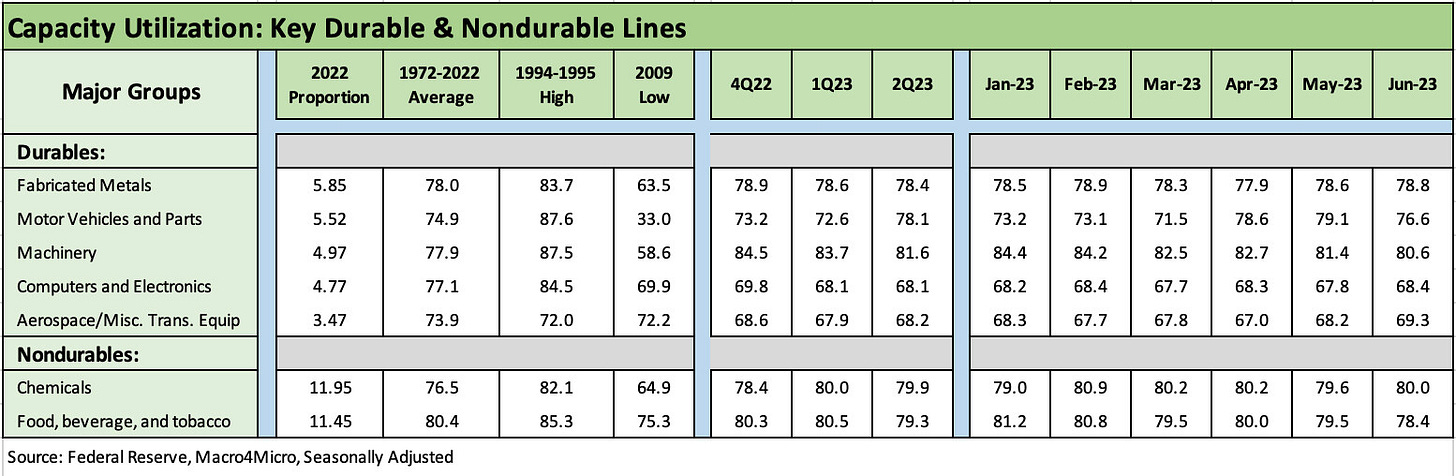

Below we run through a few layers of subsectors using capacity utilization (“Cap Ute”) trends by major manufacturing groupings. We then follow with a second chart covering the largest industry groups in Durables and Nondurables. We like to use the capacity utilization statistics rather than the industrial production index since it is more intuitive to tie into breakeven rates across industries and also the point where pricing power falters or kicks in.

The above chart highlights the downtick in total industry from 79.4% to 78.9% for the lowest run rate in 2023 and below the long-term average of 79.7%. If we use the long-term median (Jan 1972 to Jun 2023) of 78.5% posted in the time series at the chart at the top of this commentary, the June Cap Ute level is still above the post-1972 median and well above the post-crisis median (post-June 2009).

Manufacturing output ticked down by -0.3% for the month of June vs. May, but the 2Q23 quarter rose +1.5%. For capacity utilization, Durables held in well and June is ahead of 1Q23 rates while Nondurables kept an 80% handle but just below the 4Q22 and 1Q23 average. Utilities were more volatile in 2023 and at 68.5% were running below the 70% handles of 4Q22, 1Q23, and 2Q23 averages. Mining is running above the 4Q22 average and modestly below the 1Q23 and 2Q23 averages.

The above chart runs across some of the largest Durables and Nondurables industry groups based on index weight. For the largest 5 Durables industry groups detailed, the count was “3 up and 2 down” with Motor Vehicles dropping off but holding in above long-term averages. Nondurables split the difference with its largest industry groups as Chemicals was higher and Food/Beverage lower.

We would rate Industrial production as a “no decision” month based on the mix but at least one that could cause the bears to pick from other indicators (e.g., ISM, PMIs) that tell a story of a gradual weakening in the sector. Earnings season and revenue and capex guidance could help settle the debate or at least shift the talking points. We see a slew of manufacturing bellwethers reporting earnings next week and the week after.

See also:

Industrial Production in May: Holding, Waiting 6-15-23

Industrial Production: Ticking in Stereo 5-16-23

1Q23 GDP: Facts Matter 6-29-23

GDP 1Q23: Devils and Details 4-27-23