UAW: Going to the Mattresses

The UAW clash with the legacy Detroit 3 OEMs could top the historical charts at a time of radical industry change.

We try to put a fence around some of the demands on the table in the collective bargaining round for the UAW vs. the Detroit 3 (anachronistic term, but it works for now) and offer some historical perspective on a peer group known for recurring crises and a supplier chain that has been a case study in stress across the decades. (See “Laundry List” near the end.)

For now, we expect continued material escalation as seen on the screen today, but OEM acquiescence to some of these terms would be a “for sale” sign on Detroit 3 stocks and bonds.

The game theory is about keeping OEMs off balance with the work disruptions strategy and the UAW shooting for record wage increases, elimination of wage tiers, and ironclad job protection like the “Jobs Bank” of old.

Wages are the overriding cost line at stake, but the demand to return to the outsized precrisis legacy obligations (pension and OPEB) lurk as threats to equity and credit valuations and are likely to be red lines for the OEMs.

In this note, we look at some history and the UAW demands (we summarize the demand checklist at the end). We also look back across time with some war stories from our years covering the auto industry. The main takeaway is that the auto OEM cyclical history makes what the UAW is trying to do now look very threatening by creating a material divergence in competitor economics. It is about a lot more than one contract’s wage gains.

We also use some historical lookbacks as we start to get back into more automotive sector coverage in the Macro4Micro coverage universe. History has been consistent about recurring problems and constant change across the OEMs. EV transition, trade stress, and extreme UAW demands will just be the latest round of change and tension.

No lack of excitement in the history of the OEMs…

My first assignment as a buy side credit analyst in the early 1980s was the autos and integrated steelmakers. My employer was one of the lead creditors in the Chrysler multiyear restructuring in private placements before I started covering it, and I picked up the name in the bond group in 1984. The Chrysler minivan was just being launched.

Even if steel was a secular plunge for the integrated names, the auto sector was the real adventure. Drama and cyclical shocks were revisited every decade from the 1970s on through the eventual government bailouts and Chapter 11 by GM and Chrysler (and almost Ford) in 2009.

With that timeline in mind, it is hard to see the 2023 UAW list of demands as anything but a daunting set of risks for auto security holders from the supplier chain to the OEMs.

The UAW list of demands includes some items that might be more about negotiation strategy than realistic expectations (e.g., retiree health care, materially expanded defined benefit plans, and strike rights on plant closures), but the UAW is playing for keeps with a contract that will be a material outlier in the US auto industry where the Detroit 3 have a minority market share.

The point in the end is that they all are real demands by the UAW even if some would be radical departures from history (e.g., the scale of the wage hike). Some would (should) be viewed as major setbacks for the competitiveness of the legacy Detroit 3 (elimination of wage tiers, a reopening of the defined benefit plans to a much-enlarged labor force eligibility pool, and a return of OPEB/retirement health care). Breakeven rates would soar at a time when the legacy Detroit 3 (from here, let’s say “D3”) are losing market share and need ample free cash flow to fund the EV transition.

Politics will be big in this strike action…

Some think Biden should walk the picket line. Meanwhile, Trump has already jumped into the fray by announcing a speech to the UAW on GOP debate day. So far he’s been saying “to hell with EVs” to the UAW. It is no coincidence that the non-UAW transplants are moving ahead at breakneck speed to fund EV expansion (in red states).

Trump has said that China will be making all the EVs anyway. Apparently, he did not get the memo on EV content rules, and the fact is that, if reelected, he could likely slap tariffs on China autos anyway. For now, China is essentially a non-factor in US EV sales. But that could change.

Currently, the Japanese, Koreans, and Germans are the main event for EV competition in the US. In addition, Trump bills himself as “tariff man” and could “easily” prevent a role for China if he is elected.

The challenge is that China is becoming the EV supplier chain hub. In other words, the D3 factor heavily into the ability of the US to become an EV hub and control more of the supplier chain investment. That brings high paying technology as well as manufacturing jobs. At the very least, expanded EV investment can help offset the loss of ICE jobs. Higher EV production can also bring down the cost curve and expand the potential for more affordable EV pricing.

The Trump political angle on the UAW is to blame management and EVs, which is in effect blaming Biden. As we all know, Trump likes a good story line to repeat and conceptual consistency or heavy use of facts are not his main focus in a political clash.

UAW game theory and priorities are not easy to predict…

While it is always a challenge to frame the game theory around which hills the UAW or D3 are willing to die on, we expect that wages in absolute terms and elimination of tiered wages and the use of temps is more in the “holy war” category. A rejection of a return to expanded defined benefit pensions and OPEB presumably is going to be the outcome since it has to be a nonstarter for the OEMs – and especially GM.

The nature of the strike strategy targeting a smaller subset of plants and all of the D3 as strike targets can allow for steady escalation and plant disruptions and smooth out the risk of draining the strike fund by slowing outlays over time.

It is hard not to come away with the view that the UAW has prepped for all-out war. Recent communication leaks make it clear that they are looking to inflict damage to get what they want. The UAW has already picked a mix of “weapons” used over the decades and mixed up the attack. They clearly planned well.

While the markets want a quick resolution, the nature of the strikes allows for a protracted battle with a goal of leveraging the heavy political overlay for maximum value and tapping into both sides. The “game theory” goes under the heading of “these guys ain’t playin’ and this is no game.”

Today’s announcement that the UAW will target most of the GM and Stellantis parts distribution centers marks a move to DEFCON 3 since that will be an attack on dealers (and customers who need parts).

The Detroit 3 and the OEM comps…

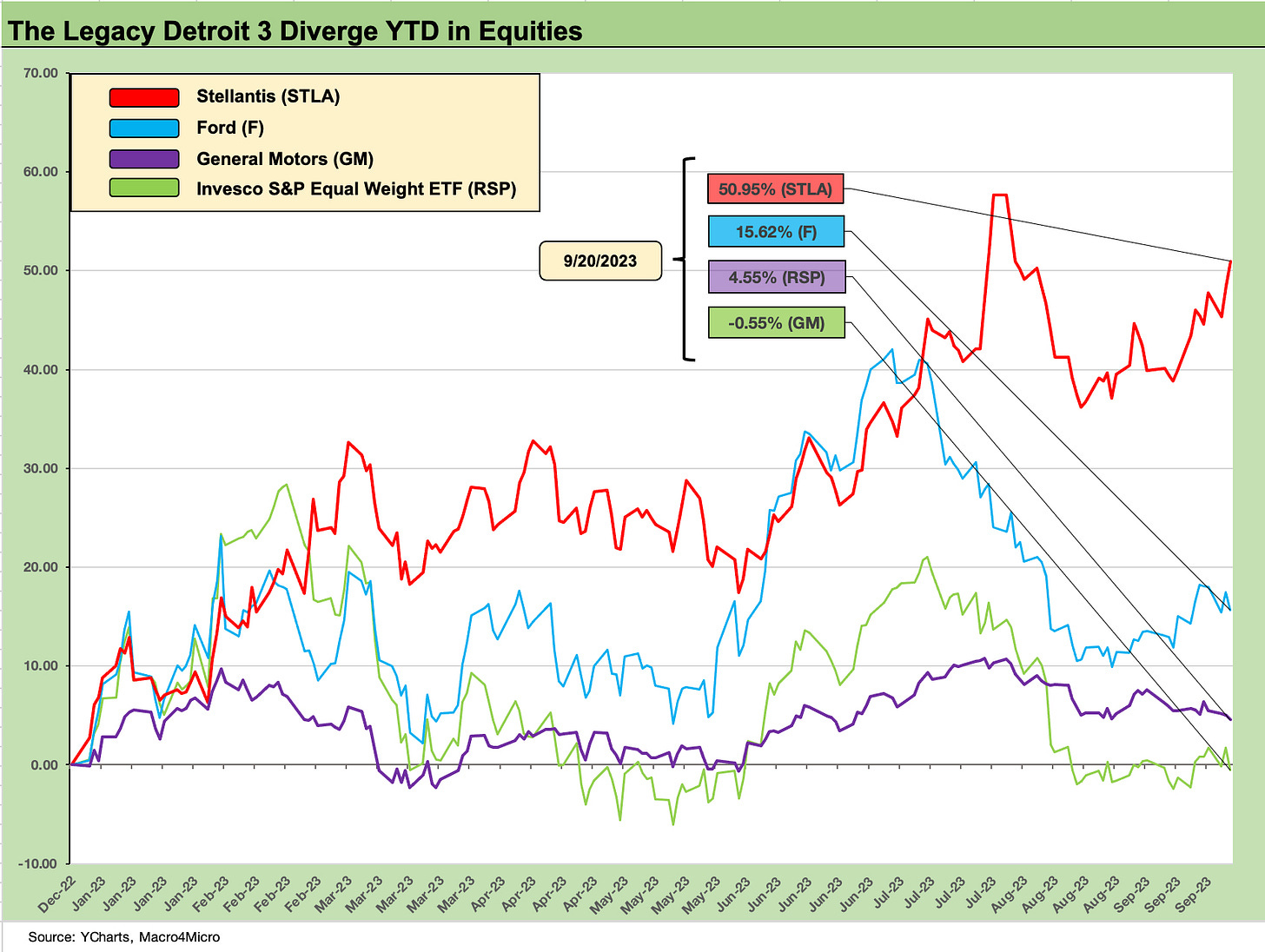

Below we update where the D3 stocks have migrated across 2023 with Stellantis well out in front and GM pulling up the rear. As we get further into this process, we see GM as the most vulnerable to the demand list even if just on the pension and OPEB threat and its relatively greater exposure to the tiered payments. GM’s stock has already been a serious laggard.

There is a lot of headline negotiation going on in here with a dose of disinformation. The UAW leaders use media (financial media and social media) very effectively. The temp worker mix is reportedly lowest at Ford, so that gives them an edge it seems to be closer to keeping the UAW happy but with a long way to go. Plus the Ford family connection tends to be less confrontational.

Disclosure is sketchy on some demands and is likely to get fleshed out in the reporting on the talks. The demand for a return of OPEB is unclear to us at this point as to who the Pension and OPEB demands would cover and when the clock would start for individuals. In the end, those demands would be negative for stocks and negative for credit if analysts look at the history.

As detailed in the stock tables below, the Japan 3 and Korean tag team (Hyundai/Kia) bring big competitive issues into the picture. Relative cost structures matter, and there are cleaner ways to play the US auto cycle. They all will be going after EVs as well as their competitive strengths in ICE vehicles, so that takes us back to the longstanding theme of how much the non-UAW OEMs pay their workers and what other benefit packages (or lack thereof) are in place.

What the non-UAW operators offer obviously is not a factor for the UAW, but the cost competitiveness issues need to be considered by the management of the D3. The stock and bond market certainly will be looking at it.

The above chart recaps the trailing time horizon returns of the Gang of 7 with the D3, Japan 3, and Hyundai (we skipped Kia). Stellantis, with its large and successful footprint in Europe where both GM and Ford failed, frames up well enough. Both Ford and GM have been weak in the markets over the trailing 3 months and trailing 1Y. GM and Ford bring up the rear in YTD returns with GM especially struggling. Among risks that GM does not need is a return to legacy pension and OPEB obligations.

Production risk and the supplier volumes…

With the UAW now targeting more GM and Stellantis parts distribution centers, the supplier chain and dealer interconnectedness issues will get more scrutiny. We look at the supplier issue with a few simple rules:

Pick one:

“One man’s expense is another man’s revenue.”

“One man’s capex is another man’s revenue.”

Both of these above rules spell trouble for suppliers. We have been watching suppliers face stress points since the 1980s (too many LBOs did not help) and the plot thickened when GM (Delphi) and Ford (Visteon) spun off their parts operations in 1999-2000 into two of the largest OE suppliers in the nation. They later both filed bankruptcy with GM and Ford taking many of the weakest parts operations back into the fold.

Delphi was an especially massive operation with very profitable and higher tech, higher margin operations and a lot of commodity-like high-cost cash flow bleeders. Those Delphi and Visteon lookbacks are for another day, but both had some great business lines to split off (Aptiv PLC as a former Delphi unit and the new VC are both back in the game in different forms). Delphi by itself was a microcosm of the global auto stress points globally and a growing US offshore presence of the supplier chain in China. Delphi essentially torpedoed all its UAW operations during its evolution.

Seeing the threat to suppliers is not too challenging if the suppliers face serious volume pressures. The auto trade rags are already highlighting how some suppliers are looking for price support and financial relief.

Looking ahead, the suppliers must be bracing for what the OEMs will be looking to extract from them to offset the UAW’s inevitable repricing of both the D3 senior wage structure, bonus payments, and increases in tiered pay if not full elimination of tiered pay and full hiring and promotion of temps. The OEMs have a history of passing along the pain in price concessions and risk sharing.

For those watching the suppliers, handicapping the scale and duration of production setbacks are the usual exercises in making assumptions. The revenue losses and disruptions now can pile up and create continued problems later. OEM production will kick back into gear later to restock the dealers and play catch-up, but even that can bring higher unit costs and margin pressure related to overtime. That means suppliers will be under production stress later as well when (not if) the whole mess is behind the industry.

A major disruption in production will do some damage on revenues and earnings for suppliers across multiple industries including OEM suppliers and steel and more. It is intrinsically bad. Among life’s ironies, however, is the idea that the UAW could put strict limits on the ability of the D3 to close plants. That means many suppliers will face less risk of downstream loss of volumes in the usual game of “plant roulette.” If the UAW gets commitments on US products or plants that don’t move to Mexico, that would also ease some supplier risks.

Where the supplier stocks stand currently…

Below we frame trailing returns for auto suppliers as those companies saw the benefits from rising production volumes in 2023 after what was a recession level volume year in 2022 on production and supplier chain problems among other factors.

The fear for auto suppliers is that the UAW actions will keep radiating out and undermining production rates in total (essentially a certainty at this point).

Production setbacks at the OEM level can run back along the Tier 1, 2, and 3 supplier chain and can generate financial stress. The UAW actions can have unintended consequences (or was it intended?) and generate supplier disruption risk tied to parts of the chain that fall under financial stress.

Unlike the backdrop of 2008-2009, the D3 can afford to pay their suppliers as OEM volumes slow or shut down. While those suppliers will get paid, they will face a potential near-term plunge in revenue and cash flow. The UAW needs to be scary and feign (or embrace?) an irrational desire to to win on all demands, so this could be a rough ride.

Pushing production into later months after a strike is not new to the industry, so being alarmist is not the goal. Volume will recover, but at what cost of structural setbacks for the D3?

Another wrestling match for the supplier chain is gauging “who’s next” among UAW suppliers for the next round of attacks. Many suppliers have been organized at the plant level (not via company-wide master agreements) in the past, so a big win by the UAW will raise eyebrows along the transplant belt as well as along the non-UAW supplier base.

We are seeing supplier threats this week in the Alabama ZF strike at an axle supplier. The same for Friday’s parts operation targeting by the UAW. The transplant states are right to work states and are generally not union friendly at the company management level or rank and file level (example: consistent failure to organize Japan 3 US transplant operations even in the north).

In the case of the ZF strike, the company is a massive global supplier to numerous OEMs. As a reminder, ZF acquired TRW back in 2015 and has an extensive product range. The headlines on ZF are tied more to the topic of multiplier effects when key components cannot be delivered to Mercedes.

In other words, the UAW will be pulling out all the stops to reshape collective bargaining at more than just the D3.

The targeted supplier strike game plan was an old part of the UAW playbook. The idea is to target a key component plant (e.g., windshield wipers) that service a disproportionate number of plants and make the impact that much greater. Shutting down a key supplier plant to have more knock-on impact at a time when the Jobs Bank paid everyone. That strategy had to be addressed by the OEMs in later contracts, and now the UAW is demanding the right to strike on a plant closing decision. That essentially takes capacity management decisions out of the hands of management.

The impact on total production volumes will be relatively minor at the initial strike exposure, but it expands weekly and daily on walkout and side effects that require layoffs tied to the disruptions. There will be ample room to run overtime and play catch-up later but at high cost. The more the work stoppages expand, the volume risk will start to create some anxiety along the supplier chain.

QUESTIONS TO PONDER

Below we detail a short list of questions to consider. There are a lot more to ask every day depending on the direction of this process.

Does the tactical move of targeting select plants of all three OEMs signal a decision to hunker down for a protracted battle with the next escalation announced Friday morning (today)?

Are the extraordinary wage demands consistent with the times given how critical skilled labor is going to be in the markets?

Will some wage peace buy some flexibility in the future around work rules and some grudging acceptance of non-UAW EV investments and JVs?

Are the cards stacked against the D3 plants given the tight labor market and exceptionally strong earnings trends, and the demonstrated pricing power on new vehicles?

Would the haircut to forward earnings from a wage hike have a more negative effect on forward equity valuation parameters than the value of sustaining peace and helping accelerate EV launches and investments in related tech and supplier chain initiatives?

Will the implied future value of EV related investments (supplier chain, battery plants, lithium sourcing, etc.) offset the material dilution of traditional ICE operations on higher labor and benefits expense?

Is there any conceivable way that the D3 would revert to OPEB liabilities after so many billions were expended to buy their way out of them with the creation of the VEBA back in 2007 and after the government bailed out new VEBA plans and transferred them to support the new entity UAW workers?

Will the government have any influence on the UAW after they bailed out the industry and transferred billions in NOLs (executed under the radar in legislation)?

Will the end game be to “focus on wages and job security and plant protection, and give on the healthcare/ OPEB quagmire?”

Will the Biden team whisper “Don’t mess with the EV transition but be uncompromising on job security and plant protection (including the movement of more production to Mexico and related low-cost assembly plant expansion South of the border).”

Will the plan stay focused on getting new commitments on new programs in a closet “Jobs Bank” strategy?

Will the reopening of the defined benefits plan be a red line for the OEMs given how that would buck every trend in the market and assure a lack of competitiveness vs. the transplant operations in the US?

In considering equity valuation parameters and how they might evolve for investors and street analysts, could the D3 protect and bolster valuation by making sure the collective bargaining process protects EV expansion? (EV brings higher multiples but at the expense of lower near-term earnings.)

