Anywhere and Real Estate Brokerage: Judgement Day

We consider some effects of the bombshell court ruling on real estate commissions.

The legal headlines have been brutal, but at least Anywhere Real Estate (HOUS) settled this one ahead of the hammer coming down on the brokerage industry.

HOUS had settled the case with a nationwide settlement announced earlier in October, but the questions around any future challenges to that nationwide class settlement outside Missouri needs some tangible legal assurance in the form of final court approval.

The cases (one for sellers and one for buyers) have been in the works for years and survived all motion challenges, but the $5.36 bn award ($1.79 bn with trebled damages) made the all-time “wow list” for a case that could have gone either way.

The worry is that “the win” will draw lawyers like flies to pursue actions all over the country on behalf of buyers (the Moehrl case) and sellers (the one in the headlines called the Burnett case) and pull even more of the tech-centric operators (Compass, Redfin, etc.) into the litigation side effects.

We saw the term Judgement Day in some of the real estate trade press, so we figured we would run with that (liked the movie, the Biblical read was also pretty colorful). The scale of this week’s judgement and trebled damages was a major eye-opener, but the event was more than “just” a big courtroom liability event.

The action is likely to have massive reverberating effects on thousands upon thousands of realtors and potential home buyers and sellers that are devastating for some (brokers) while also bringing lower costs to buyers/sellers (but possibly diminished service quality and fewer options). With existing home sales so low right now, the effects will take time to figure out.

The fee structures, the NAR, the local MLS operations (which are often misunderstood in terms of the sheer number of these MLS entities), evolution of state laws, and the way brokers can operate all seem to be up for grabs. The appeals process will keep on rolling along, but the risk of me-too class action suits is the main worry from here.

The need to make immediate changes was evident in the Anywhere settlements ahead of the trial decision. We will keep watching events unfold and listen to what the brokerage sector experts have to say in the space, but the sheer confusion and speculation around what it all means has been evident so far. Some of the leading voices in the space seem to be trying to work their way past the “WTF” stage (we recommend the Inman publication).

Residential real estate as classic old school US white collar sector…

Everyone knows someone in the residential real estate business whether they bought and/or sold a house or had family members, friends, or classmates who found their way to real estate as a career. In the 1960s and 1970s, it was a path to white collar life for blue collar town offspring who were changing with the economy (decline in manufacturing, etc.).

For the high price crowd, the 2+% handle commissions on each side of a transaction put some luxury salespeople on what some see as Easy Street. We say 2% handle (not 3%) since those are the average commissions on each transaction “side” (buy and sell has each been a side) for the major players as detailed in the Anywhere research we have posted (see links below). The concern in the real estate space is that the future may hold only one “side,” which would be the sell side commission. That is hardly a foregone conclusion.

We look at a few of the immediate issues for the risk profile of Anywhere as one of the few industry leaders in the residential brokerage space and what it means there in a narrow corner of the debt world. The bottom line is that there is not only a lot more contingent liability risk in the space but now a major laundry list of operational and strategic questions for how brokers will operate. This is an epic risk and operational shift unless it gets overturned. Even then, an overturning will set the playbook for what “not to do” if there are case technicalities that get it overturned. Lawyers will see juries can be swayed (i.e., a very rapid jury decision in this case).

There will always be a lot of real estate brokers and there will always be fees. Professions are expensive, and anyone who has paid high fees for bad legal help knows some fees are fleeting and transitory (and too often a necessary evil). A real estate broker at least gets you something that lasts and has long term (sometimes lifetime) utility.

For those who gripe that the fees are too high, that is fair. For those who do not see any value, then you have nothing to worry about. Don’t sign any deals and do your own work. For those who do not want an experienced person doing the legwork, then figure out what is a fair price whether as seller or buyer. That outcome would not be Armageddon for the industry, but the threat to buyers’ fees will be the main swing factor.

There is a reason why the majority of sellers/buyers want an agent. That was evident in the failure of Redfin’s discount commission game plan and the same for the iBuyers who came hat-in-hand looking for agents’ help from the brokers. These topics are never simple. iBuying was a case of using balance sheet intensive credit lines to buy illiquid assets with model-based valuations. That struck me as a bad business model and high financial risk from the outset. Just ask Zillow. iBuying came up as a topic a lot when then-Realogy (now Anywhere) was getting volatile. iBuying had the usual flavor of “pay for the fad disguised as cachet today, get buried tomorrow.” Check out how those stocks did further below.

The questions from here for the business planners in the sector (and a few analysts and investors trying to gauge what is going on in the space) is what the new revenue model and variable cost structure will look like in the industry going forward. For many professionals in the industry, the panic and anger is evident for the simple reality of what it means for their finances.

