Anywhere Real Estate: Credit Profile

We look at the credit profile for Anywhere Real Estate in a tough time for housing.

Existing home sales a bit unsettled…

Poor volumes, intensely competitive markets, and very weak EBITDA remains the expectation for HOUS in early 2023 with plunging volumes in line with the guidance from HOUS as well as its high-profile competitor Compass, who weighed in with its earnings after the close last night and is getting beaten up in the market today.

For HOUS, the 4Q22 segment numbers were at painful lows as net debt/EBITDA metrics trend materially higher and are likely to worsen in the period ahead when 1Q23 gets dropped in.

The most important mitigating risk factor for HOUS is the impressive realignment of its capital structure over the last two years to a heavily unsecured mix that leaves room for setbacks and allows some flexibility to react to downside surprises in 2023.

Credit Outlook

Anywhere Real Estate (ticker HOUS) will see its financial metrics remaining under serious downward pressure in 2023, and it will take a major positive breakthrough in inflation and mortgage rates to change that likely outcome. With HOUS bonds (5.75% of 2029, 5.25% of 2030) down hard MTD and hanging around the 12% yield area, the company is in the netherworld between a B tier style price framework and the longer tail of CCCs. The metrics and industry risk profile are heading more toward the CCC tier based on the direction of volumes and home prices.

The HOUS fundamental risk analysis framework has evolved in recent years. The theme right now is no longer about a mature agent-heavy business model with a lot of bricks and mortar locations being outflanked by a high-end, tech-centric unicorn (Compass) with its negative EBITDA and larger market cap. That “agent vs. tech” debate was in 2017-2019 when the reality was that the high end is still all about “agent + tech” not “tech vs. agents.”

The backdrop now is about severe cyclical pressures and spiking mortgage rates choking existing home sales volume and eventually flowing more meaningfully into price pressure as well. It is now about “inflation and the residential real estate cycle.” The intermediate outlook for housing demand is favorable, but the setbacks in 2023 will still damage the EBITDA line even if the pending home sales and existing sales numbers jump around.

The debt and EBITDA lines are going to need a very optimistic forward view to see how a 2-handle Net debt/EBITDA (ex-securitizations) in 2022 potentially transforms into a high single digit Net debt/EBITDA metric in 2023 is going to be accepted by the markets. It will be hard to keep HOUS out of the CCC tier. Liquidity is tight and total debt is north of 6x EBITDA and heading higher in an industry where multiples are more art than science at this point.

For its part, Compass also reported earnings after the bell yesterday and reported another negative EBITDA quarter in a negative EBITDA year. COMP offered an outlook for more negative EBITDA ahead in 1Q23. A tough slog of cost cutting is ahead for both HOUS and COMP. As we go to print, COMP equity is down over 16% today but on a $3 handle stock.

That leverage effect of the volume pain and EBITDA weakness for HOUS flows over into EV multiples and the equity valuation challenge. You need a higher assumed multiple of EV just to cover HOUS debt – let alone to have a meaningful equity value. The forward view therefore needs to move another year or two out into the future and assume the mortgage relief will be here so volumes can pick up. That forward valuation game is a tricky one as many in this space and others (online auto retail etc.) have learned the hard way. A constructive set of assumptions can clearly be defended after the mortgage war eases up, but the ride to that point will not be an easy one.

The good news is that HOUS has done a very good job across 2021 and 2022 realigning its maturity schedule and the secured vs. unsecured mix. HOUS locked in low coupons and extended maturities with unsecured bonds. That is likely to be a good risk mitigator in a very rough stretch ahead in case some additional financing needs to get done. The liability management actions leave low structural subordination for now but allows for some failsafe scenarios on liquidity if the housing market falls apart on both price and volume beyond current expectations.