More than game theory going on here…

The UAW has market power at the table and every right to use it to the fullest. The trick for those watching so many cheerleading the UAW is to know where facts are and where history should not be distorted.

The picture being painted by more progressive elements is that the UAW made massive sacrifices to save GM, Ford, and Chrysler. That story has some layers to peel back starting with the fact that a disorderly bankruptcy was a certainty without a bailout. The D3 would have seen their world cascade into a collapse of the supplier chain, more pension terminations, more dealer and finance company stress, and fallout across a wide range of supporting infrastructure businesses. It was about a lot more than the D3 UAW’s wages and pensions.

There is no question that the legacy UAW employees did a lot, and that the D3 needed to be saved (the Senate blocked a bailout, so it came down to Bush tapping TARP and the Obama UST later stepping in).

Sacrifices were made by the UAW to allow the OEMs to survive. However, facts matter, and the UAW’s own notice to active employees back during the 2009 restructuring included the following language sent to members in announcing what was coming out of the bailout and reorganization:

“For our active members, these tentative changes mean no loss in your base pay, no reduction in your health care, and no reduction in pensions.”

Those facts do not seem to come up in the historical recaps. Based on the above, the UAW is not owed anything from 2008 and 2009 restructuring and bailout. In today’s context, the demands that the UAW has every right to make today are tied to today’s market conditions, today’s financial and the profitability profile of their employers, and today’s competitive playing field.

The UAW should be inclined to agree to a deal that would help their unionized employers compete effectively against the non-union transplants during a time of massive structural change in the auto industry with all employees rowing the same direction. That is not their priority on the demand checklist presented.

The D3 can stay relatively competitive with a massive pay raise on the wage side but not a full retreat to ramping up unfunded pension obligations and OPEB that the competition does not face. Piling on long-term claims risk is not going to help the financial profile and capital markets reception down the line. The industry has seen how that movie ends.

The UAW made off better than everyone else in 2009…

Again, the tough thing to say politically is that the UAW is not owed anything from 2008-2009. The UAW owes the bailout architects and taxpayers a “thank you” and a “sorry about that” to lenders and savers who lost billions. The UAW did better than everyone in the mix. The UAW workers at GM, Ford, and Chrysler got off far better than anyone else during that industry collapse (salaried workers, supplier chain employees, creditors, shareholders, and taxpayers among others).

Back in late 2008/2009, the UAW was looking at the financial meltdown of their employers, suppliers, and possibly dealers in a disorderly bankruptcy process that would have devastated the supplier chain and the dealer community and put pension and health care payments at risk.

Foregoing future raises in 2009 (current base wages were protected) was not much of a sacrifice when the alternative was no bailout and a disorderly bankruptcy. The result would have been a dramatically downsized labor force and repricing of legacy UAW workers wages. The outcome would likely have led down a path to Section 1113/1114 and the loss of retirement benefits on the other side of a restructured OEM.

From the outside looking in, the UAW now has a justifiable gripe as it seeks significant wage increases since this the fourth contract round since the bailout, and there was some dissatisfaction with the collective progress made over the prior three. With their employers very profitable and needing to generate higher rates of cash flow for the transition, the D3 are more vulnerable to work stoppages since it will derail progress.

The UAW thus is better positioned now to extract more economics in the deal than at any time in the past four decades I have been spectating the industry on and off as an analyst. No doubt, they should seek to max out the wage demands. However, defined benefit plans and OPEB restoration would hearken back to some of the causes of why the D3 were getting crushed, and that would cross a line most likely for the OEMs. That might be a line for the capital markets as well.

The structural rules of the road and the economics of the business for the D3 can soon change materially. The UAW can take advantage of what is very favorable negotiating dynamics right now, but the effects and the history cannot be ignored. The next time they face a crisis, they might not have an Obama in the seat.

Equity and credit markets will have challenging variables to price…

The equity markets will have their hands full reacting to some demands that can be viewed through the lens of so many setbacks for the domestic industry across the decades. Those decades include the 1970s, 1980s, 1990s, and then on through the GM/F downgrades to speculative grade in 2005 on the way to the collapse of the auto sector and GM and Chrysler bankruptcy of 2009. That’s a lot of crises. They don’t want one in the mid/late 2020s.

Some older hands will be framing the recent set of proposals as the equivalent of a return to the “Jobs Bank” mentality before the bailouts. The “Jobs Bank” essentially turned hourly labor into an inflexible fixed cost regardless of the cycle and market conditions. In intro cost accounting, labor is usually considered a variable or semi-variable cost. UAW votes for labor as a fixed cost.

When we added in the health care retiree costs for a company such as GM (approximately $4.7 billion a year before the bailout) being amortized across a much smaller base of GM production as it downsized, the cost competitiveness was a slow and steady bleed that raised break-even volume dramatically as time went on. Even the very (very) pro-UAW Obama bailout team knew they had to quash any hint of that type of asymmetry in cyclical risk. The Jobs Bank died.

Politics make for more drama and the same in cross border trade…

The politics are now more toxic than ever in general terms (it is just in the air), but the auto sector has always been a very formidable political force even as its membership plunged. Imports and transplant market share now comprise a majority market share of the industry vs. the minority held by the legacy D3. Even then, the share of non-US OEM and non-US production is boosted by Mexican and Canadian production.

The moving parts of the D3 story are “not simple” and are in fact extraordinarily complex when you start rolling in the stories around USMCA (we will call it NAFTA out of tradition), the content rules under NAFTA, the newly promulgated EV content rules, the supplier chain vulnerability, and the threat of even more tariffs in the years ahead.

The EV and semiconductor issues (including much higher semi content in EVs) all make for a challenging analysis on where product and volumes will trend. We cannot even assume a set of inputs on tariffs. That tariff outcome could vary materially just on who gets inaugurated in Jan 2025.

Big UAW demands in 2023 in some cases are value-destructive ones…

In the context of the 2023 UAW demands, the moral of the stories from past whipsaws (we will publish more auto war stories separately just for fun) is that locking in a lack of operational flexibility (like the ability to close plants without a strike) or allowing long term legacy commitments to get entrenched in the liability structure can be a major headwind in the markets.

The damage will be worse if those costs and liabilities are not shared by the competition (defined benefit pension plans and post-retirement health care obligations at the top of the list). The unit legacy costs eventually generate major margin problems, boost breakeven volumes, and undermine cash flow for R&D as well as shareholder rewards. The market will be watching.

Such structural disadvantages can create credit stress and unit cost impairment in the future that does not hold up well across cyclical downturns and secular change. The ability to react to macro shocks is not a stress test theory but is more a fact of recent history in 2008-2009.

COVID was minor compared to the collapse of the structured credit markets and credit crunch of late 2008/early 2009. What lurks tomorrow? A China trade war and even more supplier chain crunches? The scoresheet on lost production volumes from chip shortages could broaden under some scenarios with China.

The mix of moving parts ahead in this series of UAW strike actions cuts across wages, job security, retirement pension benefits (vs. the pension plans for the post-Chapter 11 hires), a return to postretirement health care benefits (OPEB) for hourly workers, and a range of other “asks” that seem impossible to contemplate making it through the process.

The strike rights on plant closings would essentially be a return to making labor a fixed cost and make the UAW the final decision maker. The idea is simple: “If you close that plant, we will demand at a minimum very high buyouts or disrupt your operations and cost you even more than keeping the plant.”

All is fair in love, war, and collective bargaining, but securities holders will need to price that risk.

The checklist of UAW demands is nothing short of enormous considering where this industry was positioned coming out of the Chapter 11 period for GM and Chrysler (who would soon be part of Fiat after the Chapter 11 deal and later rolled into the Stellantis family tree with Peugeot).

Today’s massive profitability of the legacy D3 is at peak run rate. Within the D3, the PSA-Fiat Chrysler merger adds a wildcard in the picture given the mix of markets after Ford and GM essentially failed in Europe over the decades (no matter what they say) with Stellantis (STLA) bringing a slightly different mix of variables and priorities to their strategy.

The contract terms on the front burner…

When the smoke clears, we expect the UAW will easily shatter all records for wage gains in this industry, but a return to defined benefit pension plans and OPEB is a long shot at best. The 4-day workweek is a throwaway (we would hope…this isn’t Europe, after all).

The inclusion of COLA will be a fight, but the UAW will likely get it. The high cost of peace and mitigating production disruptions is going to be just that – as in high cost. If the UAW goes too far in their “real” expectations (which we doubt), an early 1990s Caterpillar style UAW lockout cannot be ruled out – even if highly unlikely.

If Ford and GM say yes to legally enforceable long term retirement liabilities in defined benefit plans and health care, the stock market will wonder about the structural setbacks and embedded disadvantage associated with such exposures.

That back-to-the-future optic should be a problem for the capital markets. For the D3, that fight could be worth the battle, and the UAW will need to wonder if they blow up their profit sharing for pension and OPEB when the legacy workers are still protected on pension.

On health care, the D3 paid tens of billions to set up VEBA plans for health care, and the UST bailed out the VEBA liabilities in the deal terms and transferred those obligations over to new entities. A new OPEB demand is unreasonable (How about paying back the VEBA notes to legacy GM creditors who were left behind? Or the UST?).

LAUNDRY LIST OF 2023 UAW DEMANDS

Eliminate wage tiers and temp employee “abuse”: The two-tier wage system survived a protracted strike in 2019, and a range of improvements were made to narrow the gap with the UAW in terms of pay rates and gaining full time status. This time around, the UAW system wants the tiered system to be eliminated. They want materially higher wages for the legacy top tier, lower tier wages rolled onto the top tier, and more temp workers promoted to full-time status.

The “abuse” aspect refers to the workaround on costs by using a high temp count. That has a literal multiplier effect on total dollar outlays for wages even before factoring in pension and health care demands and the additional costs tied to a much-enlarged count of full-time, full-pay employees.

Wages and COLA: The UAW wants to protect real wages with COLA provisions to offset some years of stagnation and now inflation. Pay hikes and real wage protections is a reasonable request, but the companies states that the bonus system was in part designed to cover that effect. The word “COLA” justifiably sets off memories of wage price spiral effects with such a high mix of COLA clauses in the 1970s and a high rate of unionization.

The spiral dynamic is easy to envision: “Inflation goes up, so wages go up with COLA. Then employers raise prices to protect profits, then inflation rises. Then COLA wages rise, then employer prices rise…etc.”

COLA is not a big part of the landscape in 2023 and that is different from the 1970s. The decline in employees represented by unions in the US private sector is now down to 6% and 10% overall including the public sector. With union representation down and COLA a much smaller factor in wages, the UAW would be an outlier in the picture in demanding a return of COLA. The competitors in the transplant will see the competitive differentials widen.

Work week and time off: The 4-day work week (“32 hours for 40 hours of pay” was making the rounds) was an eye opener for many. That would certainly be a good way to promote more hiring and union membership growth when taken in tandem with elimination of the two-tier wage system and a more immediate transition of temp employees to full time. A 32-hour work week in turn flows into scenarios around overtime costs and shifts per plant and any related rules around that. We will see how that one plays out.

One theory is that the contract negotiation needed some items on the list to get taken off in a give and take. A 32-hour work week is one many already flag as a likely immediate rejection (the US is not Europe). Higher per hour pay and 40 hours is a good outcome for workers and the optics of 32 hours would not warm the hearts of the capital markets, and the markets matter to the future of the OEMs and the UAW.

Job security and right to strike over plant closures: During the bad old days of the Jobs Bank, labor was a fixed cost. The UAW appears to be now asking for what in substance is the same thing on multiple fronts. The ability to close plants could tie into the structural evolution of the industry (rise of EVs), the threats of macro shocks, economic cycles (and the risk of deep recessions), and product cycles by plant.

The ability to take strike action during the contract term is a tricky one, and the UAW is seeking to get commitments on plants during the collective bargaining process. That is not new on commitments, but the ability to shut a company down on a plant decision puts capacity management and decision making in the hands of the UAW. Market conditions change, and the rise of EVs makes this request an important one that will also be quite contentious.

The cost advantages of closing uneconomic ICE plants were inevitably going to be a hot topic. We are still trying to gauge what the expectations are on the right to strike on plant closing. That essentially means no strike protection in the collective bargaining agreement for the OEMs. That means an inability to restructure operations in down cycles without reopening the deal terms. That is when the UAW will be demanding lopsided buydowns of employees.

If the company’s products don’t sell and they need to reel in costs, then the strike risk will spike. That is not a problem if there are no recessions and everything the company does works. That has not been the history. Shareholders and lenders will bear the costs, so the vote on that sort of deal structure is up to the market. Lenders and shareholders will not like it. Competitors to the D3 will like it.

Pensions: The legacy pension plan was “closed” (no new members) with the 2009 bailout but not “frozen” (i.e., accrual ended). During the bailout, many had viewed a freezing as more appropriate given how other lenders and securities holders fared and the fact that a material taxpayer bailout was part of it.

GM had been the poster OEM for excess retirement obligations, and since the bailout has worked to de-risk its pension liability through an asset allocation strategy (i.e., fixed income, bonds) that process has been ongoing for years. They also have been de-risking and buying annuities to shift the salaried pension liabilities off the books. (We will look at pension issues in a separate commentary.)

We do not know the exact terms the UAW is asking for in terms of a new defined pension liability for the hourly ranks (All new plan? Just reopening the old plan?), but the net effect could be subjecting the D3 to a much-enlarged group of employees (the former lower tier payroll plus more temps made full time, all at much higher wages) and accruing higher benefits at more generous salary rates (they also are demanding higher retiree pay). That all would flow into a much-enlarged liability and more onerous funding demands if there is an all-new wave of younger employees.