Anywhere Real Estate: One of the few debt market players in the space…

We were waiting for Anywhere to file its 10-Q for a look at the legal disclosure (it was filed this morning). In September, HOUS entered into a nationwide settlement for both the Burnett case (seller litigation) and the Moehrl case (buyer litigation) and the parties finalized it in Oct 2023. The settlement is “subject to both preliminary and final court approval.” The $83.5 million was for “injunctive relief.” The cash timing is $30 million before approval and the balance after final approval.

The 10-Q offers details on the range of MLS regions covered. These include 5 of the 10 largest MLSs in the US. Grasping the longer tailed risks here is outside my nonlawyer wheelhouse. My experience with lawyers is that two sides come to the table with 180 degree opposite views while both are (or pretend to be) 100% certain of their case.

Part of the HOUS settlement is a raft of operational demands that need to be met while admitting no guilt. HOUS got some concessions including an admission that there are economic reasons why a seller would be willing to pay buyer commissions. That also might mitigate some of the “admission of guilt” accusations (especially in later litigation that might come up if this does not get approved).

We have been watching the action at HOUS for a while, mostly in terms of the volume fallout from mortgage rates and tanking existing home sales. That was tough enough on financial risk erosion. As we mentioned in our research on HOUS, we just kept watching the clock tick as the case against the brokers crept closer to judgement day (see Credit Crib Notes: Anywhere Real Estate (HOUS) 8-24-23, Anywhere Real Estate 1Q23: Company Comment 5-4-23, Anywhere Real Estate: Credit Profile 3-1-23).

We started watching Realogy (then ticker RLGY) in prior lives after its post-LBO IPO, and it has been an adventure. There was a tendency by too many to overstate the financial risk when home sales were much higher, but after the bullish 2021, the market backdrop has since made that bearishness become more justified with the steady upward shift in the UST curve. The outsized all-in mortgage rates come with much higher spreads than in other periods with similar UST curves (see Footnotes & Flashbacks: State of Yields 10-29-23). Meanwhile, the litigation lurked and the timeline to the court date wound down.

As of now, HOUS bonds are priced in line with CCC tier composite yields on their unsecured debt (we saw 14+% to 16.5% for 2029s and 2030s unsecured). That pricing framework was as of yesterday (11-1-23). We see equity-like returns offered on the 2L bonds that were closer to 11% (various sources: TRACE, BondCliQ, 7 Chord), which is essentially in line with weak B tier names for the HOUS 2L. HOUS is not at distressed pricing levels at this point. We see those prices building in a smooth approval process, which is also not a foregone conclusion.

We believe the need for a settlement confirmation for HOUS is more important now than it was before the decision since the nationwide aspect of the settlement will not necessarily be a layup for approval when other “classes” from other states seek to tap into the claims potential. That is not a legal opinion, but a common-sense instinct that some legal eagles out there will challenge the nationwide angle. Class certification has always been a mystery as years of tobacco litigation (and some landmark decertification actions) highlighted. Some other regions are part of the settlement, but some are not.

Legal handicapping is a mug’s game…just hard to avoid…

These legal handicapping estimates are a challenge. The unsecured-to-2L bondholders exchanged for a reason. It is “sit tight and wait for good answers” time. HOUS just filed its 10-Q as we go to print, and it is interesting reading in the legal footnotes.

The approval process has its share of risks we would assume now that the big win is in the headlines. This week’s judgement was after the settlement of course. Whether that impacts nationwide approval dynamics remains to be seen. We understand it is expected to take months for final approval.

The impact of the decision on industry structure and operations…

We see some of the industry trade rags debating the utter confusion of what might unfold in industry “structure, conduct, and performance” (the title of a college textbook I used by Professor Richard Caves, who taught the class. He was Navarro’s thesis advisor. Nobody’s perfect). Among the scenarios debated in the evolution of real estate brokerage structural change is the disappearance of the “buyer agency” that is at the core of the case in raising the costs to sell a home. The plaintiffs targeted “cooperative compensation” as an NAR abuse that raised costs just to reward brokers and the industry powers that be.

The other side of that fight could bring a scenario of collapsing the “sides” into a lower seller commission and no buyer commissions. That in theory means cutting revenue by more than half. Industry experts do not see that as the outcome. If you war game this out, the result is 2 points or less commission on a sale and no buyer commission. Even at 2% on one “side,” the fees are better than on a major bond underwriting that brings material principal risk to the underwriter. The panic and anger of the brokers is not without good reason. After all, those are high fees they get.