Industry Trends: Real Estate Brokerage and Services

There is a lot of change underway in many industries with technology leading the charge, and the real estate brokerage sector has been one of the industries on the “most overdue list” for radical change. That has been reflected in the wave of venture money flowing into the space and new generation of online service providers and data and analytics companies looking to serve the home sales and finance chain.

The role of the many MLS entities, the National Association of Realtors, and fragmented regulatory frameworks by state need a lot of separate commentaries. The topic gets more muddled with all the litigation underway. Those topics will keep getting more visibility and especially as antitrust litigation timelines and court action draws closer. There has been an extraordinary amount of wealth creation and follow-on market value destruction that will get a lot of focus in 2023, but this somewhat opaque industry is still newer to the public markets domain. We looked at some of the equity peers in the recent weekly (see Footnotes and Flashbacks: Week Ending Feb 24, 2023 ). There are a lot of recent IPOs in the tank.

The most important mix of variables in the operating story and industry risk profile are as follows:

Brokerage as a commission revenue stream: “Price x volume x commission rates” is not a very complex revenue line any more than “splits” with the broker as a variable cost. On splits, a common 70-30 split means 70% for the agent and 30% for the brokerage firm. The challenge to commission structures is part competition (lower fees from online players, direct channels to owners) and partly tied to cyclical pressures as volumes plunge and prices weaken further.

Agents are a core asset: Regardless of the criticisms of MLS-protected broker fees, the producers matter in what is sometimes perceived as a Glengarry Glenn Ross “ABC” (always be closing) type of business. That is especially the case in the luxury segment that is critical to the owned brokerage segment of HOUS and the same for COMP. The high end is where the declines in volumes have been the highest for homes over $1 million (-41% most recent) and $750 to $1 million (-36.9%). The commission concentration structure is supposed to be a stabilizer in the high variable cost structure of the industry to cushion downturns, but some of the recruiting deals have longer tails that will make the variable cost adjustment more of a lag effect. The brokers do not want to risk losing the top teams. It is not like the “old days.”

Agent-heavy business models vs. new age tech: The irony of the “agent is dead” theme is that the most high-profile, tech-centric luxury player (Compass) was also the most aggressive in recruiting and hiring agents at rates that came with questionable economics as it sought to build its brand and franchise. Their 4Q22 presentation from COMP was filled with agent expansion and productivity details (posted last night). Agents were obviously crucial to the COMP business model taken in tandem with new tech tools that they develop in-house. We saw a lot of misperception around the agent topic and the competitive landscape in the industry. Even Zillow was created and built out of business lines with a goal of serving agents. Try being an iBuyer without agents! (Actually, don’t try even with agents).

The obvious counter by incumbents such as HOUS (or HomeServices or Keller) to companies such as COMP and Redfin from the agent-heavy legacy players was to invest in tech. For some of those players, they could look to the entrepreneurial tech sector for software, data, and analytics offerings in the new world of services expansion targeting the brokerage industry. Outsourcing and external vendor solutions are a part of secular trends in the industry. The incumbents saw that COMP wanted to get into some of their businesses that complemented the core business (e.g., title insurance, mortgages, related JVs, etc.), so it was really a race by all to build multifaceted, tech-supported operations.

No one says you are required to develop your own tech tools and hire waves of engineers and code-heads when there are less risky and more cost-effective solutions that can be found elsewhere for purchase. As with other business lines adapting to the pace of tech change, Real Estate brokers looking for the better mouse trap can outsource from others as the vendors fight out that contest. That is an approach that can be taken by the Big 3 (Anywhere, HomeServices of America in the Berkshire Hathaway family tree, and Keller Williams) even as they highlight their own tech investments in parallel with their agent training and tech support. The leaders are all agent intensive, so that is no longer the main debate.