The pension comes with material cash demands to fund as well as bringing a debt-like financial liability that can factor into valuation. Analysts might start dusting off their old pension-adjusted EV multiples. That means lower stock price targets with more “debt” in the EV mix and with less earnings on the wage spikes.

In practice, some on the street have a habit of toggling from PE multiples to EV multiples on convenience for stock price target (How do I get a higher price target and get my calls returned?). How the street and investors want to treat “Pension Adjusted EV/EBITDAP” had become a roll-your-on metric in the old days for the autos (Tax effect the pension numbers? At what rate? Maximum Statutory Rate? etc.).

The OEMs in the same business without those structural liabilities should get a better valuation in theory. The tax impact by itself was an art since some OEMs were not taxpayers (NOLs, losses etc.). Plus, you need to fund your pension whether you are paying taxes or not. In other words, the unfunded pension number could swing dramatically in the enterprise value math.

Health Care: The summary demand list including bringing back generous post-retirement health care obligations to hourly workers (Other Postretirement Employee Benefits, better known as OPEB). The OPEB numbers were very much a focus in the market back in 2007 as the D3 negotiated an independent VEBA to fund the health care liabilities. A new one was then generated in the bailout by the UST.

Looking back, GM was the worst positioned of the lot as a company who had more retirees per active worker than the others. GM had seen its market share essentially collapse since the 1970s, so the OPEB per unit was a built-in disadvantage. As a stark example, the GM US OPEB obligation was over $81 billion at the start of 2006 with around $20 bn in funding.

In contrast, at the end of 2022 the “Global OPEB” was only $6 bn unfunded and not tied to the UAW. That gives some indication of the scale of what the problem was in the pre-crisis years.

Using GM as an example on retiree health care, GM was paying $4.6 billion in 2007 to fund retiree health care payments. The $60 billion OPEB liability for GM at the end of 2007 was going to be reduced via the VEBA mechanism (Goodyear did something quite similar) through an asset mix that includes cash, debt, and convertibles, etc.). Some analysts even rolled out Pension and OPEB-adjusted EV/EBITDAPO.

We will look back at this history separately, but the end of the story was that debt obligation to the VEBA was protected in the Section 363 creation of the all-new GM. The UAW got more than a par recovery on the VEBA debt (new GM equity was in the VEBA funding mix) while bondholders were crushed.

In other words, the UAW was very well taken care of on that one just as they were protected on base wages, pension benefits, and active worker health care. Good for them, but they should not be waving the “sacrifice flag” so hard. More on the VEBA and heath care issues on another day.

Significantly increase in “retiree pay”: The nature of this demand was unclear on the face of it and what they meant in the context of future retirees or current retirees. This overlaps with the pension topic and is one for current employees, but it is unclear if they are talking about giving every UAW retiree (i.e., already retired) a retroactive pension payment hike. We assume not and have no idea how that would work in the vested pension obligation.

That is a nice gesture to the hourly workers who got the company here, but those workers were part of a very complex history of risk factors that got the #1 and the #3 of the D3 to Chapter 11.

The market share wars were lost badly by the Big 3 since I first started watching US autos in the early 1980s, and the debts to legacy workers were being funded by smaller companies (especially GM). That is the way the markets turned, but protection against future imbalances is tricky. Those liabilities for retiree pay have to be funded and recovered on the revenue line.

SUMMARY

As we saw on the screen today on the actions against parts distribution facilities for GM and Stellantis (not Ford), the battle is getting more hostile and more toxic. Based on past history, we assume Ford would be the first to fold but to this point they are just cooperating more. The damage will spread to customers and dealers now. Such aggressive strike actions can backfire.

The market and industry commentary is already talking about items such as the “no lockout, no strike clause” and whether a total breakdown could lead to a full lockout. That would be extreme. That was what Caterpillar did in the early 1990s to the UAW and imposed a contract as picketing workers crossed the line and replacement workers were being targeted for hire. That would be all out war and is a last resort to conserve cash and inflict pain.

If the UAW pushes too hard, it runs the risk of an end to the pattern deal approach and members could taste some real pain at the household level that starts to crush their supplier chain members or those they might seek to organize. The political risk and ill will could start to work against them after the bailout generosity gets revisited. Michigan and Wisconsin shockingly became right-to-work states and anti-union in their tone in the years after the bailouts.

These matters can get out of hand and be unpredictable. In a world where elections and jury systems are not respected, just about anything is possible, including a UAW lockout and more dramatic breakdown. Strange times.