A quick look at the broader brokerage and services sector…

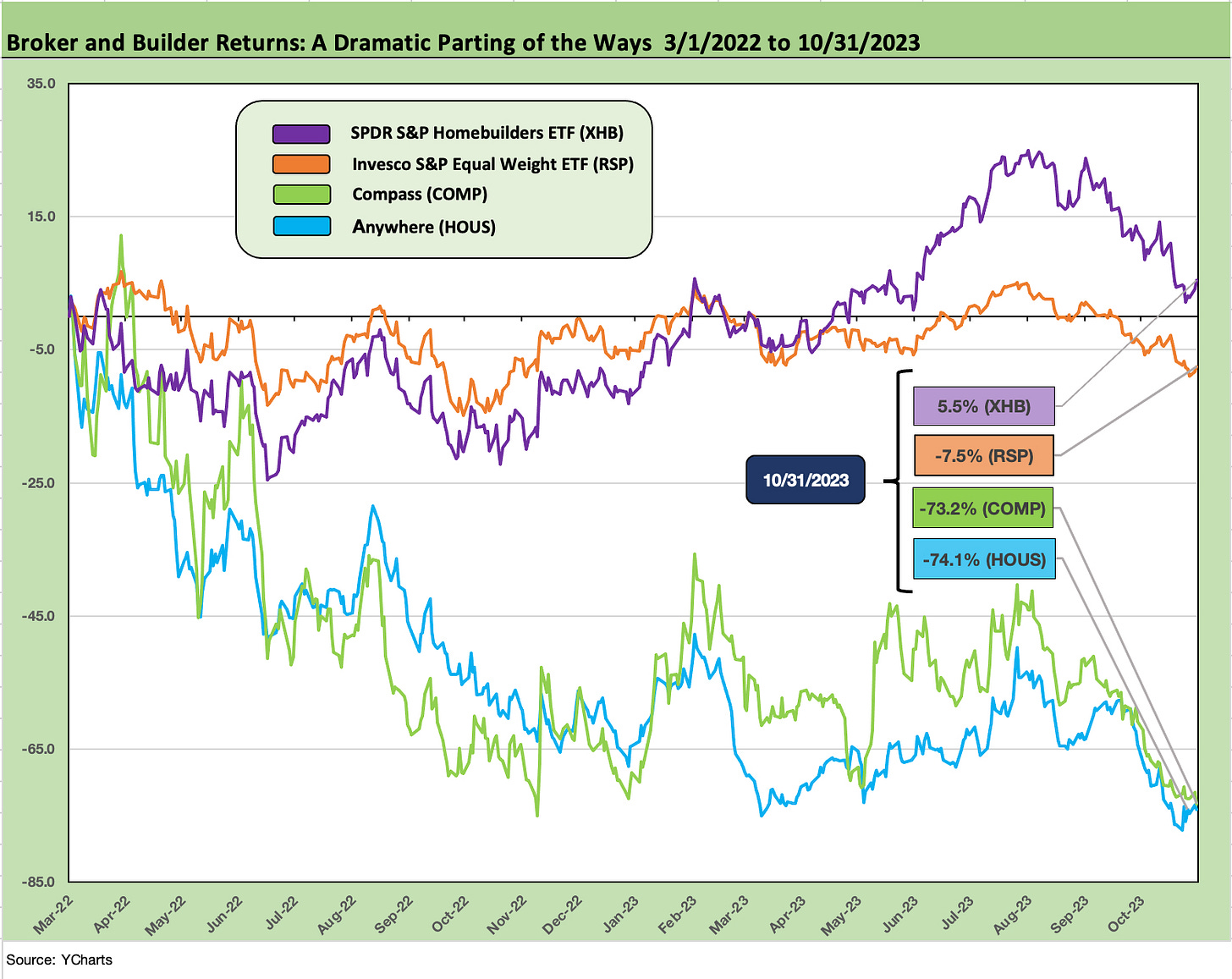

The sector generally is more an equity/equity-linked topic than a credit market topic, and 2 of the 3 biggest national names include an affiliate of Berkshire Hathaway (HomeServices of America) and another is a partnership (Keller Williams). Compass is a more recent tech-centric entry in the capital markets with its 2021 IPO. We looked at Compass (COMP) in some of our commentaries as a major competitor with HOUS and its luxury segment, but both HOUS and COMP have been pummeled in the market as plotted below.

As we detail in the above chart, the brokers had already been getting shelled on weaker volumes and much lower refinancing volumes in mortgages (refinancing is a key variable for the Title segment at HOUS). We plotted the returns across the Fed tightening cycle (starting March 2022). We will not replay all that color since we have that in the Credit Profile and Crib Notes links (see Credit Crib Notes: Anywhere Real Estate (HOUS) 8-24-23, Anywhere Real Estate 1Q23: Company Comment 5-4-23, Anywhere Real Estate: Credit Profile 3-1-23).