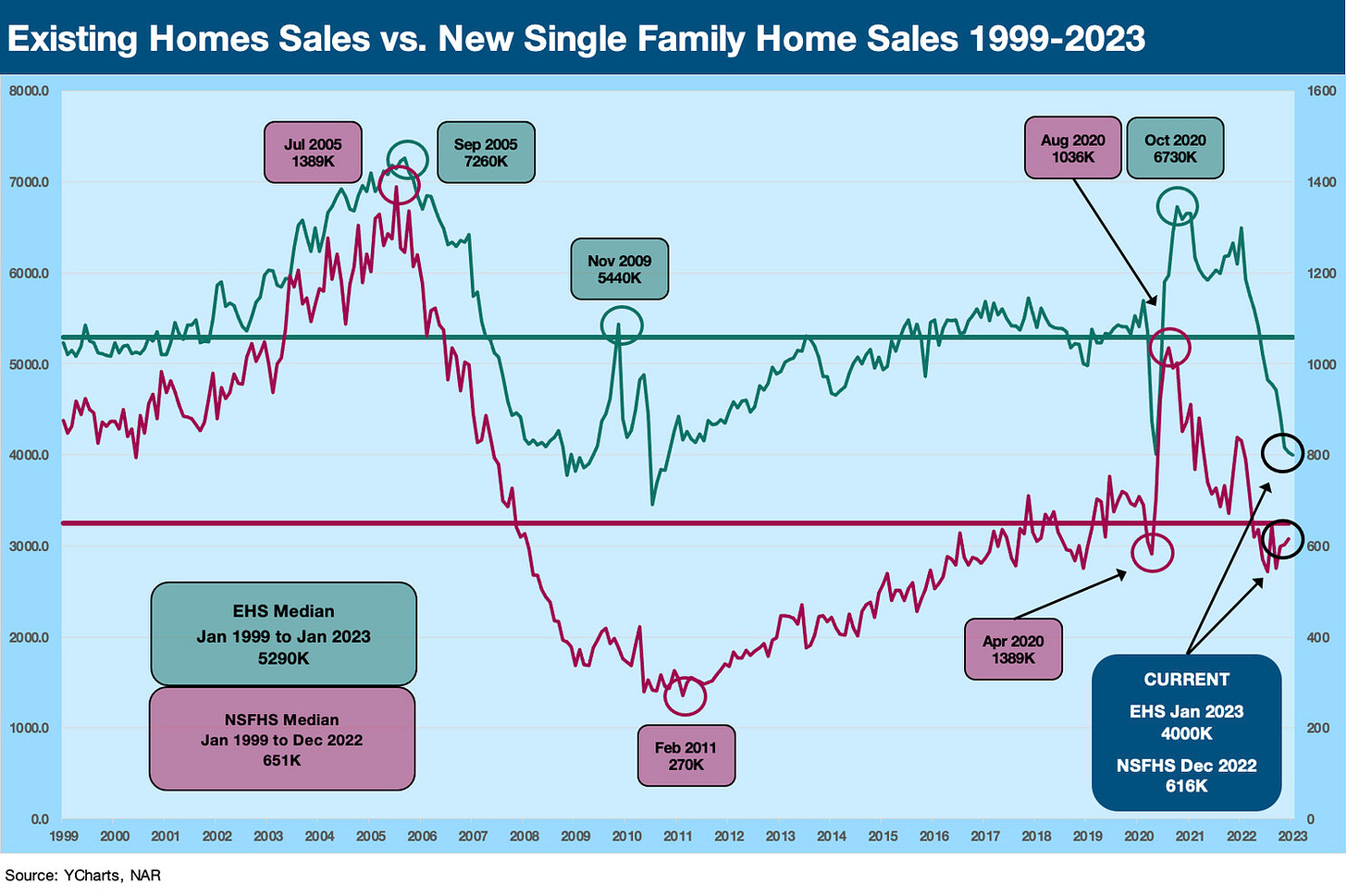

The dependence on existing home sales: While HOUS has multiple business segments, they are all at their core driven by the same underlying driver of volume – existing home sales. The existing home sales units matter just as do the prices attached to those homes. We frame existing home sales and new home sales above.

