JOLTS: More Bodies for More Jobs, Demand is Strong

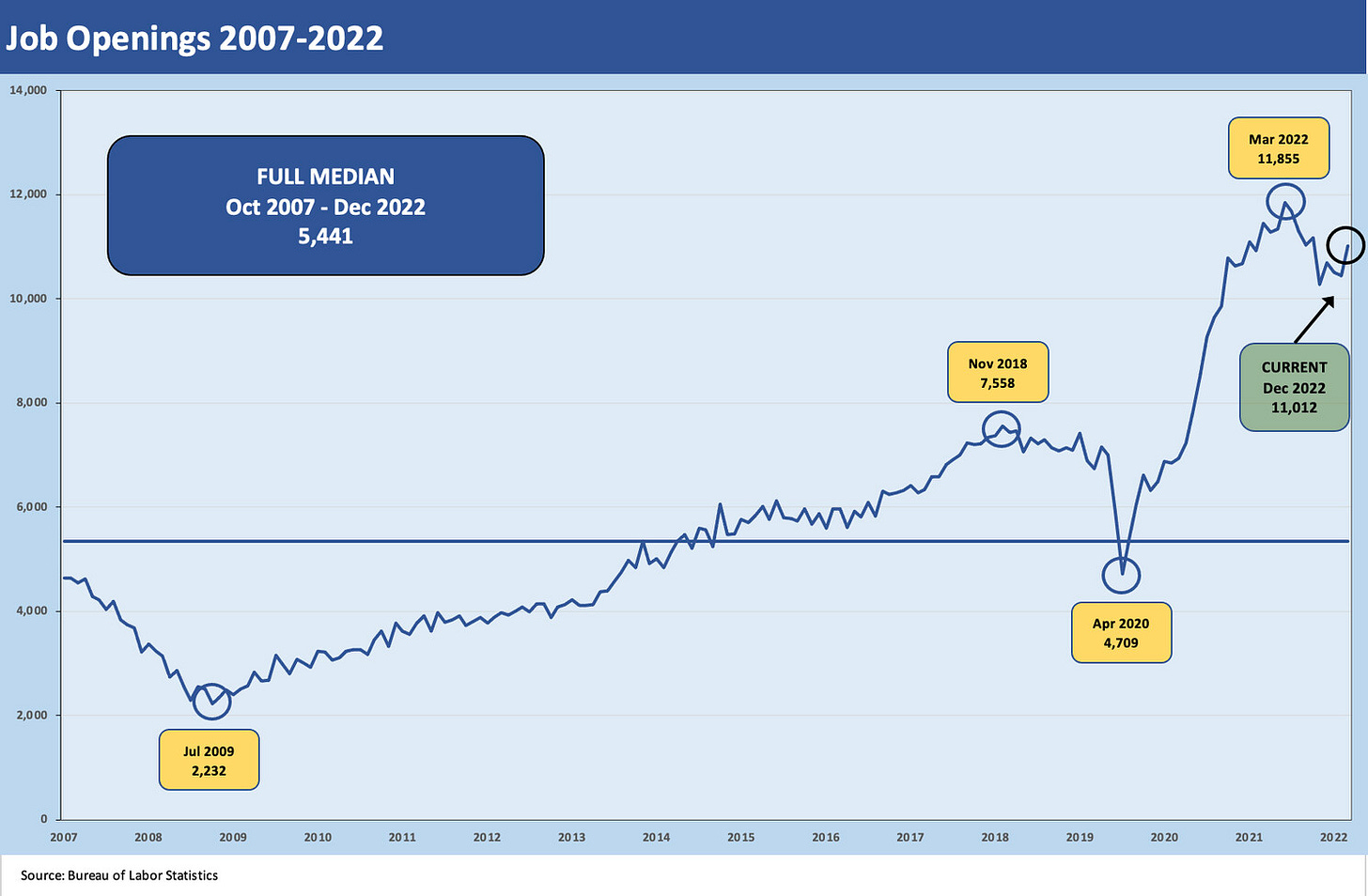

JOLTs will keep the heat on the Fed as job openings rebound to 11 million and Quits as a % of Separation remains very high.

The tight labor market is not loosening yet as job openings jump back above 11 million with a range of services categories driving demand and with Food Services in the lead on increases and Retail a distant #2.

The Construction markets posted a notable increase in Job Openings during the month while Manufacturing faded in openings.