The chart above includes HOUS and COMP, and their brutal stock performance presents a stark contrast with the builders (we include the Homebuilders/Supplier ETF, ticker XHB). We also framed HOUS, COMP, and XHB against the equal weighted S&P 500 ETF (RSP) to take out the excessive weighting of the Magnificent 7 in the mix. The comps are not very pretty with the brokerage players getting slammed.

The broader housing sector is all over the map with builders doing well but the emerging tech and data plays in the space also getting crushed since the tightening cycle started.

We detail a cross-section above, including 4 brokers (HOUS, COMP, RMAX, EXPI) and some of the so-called disruptors and new business models (COMP and EXPI also fit that description, Z, RDFN, OPAD, OPEN). We also drop in a mix of benchmarks including the Russell 2000 and equal weighed NASDAQ 100 ETF (for the tech plays in real estate). Any big % moves at this point (e.g., OPEN YTD returns) are colored by the very low stock prices for most.

On the tech-centric names, we have seen some rallies off the lower prices, but the post-IPO performance has been terrible. Compass IPO’d at the start of April 2021 at $18 and is down just under 90%. Opendoor Technologies merged with a SPAC and started trading at $31.47 on 12-21-20 vs. a $1.89 close (11-1-23), so OPEN is down 94% since then.

Offerpad (OPAD) went the SPAC route as well (we note SPAC deals in the chart as IPOs for convenience but reflects initial trading). OPAD shares cratered quickly and the company had to do a 1-for-15 stock split to maintain its listing. Adjusted for the split, the current stock price is down 94%. OPAD market cap valuation at initial trading was $2.7 bn and is now closer to $200 mn.

Below we compare three of the headliners with iBuyer Opendoor crashing while legacy tech incumbents flew too close to the iBuyer business model. Zillow started to look like a struggling incumbent data company trying to find new disruptor buzz. Redfin was one of the companies that took a hard run at legacy commission models with its discounted fee rates and online service. It did not work, and they later had to raise prices. Redfin’s failures would seem to make the case that it is about more than commission rates when so many buyers and sellers prefer agents.

It is safe to say that the process of redefining real estate brokerage business models was already struggling across the expanse of the names and diverse types of operations above. In some cases, the business models have been derailed.

First COVID and then an inflationary spiral and brutal tightening cycle have been a big part of the setbacks, and now we have landmark litigation that will be either overturned on appeal or set off a fee feeding frenzy and pile-on.

The legal risk factors get less subjective and more quantifiable…

It is hard to get too comfortable with legal risk when both sellers and buyers are suing you, and this is just one state. When the sellers win, it also gets hard to settle with the buyers. Plaintiffs’ legal teams who might want to jump in likely see upside from here at lower risks in committing expensive man hours.

In other words, the situation was already a mess, and it just got worse for the industry since the case will inspire more me-too litigation outside Missouri.

Away from the appeals, the appetites for more of these cases by lawyers (appetites will be high) is one obvious risk, but we also have to consider how to get our arms around the revenue variables and industry structure that frame the downside risks for this industry.

The industry already has enough problems with existing home sales volumes back down to around credit crisis levels (see Sept Existing Home Sales: The 7% Solution Running Low 10-19-23). Now the brokers face commission structures and strategic plans that could be totally redefined. Questions around the fate of NAR or the hundreds of MLS entities need fleshing out also. That is a lot to digest, including how to price those risks in asset markets and counterparty exposure.

Claims risk and funding demands

The damages number and trebled award will get tested on appeal, and that will help analysts frame the risks along the appeal chain. From what we read in some of the real estate broker trade rags (we like Inman), there is anger over what they were not allowed to present to the jury (e.g., these fee structures are in compliance with Missouri state law) and the lack of focus on the reality that the buyers and sellers agree to a contract. The buyers and sellers are not required to agree. That could have been a pivotal fact, but it did not sway this jury. Legal strategists will be sorting through what did not work and why.

There are plenty of examples of other real estate players who tried (and failed) to build discount fee operations at half the typical fee (e.g., Redfin). Other examples of tech revolution disruption have been abysmal failures (think iBuying). Success has been hard to come buy outside traditional business models, and that legal model just took a legal dagger.

This latest legal judgement is outsized when taken in the context of the complexity of the moving parts and “what-abouts.” For class action misbehavior, this is not like cigarette smokers who were victimized by addictive chemicals and hidden medical studies. Those who chose to smoke were not aware of the addiction studies and links to cancer (That is not overly convincing, but that “choice” angle worked for years).