Existing home sales dominate total sales volumes so that chart needs a two-axis format. Existing home sales are usually 90% of total, but that has been dropping lately. The plunging volume and tight existing inventory for sale is clear in the chart above and the inventory chart below. Volume obviously headed sharply lower for multiple reasons in 2020-2021, and now are low for a very different reason. The reality is that prices must follow in order to make more homes affordable in terms of the monthly payment level. Otherwise, volume keeps dropping. Both matter in commissions.

There will always be cash buyers, but even there one can argue they are waiting for the right time. The rise of single-family home rentals has taken some inventory out of the picture as well for the brokerage revenue lines. Those seeking to leave urban areas or take time to save down payments are logical single family renters. Many are waiting for mortgages to correct to be able to “buy more house.” The inventory decline seen in this space is clear enough in the chart below.

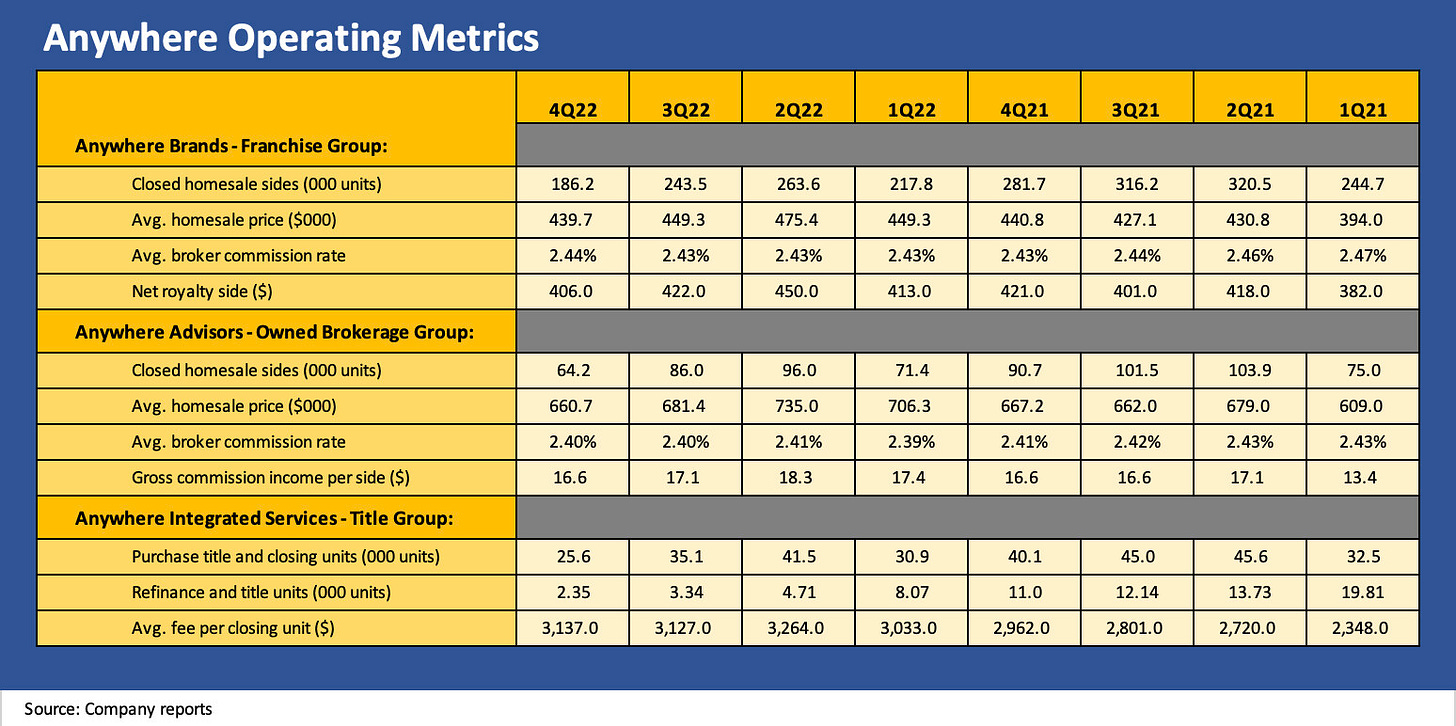

Refinancing pullback adds pressure on incremental revenues: The title and insurance business is also about volume, and the spike in mortgage rates has cut back purchased mortgage activity for 2023. The mortgage challenge has seriously damaged the refinancing portfolio of the revenue stream also for the services business. As we detail in the operating metrics section below, the mortgage refi volumes are understandably plunging and that takes another piece of the revenue puzzle out of the picture.

Low mortgage rates for existing homeowners are also a barrier to selling if the seller wants to buy another home in a move-up transaction or empty-nester move (downsizing). The fear is that mortgage rates could keep volume sliding across 2023 and hit both volume (already underway) and price (that has been slower so far). The price trends should worsen as some sellers surface to clear the market and especially for those who have high home equity that they fear will erode even more.

Operating Trends

HOUS offers rigorously detailed disclosure across the main moving parts (sides, prices, commissions) in every quarterly report. We can see very clearly the trends that a major broker sees in the market, and that is as good of a proxy as one can get. The indexes (Case-Shiller, FHFA) and the one-offs from Redfin and Zillow etc., are all useful, but the HOUS data is real transactions (“sides”) at actual prices. The easy way to look at this chart is that the Franchised Group is generally (not entirely) the “lower priced” sales and the Owned Brokerage Group more on the higher price to luxury end of the mix. Luxury means different things in different metro areas.