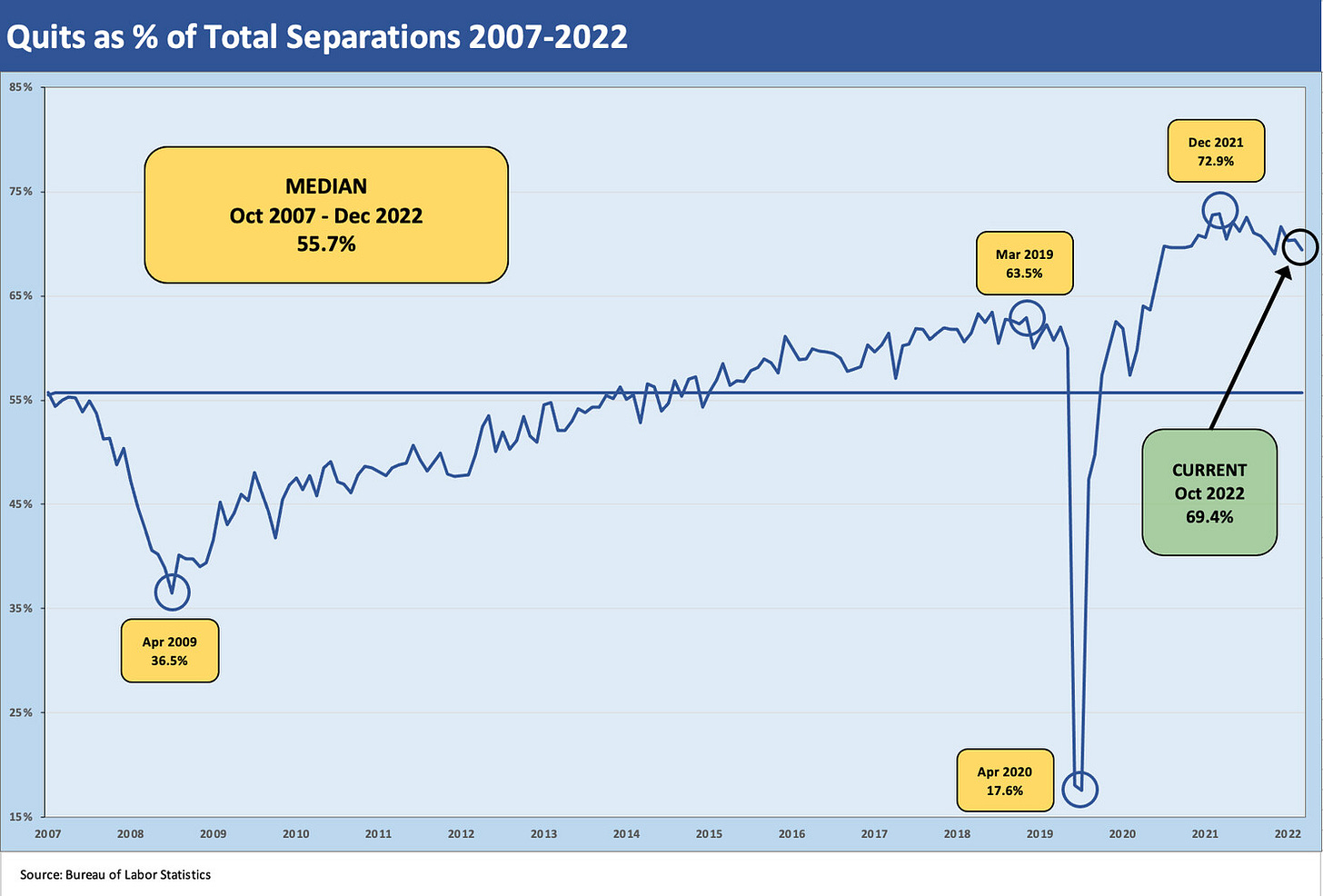

Hires still exceeds Separations, and the Quit rates as a % of Separation stays well above the median of around 55%.

On a day when Powell was speaking on the Fed’s hike to a 4.5% to 4.75% range, the JOLTS release had made some noise earlier in the day. The JOLTS report underscored continued high job demand with an increase in openings back to 11 million for an increase of just under 600K. This comes after an uneventful Nov 2022 JOLTS report (see Employment: JOLT Stats Offer a Yawn 1-4-23 ) that followed a solid set of numbers in Oct 2022 (see Jobs and the Fed: JOLTS Gets Heavy Powell Focus 11-30-22).

The Dec 2022 numbers did not support the theme of easier times ahead for wages after some modestly constructive news with the Employment Cost Index (see Employment Cost Index: Labor vs. Capital…Tide Turning or Swirling? 1-31-23). As we highlight in the attached charts, the Job Openings line remains in the top tiers of the levels seen since the 2007 cyclical peak year just before the credit crisis.

The sustained high demand for labor has kept wage inflation high in nominal terms even as the purchasing power of the work force stays negative in real terms when framed against CPI. The nominal wage growth is converging with PCE (see PCE Inflation Ticks Lower, So Does Spending 1-27-23), but we prefer the broader basket of CPI for that real wage framework (see CPI Wrap for 2022: The Beginning of the End? 1-12-23).

The easing of Goods inflation has been one piece of favorable news for real wages, but inflation in Services is still unfavorable for the consumer who will be more inclined to push for higher wages or job changes to get that raise. Some of this effect is showing up in the high Quit rates relative to Separations. Hunting for wage increases is a necessity in some cases.

The direction of employment trends as evidenced in the JOLTS data still shows Hires exceeding Separations as detailed above. The differentials are plotted below. Some major employers in Services such as Health Care and Social Services saw material excess of hires vs. separations and the same for Accommodation and Food Services. The Construction Markets and Manufacturing also saw positive relationships. Some of these were mirrored in big increases in Jobs Openings for Food Services (+409K) and Construction (+82K).

For December, we saw Separations outpace Hires by a small amount, but Job Openings showed a material increase in Retail as well (+134K). Some of these larger line items are not in the multiplier effect buckets of occupations and more in the high turnover, more transient services lines.

The Quit rates vs. total Separations remain high with Quits % Separations just over 69% vs. the longer term median closer to 55%. The rate is down from near 73% in October. Quits overall have stayed in a narrow range in recent months while discharges have been picking up. In total, Quits as a % of total employment is only 1.0%. We like to look at the Quits % Separation mix for a read on the worker mindset. The numbers are signaling confidence in the ability to land a job, and the Job Openings support that relative optimism depending on occupation and region.