Industrial Production in May: Holding, Waiting

We take a look at the latest Industrial Production trends as the cyclical debate goes on and on…

"I think I got here too early...Congress let me down..."

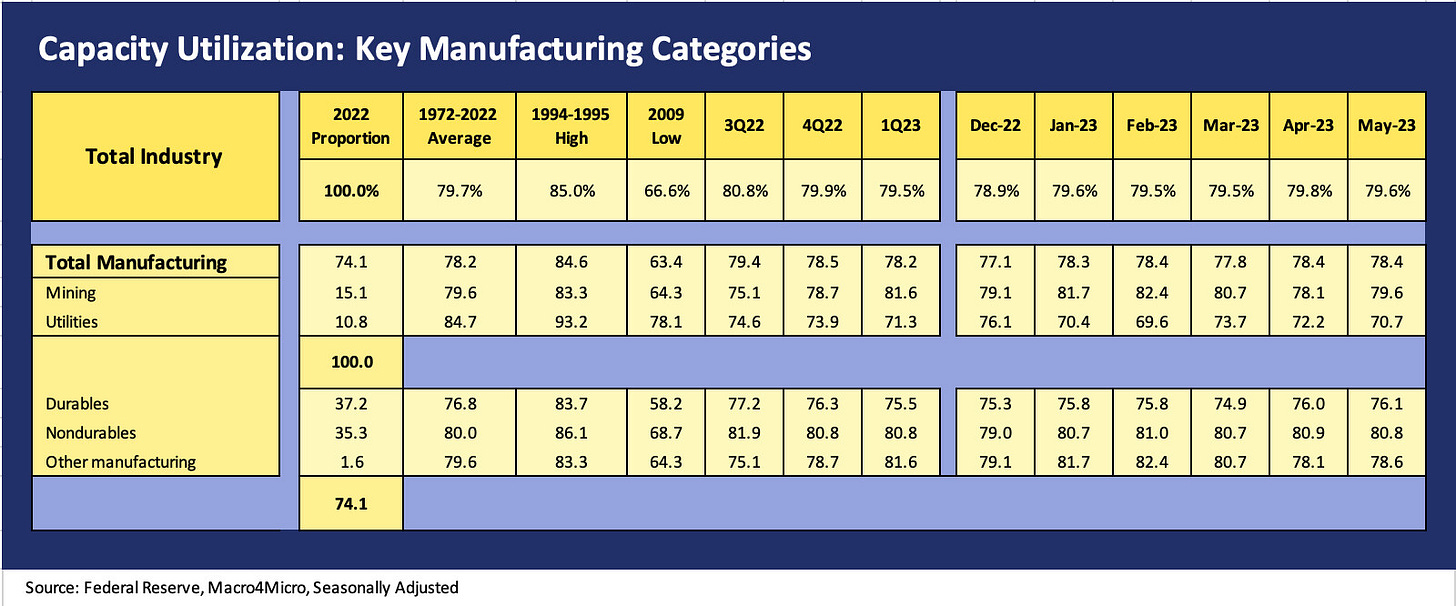

May 2023 numbers for Industrial Production tell us very little that’s new with total Capacity Utilization down 0.2 ticks, but Manufacturing in total, Durables, and Nondurables essentially flat.

Capacity Utilization rates offer a useful way to monitor pricing power in the industrial sector and can signal which sector might be more exposed to any material cost pressures on shifts in demand.

For now, the industrial sector is hanging in despite the steady increase in working capital funding as the better state of affairs in supplier chains is also supported by solid, sustained activity across a number of end markets.

In this commentary, we update Industrial Production trends and more narrowly look at the latest Capacity Utilization stats. As a reminder, we like to watch capacity utilization more than the overall production index aggregates since capacity utilization is more intuitive to most of us in the area of pricing power. Rising capacity utilization translates into pricing power or a lack thereof if “cap ute” rates are falling. That pricing power in manufacturing matters more during times of rising input costs from materials and energy costs to labor. Pricing power in goods and services flow downstream.

At the end of the chain, we can watch for Goods inflation, and that part of the inflation story has been positive of late for inflation worries at least in the area of Goods. We saw that in the CPI release of this week (Durables inflation at 0.0% YoY, Nondurables at 1.0% YoY). We had pretty good numbers for PCE Goods inflation released at the end of May (April numbers), so we expect more of the same with the Personal Income and Outlays and PCE inflation for Goods later this month.

Below we update the longer-term timeline for Durables and Nondurables. The current run rates stack up reasonably well against the long-term medians for total manufacturing. That had been a very good result after the breakeven volume for many US manufacturing concerns had been lowered with major restructuring initiatives to bring down unit costs. The trick now is how to sustain that profitability in the face of such a range of cost pressures that keep bubbling up. In addition, the trend of reshoring, friendshoring, and nearshoring could drive more cost creep. In such situations, pricing might be the swing factor to defend profitability. The alternative is margin pressure. The key is whether pricing power can in fact be exercised.

Services has been the sticking point and that remained the case with the CPI report this week (See May CPI: The Big 5 Buckets and Add-Ons 6-13-23). Services was +6.3% YoY in the CPI report while Services ex-Shelter was +4.2%. In last month’s PCE report, Services was still ugly at +5.5% (see Personal Income and PCE: Inflation Stickier 5-26-23). Thus the wild eyed hawkish tone yesterday in the FOMC “pause of pain” (see FOMC: Hit Squad or Suicide Squad 6-14-23).

Labor has been a more worrisome pressure point for many manufacturers in 2023 on a tight labor market. We have some very high-profile collective bargaining events ahead. Notably, the UAW contract is up for a new deal in September, and the UAW is sounding ambitious. This week it looks like a deal was finally struck with the Longshoremen but that needs to be ratified. Labor was not the main event in 2022 since it was more about other cost trouble in key material lines. We saw inputs tied to energy costs roiled, including the petrochemicals chain and power costs.

The above chart looks at the largest line items in the Durables and Nondurables manufacturing sectors. The Durables line shows three higher and two lower sequentially as it all flowed up into an overall Durables line (shown in earlier chart) that ticked up slightly by 0.1 points. Motor Vehicles ticked higher as both the light vehicle production rates in the US play catch-up after the supplier headaches (some ongoing) and commercial vehicles also ticked higher YTD.

Overall, we would frame manufacturing activity as solid, but the potential for more rate hikes will keep planners on edge and working capital under closer scrutiny as funding costs rise and more planners second guess the durability of the consumer sector. Betting against the US consumer has been a bad plan to this point for the bears, but household leverage will keep attracting attention.

See also: