CPI: January Big 5 and Add-Ons

The Jan 2023 CPI release was another reminder that inflation fighting has moved into the trench warfare stage.

We did more of a Full Monty review of inflation with the December 2022 commentary when we looked backed at the CPI vs. Fed Funds relationship across the cycles. That relationship is still not in line with the historical medicine doled out in inflation tightening success stories (see CPI Wrap for 2022: The Beginning of the End? 1-12-23, Fed Funds – CPI Differentials: Reversion Time? 10-11-22). The numbers reported for January did not change the “core challenge” for the FOMC. The market disliked the numbers even if it did not initially loathe the headline and core. As we go to print, the acrimony is rising with the market selling off harder.

The focus on Services as the swing factor is still the challenge. Services inflation represents the toughest nut to crack even if just on labor intensity and high demand. As we discussed last month, the inflation line items can end up focusing on various “CPI ex” categories. The Fed and others have now taken to talking up the metric of “CPI ex-Food, ex-Energy, and ex-Shelter.” Some even use the term “Super Core.” You also hear “Services ex-Shelter” as a focal point. Services overall was running YoY at 7.6% with Services ex-Shelter at 7.2%. Services ex-Medical Care Services is 8.2%. That all adds up to inflation remains high with a battle ahead.

The skeptics on inflation policy success are still of the school that the Fed has brought the proverbial knife to a gunfight. The more defensive policy wonks who worry about a recession see the Fed having already moved “too far too fast.” They are often of the school that the Fed should hold and see where it goes. The more cautious and bearish (often axed and long) say the Fed should make sure the Doves don’t cry. After all, the YoY math will be helpful as the year proceeds and they should let this play out (that is, “don’t hike anymore”). The much-discussed labor factor is not fading so far. In fact, it keeps getting stronger (see Jobs: The Human Wave Continues 2-3-23, JOLTS: More Bodies for More Jobs, Demand is Strong 2-1-23)

We read the ex-shelter angle from the Fed is a subtle confirmation that the Owners’ Equivalent Rent (OER) line item (the largest in the CPI index at over 25%) strike many inflation watchers as detached from the economic reality of many homeowners and a metric that is not all that useful. We have discussed OER in the past, and it has taken plenty of abuse from more pedigreed economists.

The CPI drill-down exercise just became more complicated for the hardcore inflation modeling crowd with the annual revisions to seasonal adjustments and changes in weightings for line items. The unadjusted YoY numbers are what we use in the charts below as an easy scan for the trend lines and weighting mix in the CPI.

By the numbers…

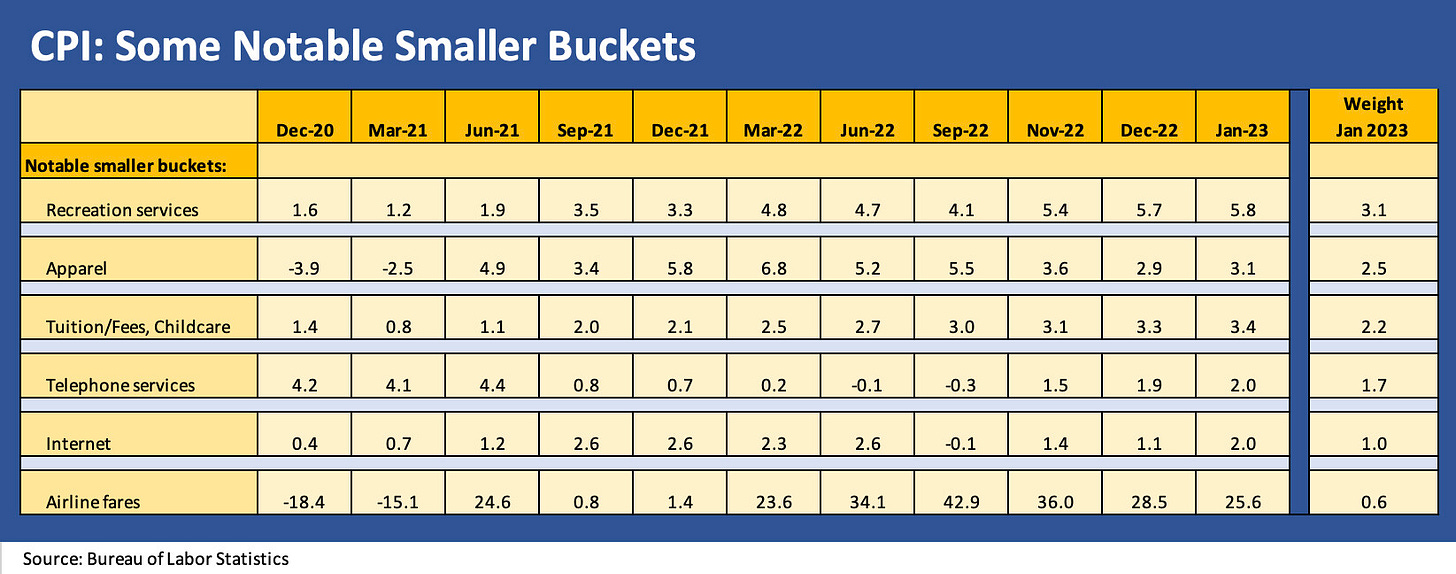

Below we break out our usual key line items for the Big 5 (Food, Energy, Shelter, Auto Related, and Medical Services/Goods). The Big 5 categories in the chart add up to just under 75% of the CPI index, so the Big 5 lineup makes for the bulk of the story. The “Notable Smaller Buckets” chart that follows below the Big 5 chart adds in another 11+% that brings the detailed line items to almost 86% of the CPI index based on the most recent weightings in the CPI release.

The various line items above are easy enough to scan with the Big 5 putting up some inflation metrics that are clearly diverging. Used cars are now in double-digit deflation mode at a time when new light vehicle sales were in whispering distance of a 16 million SAAR rate in Jan 2023 (we looked at multicycle SAAR rates and auto cycles in our recent weekly see Footnotes and Flashbacks: Week Ending Feb 10, 2023). While average transaction prices on light vehicles remain near record levels (in part on mix, in part on tight supplies in 2022), we see new vehicle inflation off the highs at a 5% handle vs. the double digits of mid-2022. The auto production chain and supply problems have eased even if problems remain. The CPI index weight of used cars is down from around 4% to under 3%, so the flowthrough to the headline benefit is limited.

Some limited (very limited) good news is that wages and inflation are getting closer to many CPI line items and notably in some of the Goods categories. That of course is a double-edged sword for Fed policy. High demand means pricing power and allows the wage increase to get passed on in many goods and services lines (especially services).

Food is still inflicting more than a little suffering in purchasing power with double digit price increases for Food All and 11.3% for Food at Home. The scrambled eggs and omelet lovers are staring at 70% eggs inflation in Jan 2023 (up from 60% in Dec 2022). The chick circle of life needs to rotate faster.

The above charts include lines that touch most households directly and are worth focusing on beyond the earlier Big 5. Apparel is off the highs and at least below wage growth. Rising education costs don’t capture the price tag impact on household balance sheets for the high absolute price. Slow growth from unaffordable levels is an asterisk at best. Telephone and internet inflation is on the lower end of the scale on the list above with telephone down from the Dec 2020 4% handles.

Recreation is above wage growth and still ticking higher. That leisure and recreation demand factor shows up in employment data and the highly visible travel and leisure strength in the broader market. Airline fares factor into many consumers economic experience these days based on the painful lines to clear security and get on the plane. For others, that encourages many to stay away from airports. For all of the problems in airline services, the airline carriers are able to pass along rising labor and fuel costs.