We see prices in the Franchise Group (Century 21, etc.,) hit the 2022 peak in 2Q21 at $475K and volumes peak for the year 2022 came in 2Q22 as well (263K sides). We would note that 2Q21 during the prior year was materially higher on volume but lower on price than 2Q22. In Owned Brokerage, we also see a 2Q22 top for the year in price and volume, but 2Q21 was also slightly higher on volume and lower in price.

Looking ahead to 2Q23, we assume lower on both price and volume. Price is fading in Owned Brokerage and 4Q22 was the lowest since 1Q21. In the Franchise Group, the 4Q22 average price was the lowest since 3Q21. As a reminder, 1Q22 marked the end of ZIRP and steady upward migration of the yield curve. We highlight these prices are averages and not medians. That can wag the trend line depending on mix by price tier and/or region.

In terms of margin analysis at the agent split level, HOUS is necessarily vague about splits and incentive packages for competitive reasons. The split topic dominated the rapid growth of Compass as that firm repriced the talent market and offered deals that were considered any combination of ruthless or uneconomic, or both. Some reportedly included stock/option packages. Welcome to luxury real estate.

The volume, price, and other services revenue metrics flow into the segment disclosure as broken out below in the segments section.

Business Segments

The segments breakdown still revolves around transactions tied to existing homes, but the history has been to break out separately the “Franchise Group” businesses that are tied to franchise fees versus the “Owned Brokerage operations.” The owned commission-driven business lines cater heavily to the luxury end of the market (or the tiers well above median price levels). The Owned Brokerage groups also pay fees (disclosed in the chart) that can have the effect of understating the segment profitability of Owned Brokerage. It is “Peter paying Paul” within the HOUS family tree.

We break out the quarterly segments back to 1Q20 when COVID first set off the shutdowns. The segment EBITDA of $32 mn in 1Q20 was the worst one across this time horizon until 4Q22. That says a lot. The 4Q22 segment mix saw the worst quarter in Owned Brokerage and the Title Group, but 4Q22 beat 1Q20 in the Franchise Group.

