May CPI: The Big 5 Buckets and Add-Ons

We look at our Big 5 CPI items and key add-ons for May.

"A smooth ride ahead of FOMC decisions."

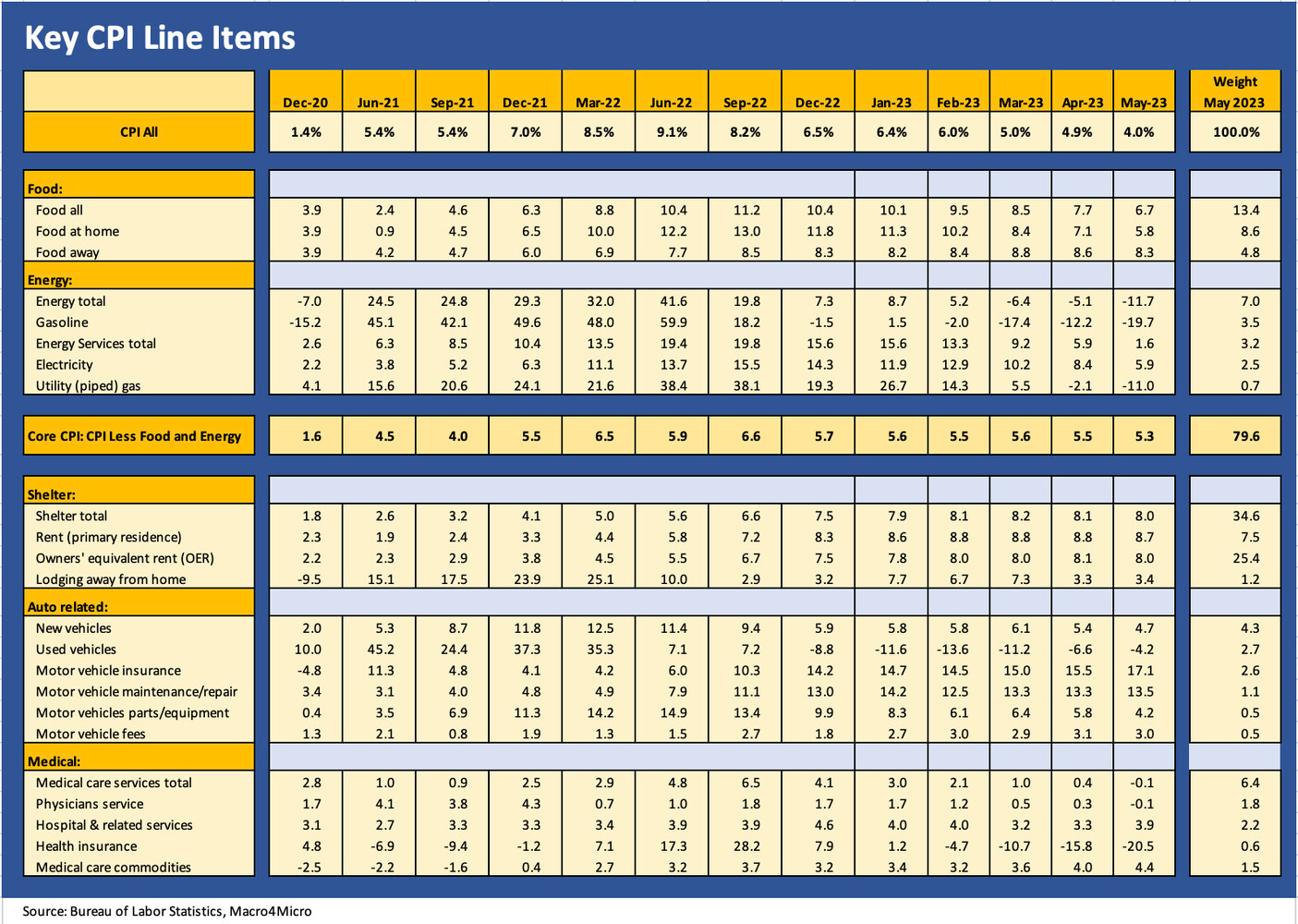

The magic line of 4.0% for headline inflation has almost been crossed with a 3% handle whispering in our ear as the YoY comps for next month will be framed against the CPI highs of June 2022.

The “CPI-ex” chowder of adjusted metrics has CPI ex-shelter at 2.1% for May but Services CPI alone is at 6.3% with “Services ex-Rent of Shelter” at 4.2%.

The good news for those driving to the grocery store is that gasoline is at -19.7% YoY and Food At Home is down to 5.8% (vs. 7.1% in April).

The CPI trend line got the market immediately excited even if just on the absence of a negative surprise plus some favorable trend lines across some key line items. Below we do the monthly drill (see CPI: April Flowers?? 5-10-23) with an update of the line items in our Big 5 buckets. We then post the “Add-ons” that are near and dear to many a household heart. The two charts combined comprise just under 7/8 of the CPI index.

The Shelter line is the biggest asterisk in the mix as we have detailed in past commentaries, so we will not fully replay it all here. Shelter is 34.5% of the CPI index but the economists have dug in on their approach since they changed it in the early 1980s. Owners’ Equivalent Rent (OER) violates the “cash in, cash out rule” of household finances and is a purely theoretical metric cooked up over drinks at the Faculty Club. That said, it is over 25% of the CPI index. A homeowner with a 2% handle mortgage and a lot of home equity is experiencing 8% inflation (who knew?). So is the household that has paid off its mortgage and is sitting on a capital gain to be named later or an estate gift to a relative.

The rental rates are best tracked in other sources and can vary dramatically by region. The rental rate inflation has a good outlook ahead with so many multifamily homes under construction (see Home Starts and Permits: Performing with a Net? 5-17-23) and the rise of single family rentals helping to alleviate the supply-demand balance in what is still a housing shortfall (see Single Family Rental: A Major D.R. Horton Asset Sale 6-6-23). We get updated starts information next week.

As a reminder, we fashioned our own version of Automotive CPI trends by including the lines that make autos a very expensive item for many households. The insurance and repair costs tell a story. Autos are more complex than ever and are often more about diagnostics than Mr. Goodwrench, and labor tightness has been a challenge for dealers. Some of their most profitable business segments in the dealers has been “Parts and Services.” As they say, one man’s revenue is another man’s expense. True to form, the insurance companies are right on cue with major rate increases.

The Add-Ons we use each month are self-explanatory and add up to 11% of the CPI index. All six moved in the right direction by declining on a YoY basis from April. The airline fares jump out in deflation mode since jet fuel is such a massive and important cost component that needs to be recouped in fares. So good news all around with all six trailing the growth in wages. Recreation will be one to watch across the peak travel months. So will Apparel as we get closer to the back-to-school spending season.