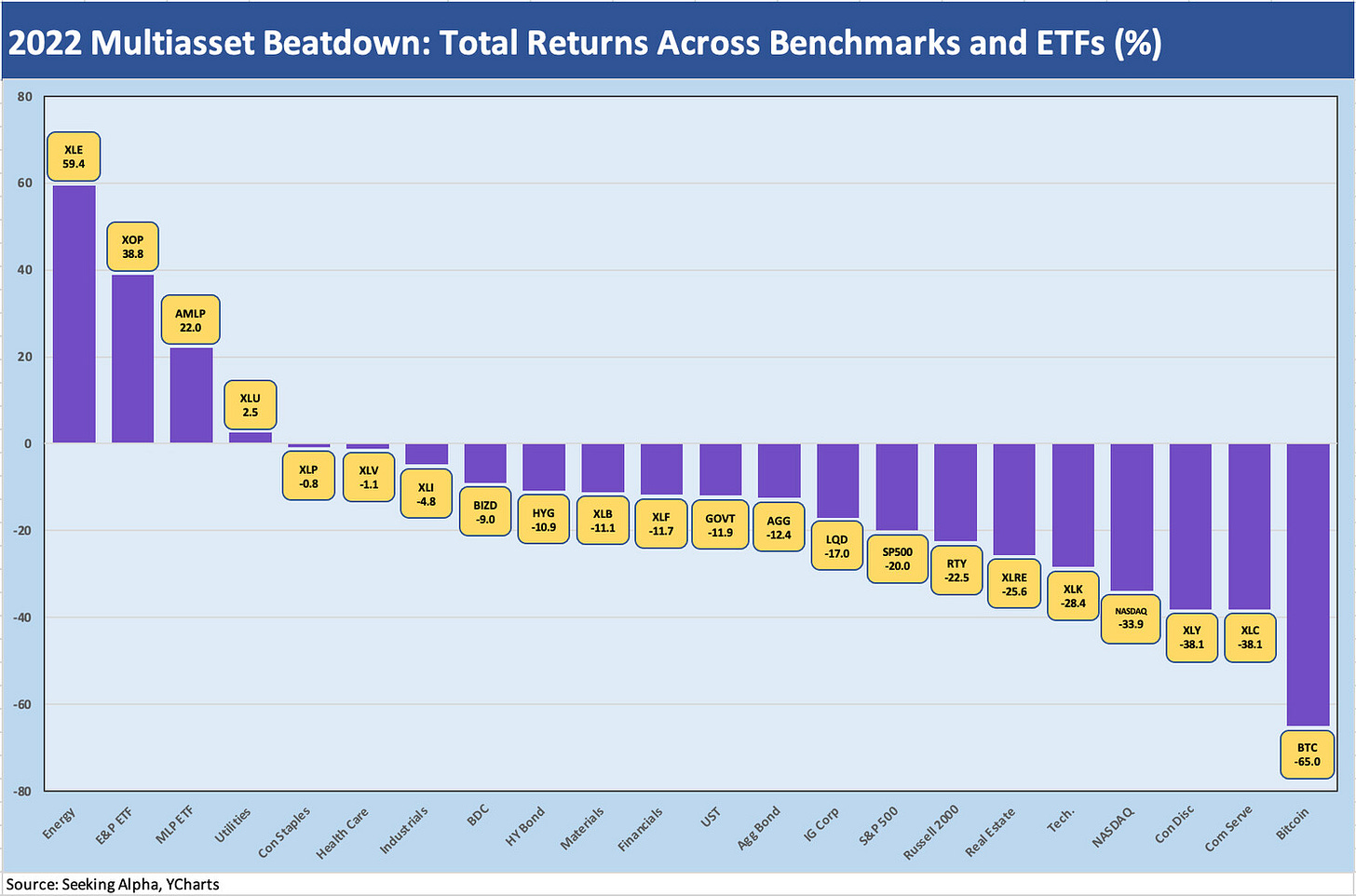

The 2022 Multi-Asset Beatdown

We detail the final score in a painful year across benchmark industry ETFs, equity and debt, and broad market metrics.

The market postmortems started weeks ago, and the superlatives picked up as December skipped the Santa Claus Rally and saw equities down badly (very badly) for the year with NASDAQ and the tech bellwethers really feeling the worst of it. I thought it would be worth posting up a broad cross-section of equity and debt categories as food for thought.

In the chart above, we mostly use ETF proxies to capture a broader mix of industry groups. We also detail the major equity market benchmarks. We include credit and fixed income ETFs with LQD, HYG, AGG, and GOVT looking especially grim for such asset classes. We add Bitcoin on the far right since it shows just how treacherous that speculative swamp is getting as 2022 ends.

The year does not need much retelling with growth stocks hammered out of the chutes and then the move off ZIRP and inflation panics taking over just as the largest land war in Europe since 1945 was literally firing up. Russia-Ukraine set off massive dislocations in the global energy markets that will keep the cyclical problems unfolding across the winter in Europe. The lingering problems will extend to what may be a totally overhauled US strategy in global trade, tariffs, and broader systemic protectionism (see State of Trade: The Big Picture Flows).

Looking back across the year at the asset class “ugly contest,” the duration pain delivered in fixed income was sustained across the first three quarters even as credit spreads widened before some 4Q22 spread relief. Supply chain problems were also being slowly addressed across the year with some that will linger into 2023 (notably chips in autos). The chatter now is whether some inventories have overcorrected in the move from “just in time” to “just in case.” The inventory question will come down to how 1Q23 plays out on the demand side.