We highlight the fees/royalties paid by the Owned Brokerage to the Franchise Group at the bottom of the chart. Some of the bellwether brands in the Owned Brokerage Group are also in the Franchise Group (notably Coldwell Banker). As a matter of clarification, the FY 2022 profits for the Owned Brokerage Group (Anywhere Advisors) was $287 million before “royalties and and marketing fees” paid to the Franchise Group.

The year 2021 was a very strong housing market with demand soaring for homes that were seeing new highs in pricing. The work-from-home and COVID flight-to-the-suburbs trends already received plenty of attention, so there is no need to revisit those themes. The main effects were high volume and even higher prices as demand outpaced supply. Existing home sales and new home construction could not meet the demand. The new home sector had their own set of supplier chain issues.

Mortgage activity both for purchase mortgages and refi were running impressively in the the aftermath of so much Fed support, but that has now gone the other way with Fed tightening and the UST curve heading north. The refinancing title volumes for HOUS were very strong in 2020-2021 while purchase activity peaked in 2020-2021. We see 3Q20 as the best quarter for the title group. The ability to buy a lot more house at low mortgage rates turbocharged the housing cycle ahead of the 2022 mortgage spike that hit the brakes on the house chase.

The question is how much of the effect was a matter of pull-forward demand. That would imply the quiet period of early 2023 means an even more pronounced cyclical downside effect as homebuyers wait out the inflation and mortgage rate battle. With jobs at record highs and unemployment at 50-year lows, housing is more vulnerable if the economic cycle also starts backtracking on Fed actions to weaken demand. The symmetry is complicated since sustained economic strength could send the long end of the curve higher into a bear flattening as we discuss in the current weekly (see Footnotes and Flashbacks: Week Ending Feb 24, 2023 ).

The history on existing home sales will remain very much swept up in the inflation and mortgage debate. While some recent 2022 purchases are underwater already, legacy homeownership and high home equity are still a reality. The chance for a lot more sellers to appear is a demographic reality and the record number of employed would imply that demand will be strong at the right monthly payment economics. That means mortgage rates or prices need to come down in some proportion vs. volume declines to get the market there.

That typical self-correcting supply-demand dynamic makes it easier to get on board with HOUS having the ability to buy time and avoid major financial pressures with such a low secured mix and much lighter maturity schedule. They have backstops in the event the year 2023 proves far worse than currently anticipated, but the year will not be an easy one. The forecast for HOUS in 1Q23 is for serious volume weakness of around 30% in 1Q23 and 15% to 20% for the FY 2023.

The cost-cutting pitch was very active on both the HOUS and COMP earnings calls. HOUS cited the $150 mn in savings the achieved in 2022. HOUS is calling for another $200 million in savings in 2023. On the earnings call, they indicated the savings have been identified. They already had ample reason in 2H22 to plan for it. There are plenty of targets for cuts, but the details were unclear. Headcount has been reduced by 11% since June 2022.

The Owned Brokerage offices tally 670. As a frame of reference, the Franchise offices in operation are broken out in detail in the 10K with Century 21 (13,611 offices) and ERA (2,407 offices). We are unclear at this point on how the company can take costs out of the Franchise Group. The Owned Operations are more intuitive. The company cited the real estate footprint as the main cost area along with the related support costs in “non-agent activities.”