The business model is straightforward, but the risks are now highly uncertain…

There is a lot of jargon tossed around in this space and entities from the fragmented and contentious trade groups from NAR to myriad MLS operation that make the moving parts unwieldly. There is a lot of “human nature” across such a collection of groups and clusters of views. We define the industry simply as follows:

The commissions are the broker’s revenues: For HOUS, the commission stream is the revenue. If you are less familiar with the company and industry, see the links above for the basics of the business model. But this litigation target is Anywhere’s revenue line. The litigation wants it to decrease – by a lot.

The commission fees are the agent’s earnings: The commissions are the agent’s income. The commission revenue total includes “splits” for the broker. The focus on how brokers get paid and how to retain good brokers got a lot of attention at Anywhere as well as Compass in the luxury tiers. The industry buzzword of “splits” just ran into a buzzsaw with this litigation. The plaintiffs took pains to say they were not attacking brokers or their salespeople and even said that was not their goal and they were not calling them conspirators. We need to call BS on that one. The reality is that was exactly what plaintiff’s lawyers were saying.

Franchise vs. owned brokerage: For the “real world” of normal home sales (outside the luxury segment) in the $250K-$500K sweet spot of the industry, many agents are housed in independent franchisees. The commission issues will be a factor that need to be held up to the commitments of the parties in the franchise deals if all the rules change. We are not clear what this all means for the franchise contractual relationships. That will take more digging and industry feedback.

Business model risk: The pressure on fees overall that could come from this legal disaster could fragment business models or lead to all-new business concepts that make fees more negotiable and thus not trigger antitrust claims. The model could be agent owned with financial partners backing them. The MLS groups could get the middle finger from new groups. The NAR could be dead or lose their clout. At this point, we don’t know. Top guns could set up their own shops to make sure that they are able maximize their sales rainmaker skills. That would be bad news for luxury leaders as high producing brokers split off with new entities. That would be bad for HOUS and COMP. Everyone would sue everyone (time honored tradition).

Debt incurred to pay settlements comes at a time of collapsing cash flows: The ability to settle legal costs in cash will get strained by what could be plunging commissions. HOUS will see its debt metrics deteriorate again if revenues take a major hit. The debt will be modestly higher pro forma for the settlement but that revenue question will remain even if they get to avoid the claims risk. Business risk and uncertainty also intrinsically climbs with the questions around how these business lines will evolve.

Appeals to come…

The aftermath of the case is already setting the stage for appeal even if just with the fact that the agents commission structure was in compliance with Missouri state law. According to what we read the judge did not permit defendants to raise that issue.

There was also the fact that the buyer and seller always had the right to say “no” and not commit to the MLS requirements. They did not have to agree to any of the terms and could negotiate on terms to avoid price distortions. The plaintiff’s point is that the seller would not get a broker or a transaction completed if they rejected the fees. This is, unless the seller and buyer did all the work. Of course, if they value the broker, they agreed to a commission rate.

What was more damning from an empirical standpoint is that the fee structures have been so stable for so long and at a fee structure above high-risk equity IPOs from the late 1990s. That kind of fee stability in a profession that lucrative always has a hard time passing the smell test under antitrust law. And the industry knew it had frequent flyer miles with the DOJ. They even had their own home page on the DOJ site. The NAR and MLSs got cocky.

The legacy brokers can point to the rise of low fee online brokers who could not crack the code. Back and forth, back and forth. The failure of low cost online brokers implies that the consumers wanted agents and were willing to pay up. That is a choice. Armchair lawyering is recreational, but the brokers just got crushed on their defenses.

Lawyers will have fun storming the castle…

One has to assume this court victory just lit the fire under the contingency fee seekers to look for more Class Action winnings at the various state levels. I am no lawyer, but the market has seen strange decisions before and especially back in the days of tobacco litigation where various classes were nullified for lack of commonality with the related avalanche of legal grounds and word torture.

Tobacco was another swamp of litigation handicapping. I got “volunteered” to work on tobacco back in 1996 after the landmark case “Carter” case. The “Cigarette Papers” made it into movies and books and were in the market broadly by 1996. You could read those and conclude that the tobacco companies were screwed for withholding massive amounts of damaging information.

From our armchair lawyer seat, we have a hard time finding conspiracies in real estate. Home sellers and buyers have not been slipped addictive substances to make them long for high fees. The brokers may be addicted, but the buyers and sellers have a choice. This remains a strange one that states have long embraced.

Now the waiting time begins for the Anywhere settlement approval and more sorting out by the industry.