The moving parts were all there across 2022 to have a brutal year, and that is just what is evident in the numbers. Very bad years are often followed by very good years, but the lost decade of 2000 to 2009 should not be forgotten. This is a good time to keep doubling down on due diligence.

Cyclical and secular questions haunt and help some industries more than others…

The recession debate and how the Fed and inflation will weigh on that risk has been a focus all year. We started writing market commentary in our LinkedIn articles section as we found it hard to ignore such an unpredictable market. It is all too interesting to stay on the sidelines. Inflation as a major risk factor was part nostalgia and part flashback for some in the markets. As someone who came of working age during the stagflation years of long ago, the compare-and-contrast was going to be a challenge when considering how much has changed in the market. The structure of the economy (manufacturing vs. services), the industry mix, the rise of systemic corporate sector leverage, and the changing labor markets are so different than the 1980-1982 double dip years.

The most glaring difference of all from the stagflation years is the fact that the US is the #1 producer of oil and natural gas products. With Energy sectors at #1 in equity performance and the growth stocks and emerging asset classes (crypto) battered so badly, there was little good news to be found in many sectors during 2022.

The new year in 2023 might get back to fundamental basics where cash flow and rational multiples on near term earnings expectations are the main event. The renewed embrace of long-term, assumption-driven forward valuation models (turbocharged at times by some speculative hype) was a throwback to the TMT bubble years as a reminder that history not only repeats itself, it stutters (someone said that somewhere sometime, I have no idea who). The assumptions built into valuations for such names as Carvana and Tesla (Tesla viable, Carvana not so much) was just a rejection of industry valuation histories. There was always an explanation and defense, but markets such as 2022 are reality checks.

The pursuit of income at least has a bigger menu to start 2023…

The price return vs. cash return trade-offs never go away, but in 2023 there will be much more to think about with new issue coupons repricing in fixed income, loans seeing income flows rising, and high dollar prices on call-protected legacy IG long bonds seeing dollar prices come back to earth after the ZIRP and low UST years. The idea of just sitting in cash for a while to let some more variables play out is less painful now in terms of foregone income.

For my own retirement portfolio, I had been overweight Energy and BDCs and actively in and out of REITs during the year. My favorite in Energy for income was the MLPs and Midstream C-Corps. There is an element of “no guts, no glory” in how I approached E&P exposure vs. Midstream, and I exited most upstream by midyear on gains with a few exceptions. I still see Midstream issuers and the higher dividend yields as a good core exposure. Maturing capex programs in Midstream and high credit quality support the holdings in equities (and debt). I say “high credit quality” even if many equity investors tend to view cusp low BBB and high BB names as risky. The BB tier presents very low default risks at a fraction of 1% default rates. The “junk” label still needs some nuance in equity markets. Risks rise exponentially below BB and then again below the B tier.

Duration out of red zone for now?

I avoided fixed income and bonds across the year. That is not an option for the asset class constrained, but I moved down the capital structure instead for income. BDCs offered floating rate assets at cash dividend yields alone in line with long-term equity returns. Price performance was mixed and biased to the negative side. As noted in the BDC ETF above, the cash dividends offered a good cash return offset. Some BDCs spent a lot of time in the green on price and some finished in the green on price even before dividends.

In risky assets, floating rate secured assets are still very much in the game as good core holdings in 2023 until more curve and inflation issues get sorted out. Whether you allocate from equity share of a portfolio from bonds or from a more refined and granular risk-reward continuum, leveraged loan and HY bonds have a role.

The duration hit to total return was abundantly clear in LQD above as high-quality bonds underperformed US HY. Now bonds generally are in a much better starting position with all-in yields in IG better set to mitigate duration hits after a year of material spread widening and painful upward migration of the UST curve.

The year started with some wealth advisors missing the plot on bonds as a diversified play against equities. The same overriding variables – inflation and the yield curve – were driving the losses in both debt and equity. Higher UST rates could still soon undermine fundamentals as well and create new worries around cash flow risks, multiples, and spreads in the risky asset classes. That debate is still unfolding. We will be spending more time on that asset allocation topic as 2023 rolls in.

Pension asset allocation has more to ponder on covering benefit payouts…

Beyond my own tiny micro world of retirement investing, the broader pension and retirement planning industry out there has a lot to trade off when equities have been repriced materially lower and the UST curve now offers more means of supporting cash flow-based liability management (in institutional pension plans). That also applies to individuals at the household level. The challenge is how to manage the rate of “pension plan drain” whether self-managed or based on contractual committed benefit payments by plan sponsors.

Many defined benefit plans have payout rates in the mid-single digits (some notably higher), and meeting those commitments takes cash flow and income returns and not just mark to market gains. The simple formula of “projected benefit payments for the next year divided by period end pension assets” creates an inescapable reality. The plan trusts must generate the cash flow to meet those demands, monetize assets, or put more funds in the plan. The legal, tax, and ERISA issues are obviously all much more complicated than that for legacy defined benefit plans in the public or private sector.

The rapidly shifting risk-return profiles on the way into 2023 raise many issues around how asset allocation strategies will evolve from here. 2023 is heading to a rare ZIRP free calendar year since 2007 with higher rates and more economic yields and new issue coupon rates.

We will be diving into the pension topic in the new year as more companies file their updated disclosure on pensions after a very negative year for returns. Pensions have always been a major focus for the debt markets. The cash vs. bonds vs. equities decision making will now at least offer good debating points for all sides in 2023. It will be less about the “least worst” with fixed income as well as loans and cash having a story to tell.