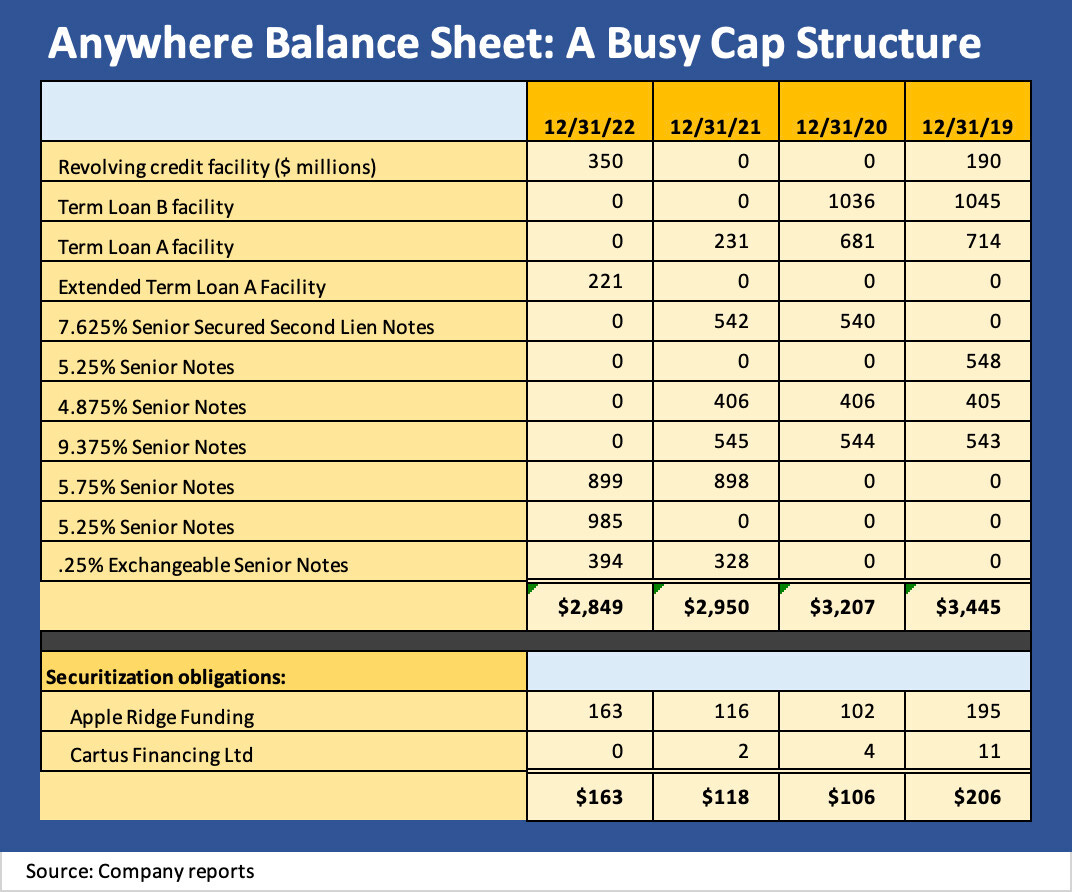

Capital Structure

To say Realogy and its later-rebranded name of Anywhere Real Estate has a long and convoluted history in its capital structure would be a gross understatement. The evolution from a spring 2007 vintage LBO at the peak of credit market and LBO excess to a merely overleveraged company in 2023 has been a busy one.

The company had exited its LBO years as a prudently financed operation on the way to an IPO in late 2012. There has been a lot of action in the capital structure since then across term loans, secured bonds and unsecured. We break out the trend in short and long term debt balance sheet line items since 2019 below in the cap structure table.

The most recent wave of balance sheet realignment and refi-and-extension moves occurred at a very fortuitous time in 2021, and it continued into 2022 as market conditions were rapidly eroding with the upward shift in the UST curve and the reactions to the stubbornly high inflation. The biggest moves were in 1Q21, 2Q22, and some last cleanup in 4Q22.

The 1Q21 reduction in secured debt: The issuance of the $900 mn of 5.75% Jan 2029 was targeted to pay down secured debt in Term Loan A and Term Loan B. Part of the Term Loan A of $681 at 12-31-20 was extended ($236 mn) and a part was not extended as of 1Q21 ($196 mn). As noted in the table above, the term loan reduction and bond market access was well timed considering how the market played out in 2022. During 1Q21, $655 million of the $1036 mn in Term Loan B was paid during 1Q21 and the remainder in 2Q21. HOUS also paid down $250 of the Term Loan A in 1Q21.

