CPI Wrap for 2022: Beginning of the End?

CPI numbers are trending favorably off the highs, but services remain a problem and requires some “ex” metrics variations.

The battle over the shifting weights of “Which inflation metrics are the most pressing?” over the short term has been getting a lot of financial media airtime and internal back and forth by those who live in the markets. We look at that topic further below, but we can start with the old-fashioned CPI first.

The market reaction on Dec 2022 CPI was about both trend and “actual vs. expectations.” The CPI trend weighed in with another positive path, and that helps the soft-landing scenario. The stock market always wants a positive surprise even as it fears a negative one, so the reaction was a tepid and mixed one as we go to print.

The 6.5% headline CPI and 5.7% core number (ex-food-energy) is good enough to avoid trouble, but those numbers vs. fed funds still make for a tough challenge. The traditional concept is that real fed funds need to be positive, especially when battling inflation (see Fed Funds vs. CPI: Narrowing of the Gap 12-14-22, Fed Funds – CPI Differentials: Reversion Time? 10-11-22). The latest numbers are well below the 9.1% high of June 2022 for headline CPI and the Core CPI high of 6.6% in September.

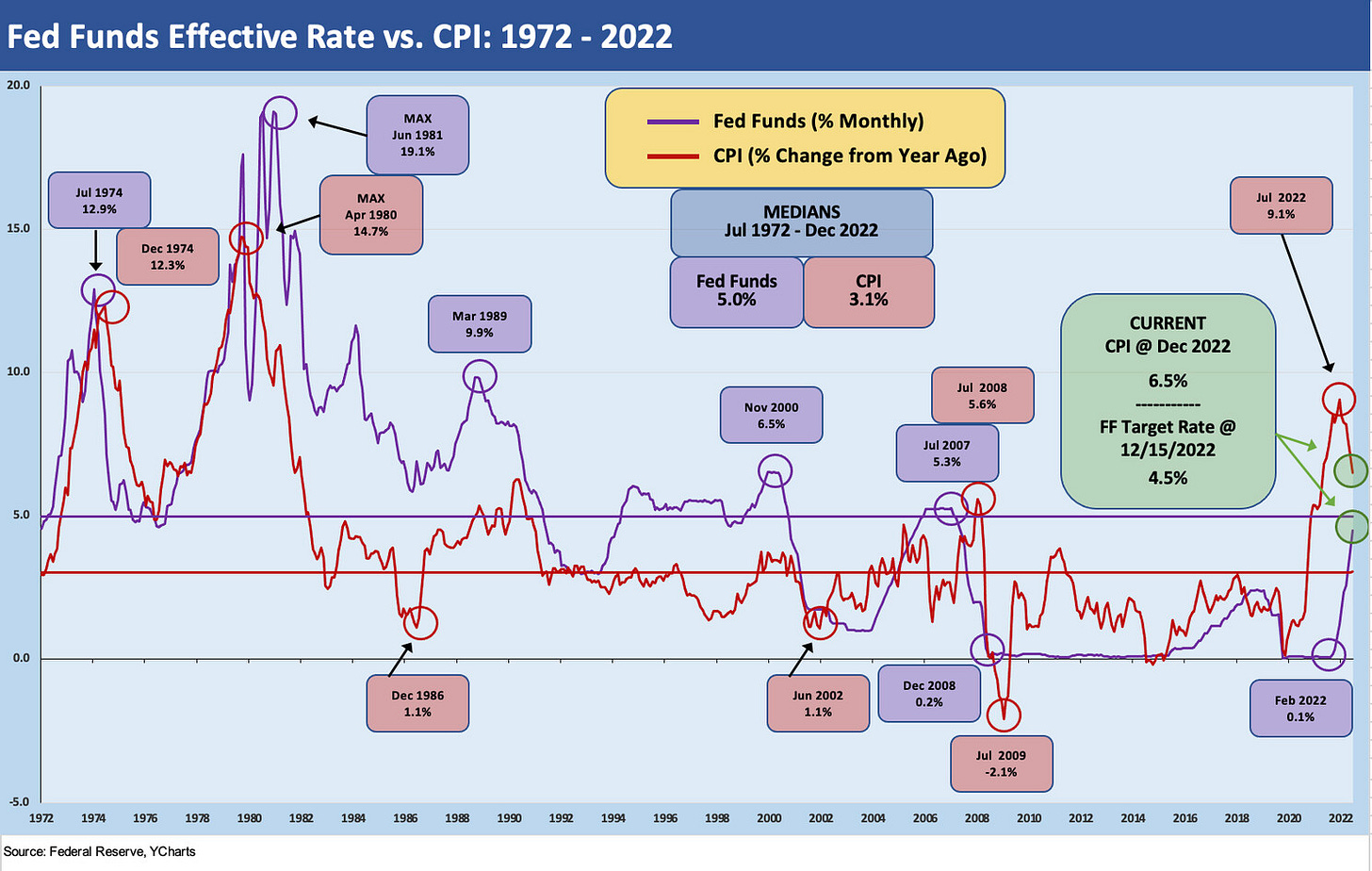

Below we update the Fed Funds-CPI differentials. The higher rates hurt many, but it is a very long way from Volcker-esque (on the chart keep in mind Volcker targeted monetary aggregates with fed funds allowed to swing wildly during some periods).