The 2Q21 reduction in secured debt: In June 2021, HOUS issued $403 mn of 0.25% Exchangeable Senior Notes due June 2026 (carrying value $320 mn). The remaining $196 mn of Non-Extended Term Loan A was paid down in full for $197 mn in Sept 2021. The remaining balance of Extended Term Loan A at the end of 2021 was extended to Feb 8, 2025 with amoritization of $16 mn in 2023 and $22 mn in 2024.

The 1Q22/2Q22 refi and extension continues: HOUS issued $1 bn of 5.25% notes due 2030 in Jan 2022 and in Feb 2022 redeemed the $550 mn 9.375% of 2027 and the $550 mn 7.625% 2L bonds due 2025. The last remaining maturity challenge was the $406 mn of 4.875% of 2023, which was cleaned up through market repurchases and the use of revolver and cash on hand to redeem the final $340 mn during 4Q22.

The maturity cleanup, the reduced structural subordination, and the refi-and-extension trades bought the company some maneuvering room if the markets get even uglier than they are now after the mortgage shock. The lower base of encumbered assets is a good start. The cleaner maturity schedule and the smaller slice of revolver will not be risk free by any stretch, but that structural risk profile is much better than the term-loan-heavy structure and a heavier set of refi demands. The process was a good one to get behind them with stagflation risks in the air.

Contingent liability risks

The headline litigation risk has been around for some years now and is in various later stages at this point. The legal threats have surfaced on a larger scale and grown in total since we started looking at the company a half dozen years ago. The antitrust cases are not new to the industry in terms of the conceptual angles. After all, this industry had its own home page for a while on the DOJ site and they have battled before.

While the DOJ involvement could always be looked at like prior efforts to get the industry to modify its behavior, this latest generation of cases are far more daunting. They are comprised of plaintiffs looking for massive damages tied to how the NAR, MLS, and major players operate on fees and commissions.

On the call, HOUS cited two class action jury trials. There are others and more me-too cases that could happen (“these are just the things we know about”). The litigation footnotes read like Tim Burton with a Legal TV series. The usual scary words such as trebled damages and “joint and several” can make the liability scenarios run wild at a time when the industry and some of its participants have enough problems on their hands. The idea that either the seller or the buyer of a home could be seeking repayment for even 1% or 2% of the 5% area total for both sides of the transaction defies logic (and reality) when all parties agree to the terms and have the option to say “no.”

We suspect plaintiffs who were buyers are not offering to return any share of the home equity growth they experienced this cycle. We can revisit the legal issues in other commentaries. We are not looking to play country lawyer on this topic since they have withstood numerous attempts to dismiss. The legal filings tell us the usual “100% certain, 180-degree opposite” views one often sees in the court filings. The company has been adding to legal accruals, but the language always lacks specifics in such areas of litigation.

Background and History Highlights

Realogy was formerly part of Cendant (legacy entity that is now Avis). Realogy was part of what was a very wide mix of franchise holdings by Cendant in business lines from hotels and leisure to real estate before the company was broken up into separate units in a major July 2006 spinoff transaction. Realogy as a stand-alone was quickly targeted by Apollo for an LBO in Dec 2006 (closed April 2007), and the rest was history as the residential real estate markets collapsed with the credit crisis. After years of realigning its balance sheet under the Apollo umbrella, Realogy returned to the public markets in an Oct 2012 IPO.

Realogy reached an agreement to sell its Cartus relocation business in 2020, but the deal fell apart on the usual questionable grounds that “closing conditions were not met.” Twitter-Tesla was not a new gambit and this one did not have a happy ending for the asset sale. The reality is that COVID killed the Cartus deal, and the buyer backed out.

Realogy was rebranded as Anywhere Real Estate during 2022 (2Q22). “Anywhere” at this point could be forecast on where mortgage rates will be in a year.