The above chart shows the actual fed funds and CPI and the chart below updates the differentials across time. The differential line below includes some medians across time as discussed in earlier commentaries. The theory is the pre-crisis years would be more a reflection of fed funds realities than the post-crisis and COVID years when ZIRP became a norm. The idea of a median of +2.2% is a long way from where the market is today. The post-crisis median is negative, and that says more about the credit crisis than the pandemic.

The “CPI-ex” metrics stack up…

On the topic of “which inflation matters” we see bouncing around the headlines, the CPI release breaks out a number of metrics to play with. The headlines in the Wall Street Journal cited the logical focus on Services inflation that has been the stickiest problem the Fed has been citing. Services is where wage inflation and high job openings get into the equation given the personnel-intensive nature of many services sectors.

Services inflation for Dec 2022 stood at 7.5% while Services ex-shelter came in at 7.4% in Dec 2022. Services ex-Energy Services was 7.0%. Shelter has been cited as lagging economic reality. That may be true, but one can easily question the entire Owners Equivalent Rent framework and question whether it “has a room” in the economic reality of day-to-day homeowners with no mortgage or a low coupon mortgage.

Other metrics in the CPI release include the following (we can’t resist citing real world relevance outside inflation handicapping).

All items less energy: This weighed in at 6.4% and carried a CPI weight of over 92%. (This metric is ideal for those who stop driving and walk the earth like Caine).

All items less food: This weighed in at 5.8% and an 86% weight (For use by those on a diet).

All items less food and shelter: This posted 4.8% inflation and a 53% weight (For young adults whose parents offer housing on the couch with a choice of leaving vs. dining).

All items less shelter: Posted 5.9% inflation and 67% weigh in CPI index. (For those on the couch with a food allowance.)

All items less food, shelter, and energy: Inflation at 4.4% here and 45% weight (Very hard on those from New England and Minnesota).

All items less food, shelter, energy, and used cars and trucks: 5.7% inflation and 42% weight. (Limits ability to drive to find a cheaper state and warmer weather – and usually lower or no taxes).

These varied metrics are indirectly helpful, but we’d rather look directly at the line items themselves for the trend as we break out in the charts further below. Each household has its own distinctive consumption patterns from lengthy suburban and exurban commutes (autos and gasoline) to expensive urban retail food costs (that double-digit food inflation) to those who have locked in low mortgages and are not planning to move or rent out their house (it gets crowded under the Owners’ Equivalent Rent concept!).

By the numbers…

Below we break out our usual key line items for the Big 5 (Food, Energy, Shelter, Auto Related, and Medical (Services and Goods). The Big 5 add to just over 75% of CPI Index weight, so it makes for the bulk of the story. The “Notable Smaller Buckets” chart that follows below the Big 5 adds in another 11+%, which brings the detailed line items to over 86% of the CPI Index based on the most recent weightings.

Among the big movers was lower Energy and lower gasoline within that bucket. Energy Services, Electricity, and Utility Gas still make for a tough comparison. This may clash with the headlines on today’s crude oil and natural gas pricing, but the services providers do not mark their services to market. You need to factor in their purchasing cycles and cost of service.

Shelter gets a pushback from many commentators on the lagging effects of how those numbers adjust, but the whole concept of Shelter inflation and its 32.9% index weight has always had a conceptual cloud and measurement asterisk attached to it since the methodology was overhauled in the early 1980s (rolled in during 1983). You can find rental price data from numerous sources (Redfin, Zillow, etc.,) and market clearing prices from the NAR, so using ex-shelter metrics has a lot of merit.

When you are heading through the grocery store aisles in the US, the food inflation numbers do not need much verification by economists. That 10% handle number is off the highs but is one that has political clout above its 13.8% CPI weight.

Used cars are in material deflation mode and gasoline in negative inflation offsets some of the impaired food purchasing power for some households. We see the services and labor inflation and auto repair and maintenance higher again at 13%, and the insurance companies enjoying themselves at a 14% handle on motor vehicle insurance inflation. Medical care services inflation and the narrow category of health insurance coming off their highs in Sept is positive in an aging America. Lower health insurance inflation is also helpful with lesser employee benefits in the gig age for the younger crowd.

The add-ons tell some stories that are not too mysterious, such as sustained brutal airfare inflation and weakness in apparel with way too many deep discount sales in the markets. Recreation Services is up at a high on the chart across the timeline and reflects the shifts toward services from Goods in the consumer sector. Education is climbing slowly again on their rising costs in all areas. The labor and union pressures for wage increases in many states will keep education budgets under pressure to raise prices.

The Household will feel the CPI wage differentials…

The comparison of Dec 2022 CPI vs. lower sequential wage inflation as released with the jobs report also signals pressure on household budgets. The Dec 2022 jobs report posted a downtick in wage inflation to 4.6%, and that got the market briefly excited (see December Jobs Report: Mixed Feelings 1-6-23), so wage growth and fed funds are both below CPI.

Something needs to give on the demand side if inflation outpaces wage growth. The consumer has a “volume decision” in the price x volume equation in his consumption menu. Alternatively, the consumer can tap credit lines and spend above after-tax earnings and household cash flow. In the end, that comes down to household consumption mix and the purchase decisions they make on the way into a potential recession. Fighting the Fed and fighting the ability of the US consumer to consume have never worked well.